Zigzag With Line At Lows And Line At Highs Mt4 Indicator Review

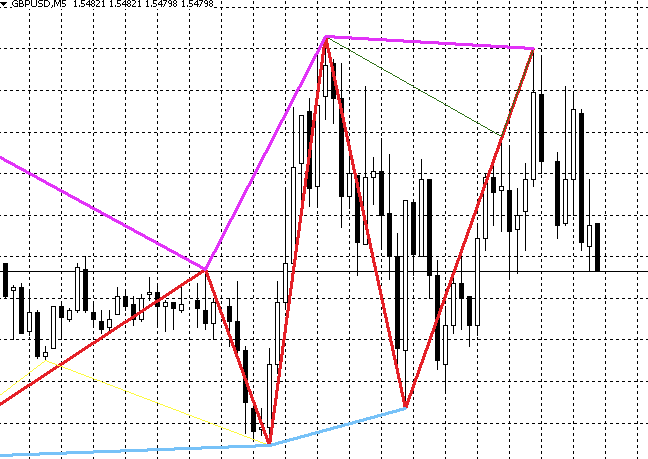

The ZigZag with Line at Lows and Line at Highs MT4 Indicator is a powerful tool for technical analysis in the world of trading. This indicator is designed to help traders identify trend reversals by showing the highs and lows of an asset’s price movement. The zigzag pattern is formed when there are significant price changes in an asset, creating a series of peaks and valleys on a chart.

This indicator can be used for day trading, swing trading, and long-term investing. The ZigZag with Line at Lows and Line at Highs MT4 Indicator has become popular among traders due to its ability to filter out minor price movements that do not contribute to the overall trend of an asset. By doing so, it helps traders focus on significant changes in price that could affect their investment decisions.

Download Free Zigzag With Line At Lows And Line At Highs Mt4 Indicator

Additionally, this indicator simplifies market analysis by identifying key support and resistance levels for traders. Overall, the ZigZag with Line at Lows and Line at Highs MT4 Indicator is a valuable tool for any trader looking to make informed decisions based on technical analysis data.

Understanding the ZigZag with Line at Lows and Line at Highs MT4 Indicator

The present section aims to provide comprehensive comprehension of the technical analysis tool that depicts a continuous fluctuation in price movement with distinctive markers representing points of reversal towards a new trend.

The zigzag with line at lows and line at highs MT4 indicator is commonly used by traders seeking to identify crucial market reversals and trend changes. This indicator consists of lines representing the highest and lowest points of price movement, joined together by a zigzagging line that denotes significant turning points.

Interpreting signals from the zigzag with line at lows and line at highs MT4 indicator requires an understanding of how it functions. It is important for traders to adjust the settings according to their specific trading style and preferences.

For instance, some traders may prefer to use longer time frames such as daily or weekly charts while others may opt for shorter ones such as hourly or 15-minute charts. By adjusting these settings, traders can better visualize market trends and identify potential entry or exit points based on their desired level of risk tolerance.

In summary, the zigzag with line at lows and line at highs MT4 indicator provides valuable insights into market trends that are critical for successful trading strategies when interpreted correctly.

Using the Indicator for Day Trading

This section will discuss the use of the ZigZag with Line at Lows and Line at Highs MT4 Indicator for day trading by identifying short-term trends and setting entry and exit points.

Short-term trends can be identified by observing the highs and lows on the chart, which can then be used to set entry and exit points for trades.

By using this indicator in conjunction with other technical analysis tools, traders can make more informed decisions when executing trades in a fast-paced market environment.

Identifying Short-Term Trends

An analysis of the chart pattern is necessary to determine the prevailing direction of short-term trends, which can assist traders in making informed decisions. The zigzag with line at lows and line at highs MT4 indicator is a useful tool for identifying short-term trends. This indicator plots trend lines that connect the highest high and lowest low points on a chart, allowing traders to see where price has been rejected multiple times.

Analyzing market volatility is an important aspect of using this indicator for short-term trend identification. When markets are volatile, prices tend to move quickly in one direction before reversing course. Traders can use the zigzag with line at lows and line at highs MT4 indicator to predict price movements by looking for instances where price breaks through previous resistance or support levels.

By identifying these areas, traders can enter trades with greater confidence and potentially profit from short-term trends.

Setting Entry and Exit Points

Establishing precise entry and exit points is a critical aspect of successful trading, and traders can accomplish this by utilizing the trend lines generated by technical analysis tools such as the ‘zigzag with line at lows and line at highs’ MT4 indicator to identify key levels at which to enter or exit trades.

Technical analysis involves studying past market data, primarily price and volume, to predict future price movements. The ‘zigzag with line at lows and line at highs’ indicator helps traders identify short-term trends in market volatility, making it easier for them to make informed decisions about when to enter or exit trades.

To set entry and exit points using this MT4 indicator, traders should first draw a trend line connecting the peaks (for sell orders) or troughs (for buy orders) identified by the zigzag pattern. This trend line provides a visual representation of the direction of the trend that has been established in the market.

Once this trend line is drawn, traders can then set their entry point just below (for sell orders) or above (for buy orders) this level. Similarly, they can use another trend line connecting the most recent lows/highs in order to establish an appropriate exit point for their trade.

By using these methods together with other technical indicators like Moving Averages or Bollinger Bands, traders can improve their chances of success in trading while minimizing risks through calculated entries and exits based on objective data rather than emotions or gut feelings.

Using the Indicator for Swing Trading

This section will discuss how to use the zigzag with line at lows and line at highs MT4 indicator for swing trading.

Specifically, we will focus on identifying medium-term trends, setting targets, and stop losses. By utilizing this indicator in conjunction with these key points, traders can make informed decisions about when to enter and exit trades while minimizing risk and maximizing profits.

It is important to note that understanding these concepts requires a deep knowledge of MT4 indicators and the ability to explain complex topics in a straightforward manner.

Identifying Medium-Term Trends

The section at hand concerns identifying trends of medium duration using a particular technical analysis tool, the zigzag with line at lows and line at highs MT4 indicator.

This tool is useful in analyzing market volatility and predicting trend reversals. To identify medium-term trends, traders can use this indicator to highlight the areas where price movements have reversed direction, indicating a change in trend.

By looking at the zigzag pattern created by the indicator, traders can gain insight into market sentiment and determine whether the trend is bullish or bearish. The lines drawn at the highs and lows of each swing also provide valuable information about potential support and resistance levels that may affect future price movements.

Overall, identifying medium-term trends allows traders to make informed decisions when entering or exiting positions based on their analysis of market conditions using this technical analysis tool.

Setting Targets and Stop Losses

To effectively trade using the zigzag with line at lows and line at highs MT4 indicator, traders must not only identify medium-term trends but also set targets and stop losses.

This involves calculating risk reward and position sizing to ensure profitable trades while minimizing potential losses.

Calculating risk reward involves determining the potential profit of a trade in relation to its potential loss. Traders must assess the probability of their target being reached versus the probability of their stop loss being hit.

Position sizing, on the other hand, is determining how much to invest for each trade based on one’s account size and risk tolerance. It is crucial for traders to manage their positions properly to avoid overexposure or underutilization of capital.

By incorporating these techniques into their trading strategy, traders can increase their chances of success when using the zigzag with line at lows and line at highs MT4 indicator.

Using the Indicator for Long-Term Investing

Investors seeking a long-term strategy may find value in utilizing the Zigzag with Line at Lows and Line at Highs MT4 indicator to identify potential patterns and trends in the market. This technical analysis tool allows investors to track price movements over time, highlighting areas of support and resistance.

By identifying these key levels, investors can make informed decisions about when to enter or exit positions, as well as set appropriate targets and stop losses.

In addition to its use in portfolio management, this indicator can also be useful for identifying longer-term trends in the market. By analyzing price movements over an extended period of time, investors can gain insight into the broader direction of an asset’s value.

This information can be particularly valuable for those looking to make strategic investments that will pay off over time rather than focusing on short-term gains. Ultimately, the Zigzag with Line at Lows and Line at Highs MT4 indicator offers a powerful tool for investors seeking a comprehensive approach to technical analysis that takes both short- and long-term factors into account.

Frequently Asked Questions

What is the accuracy rate of the ZigZag with Line at Lows and Line at Highs MT4 Indicator?

Exploring the reliability, limitations, and potential applications of technical indicators is a crucial task for traders seeking to enhance their trading strategies.

When examining the accuracy rate of an MT4 indicator such as ZigZag with Line at Lows and Line at Highs, it’s important to consider several factors that may impact its readings. Market volatility and fluctuations can significantly affect the performance of technical indicators by creating false signals or reducing their effectiveness. Therefore, relying solely on this indicator might not be sufficient to make informed trading decisions.

Additionally, the reliability of this tool should be assessed based on historical data analysis and backtesting results. While ZigZag with Line at Lows and Line at Highs MT4 Indicator has some limitations, it still holds potential in identifying key support and resistance levels by filtering out market noise.

Can this indicator be used for trading cryptocurrencies?

Cryptocurrency trading strategies involve using various techniques and tools to make informed decisions about buying and selling digital assets. Technical indicators, such as moving averages, relative strength index (RSI), and stochastic oscillators, can be useful in identifying trends and market conditions that may influence the price of cryptocurrencies.

The advantages of using technical indicators in cryptocurrency trading include their ability to simplify complex data sets into easy-to-read charts and graphs, providing traders with a bird’s-eye view of market trends. Additionally, they can help traders identify entry and exit points for trades based on predetermined criteria.

While there are many different technical indicators available to traders, it is important to understand how they work and which ones are most effective in specific market conditions when making trading decisions.

Does the indicator provide any alerts or notifications when a new high or low is detected?

Alerts and notifications have become essential tools in modern trading strategies. They provide traders with timely information on price movements, allowing them to make informed decisions about their trades. Alerts can be set for various events such as new highs or lows, trend changes, or specific price levels. Notifications can be delivered via email, SMS, or pop-up windows on the trader’s platform.

These features are particularly useful for traders who want to stay up-to-date with market developments but cannot monitor the markets continuously. Incorporating alerts and notifications into a trading strategy can improve efficiency and profitability by reducing manual monitoring time while ensuring that important events are not missed.

Is it possible to customize the settings of the ZigZag with Line at Lows and Line at Highs MT4 Indicator?

Customizing settings is a crucial aspect of technical analysis when it comes to using MT4 indicators. It enables traders to tailor the indicator to their individual needs and preferences, thereby enhancing its effectiveness in generating signals and identifying trends.

Customization may include changing the color, style, or width of lines, modifying parameters such as period or deviation, and selecting alert options that suit one’s trading strategy. By customizing an indicator like ZigZag with Line at Lows and Line at Highs MT4 Indicator to reflect their unique trading style, investors can gain insights into market movements that could help them make better trading decisions.

While customization requires a basic understanding of MT4 indicators’ functions and features, it can be accomplished through simple steps in the platform’s Settings menu.

How does this indicator differ from other zigzag indicators available in the market?

One of the most popular indicators used in technical analysis is the zigzag indicator. It helps traders identify significant price reversals and trend changes by filtering out minor price movements.

However, there are various types of zigzag indicators available in the market that differ in terms of their settings and features. One differentiating factor of a ZigZag with Line at Lows and Line at Highs MT4 Indicator is its ability to draw lines at both lows and highs, providing a clearer picture of potential support and resistance levels.

Another advantage of using this indicator is its real-time data analysis capabilities, allowing traders to make informed decisions quickly based on current market trends. Overall, this indicator can be a valuable tool for any trader looking to gain an edge in the markets.

Conclusion

The ZigZag with Line at Lows and Line at Highs MT4 Indicator is an essential tool for day traders, swing traders, and long-term investors. This indicator is designed to help traders identify market trends by showing the highs and lows of asset prices over a specific period. The zigzag pattern displayed on the chart makes it easier for traders to understand the direction of price movements.

Day traders use this indicator to make quick decisions about buying or selling assets based on current market trends. Swing traders use it to identify potential entry or exit points in a particular trade, while long-term investors use it to make informed decisions about holding onto their investments for extended periods.

In conclusion, the ZigZag with Line at Lows and Line at Highs MT4 Indicator is a powerful tool that can help traders make better-informed decisions about their trades. Whether you are a day trader, swing trader or long-term investor, this indicator can provide valuable insights into market trends and help you achieve your financial goals.

With its user-friendly interface and straightforward presentation of complex data, this indicator has become a popular choice among experienced traders looking to gain an edge in today’s competitive markets.