Zigzag Own Channel Indicator For Mt4 Review

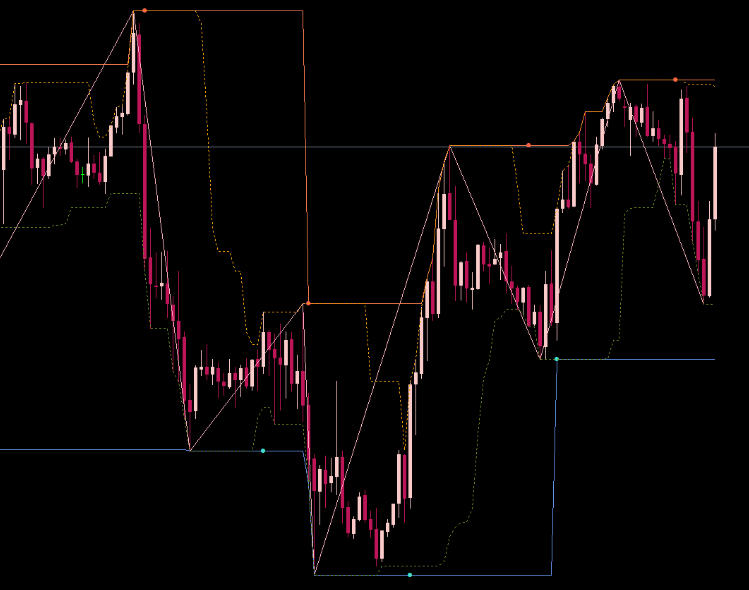

The Zigzag Own Channel Indicator is a technical analysis tool that is widely used in the forex market. It is designed to help traders identify trends and potential reversal points by drawing trend lines around price movements on a chart.

This indicator works by connecting the highs and lows of price movements, creating a zigzag pattern that can be used to analyze market movements. The MT4 platform has become a popular choice for forex traders due to its advanced features and user-friendly interface.

Download Free Zigzag Own Channel Indicator For Mt4

The Zigzag Own Channel Indicator is one of many indicators that can be added to the platform, allowing traders to customize their trading strategies according to their individual needs and preferences.

In this article, we will explore how the Zigzag Own Channel Indicator works, as well as some tips for using it effectively in your trading strategy.

Understanding the Zigzag Own Channel Indicator

The present section provides an in-depth comprehension of a technical tool utilized by traders to identify trends and possible reversal points in financial markets, through the calculation of a channel formed by connecting highs and lows. This tool is known as the Zigzag Own Channel Indicator.

The indicator is derived from the Zigzag Indicator, which plots lines that connect price highs and lows over a specific time period. It then uses these lines to form channels that show areas of support and resistance.

Traders can apply the Zigzag Own Channel indicator to different timeframes, ranging from minutes to weeks, depending on their trading strategy. The longer timeframes are ideal for swing traders who hold positions for several days or weeks, while shorter timeframes are suitable for day traders who open and close positions within hours or minutes.

Comparing Zigzag Own Channel to other trend indicators such as Moving Averages (MA) or Bollinger Bands (BB), it stands out because it accounts for both price movement and volatility. While MAs smooth out price movements over a given period, BBs plot bands around the moving average based on standard deviation, indicating areas where prices are more likely to reverse direction. However, both indicators do not account for volatility changes in the market like the Zigzag Own Channel does.

Using the Indicator in Your Trading Strategy

Incorporating the Zigzag Own Channel Indicator into one’s trading plan may provide a visual representation of market trends and potential price reversals, aiding in decision-making processes. However, it is important to note that this indicator should not be solely relied upon for making trading decisions. It is recommended to use multiple indicators and backtest your strategy before implementing any trades.

To effectively use the Zigzag Own Channel Indicator, it is important to understand its signals. A buy signal occurs when the current bar closes above the upper channel line while a sell signal occurs when the current bar closes below the lower channel line. Additionally, if you notice a trend reversal on the chart, such as a break in support or resistance levels, it may indicate a potential change in direction.

Overall, incorporating this indicator into your strategy can aid in identifying potential trade opportunities but should be used in conjunction with other technical analysis tools.

Tips for Maximizing the Effectiveness of the Indicator

To optimize the utility of this technical analysis tool, traders may consider utilizing it in conjunction with other indicators and performing comprehensive backtesting to validate its effectiveness in identifying potential trade opportunities based on market trends and price reversals. One common mistake that traders make when using the zigzag own channel indicator is relying solely on it to make trading decisions without considering other factors such as economic news releases or fundamental analysis. It is important to use multiple indicators and perform thorough analysis before making any trades.

Customizing settings within the indicator can also enhance its effectiveness. For example, adjusting the minimum percentage change required for a swing high or low can help filter out minor fluctuations in price and provide more accurate signals for potential trades. Additionally, experimenting with different timeframes can provide insight into how the indicator performs under different market conditions and increase its versatility in various trading strategies. By taking these steps, traders can maximize the effectiveness of the zigzag own channel indicator and improve their overall trading performance.

| Tip | Explanation |

|---|---|

| Utilize Multiple Indicators | Using multiple indicators along with Zigzag Own Channel Indicator helps you get more accurate results which will lead to better decision making while trading |

| Adjust Minimum Percentage Change | Setting up a minimum percentage change required for swing high/low helps eliminate minor fluctuations from your data set leading you towards better accuracy |

| Experiment with Different Timeframes | Try out different time frames to understand how your indicator functions under different market conditions. |

| Backtest Your Trading Strategy | Performing comprehensive backtesting helps you validate your strategy’s effectiveness by testing it against past data. |

| Do Not Rely Solely on ZigZag Indicator | Do not rely solely on one technical analysis tool while trading; always consider other factors such as economic news releases or fundamental analysis. |

Conclusion

In conclusion, the Zigzag Own Channel Indicator is a useful tool for technical analysis in the forex market. Its ability to identify trend lines and price channels can help traders make more informed decisions about their trades.

However, it should be noted that no indicator is foolproof and traders should always use multiple indicators and analysis methods to confirm signals before making a trade.

When using the Zigzag Own Channel Indicator, it is important to understand its limitations and adjust your trading strategy accordingly. This may involve setting stop loss orders or taking profits at certain points based on the indicator’s signals.

Additionally, it is important to stay up-to-date with market news and events that could impact your trades. By combining the use of this indicator with other analytical tools, traders can improve their chances of success in forex trading.