Zig Zag Signals Mt4 Indicator Review

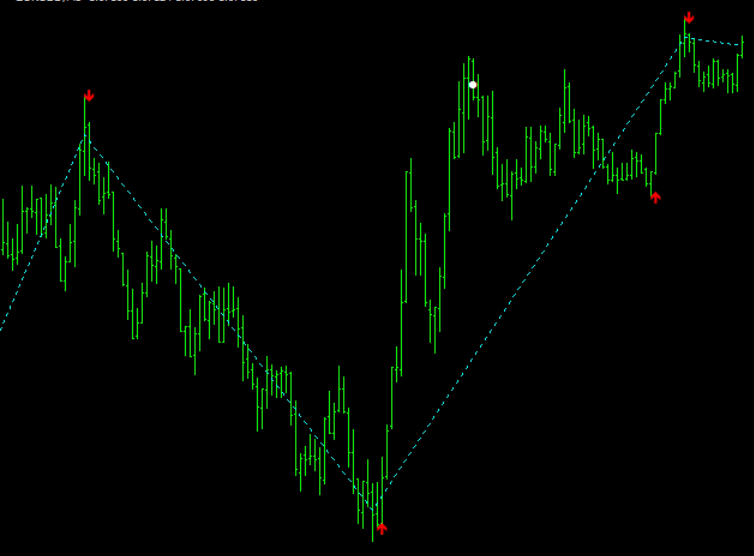

The Zig Zag Signals MT4 Indicator is a technical analysis tool that helps traders identify potential trend reversals in the financial markets. It works by filtering out noise and smoothing price movements, making it easier to spot significant market turning points.

The indicator is widely used in forex, stocks, and futures trading and has gained popularity due to its effectiveness in predicting trend changes. The Zig Zag Signals MT4 Indicator operates by connecting swing highs and lows on the price chart. It disregards minor price fluctuations, instead focusing on major peaks and valleys that form critical support and resistance levels.

Download Free Zig Zag Signals Mt4 Indicator

As such, it can be an essential tool for both short-term scalpers looking to capitalize on small market moves as well as long-term position traders seeking to capture major trend shifts. In this article, we will explore how the Zig Zag Signals MT4 Indicator works, how to use it effectively in trading strategies, and tips for maximizing its potential benefits.

Understanding the Basics of the Zig Zag Signals MT4 Indicator

The current section delves into the fundamental principles of an essential technical analysis tool commonly utilized in financial markets, which enables traders to identify significant price movements and trend reversals, through the use of a specific algorithmic approach.

The Zig Zag Signals MT4 Indicator is a widely recognized tool among traders for its ability to highlight critical market trends by smoothing out the noise that often occurs in financial markets. Customizing settings on the Zig Zag Signals MT4 Indicator allows traders to adjust specific parameters such as minimum price change or percentage change required for a reversal signal.

By interpreting chart patterns created by this indicator, traders can make informed decisions about buying and selling positions based on how strong or weak a particular trend may be. Additionally, understanding how this indicator works can help traders make better trading decisions by identifying key support and resistance levels at important market turning points.

Using the Zig Zag Signals MT4 Indicator in Trading

Identifying trend reversals using the Zig Zag Signals MT4 Indicator requires a clear understanding of its function.

The indicator identifies swings or changes in price direction and can be used to spot potential trend reversals.

Setting stop loss and take profit levels can also benefit from using the Zig Zag Signals MT4 Indicator, as it helps traders identify support and resistance levels more accurately.

Strategies for trading with this indicator include combining it with other technical indicators or analyzing multiple timeframes to confirm signals.

Identifying Trend Reversals

By analyzing patterns and interpreting market signals, traders can effectively identify trend reversals in financial markets. One useful tool for this is the Zig Zag Signals MT4 Indicator, which helps traders to visualize potential turning points in price movements.

The indicator works by filtering out price movements that are below a certain threshold, highlighting only significant changes in direction. To identify trend reversals using the Zig Zag Signals MT4 Indicator, traders should first pay attention to key support and resistance levels on their chart.

These levels can be identified by drawing horizontal lines at areas where prices have historically struggled to break through or have rebounded from. When the zig zag line of the indicator crosses one of these levels, it may indicate a potential reversal in trend direction.

However, traders should also use other technical indicators and fundamental analysis to confirm whether a reversal is likely before making any trading decisions based solely on the Zig Zag Signals MT4 Indicator output.

Setting Stop Loss and Take Profit Levels

Establishing appropriate stop loss and take profit levels is a key aspect of managing risk and maximizing profitability in financial trading. Stop loss orders are used to limit potential losses by automatically closing out a trade when the price reaches a predetermined level.

Take profit orders, on the other hand, are used to lock in profits by automatically closing out a trade when the price reaches a predetermined level of profit.

Here are some tips for setting stop loss and take profit levels:

- Use trailing stops: Trailing stops allow traders to adjust their stop loss order as the market moves in their favor, thereby locking in profits while minimizing potential losses.

- Set risk reward ratios: A risk reward ratio is the amount of money that can be potentially lost compared to the amount that can be potentially gained from a trade. Setting an appropriate risk reward ratio helps traders determine where to place their stop loss and take profit levels.

- Consider volatility: Highly volatile markets may require wider stop loss orders than less volatile markets.

- Use technical analysis: Technical analysis tools such as support and resistance levels, trend lines, and moving averages can help traders identify key levels at which to set their stop loss and take profit orders.

By following these guidelines, traders can effectively manage their risk while maximizing their profitability in financial trading.

Strategies for Trading with the Indicator

This section explores various strategies for utilizing the zig zag signals MT4 indicator in financial trading. By integrating this technical analysis tool into their trading approach, traders can effectively analyze market trends and make informed decisions.

One widely used strategy is to use the indicator as a confirmation tool for price breakouts or trend reversals. In such cases, traders look for instances where the zig zag lines move beyond previous highs or lows to confirm that a new trend is emerging.

Another useful application of the zig zag signals MT4 indicator involves backtesting results and developing risk management techniques. Traders often use historical data to test different trading strategies and assess their effectiveness over time. This process can help identify patterns in price movements, allowing traders to develop more accurate predictions about future market conditions.

Additionally, using stop loss and take profit levels in conjunction with the indicator can help traders manage risk by setting clear parameters around when they will exit a trade based on predetermined profit targets or acceptable losses.

Overall, incorporating the zig zag signals MT4 indicator into one’s trading practice offers numerous benefits for both novice and experienced traders alike.

Tips for Maximizing the Effectiveness of the Zig Zag Signals MT4 Indicator

Combining the Zig Zag Signals MT4 Indicator with other technical indicators such as moving averages or oscillators can enhance its effectiveness in identifying market trends.

Adapting to volatile markets involves adjusting the parameters of the indicator to suit current market conditions and avoiding false signals.

Regular monitoring and adjustments are necessary to ensure that the indicator continues to perform accurately over time, especially in fast-moving markets where sudden price movements may trigger false signals.

Combining with Other Indicators

The utilization of multiple indicators in conjunction with one another can provide traders with a more robust analysis of market trends and potential trading opportunities. The Zig Zag Signals MT4 Indicator is just one tool in a trader’s toolbox, and combining it with other technical analysis indicators may lead to more accurate predictions of price movements.

Some popular indicators that traders often use alongside the Zig Zag Signals MT4 Indicator include the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands.

Backtesting results have shown that combining these indicators with the Zig Zag Signals MT4 Indicator has led to increased accuracy in identifying potential entry and exit points. However, it is important for traders to remember that no indicator or combination of indicators will provide 100% accurate predictions, and market conditions are subject to change at any moment.

It is crucial for traders to continuously monitor their trades and adjust their strategies accordingly based on new information and changing market conditions.

Adapting to Volatile Markets

Combining the zig zag signals mt4 indicator with other technical indicators can help traders identify trading opportunities and make informed decisions. However, market conditions can change rapidly, especially during periods of high volatility.

Therefore, traders need to adapt their strategies accordingly to avoid excessive losses. Trading psychology during volatile markets is crucial for successful trading. Traders need to remain calm and composed even when faced with sudden price movements.

Panic selling or buying can lead to significant losses in a short amount of time. Therefore, it is important to have a well-defined risk management strategy in place before entering into high volatility trades. The zig zag signals mt4 indicator can help traders identify potential entry and exit points, but it is up to the trader to manage their positions effectively by setting stop-loss orders and taking profits at appropriate levels.

By adapting their strategies according to market conditions and remaining disciplined in their approach, traders can minimize risks while maximizing returns in volatile markets using the zig zag signals mt4 indicator.

Regular Monitoring and Adjustments

To ensure success in volatile markets, traders must consistently monitor and adjust their strategies according to changing market conditions. This requires a significant amount of patience and discipline as it can be tempting to make impulsive decisions based on short-term market movements.

However, successful traders understand the importance of taking a long-term approach and utilizing technical indicators such as the zig zag signals MT4 indicator to identify trends and potential entry or exit points.

Regular monitoring is crucial in volatile markets as sudden market shifts can occur at any time. Traders who fail to keep a close eye on the market risk missing out on profitable opportunities or suffering significant losses.

Additionally, adjustments may need to be made to trading strategies based on new information or changes in the overall market environment. Maintaining discipline throughout this process is essential as emotional decision-making can lead to poor outcomes.

By staying patient, disciplined, and vigilant in their analysis and decision-making processes, traders can increase their chances of success in volatile markets.

Conclusion

In conclusion, the Zig Zag Signals MT4 Indicator is a valuable tool that can help traders identify potential trend reversals and changes in market direction.

It works by filtering out minor price fluctuations and highlighting significant price movements, making it easier for traders to spot important levels of support and resistance.

However, like any technical indicator, it is not foolproof and should be used in conjunction with other analytical tools to confirm trade signals.

To maximize the effectiveness of the Zig Zag Signals MT4 Indicator, traders should take care to adjust their settings based on the timeframe and market conditions they are trading in.

They should also avoid relying solely on this indicator and should instead use it as part of a broader trading strategy that considers multiple factors such as fundamental analysis, chart patterns, and market sentiment.

By doing so, traders can increase their chances of making profitable trades while minimizing risk.