Uni Zigzag Channel Indicator Mt4 Review

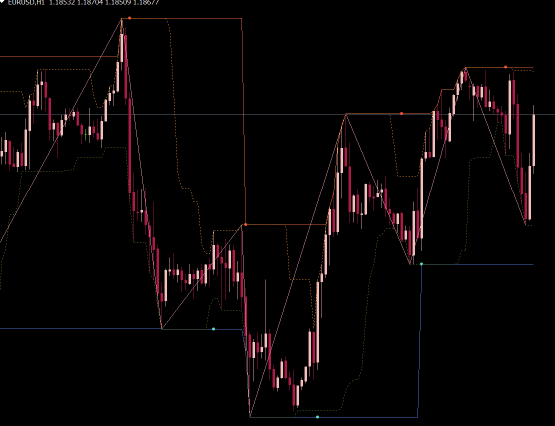

The Uni ZigZag Channel Indicator MT4 is a technical analysis tool that helps traders identify potential trend reversals and breakouts in the financial markets. This indicator uses a zigzag pattern to plot price movements, creating channels that show support and resistance levels.

Traders can use this indicator on various timeframes, including intraday charts, daily charts, and weekly charts. By analyzing the Uni ZigZag Channel Indicator MT4, traders can gain insights into market trends and make informed trading decisions based on their findings.

Download Free Uni Zigzag Channel Indicator Mt4

In this article, we will explore how to understand and customize the Uni ZigZag Channel Indicator MT4 for optimal use in your trading strategy. We will also provide tips for maximizing its effectiveness in identifying potential trades.

Understanding the Uni ZigZag Channel Indicator MT4

The present section aims to provide an in-depth understanding of the Uni ZigZag Channel Indicator MT4, a technical indicator utilized within trading platforms.

This algorithm is designed to identify key features on price charts and provide traders with valuable insights into market trends.

Exploring the algorithm of this indicator, it works by analyzing the highs and lows of price movements over a specified period.

The resulting channel represents support and resistance levels that traders can use to make informed decisions about when to enter or exit trades.

Additionally, the Uni ZigZag Channel Indicator MT4 also provides signals for potential trend reversals, making it a valuable tool for identifying market shifts.

By incorporating this indicator into their trading strategy, traders can gain a competitive edge in the markets and increase their chances of success.

Customizing the Indicator

In this section, the user can modify the parameters of the Uni ZigZag Channel Indicator MT4 to tailor it to their specific needs and preferences. This allows for greater flexibility in analyzing market trends and making informed trading decisions.

The indicator offers a range of customizable options that can be adjusted to suit individual preferences. One such option is adjusting settings. This can be done by changing the input values of the indicator, which determine how it calculates and displays price movements over time. Users may choose to adjust these settings based on their trading style or market analysis approach.

Another customization option is modifying colors. The indicator provides several color schemes that users can select from to make it more visually appealing or easier to read, depending on personal preference.

Overall, these customization features allow traders to use the Uni ZigZag Channel Indicator MT4 in a way that best suits their needs and helps them make more informed trading decisions.

Using the Indicator in Your Trading Strategy

Utilizing the uni zigzag channel indicator in forex trading can enhance one’s trading strategy by providing valuable insight into market trends and identifying potential entry and exit points. As a technical analysis tool, this indicator helps traders to identify price movements with greater accuracy while minimizing risk.

By following the trend lines created by the indicator, traders can make informed decisions about when to enter or exit trades based on the market conditions. Integrating the uni zigzag channel indicator into a swing trading strategy is especially useful for those who prefer longer-term trades.

Swing traders look for opportunities over several days or weeks rather than attempting to profit from short-term fluctuations in price. The uni zigzag channel indicator can assist them in identifying key support and resistance levels that indicate when it is time to enter or exit a trade. By using this tool as part of their overall strategy, swing traders can potentially increase their profits while minimizing their risks in the highly volatile forex market.

Tips for Maximizing the Effectiveness of the Uni ZigZag Channel Indicator MT4

The effectiveness of the Uni ZigZag Channel Indicator MT4 can be further enhanced by combining it with other indicators that complement its performance. Traders can experiment with different combinations and observe which ones work best for their trading strategy.

Additionally, practicing with a demo account is highly recommended as it allows traders to test their strategies without risking real money, helping them gain confidence in using the indicator effectively.

It is important to approach these methods objectively and analytically to ensure maximum effectiveness of the Uni ZigZag Channel Indicator MT4.

Combining with Other Indicators

The integration of multiple technical indicators can provide traders with a more comprehensive analysis of market trends and potential trading opportunities. Combining the Uni Zigzag Channel Indicator MT4 with other indicators can help traders confirm or identify potential trend reversals, breakouts, and price consolidation areas.

By using multiple indicators, traders can filter out false signals and increase their chances of making profitable trades. When combining the Uni Zigzag Channel Indicator MT4 with other indicators, it is important to backtest the results to ensure that the combination is effective.

Some possible combinations include using the Relative Strength Index (RSI) to confirm oversold or overbought conditions when price touches a support or resistance level identified by the Uni Zigzag Channel Indicator MT4. Another possible combination is using Moving Averages to identify potential trend changes when they intersect with a channel line drawn by the Uni Zigzag Channel Indicator MT4.

Finally, traders could use Fibonacci retracements in conjunction with the Uni Zigzag Channel Indicator MT4 to identify potential price targets after a breakout occurs from a channel line.

Practicing with a Demo Account

Having discussed the potential benefits of combining the uni zigzag channel indicator with other technical indicators in the previous subtopic, it is important to note that novice traders may not have enough experience or knowledge to make informed decisions when using these tools.

Therefore, it is highly recommended for traders to practice with a demo account before risking real money in live trading.

Demo accounts are simulation platforms offered by many brokers where traders can practice trading without risking their funds. It allows them to understand and familiarize themselves with market conditions, test different strategies, and become comfortable with using various trading tools such as the uni zigzag channel indicator.

The benefits of demo trading also include the ability to learn from mistakes without any financial repercussions. However, common mistakes in demo trading include neglecting risk management principles and treating it as a game instead of taking it seriously.

Overall, practicing with a demo account provides novice traders an opportunity to gain experience and confidence before moving on to live trading.

Frequently Asked Questions

What is the history behind the development of the Uni ZigZag Channel Indicator MT4?

The development history of technical indicators can be traced back to the early days of trading, when traders sought ways to analyze price movements and make informed decisions. These indicators are designed using mathematical formulas that enable traders to identify patterns and trends in market data.

The development history of the Uni ZigZag Channel Indicator MT4 is not well-documented, but it is likely that it was created to improve upon existing channel indicators by incorporating features such as zigzag lines and customizable parameters. Technical specifications for this indicator include settings for the depth, deviation, and backstep of the zigzag lines, as well as options for displaying channels based on different timeframes or currency pairs.

Overall, the Uni ZigZag Channel Indicator MT4 is a valuable tool for traders seeking to identify support and resistance levels in volatile markets.

Are there any limitations to using the Uni ZigZag Channel Indicator MT4?

When considering using any technical analysis tool, it is important to weigh its strengths and limitations. The Uni ZigZag Channel Indicator MT4 is no exception.

While this indicator can be effective in identifying trends and potential price reversals, it is not a foolproof solution to trading success. One of the main limitations of this indicator is the fact that it relies heavily on past price data, which may not always accurately predict future market movements.

Additionally, the user must carefully determine appropriate settings for their specific trading strategy and market conditions in order to maximize its effectiveness.

As with any tool, proper understanding and usage are key factors in determining whether or not the Uni ZigZag Channel Indicator MT4 will be beneficial to a trader’s overall approach.

Can the Uni ZigZag Channel Indicator MT4 be used on multiple timeframes?

The use of multiple timeframes in trading strategies is a common practice among traders. Utilizing different timeframes allows for a more comprehensive analysis of market trends and potential entry and exit points.

By analyzing the same financial instrument on various timeframes, traders can obtain a better understanding of the overall trend, as well as identify short-term fluctuations that could indicate an opportunity to enter or exit positions.

The Uni ZigZag Channel Indicator MT4 is a versatile tool that can be used across multiple timeframes to aid in identifying these opportunities. Its ability to filter out noise while simultaneously highlighting significant price movements makes it an invaluable asset in constructing effective trading strategies that capitalize on trends both big and small.

Are there any alternative indicators that work well in conjunction with the Uni ZigZag Channel Indicator MT4?

Indicator combinations are a crucial aspect of trading strategies, as they enable traders to gain a more comprehensive understanding of market trends and make informed trading decisions.

There are several alternative indicators that work well in conjunction with other technical analysis tools, such as moving averages and oscillators, to provide additional insights into the market.

For instance, combining the Relative Strength Index (RSI) with the Moving Average Convergence Divergence (MACD) can help identify potential trend reversals and generate buy or sell signals.

Additionally, pairing the Bollinger Bands with the Stochastic Oscillator can assist in identifying overbought or oversold conditions in the market.

Overall, utilizing indicator combinations can enhance one’s trading strategy by providing a more holistic view of market trends and patterns.

How does the Uni ZigZag Channel Indicator MT4 compare to other popular indicators in terms of accuracy and reliability?

When comparing the accuracy and reliability of various indicators, there are both pros and cons to consider. Some popular indicators may be more effective in certain market conditions or for specific trading strategies, while others may have limitations.

For example, the moving average indicator can provide a simple way to identify trends and potential support/resistance levels, but it may not always accurately capture sudden price movements or changes in volatility. On the other hand, oscillators like RSI or MACD can help traders gauge momentum and overbought/oversold conditions, but they too have their drawbacks such as false signals during choppy markets.

Real life examples of these strengths and weaknesses can be seen through backtesting different indicators on historical data or observing how they perform in live trading environments. Ultimately, finding the right combination of technical analysis tools that align with individual trading styles is key to achieving consistent profitability in the markets.

Conclusion

The Uni ZigZag Channel Indicator MT4 is a powerful technical analysis tool that can help traders identify potential trend reversals and trade entry points. This indicator uses zigzag lines to highlight key support and resistance levels, making it easy for traders to spot important price levels. Additionally, the Uni ZigZag Channel Indicator MT4 allows traders to customize the indicator settings to fit their specific trading style.

Using the Uni ZigZag Channel Indicator MT4 in your trading strategy can be highly effective if used correctly. Traders should look for areas where the zigzag lines converge or diverge, indicating potential trend reversals. Additionally, traders should use other technical indicators and price action analysis in conjunction with this indicator to confirm trade signals. It is also important to note that this indicator works best on higher timeframes such as daily or weekly charts.

In conclusion, the Uni ZigZag Channel Indicator MT4 is a valuable tool for any trader looking to improve their technical analysis skills. By customizing the indicator settings and using it in combination with other technical indicators, traders can increase their chances of successfully identifying high-probability trades. However, like any other technical analysis tool, it is not foolproof and should be used in conjunction with good risk management practices.