Turtle Channel Indicator Mt4 Review

The Turtle Trading System is a well-known trend-following trading strategy that has been widely used by traders for decades. The system was developed by Richard Dennis and William Eckhardt in the 1980s, where they trained a group of novice traders to trade using their rules-based system. The success of this experiment led to the publication of the book ‘The Complete Turtle Trader’ which detailed the principles and rules of the system.

One key aspect of this trading strategy is the use of channels to identify potential entry and exit points, with one such channel being the Turtle Channel Indicator MT4.

Download Free Turtle Channel Indicator Mt4

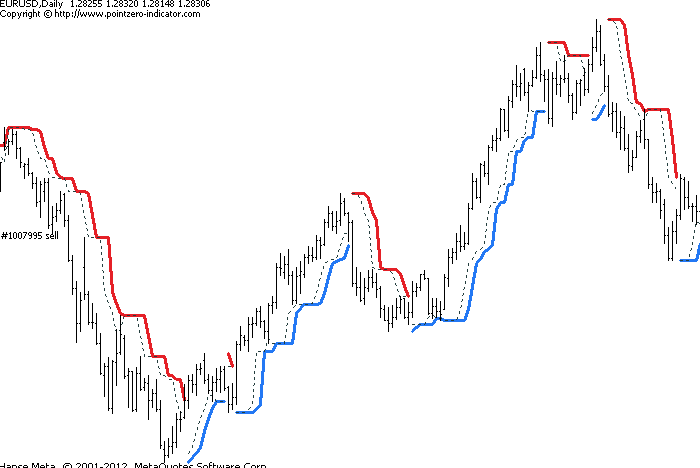

The Turtle Channel Indicator MT4 is a technical analysis tool that allows traders to plot two lines above and below an asset’s price chart. These lines represent the upper and lower bounds of a channel, which helps traders identify potential breakouts or breakdowns in price movements.

This indicator can be customized based on individual preferences, including choosing different timeframes, colors, and line thicknesses. With its roots in trend-following strategies, this indicator can be particularly useful for identifying buy or sell signals during periods of strong market trends.

In this article, we will explore how this indicator works and provide tips for integrating it into your own trading strategy.

The History and Principles of the Turtle Trading System

The section delves into the historical background and fundamental principles that underpin the development of a widely popular trading strategy known as the Turtle Trading System.

The system was developed by Richard Dennis and William Eckhardt in the early 1980s, who believed that anyone could learn to trade successfully by following a set of specific rules.

They recruited a group of novice traders, taught them their proprietary trading system, and gave them capital to trade with. These traders became known as the ‘Turtles,’ and they went on to achieve remarkable success using this system.

The Turtle Trading Rules are based on sound fundamental principles such as risk management, position sizing, and trend following.

The system emphasizes protecting capital above all else through careful risk management techniques such as stop-loss orders and diversification across multiple markets.

Position sizing is also an essential component of the strategy, where traders allocate a fixed percentage of their account balance per trade to control risk while maximizing potential profits.

Additionally, the system relies heavily on trend-following strategies that identify long-term trends in various markets using technical analysis tools such as moving averages.

Famous Turtle Traders include Paul Rabar, Jerry Parker Jr., Liz Cheval, among others who have achieved significant success using this trading approach.

How Does the Turtle Channel Indicator MT4 Work?

This section delves into the mechanics behind the functionality of using turtle channel indicator in forex, specifically in MetaTrader 4.

The turtle channel indicator is a technical tool that helps traders identify trends and potential entry and exit points for their trades. It works by plotting two lines on a chart: an upper line that represents resistance levels and a lower line that represents support levels. These lines are based on the highest high/lowest low prices over a set number of periods, which can be customized according to the trader’s preferences.

One of the advantages of turtle channel indicator mt4 is its ability to provide clear signals for both bullish and bearish trends. When prices move above or below the channels, it indicates a potential reversal or continuation of the trend, allowing traders to make informed decisions on their trades.

Additionally, traders can use different settings for the indicator to adapt to various market conditions and timeframes. However, as with any technical tool, it is important to exercise caution and not rely solely on its signals but also incorporate other analysis methods in one’s trading strategy.

Tips for Using the Turtle Channel Indicator MT4 in Your Trading Strategy

Combining the Turtle Channel Indicator MT4 with other technical analysis tools can enhance your trading strategy.

For instance, you can use the indicator in conjunction with trend lines, moving averages, and other indicators to confirm trade signals.

Additionally, setting stop loss and take profit levels with the indicator is vital for managing risk and maximizing profits.

Combining the Indicator with Other Technical Analysis Tools

By utilizing additional technical analysis tools in conjunction with the turtle channel indicator, traders can gain a more comprehensive understanding of market trends and make more informed trading decisions.

One such tool is Fibonacci retracements, which can be used to identify potential support and resistance levels within the trend identified by the turtle channel indicator. Traders can use these levels as entry and exit points for trades, as well as to set stop-loss orders.

Another useful tool to combine with the turtle channel indicator is moving averages. By overlaying a moving average on top of the turtle channels, traders can look for crossovers between the two lines as potential signals for entering or exiting trades.

For example, if the price crosses above both the upper turtle channel and the moving average line, it could be interpreted as a bullish signal, while a cross below both lines could be seen as bearish.

Overall, combining different technical analysis tools with the turtle channel indicator mt4 can help traders enhance their strategies by providing more insight into market trends and potential trade opportunities.

Setting Stop Loss and Take Profit Levels with the Indicator

In order to effectively manage risk and protect profits, traders can utilize the turtle channel indicator in conjunction with their own analysis to set appropriate stop loss and take profit levels for their trades.

By using trailing stops, traders can adjust their stop loss level as the market moves in their favor, allowing them to lock in profits while minimizing potential losses.

The Turtle Channel Indicator MT4 provides a visual representation of support and resistance levels that can be used to determine where to place stop loss and take profit orders.

Traders can also use the Turtle Channel Indicator MT4 to help determine position size for each trade. By analyzing the range of price movements within the channel, traders can calculate how much capital they should allocate for each trade based on their risk tolerance.

This allows traders to limit potential losses while maximizing potential gains.

Overall, by incorporating the Turtle Channel Indicator MT4 into their trading strategy, traders have a powerful tool at their disposal that can help them manage risk and increase profitability.

Managing Your Risk and Sticking to Your Trading Plan

Risk management techniques are crucial for any trader to minimize losses and maximize profits in the market. The turtle channel indicator MT4 provides traders with a visual representation of price movement, which can help them identify key levels for setting stop loss and take profit orders.

However, it is important to remember that risk management goes beyond simply setting these orders. Traders must also develop a comprehensive trading plan that outlines their strategy, risk tolerance, and exit points.

To effectively manage risk when using the turtle channel indicator MT4, traders should consider implementing the following techniques:

- Use proper position sizing: Traders should calculate their position size based on their account balance and risk tolerance to ensure they do not over-leverage their trades.

- Set realistic profit targets: By setting appropriate profit targets based on market conditions and the trader’s strategy, they can avoid taking unnecessary risks.

- Monitor trade progress: Traders should regularly monitor open positions and adjust stop loss or take profit orders as needed based on changes in market conditions.

By incorporating these risk management techniques into their trading plan, traders can reduce their exposure to potential losses while still taking advantage of opportunities presented by the market. It is essential to stick to this plan consistently rather than making impulsive decisions based on emotions or short-term fluctuations in price movements.

Conclusion

The Turtle Channel Indicator MT4 is a technical analysis tool that traders can use to identify potential entry and exit points in the market. Based on the principles of the Turtle Trading System, this indicator plots two lines around price action that act as support and resistance levels.

By following these levels, traders can make informed decisions about when to buy or sell assets. To effectively use the Turtle Channel Indicator MT4 in your trading strategy, it is important to understand its history and underlying principles.

Additionally, incorporating other technical indicators and fundamental analysis can further enhance your decision-making process. Overall, the Turtle Channel Indicator MT4 is a valuable tool for traders looking to make informed decisions based on market trends and data.