Trend Follower System (5 Min) Mt4 Indicator Review

The Trend Follower System (5 min) MT4 Indicator is a popular tool utilized by traders to identify and track trends in the market. This indicator can be used on any financial instrument, including currencies, stocks, and commodities.

The purpose of this article is to provide an overview of the Trend Follower System (5 min) MT4 Indicator, explain how it works, and offer tips for using this indicator effectively.

Download Free Trend Follower System (5 Min) Mt4 Indicator

Traders use trend following indicators like the Trend Follower System (5 min) MT4 Indicator to identify market trends and determine when to enter or exit trades. By analyzing price movement over time, traders can identify patterns that indicate whether a trend is gaining momentum or losing steam.

While no indicator can predict future price movements with 100% accuracy, utilizing trend-following indicators like the Trend Follower System (5 min) MT4 Indicator can help traders make informed decisions based on historical data.

In the next section of this article, we will dive deeper into how this indicator works and how traders can use it in their trading strategies.

Overview of the Trend Follower System (5 min) MT4 Indicator

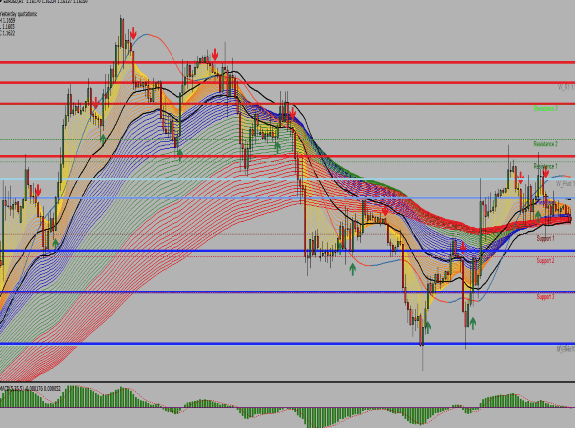

The present section provides a comprehensive overview of a technical analysis tool designed for identifying and following the direction of price movements in financial markets. The Trend Follower System (5 min) MT4 Indicator is a trading strategy that aims to identify trends in the market by analyzing historical price data. This tool uses various technical indicators such as Moving Averages, Relative Strength Index (RSI), and Stochastic Oscillator to determine the trend direction.

Technical analysis is an approach used by traders and investors to analyze historical market data, including price and volume, to predict future trends. It relies on the idea that market trends tend to repeat themselves over time, making it possible to identify patterns and make informed decisions about buying or selling assets.

The Trend Follower System (5 min) MT4 Indicator is one such tool that utilizes technical analysis principles to help traders identify potential entry points for trades based on trend direction. By providing clear signals about when to enter or exit positions, this indicator can be a valuable asset for those looking to improve their trading strategies.

How to Use the Indicator

This section outlines the steps one should take to effectively utilize the Trend Follower System (5 min) MT4 Indicator.

The first step is to set up the indicator settings according to personal preference and trading style. This includes selecting the appropriate time frame, setting the period for moving averages, choosing preferred color schemes, and adjusting other parameters as needed.

Once these settings are in place, traders can begin using the tool to analyze market trends and generate reliable trading signals.

To achieve desired results with this indicator, it is important to understand how it generates trading signals. The system uses a combination of moving averages and price action analysis to identify potential trend reversal points or entry/exit points for trades.

When a signal is generated, traders should use their own judgment and technical analysis skills to confirm whether or not they should enter a trade based on that signal.

With proper usage of this tool and careful consideration of its output signals, traders can increase their chances of success in today’s fast-paced financial markets.

Tips for Using the Indicator Effectively

In order to maximize the utility of the trend follower system (5 min) MT4 indicator, traders should carefully consider their individual trading strategies and goals, and closely monitor market trends using the data provided by the software. Effective strategies include setting clear entry and exit points based on the indicator’s signals, using stop-loss orders to limit potential losses, and adjusting positions as market conditions change. Additionally, traders should avoid common mistakes such as over-reliance on a single indicator or ignoring other important factors that may impact market movements.

To use this financial analysis tool effectively, traders must remain disciplined in following their chosen strategy and resist making impulsive decisions based solely on emotional reactions to market fluctuations. It is also important to continuously educate oneself about trading techniques and keep up-to-date with current events that may influence financial markets.

By utilizing these effective strategies and avoiding common mistakes, traders can increase their probability of success when using the trend follower system (5 min) MT4 indicator.

Sub-lists:

- Identify key support/resistance levels to help guide decision-making

- Use technical analysis tools in conjunction with the trend follower system for more accurate predictions

- Develop a risk management plan to mitigate potential losses

Conclusion and Next Steps

To effectively utilize the strategies and techniques outlined in the previous section, traders must remain disciplined and continuously educate themselves about trading techniques. This will help them to stay up-to-date with new market trends and indicators that could impact their trading decisions.

Furthermore, it is crucial for traders to remain patient as they wait for the right trading opportunities to arise. Rushing into trades without proper analysis can lead to significant losses.

In terms of next steps, traders should consider backtesting their trend follower system using historical data to assess its effectiveness. This will allow them to identify potential improvements that can be made before implementing the system in live trading environments.

Additionally, traders may want to consider using other technical indicators alongside the trend follower system for more accurate market analysis.

Ultimately, continuous learning and improvement are essential for success in financial markets.

Frequently Asked Questions

Can the Trend Follower System (5 min) MT4 Indicator be used in other timeframes besides 5 minutes?

Adapting indicators to different timeframes is a common practice in technical analysis. Backtesting the performance of an indicator in various markets and timeframes can provide insights into its effectiveness and suitability for different trading strategies. However, it is important to note that past performance does not guarantee future results, and traders should exercise caution when using historical data as a basis for their trading decisions.

Additionally, factors such as market volatility, liquidity, and economic events can influence the accuracy of indicators in different timeframes and should be taken into consideration when analyzing their performance. Overall, adapting indicators to different timeframes requires careful analysis and testing to determine their efficacy in specific market conditions.

Is the indicator suitable for all types of markets, such as stocks, forex, and commodities?

Trend following indicators are popular among traders due to their ability to identify the direction of market trends and generate trading signals accordingly. However, the effectiveness of these indicators varies depending on the market conditions.

In volatile markets, trend following strategies may produce false signals or result in significant losses. Therefore, traders need to carefully consider the pros and cons of using trend following indicators in different types of markets before incorporating them into their trading strategies.

While these indicators can be useful for identifying trends in stocks, forex, and commodities, it is important to understand that they are not foolproof and should be used in conjunction with other technical analysis tools.

Ultimately, successful trading requires a comprehensive understanding of market dynamics and risk management strategies that go beyond relying solely on trend following indicators.

Does the indicator provide any signals for entry and exit points or does it only indicate trends?

When considering the accuracy of an indicator, it is important to evaluate its ability to provide signals for entry and exit points.

While some indicators may simply indicate trends without providing specific recommendations for trading decisions, others may offer more detailed information on when to buy or sell assets.

However, it is crucial to note that even the most accurate indicators may have potential drawbacks such as false signals or lagging information.

Traders should carefully consider these factors before relying solely on any one indicator in their decision-making process.

Is it possible to customize the indicator settings to fit individual trading strategies?

Customization options are important in any trading strategy, as they allow traders to optimize their results by tailoring their indicators and tools to fit their individual needs. When it comes to the Trend Follower System (5 min) MT4 Indicator, it is possible to customize its settings according to one’s own trading strategies.

For instance, a trader can adjust the indicator’s parameters such as the time frame, moving averages used, and other technical indicators based on their preferences. This customization can help traders obtain better signals for entry and exit points that fit their specific trading style. By fine-tuning the settings of this indicator, traders can potentially improve the accuracy of their trades and increase profitability over time.

Are there any recommended stop loss and take profit levels when using the Trend Follower System (5 min) MT4 Indicator?

When using any trading strategy, it is always recommended to have a proper risk management plan in place. This includes setting stop loss and take profit levels that align with the individual’s trading goals and risk tolerance.

Best practices for using the Trend Follower System (5 min) MT4 Indicator suggest that traders should consider a 1:2 or higher risk-reward ratio when setting these levels. For example, if the trader sets a stop loss of 10 pips, they should aim for a take profit level of at least 20 pips or more.

It is also important to adjust these levels as market conditions change and to not set them too close to current price levels in order to avoid premature exits or significant losses. Ultimately, determining the appropriate stop loss and take profit levels for the Trend Follower System (5 min) MT4 Indicator requires careful consideration of personal trading objectives and market conditions.

Conclusion

The Trend Follower System (5 min) MT4 Indicator is a valuable tool for traders seeking to identify trends in the market. By plotting moving averages and trend lines on a chart, it helps traders make informed decisions about when to buy or sell assets. To use the indicator effectively, traders should pay attention to key levels of support and resistance and use stop loss orders to limit potential losses.

While the Trend Follower System (5 min) MT4 Indicator can be a useful tool, it should not be relied upon exclusively. Traders should also consider other technical indicators, fundamental analysis, and market news before making trading decisions.

Additionally, practice and experience are necessary for successful trading with any system or tool. With dedication and discipline, traders can utilize the Trend Follower System (5 min) MT4 Indicator to improve their trading strategies and achieve greater success in the markets.