Trend Direction Force Index Indicator Mt4 Review

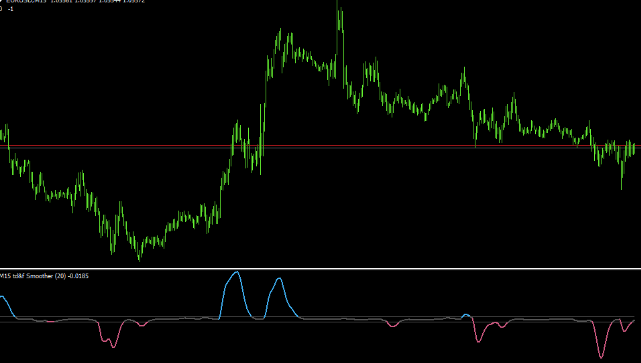

The Trend Direction Force Index Indicator MT4 is a technical analysis tool that traders use to gauge the strength and direction of trends in the financial markets. It is a momentum oscillator that measures the force behind price movements over a specified period, allowing traders to identify potential trend reversals or continuations.

This indicator’s popularity stems from its ability to filter out market noise and provide reliable signals based on price action. By analyzing changes in trend direction and strength, traders can make informed decisions about entry and exit points, as well as adjust their risk management strategies accordingly.

Download Free Trend Direction Force Index Indicator Mt4

In this article, we will explore how the Trend Direction Force Index Indicator MT4 works and how it can benefit traders when incorporated into their trading strategy.

Understanding the Trend Direction Force Index Indicator MT4

The present section delves into the comprehension of a technical analysis tool utilized in financial markets, specifically designed to calculate the strength and direction of trends. Known as Trend Direction Force Index Indicator MT4, this indicator is widely used by traders worldwide to identify market trends and make informed trading decisions.

It works by analyzing price movements over time and providing an accurate representation of the trend’s momentum. To use this indicator effectively, traders must adjust its settings based on their individual preferences. This includes setting the period length, smoothing intervals, and other parameters that impact how it calculates trend strength and direction.

Additionally, historical performance analysis can help traders understand how well this indicator has worked in past trading scenarios. By examining its accuracy over time, traders can gain valuable insights into when to buy or sell assets based on current market conditions. Overall, understanding this tool’s inner workings is crucial for successful technical analysis in financial markets.

Benefits for Traders

This analytical tool provides traders with a means to assess the strength of market trends, allowing them to make informed and strategic trading decisions based on objective data.

The Trend Direction Force Index Indicator MT4 is particularly beneficial for long-term traders as it can help identify trends that last for extended periods of time. By analyzing the changes in price and volume over a longer timeframe, this indicator can provide more accurate readings and reduce false signals.

Furthermore, the Trend Direction Force Index Indicator MT4 is effective even when market volatility is high. This is because it takes into account both price and volume changes, which can help filter out noise caused by short-term fluctuations.

Traders can use this indicator to confirm their analysis of market trends or identify potential reversals before they occur. The ability to accurately predict trend direction regardless of market conditions makes this tool an essential addition to any trader’s toolbox.

Incorporating the Indicator into Your Trading Strategy

Incorporating the trend direction force index indicator MT4 into your trading strategy can help you find optimal entry and exit points.

This is because the indicator provides insight into trend strength and momentum, allowing traders to identify potential reversals or continuations of trends.

To maximize effectiveness, it’s recommended to use the indicator in conjunction with other tools such as price action analysis, support and resistance levels, and other technical indicators for confirmation.

Finding optimal entry and exit points

As traders seek to make profitable trades, identifying the most advantageous entry and exit points in relation to trend direction force can be a key factor in achieving success.

Technical analysis plays a crucial role in determining these optimal points. The trend direction force index (TDFI) indicator is a helpful tool for traders looking to incorporate technical analysis into their strategy. By calculating the strength and momentum of trends, TDFI helps identify potential entry and exit points based on trend direction.

Market volatility is another factor that should be considered when using TDFI to find optimal entry and exit points. During periods of high volatility, it may be more difficult to accurately predict future price movements based solely on technical indicators like TDFI.

Traders should also consider other factors such as fundamental analysis, market news, and economic data before making trading decisions during times of increased market turbulence. Overall, incorporating TDFI into one’s trading strategy can provide valuable insights into trend strength and momentum, but careful consideration of market conditions is necessary for finding the most effective entry and exit points.

Using the indicator in conjunction with other tools for maximum effectiveness

Maximizing the effectiveness of TDFI involves utilizing it in conjunction with other technical analysis tools and considering market conditions to make informed trading decisions. Technical analysis tools such as moving averages, Bollinger Bands, and Fibonacci retracements can be used alongside TDFI to confirm signals and identify entry and exit points. For example, a trader may use TDFI to identify a strong trend but then use a moving average crossover as confirmation before entering the trade.

Market volatility analysis is also important when using TDFI as it can help traders gauge potential price movements and adjust their trading strategy accordingly. Volatility indicators such as Average True Range (ATR) can be used in conjunction with TDFI to identify periods of high or low volatility. During high volatility periods, traders may want to increase their stop loss levels or reduce their position sizes to manage risk appropriately. On the other hand, during low volatility periods, traders may want to consider using options strategies or increasing leverage for potentially higher returns.

| Technical Analysis Tools | Market Volatility Analysis | |||

|---|---|---|---|---|

| Moving Averages | Average True Range (ATR) | |||

| Bollinger Bands | Historical Volatility | |||

| Fibonacci Retracements | Implied Volatility | |||

| MACD | VIX Index | Relative Strength Index (RSI) | Put-Call Ratio |

Conclusion

The Trend Direction Force Index Indicator MT4 is a popular technical tool used by traders to identify the strength and direction of trends in the forex market.

This indicator measures the force behind price movements over a specified period, allowing traders to make informed decisions about possible entry and exit points.

By providing insights into market momentum, this indicator can be integrated into a trader’s strategy for greater accuracy and profitability.

In conclusion, the Trend Direction Force Index Indicator MT4 is an essential tool for traders looking to gain a competitive edge in the forex market.

Its ability to measure trend strength and direction allows for better decision-making when entering or exiting trades.

With its ease of use and customizable features, it has become a popular choice among both novice and experienced traders alike.

Incorporating this indicator into your trading strategy can help you stay ahead of market trends and increase your chances of success in forex trading.