Trend Direction & Force Index Averages Mt4 Indicator Review

Technical analysis is a popular approach for traders to make informed decisions about buying and selling assets. It involves using charts and indicators to identify patterns and trends in price movements over time.

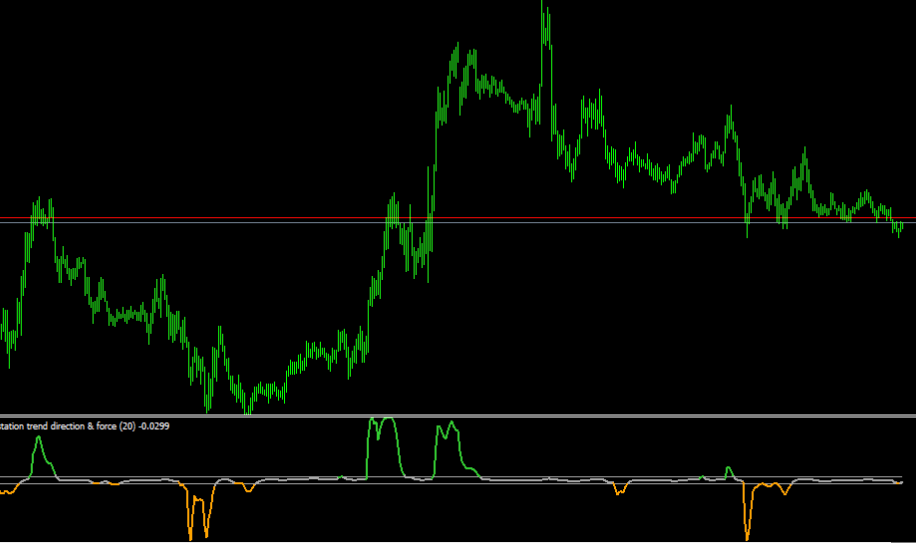

One such indicator that can be used to evaluate the strength of a trend is the Trend Direction & Force Index Averages MT4 Indicator. This tool combines two separate indicators, the Trend Direction Index (TDI) and the Force Index, to provide an overall measure of trend direction and momentum.

Download Free Trend Direction & Force Index Averages Mt4 Indicator

The TDI is a technical indicator that uses multiple moving averages to determine the direction of a trend. It consists of three lines: a red line representing the current price movement, a green line representing the upward momentum, and a yellow line representing downward momentum. The intersection of these lines can provide signals for traders on when to enter or exit trades based on trend changes.

The Force Index, on the other hand, measures the strength behind price movements by combining volume data with price changes over time. By combining these two indicators into one tool, traders can get an even more comprehensive view of market trends and make more informed trading decisions.

Understanding the Trend Direction Index (TDI)

The analysis of market trends can be facilitated by understanding the Trend Direction Index (TDI), a technical tool that combines both moving averages and volatility in order to identify potential entry and exit points in financial markets.

The TDI trading strategies are based on the concept of identifying trend direction, momentum, and strength. This indicator is used by traders all over the world as it provides them with a comprehensive view of the market conditions.

TDI is often compared to other popular trend indicators such as Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI).

While MACD helps traders identify trends, TDI takes this one step further by also measuring volatility. On the other hand, RSI measures only price strength or weakness but does not take into account volatility or momentum.

Therefore, TDI proves to be a more comprehensive tool for trading decisions that involve identifying both trend direction and force index averages.

Understanding the Force Index

The Force Index is a technical indicator that measures the strength of price movement. It is calculated using three components: recent price changes, trading volume, and an exponential moving average.

Traders can use the Force Index to identify trend direction and measure buying and selling pressure in the market.

Calculation and interpretation of the Force Index

Understanding the calculation and interpretation of the Force Index can provide valuable insight into market activity and potential shifts in momentum. The force index formula is based on three components: price change, volume, and time. It measures the strength of buying or selling pressure by calculating the difference between today’s closing price and yesterday’s closing price, multiplied by today’s volume. The result is then smoothed over a specified period using an exponential moving average (EMA).

Interpreting the force index involves analyzing its trend direction and magnitude. A positive force index indicates that buyers are in control, while a negative force index suggests that sellers are dominating the market. Traders can use this information to identify potential entry or exit points for their trades.

Additionally, traders may also use the force index trading strategy to confirm trends or divergences with other technical indicators such as moving averages or oscillators. Overall, understanding how to calculate and interpret the force index can be a useful tool for traders looking to gain insights into market activity and make informed trading decisions.

Using the Force Index to measure buying and selling pressure

By utilizing the Force Index, traders can accurately measure the levels of buying and selling pressure in the market, providing valuable insights into potential shifts in market activity. This calculation involves measuring changes in price and volume over a set period of time, resulting in a numerical value that indicates whether buyers or sellers have more control over the market.

When the Force Index is positive, it suggests that buyers are dominant and there is strong bullish momentum. Conversely, when it is negative, sellers are dominant and bearish momentum is present.

Trading applications for the Force Index include using it to confirm trend direction and identify potential trade opportunities. For example, if an uptrend is established but the Force Index begins to decline while prices continue to rise, this may signal weakening buying pressure and a possible upcoming reversal. Additionally, if prices are consolidating but there is a sudden surge in volume accompanied by a spike in the Force Index, this could indicate an increase in buying or selling pressure leading to a breakout or breakdown.

Limitations and drawbacks of using the Force Index include its sensitivity to minor fluctuations in both price and volume as well as its reliance on past performance rather than future events. Traders should use this indicator alongside other technical analysis tools for confirmation purposes before making any trading decisions based solely on its readings.

Benefits of Using the Trend Direction & Force Index Averages MT4 Indicator

This tool offers advantages for traders seeking a comprehensive and reliable technical analysis approach, as it combines two key indicators to provide a clearer picture of market momentum and potential trend shifts.

The Trend Direction & Force Index Averages MT4 indicator calculates the average force index and moving averages of price trends for any selected period, offering valuable insights into buying and selling pressure in the market. By using this indicator, traders can gain an understanding of whether buyers or sellers are dominating the market at any given time.

Furthermore, the Trend Direction & Force Index Averages MT4 Indicator allows for customization to fit individual trading strategies. Traders can modify input parameters such as period length or smoothing factors to tailor the indicator to their specific needs.

This flexibility enables traders to adapt their technical analysis approach based on changing market conditions or personal preferences. Overall, incorporating this indicator into one’s trading strategy can aid in making more informed decisions by providing a more accurate assessment of market momentum and potential trend shifts.

Conclusion

The Trend Direction & Force Index Averages MT4 Indicator is a technical tool that combines two well-known indicators, the Trend Direction Index (TDI) and the Force Index.

The TDI is designed to identify trend direction and strength, while the Force Index measures buying or selling pressure behind market movements.

By combining these two indicators, traders can gain a more comprehensive understanding of market conditions and make better-informed trading decisions.

The indicator provides clear signals for entry and exit points based on the average values of both indicators.

Overall, the Trend Direction & Force Index Averages MT4 Indicator is an effective tool for traders looking to improve their technical analysis skills.

It offers valuable insights into trend direction and momentum in one easy-to-use indicator.

By utilizing this indicator as part of an overall trading strategy, traders can improve their chances of success in today’s dynamic markets.