Trend Channel System Review

Technical analysis is an essential aspect of trading that helps traders predict future price movements based on past market data. It involves analyzing historical market trends and patterns to identify potential trading opportunities.

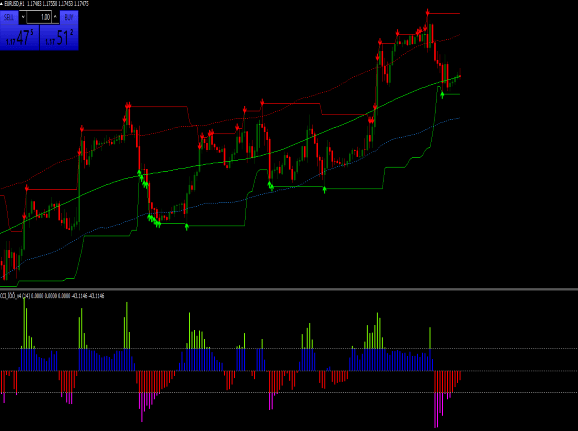

One popular technical analysis tool is the trend channel system, which provides traders with a framework for identifying and exploiting market trends. The trend channel system is a technical analysis tool that uses two parallel lines to track the movement of an asset’s price within a defined range. The upper line represents the resistance level, while the lower line represents the support level.

Download Free Trend Channel System

The system works by identifying significant highs and lows in price movements and then drawing two parallel lines connecting them. Traders can use this tool to identify potential entry and exit points for their trades based on where prices are trending relative to these lines.

In this article, we will explore how traders can apply the trend channel system to their trading strategy, its benefits, and why it has become such a popular technical analysis tool among traders of all levels.

Understanding the Basics of Technical Analysis

The current section provides an introduction to the fundamental concepts of technical analysis, which involves evaluating market data to identify patterns and trends that can inform investment decisions.

Technical analysis relies on the use of charts and other graphical representations of market data to identify patterns that indicate future price movements. This type of analysis is based on the assumption that historical market data can provide insights into future performance.

Candlestick patterns are one example of a tool used in technical analysis. These patterns are created through the use of candlestick charts, which graphically represent changes in price over time. Candlestick charts are named for their resemblance to candles with wicks at either end.

The body of each candle represents the opening and closing prices for a given time period, while the wick indicates high and low points during that same period. By analyzing these charts, traders can identify specific patterns, such as ‘bullish engulfing’ or ‘doji,’ which may indicate potential price movements in the near future.

Moving averages are another tool commonly used in technical analysis. A moving average is calculated by averaging a set number of past prices over a specified period. Traders often use moving averages to help smooth out short-term fluctuations in price and identify long-term trends that may be useful in making investment decisions.

Applying the Trend Channel System to Your Trading Strategy

By incorporating a data-driven approach that considers historical price movements, traders can enhance the precision of their trading strategies and potentially increase profitability.

One such approach is the trend channel system, which involves using trend lines to identify the direction of a stock’s movement and setting stop losses to minimize potential losses.

To apply this system effectively, traders must first identify two trend lines: one for the upper limit of the price movement (resistance) and one for the lower limit (support).

Once these lines are established, traders can use them to predict future price movements and make informed buying or selling decisions. Additionally, setting stop losses at key points along these trend lines can help mitigate risks by automatically triggering a sale when prices fall below a certain threshold.

Overall, incorporating the trend channel system into your trading strategy can help you make more informed decisions based on historical data and reduce potential losses through strategic risk management techniques.

Benefits of Using the Trend Channel System

Utilizing historical price movements to inform trading strategies has been shown to increase precision and profitability, making it a valuable tool for traders seeking data-driven approaches. The Trend Channel System is one such tool that can be used by traders to identify trends in the market and make informed decisions regarding their trades.

This system uses two parallel lines to create a channel around the trend, allowing traders to observe when prices deviate from this channel and make adjustments accordingly. One of the advantages of using the Trend Channel System is that it allows traders to quickly identify changes in market trends. By observing whether prices are moving above or below the upper and lower bounds of the channel, traders can gain insight into where the market is headed and adjust their trades accordingly.

Additionally, this system provides a visual representation of price movements over time, making it easier for traders to spot patterns or anomalies that may not be apparent through other analytical methods. For example, if prices consistently move towards one end of the channel, this could indicate a potential breakout or reversal in trend direction. Overall, utilizing tools like the Trend Channel System can help traders make more informed decisions based on empirical data rather than relying solely on intuition or speculation.

Conclusion

In conclusion, the Trend Channel System is an effective tool that traders can use to identify trends and make informed trading decisions. Technical analysis is a crucial aspect of successful trading, and understanding its basics is essential.

By applying the Trend Channel System to their trading strategies, traders can minimize risks and maximize profits by identifying appropriate entry and exit points based on market trends. The system’s advantages include its simplicity, flexibility, accuracy, and ability to filter out noise from the market data.

However, it is worth noting that no trading strategy is foolproof or guaranteed to generate profits consistently. Traders should always exercise caution when making investment decisions and conduct thorough research before implementing any new strategies.

Ultimately, success in trading comes down to discipline, patience, and a willingness to learn continuously. By combining technical analysis tools like the Trend Channel System with sound money management practices and risk mitigation techniques, traders can increase their chances of achieving long-term profitability in the financial markets.