Tma Centered Bands Multi Time Frame For Mt4 Review

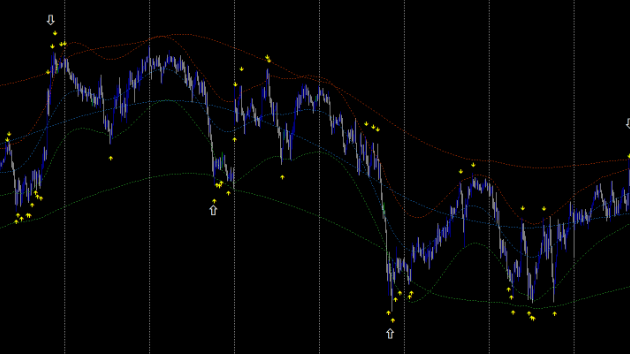

The TMA Centered Bands Multi Time Frame Indicator is a technical analysis tool designed for traders who use the MetaTrader 4 (MT4) platform. This indicator is based on the Triangular Moving Average (TMA) and helps traders identify potential market trends by analyzing price data across multiple timeframes.

By using this tool, traders can gain a deeper understanding of market conditions and make more informed trading decisions. The TMA Centered Bands Multi Time Frame Indicator uses a unique algorithm to calculate its values, which are then plotted as bands on the chart. These bands represent dynamic support and resistance levels that change in response to changes in market conditions.

Download Free Tma Centered Bands Multi Time Frame For Mt4

Traders can use these bands to identify potential entry and exit points, as well as to set stop-losses and take-profit targets. The multi-timeframe feature of this indicator allows traders to see how price action is unfolding across different timeframes, which can help them identify longer-term trends and make more accurate predictions about future price movements.

Overview of the TMA Centered Bands Multi Time Frame Indicator for MT4

The following section provides an overview of an indicator designed for the MetaTrader 4 platform that allows users to analyze multiple time frames simultaneously. The TMA Centered Bands Multi Time Frame Indicator for MT4 is a powerful tool that has gained popularity among traders due to its various features.

This indicator uses the Triangular Moving Average (TMA) as its primary calculation method, which is known for providing more accurate signals than traditional moving averages. The TMA Centered Bands Multi Time Frame Indicator displays the price action of multiple time frames on a single chart, making it easier for traders to spot trends and potential trading opportunities.

It also includes other useful features such as customizable settings, sound alerts, and visual notifications. Trading examples using this indicator could include waiting for a bullish signal on the higher time frame while looking for entry points on the lower time frames or using it in conjunction with other technical indicators to confirm trading decisions.

Overall, this multi-time frame analysis tool can help traders make more informed decisions by providing a comprehensive view of the market movements across different periods.

How to Use the Indicator

To effectively use the tma centered bands multi time frame indicator on MT4, setting it up is the first step. This involves downloading and installing the indicator on your MT4 platform.

Once set up, you can customize the settings to suit your trading strategy by adjusting parameters such as period, deviation and shift values.

Interpreting signals from the indicator requires an understanding of how it works and its relationship with price action, which can be achieved through backtesting and observing market behavior in real-time.

Setting Up the Indicator on MT4

By following the steps outlined in this section, traders can easily set up the TMA centered bands indicator on their MT4 platform to gain valuable insights into market trends and potential trade opportunities.

The installation process of the TMA centered bands indicator is relatively straightforward. First, traders need to download the indicator file from a reputable source and save it on their computer. They can then open their MT4 trading platform and navigate to ‘File’ > ‘Open Data Folder.’ In the opened folder, they should locate ‘MQL4’ > ‘Indicators’ and copy-paste or drag-drop the downloaded TMA centered bands file into this folder.

After completing these steps, traders can restart their MT4 platform or click on ‘Refresh’ under the Navigator window to see the newly added indicator. To apply it onto a chart, they need to drag-and-drop it from the Navigator window onto a specific currency pair’s chart.

Troubleshooting tips for common issues with installing or applying indicators include checking if they are compatible with your MT4 version, restarting your platform or computer, re-downloading files from official sources, and seeking support from experienced traders or online forums.

Overall, setting up an indicator like TMA centered bands can enable traders to make more informed decisions based on technical analysis tools that help them identify key levels of support/resistance and potential price movements in different time frames. In conclusion, setting up an indicator like TMA centered bands on MT4 requires some basic knowledge of downloading files and locating folders within your trading platform.

However, once installed correctly, this tool can be highly beneficial for traders looking to gain additional insights into market dynamics beyond simple price action analysis. By using TMA centered bands multi-time frame views along with other technical indicators like moving averages or trend lines, traders may create comprehensive strategies that increase their chances of success in different market conditions while minimizing risks associated with volatile price swings or sudden news events impacting overall market sentiment.

Customizing the Indicator Settings

This section focuses on the customization of indicator settings, allowing traders to tailor the tool to their specific needs by adjusting parameters such as period length, deviation levels, and color schemes.

To adjust parameters, users can click on the ‘inputs’ tab and modify values for each setting. For instance, increasing the period length will result in smoother curves that are less responsive to price changes, while decreasing it will create more jagged lines that react faster to market movements. Similarly, changing deviation levels allows traders to fine-tune the sensitivity of bands around moving averages.

Modifying visual appearance is also possible through various color schemes offered by TMA centered bands multi-time frame for MT4. Users can select between different themes such as black/white or blue/green/red/yellow and customize line thicknesses and styles according to their preferences.

This flexibility enables a more personalized trading experience that suits individual user requirements. By experimenting with different parameter combinations and visual settings, traders can gain greater insights into market dynamics and optimize their strategies accordingly.

Interpreting the Indicator Signals

Understanding the signals generated by the TMA Centered Bands Multi Time Frame indicator is crucial in interpreting market trends and making informed trading decisions. Traders can use various signal confirmation techniques to validate the indicator’s signals, such as using other technical analysis tools like trend lines, support and resistance levels, or candlestick patterns. Additionally, traders can also consider fundamental analysis factors like economic data releases or news events that may affect the market.

It is important to note that there are common misconceptions about indicator signals. Some traders believe that a buy/sell signal from an indicator alone guarantees profitable trades, which is not always the case. Indicator signals should be used in conjunction with other forms of analysis to make informed trading decisions. Moreover, traders should also take into consideration the current market conditions and their risk management strategy before making any trade based on an indicator’s signal alone.

Tips and Strategies for Trading with the TMA Centered Bands Multi Time Frame Indicator

Using multiple time frames is a common practice among traders to confirm trends. With the TMA Centered Bands Multi Time Frame Indicator, traders can identify key support and resistance levels with ease.

Integrating the indicator with other technical analysis tools such as oscillators or moving averages can enhance its effectiveness in predicting market movements.

Using Multiple Time Frames to Confirm Trends

Incorporating multiple time frames to validate trends can provide traders with a more comprehensive understanding of the market and potentially improve decision-making. This method is especially useful for traders who prefer longer-term positions but do not want to miss out on short-term opportunities.

By analyzing charts using different time frames, it is possible to identify short-term fluctuations within a larger trend, which may help traders determine entry and exit points. The importance of trend confirmation cannot be overstated in trading as it helps reduce uncertainty and increase confidence in making trades.

Using multiple time frames also allows traders to spot reversals or potential trend changes by comparing the behavior of price action across different periods. For example, if a trader is considering a long position based on a daily chart but notices bearish signals on an hourly chart, they may reconsider their position or wait for further confirmation before entering the trade.

In summary, incorporating multiple time frames into technical analysis provides benefits that can enhance trading performance by providing additional insights into market trends and allowing traders to make more informed decisions based on solid data analysis rather than relying solely on intuition.

Identifying Key Support and Resistance Levels

Identifying key support and resistance levels is an essential aspect of technical analysis that can aid traders in making informed decisions by providing crucial insights into the market’s supply and demand dynamics. These levels are not just random lines on a chart; they represent areas where the price tends to stop or reverse, indicating significant buying or selling pressure from market participants.

Identifying these levels requires using price action analysis techniques such as trendlines, horizontal lines, and Fibonacci retracements. To identify key levels accurately, traders need to follow a structured approach that involves the following steps:

- Identify significant swing highs and lows on the chart: These points represent areas where the price has previously reversed or paused, indicating potential support or resistance.

- Draw trendlines connecting these swing points: Trendlines help visualize the current trend direction and highlight potential support and resistance zones.

- Use horizontal lines to mark critical price levels: Horizontal lines drawn at key psychological levels such as round numbers or previous highs/lows can provide additional confirmation for potential support/resistance areas.

By following this systematic approach, traders can identify key support and resistance levels that may influence future price movements. However, it’s important to note that no level is 100% accurate, so it’s crucial to incorporate other technical indicators and fundamental analysis when making trading decisions.

Integrating the Indicator with Other Technical Analysis Tools

The integration of technical indicators with other analysis tools is a crucial aspect of technical analysis that can provide traders with a more comprehensive view of the market’s supply and demand dynamics, allowing them to make informed trading decisions. One way to integrate the TMA Centered Bands Multi Time Frame indicator with other tools is by combining it with Fibonacci retracements. Fibonacci retracements are commonly used in technical analysis to identify potential support and resistance levels based on the key price levels that occur after a significant move in an asset’s price. By combining this tool with the TMA Centered Bands Multi Time Frame indicator, traders can gain additional insights into potential reversal points.

Another way to integrate this indicator with other tools is through trading divergence signals. Divergence occurs when the price of an asset moves in one direction while its corresponding technical indicator moves in the opposite direction. This can be seen as a warning sign that the current trend may be losing momentum or reversing, potentially leading to a profitable trade opportunity for those who act accordingly. Combining divergence signals with the TMA Centered Bands Multi Time Frame indicator can help traders identify these opportunities more easily by highlighting potential areas where divergences may occur on different time frames simultaneously, providing valuable confirmation of potential trend reversals.

| Technical Analysis Tool | Advantages | Disadvantages | Example | |

|---|---|---|---|---|

| TMA Centered Bands Multi Time Frame Indicator | Provides clear visual representation of support and resistance levels across multiple time frames | Can generate false signals in choppy markets or during periods of low volatility | Identifying key price levels for entry/exit points | |

| Fibonacci Retracements | Provides objective support/resistance levels based on historical price action | Does not always work well during periods of high volatility or sudden market shocks | Identifying potential reversal points after significant moves in asset prices | |

| Trading Divergence Signals | Provides early warning signs for potential trend reversals | Can be difficult to identify accurately without proper training or experience | Identifying potential trading opportunities based on divergence between price and technical indicators | … can lead to profitable trades if accompanied by other confirming factors such as support and resistance levels and volume analysis. |

Conclusion

The TMA Centered Bands Multi Time Frame Indicator for MT4 is a useful tool for traders who want to identify trends across multiple time frames. By using the indicator, traders can plot trend lines and support and resistance levels based on the TMA bands, allowing them to make more informed trading decisions.

Additionally, by incorporating other technical indicators and analyzing price action, traders can enhance their strategy when using this indicator.

Overall, the TMA Centered Bands Multi Time Frame Indicator for MT4 can be a valuable addition to any trader’s toolbox. However, it should not be used in isolation and must be combined with other techniques to ensure profitable trades. Traders should also remember that no indicator or strategy guarantees success in trading; it is essential to remain disciplined and use risk management techniques at all times.