Two Ma Channel Breakout Mt4 Indicator Review

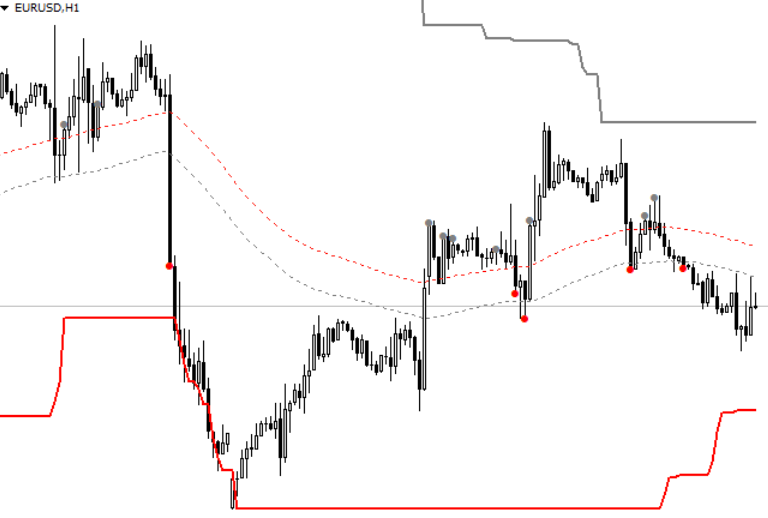

The Two Ma Channel Breakout MT4 Indicator is a powerful tool for traders seeking to identify profitable breakout opportunities in the markets. This indicator utilizes moving averages and price channels to help traders visualize market trends and potential entry and exit points. With customizable settings, the Two Ma Channel Breakout MT4 Indicator can be tailored to fit individual trading strategies and preferences.

To fully understand the potential of this indicator, it is important to have a good understanding of moving averages and price channels. Moving averages are commonly used by traders to track the average price of an asset over a set period of time, smoothing out short-term fluctuations in price.

Download Free Two Ma Channel Breakout Mt4 Indicator

Price channels, on the other hand, plot two parallel lines above and below the moving average based on a set deviation from that average. Together, these tools provide valuable insight into market trends and potential areas of support or resistance. By utilizing these concepts in conjunction with the Two Ma Channel Breakout MT4 Indicator, traders can identify breakout opportunities with greater precision and confidence.

Understanding Moving Averages and Price Channels

The current section provides an explanation of the concepts of moving averages and price channels, which are fundamental tools for technical analysis in financial markets.

Moving averages (MA) are used to smooth out fluctuations in price data over time by calculating the average price of a security over a specified period. They are commonly used as trend indicators, with traders using them to determine whether prices are trending upwards or downwards.

Price channels, on the other hand, are formed by drawing two parallel lines around a security’s price action, with one line representing resistance and the other support. These channels can help traders identify potential breakout opportunities when prices move beyond these levels.

Exploring the benefits and limitations of moving averages and price channels for technical analysis is crucial before applying them to trading strategies. While they provide valuable insights into market trends, they also have drawbacks such as lagging behind actual market movements and producing false signals.

As such, traders must use them in conjunction with other indicators to make informed decisions while trading. Comparing different types of breakout indicators for trading is also essential since there is no single indicator that guarantees success in trading.

Customizing Your Settings

When it comes to customizing your settings for the two ma channel breakout mt4 indicator, there are several key points to consider.

First and foremost, choosing the right Moving Average period is crucial in determining the indicator’s effectiveness in identifying market trends.

Additionally, setting the Price Channel distance can help fine-tune your trading strategy by adjusting the level of volatility you want to track.

Finally, adjusting alert settings allows you to stay on top of any potential market movements without constantly monitoring the charts.

By carefully considering these customization options, you can maximize your chances of success in today’s ever-changing financial markets.

Choosing your Moving Average period

Selecting an appropriate moving average period is a critical step in the analysis of price movement and should be done with careful consideration to ensure reliable results.

The optimal period for a moving average depends on various factors, including the time frame of analysis and the volatility of the market being studied.

A shorter moving average period will respond more quickly to changes in price, but may result in more false signals due to noise. On the other hand, a longer moving average period will smooth out noise but may lag behind significant price movements.

Historical analysis can help determine an appropriate moving average period by observing how it has performed during different market conditions. For example, if historical data shows that a 50-day moving average has been reliable in identifying trends during periods of low volatility, then it may be suitable for similar market conditions going forward.

However, if recent data indicates increased volatility, it may be necessary to adjust the moving average period accordingly. Ultimately, selecting an appropriate moving average period requires an understanding of market trends and a willingness to adjust based on changing conditions.

Setting Price Channel distance

Determining an appropriate distance for the Price Channel is a crucial step in technical analysis when using the two ma channel breakout mt4 indicator. The Price Channel is calculated by plotting two parallel lines above and below a moving average line, with the distance between them being determined by market volatility. A wider price channel indicates high volatility while a tighter one indicates low volatility. Traders should consider historical price movement to determine a suitable width for the channel.

Adjusting channel slope may be necessary to accommodate changing market conditions. When prices are trending strongly, increasing the slope of the price channel can help capture larger profits, while decreasing it during consolidating markets can reduce false breakouts.

To confirm entry and exit signals from this indicator, traders may also use multiple indicators such as volume or momentum oscillators to increase their confidence in making trades. It is important not to rely solely on any single indicator for decision-making but rather use them in conjunction with others to optimize trading strategies and minimize risk.

Adjusting alert settings

The configuration of alert settings for the Price Channel indicator is a necessary step in optimizing trading strategies and minimizing risk. Adjusting sensitivity levels is an essential feature that helps traders set up alerts when prices break above or below the channel lines. Sensitivity levels must be adjusted based on market conditions, volatility, and trading style.

For example, if a trader wants to receive alerts only when prices make significant moves beyond the channel lines, they can set higher sensitivity levels. On the other hand, if a trader wants to receive alerts even with minor price movements within the channel lines, they can set lower sensitivity levels.

Another crucial aspect of adjusting alert settings is setting up email alerts. Email notifications are particularly helpful for traders who cannot monitor their trades regularly or need to take action immediately after receiving an alert. To set up email alerts, traders have to configure their email accounts on their MT4 platform and select the appropriate options under Alert Settings.

It is also important to note that email notifications may incur additional charges from internet service providers or mobile phone carriers. Therefore, traders should verify with their service provider before using this feature extensively.

Overall, adjusting alert settings for the Price Channel indicator requires careful consideration of market conditions and trading preferences while keeping in mind practicalities such as costs and availability of resources like email services.

Identifying Breakout Opportunities

The two ma channel breakout mt4 indicator is a powerful tool for identifying potential breakout opportunities in the market. This indicator works by detecting when price action breaks through two moving averages, indicating a potential shift in trend direction.

Traders can interpret alert signals generated by the indicator to make informed trading decisions and may combine it with other indicators for confirmation of entry or exit points. With a good understanding of market trends and technical analysis, traders can use this indicator to stay ahead of the curve and capitalize on profitable trading opportunities.

How the indicator detects potential breakouts

Through a systematic analysis of price movements, the two ma channel breakout mt4 indicator identifies key patterns that signal potential breakouts with a high degree of accuracy. This analytical tool uses a combination of two moving averages to identify trends in historical market data and compares them to current market conditions. When there is a significant deviation from these trend lines, the indicator recognizes this as a potential breakout opportunity.

To detect potential breakouts, the two ma channel breakout mt4 indicator relies on various technical indicators that are designed to spot changes in momentum and direction. These include trend lines, support and resistance levels, and moving averages. By analyzing these patterns systematically, traders can gain valuable insights into market trends and make informed decisions about when to enter or exit positions.

The four key benefits of using this indicator are:

- It provides accurate signals for predicting future price movements.

- It helps traders identify entry and exit points for their trades.

- It reduces the impact of emotional decision-making by providing objective data.

- It allows traders to automate their trading strategies based on specific rules or criteria.

Interpreting alert signals

This section focuses on how to interpret alert signals generated by the Two Ma Channel Breakout MT4 Indicator, which is a valuable analytical tool for traders seeking insight into market trends and making informed decisions about trading positions. The indicator provides traders with alerts when there is a potential breakout in the market, allowing them to take advantage of profitable opportunities.

However, it’s important to understand that not all breakouts are genuine. False breakouts can occur when prices move beyond the support or resistance levels but then quickly reverse their direction. Therefore, it’s crucial to know how to avoid false breakout signals in your trading strategy.

To use the Two Ma Channel Breakout MT4 Indicator effectively in different markets, you need to consider various factors such as market volatility and liquidity. When interpreting alert signals generated by this indicator, you should take note of key price levels and identify significant support and resistance levels before entering any trades.

Additionally, it’s essential to pay attention to other technical indicators that may provide complementary signals or confirm trend reversals. By doing so, you will be able to make more informed decisions about your trading positions while minimizing risks associated with false breakouts.

Ultimately, understanding how the Two Ma Channel Breakout MT4 Indicator works and using it appropriately can help improve your overall trading performance across various markets.

Combining with other indicators for confirmation

Combining the alert signals generated by the two ma channel breakout MT4 indicator with other technical indicators can provide traders with valuable information about market trends. This analytical tool is particularly effective when used in conjunction with trend following indicators, such as moving averages or trendlines.

By analyzing price movements using these tools, traders can identify potential areas of support and resistance where prices are likely to bounce back or break through. Moreover, combining the two ma channel breakout MT4 indicator with oscillators for confirmation can help traders confirm trend reversals and avoid false signals.

Oscillators are technical indicators that measure the momentum of price movements over time. When combined with the two ma channel breakout MT4 indicator, they can help traders determine whether a particular market is overbought or oversold, which can be useful in predicting future price movements.

Overall, incorporating multiple technical indicators into one’s trading strategy can lead to increased accuracy when identifying profitable trades and ultimately improve overall trading performance across different markets.

Using the Two Ma Channel Breakout MT4 Indicator in Your Trading Strategy

This subtopic focuses on utilizing the Two Ma Channel Breakout MT4 Indicator in trading strategies.

Short-term and long-term trading strategies can be implemented with this indicator to identify breakout opportunities.

Additionally, managing risk and setting appropriate stop loss levels are important factors to consider when using this tool.

Finally, maximizing profits can be achieved by setting take profit targets based on market trends and analysis.

A detailed understanding of this indicator and its application in the market is crucial for successful trading strategies.

Short-term and long-term trading strategies

An analysis of the short-term and long-term trading strategies employed when using the two ma channel breakout mt4 indicator reveals a nuanced approach that involves careful consideration of market trends and historical price data. Incorporating technical analysis is crucial for traders who wish to use this tool effectively. Technical analysis helps in identifying patterns in the market, making it easier for traders to predict future price movements.

Scalping vs Swing trading are two commonly used trading strategies that can be employed with the two ma channel breakout mt4 indicator. Scalping is a short-term strategy where traders aim to make small profits by buying and selling securities quickly. On the other hand, swing trading is a longer-term strategy where traders hold positions for several days or weeks, aiming for large profits from major market moves.

Both strategies require different levels of risk tolerance, as well as different approaches to analyzing market trends and historical data. Traders should carefully consider their goals and preferences before deciding which strategy to employ with this technical tool.

Managing risk and setting stop loss levels

The current section delves into the crucial aspect of managing risk and setting stop loss levels, which is a vital consideration for traders who seek to minimize potential losses while maximizing profits.

Position sizing is one of the most important factors in managing risk. Traders must determine how much they are willing to risk on each trade based on their account size and trading strategy. This involves calculating the appropriate lot size to trade based on the stop loss level, as well as considering other factors such as market volatility and overall portfolio risk.

In addition to position sizing, setting stop loss levels is also essential in managing risk. The two ma channel breakout mt4 indicator can assist traders in this process by providing clear signals for entry and exit points.

When placing a trade, traders should set a stop loss at a level that limits potential losses if the trade moves against them. The stop loss level should be determined based on technical analysis of support and resistance levels, as well as other indicators such as moving averages or trend lines.

By effectively managing risk through position sizing and setting appropriate stop losses with the help of tools like the two ma channel breakout mt4 indicator, traders can increase their chances of success in the markets over time.

Maximizing profits with take profit targets

To optimize gains and attain financial success, traders must implement a systematic approach to profit maximization by setting take profit targets based on their account size, trading objectives, and market conditions. Take profit strategies are crucial in ensuring that traders lock in profits when prices reach predetermined levels. These strategies also help traders avoid making emotional decisions that can lead to losses.

Trade management techniques play a critical role in setting take profit targets. Traders using the two ma channel breakout mt4 indicator should consider the following when setting their take profit targets:

- Analyzing price trends: Traders need to analyze market trends to determine potential support and resistance levels where they can set their take profit targets.

- Using trailing stops: Trailing stops allow traders to adjust their stop loss levels as prices move in favor of their trades. This strategy helps maximize profits while minimizing losses.

- Considering risk-reward ratios: Traders need to balance the amount of risk they are willing to take with the potential rewards of a trade. They can use this ratio to determine appropriate take profit levels for different trades.

By implementing these trade management techniques, traders using the two ma channel breakout mt4 indicator can increase their chances of maximizing profits and achieving long-term success in the markets.

Frequently Asked Questions

Can the Two Ma Channel Breakout MT4 Indicator be used on any trading platform other than MetaTrader 4?

Exploring the versatility of trading indicators is crucial for traders seeking to maximize their profits. An analysis of the performance of different trading platforms and market conditions can provide valuable insights into the effectiveness of particular indicators.

Evaluating the effectiveness of the Two Ma Channel Breakout MT4 Indicator in generating profitable trading signals across different timeframes and trading styles provides a comprehensive understanding of its capabilities. The indicator’s ability to adapt to various market conditions, including trending and range-bound markets, makes it a useful tool for traders with different risk appetites.

However, it is important to note that while this indicator has proven effective on MetaTrader 4, its performance may vary on other platforms due to differences in technical specifications and data feeds. Therefore, traders must conduct thorough research before using this indicator on alternative platforms.

What is the optimal timeframe to use when trading with the Two Ma Channel Breakout MT4 Indicator?

When it comes to trading, choosing the right timeframe is crucial for successful trades. The optimal timeframe to use when trading depends on various factors such as market volatility and personal preferences.

Traders can consider using shorter timeframes like 1-minute or 5-minute charts for scalping while longer timeframes like daily or weekly charts are ideal for swing trading. To optimize trades with the two ma channel breakout indicator, traders can use a combination of different timeframes to confirm signals and avoid false breakouts.

It is also important to have a good understanding of market trends and implement best strategies for trading with the two ma channel breakout indicator, such as setting stop-losses and taking profits at key levels. These tips can help traders maximize profits and minimize losses when using the two ma channel breakout indicator in their trading strategy.

Is it necessary to use multiple timeframes when using this indicator, or can it be used effectively on just one timeframe?

When it comes to day trading, using multiple timeframes can provide a more comprehensive view of market trends and increase the possibility of identifying profitable opportunities. However, there are also benefits to using only one timeframe.

By focusing on a single timeframe, traders can develop a deeper understanding of the specific market they are trading in and make more informed decisions based on that knowledge.

When utilizing the two ma channel breakout MT4 indicator for day trading, it is important to consider both options and determine what works best for your individual strategy.

Regardless of whether you choose to use one or multiple timeframes, ensuring that you have a good understanding of the indicator’s functionality and how it can be applied within different market conditions is crucial for success.

How can I determine the best stop loss and take profit levels when using this indicator?

Determining optimal stop loss and take profit levels is an essential aspect of trading in any market. Traders must adjust these levels according to the level of market volatility, which can vary significantly depending on specific market trends.

It is crucial to have a good understanding of the current market conditions and use this information to set appropriate stop loss and take profit levels. Trading indicators, such as the Two MA Channel Breakout MT4 Indicator, can aid traders in making informed decisions about when to enter or exit trades based on their chosen strategy.

However, it is important to note that no indicator guarantees success in trading, and traders must rely on their knowledge, expertise, and experience when determining optimal levels for each trade they make.

Are there any specific currency pairs or markets that this indicator works particularly well with?

Best practices for trading in foreign exchange markets involve selecting currency pairs and understanding their unique characteristics. Backtesting results can provide insight into the effectiveness of specific indicators with different currency pairs. It is important to consider factors such as volatility, liquidity, and economic news releases when choosing a currency pair to trade with.

Additionally, it is essential to have a good understanding of market trends and technical analysis concepts before making any trades. By combining these elements, traders can increase their chances of success in the forex market regardless of the specific indicator they choose to use.

Conclusion

Moving averages and price channels are popular technical tools used by traders to identify trends and potential breakout opportunities in the market.

By combining these two indicators, the Two Ma Channel Breakout MT4 Indicator provides a comprehensive approach to analyzing price movements and making informed trading decisions.

Customization is key when using this indicator, as traders can adjust the settings to best suit their individual trading style and preferences.

Once customized, the indicator will help identify potential breakout opportunities based on price movements above or below the moving averages within the defined channel.

Incorporating the Two Ma Channel Breakout MT4 Indicator into your trading strategy can provide valuable insights into market trends and potential breakout opportunities.

However, it is important to remember that no single indicator should be relied upon entirely for making trading decisions.

It is always recommended to use multiple indicators and analysis methods for a well-rounded approach to successful trading.

Stay informed, stay vigilant, and make informed trades based on thorough analysis of market trends with the Two Ma Channel Breakout MT4 Indicator at your disposal.