Trade Channel Indicator For Mt4 Review

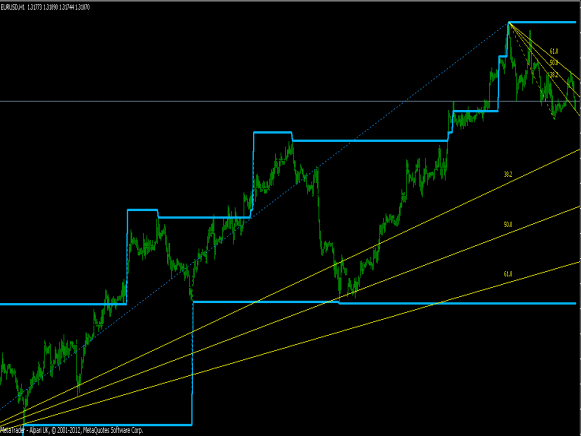

The Trade Channel Indicator is a technical analysis tool commonly used by traders to identify trends and potential changes in market direction. The indicator utilizes a series of upper and lower trendlines to create channels that visually represent the price range within which a security has been trading.

By observing how prices behave within these channels, traders can make informed decisions about buying or selling securities. This article provides an overview of the Trade Channel Indicator for MT4, its functions, and practical examples of using it in trading strategies.

Download Free Trade Channel Indicator For Mt4

Readers will learn how to use the indicator to identify key support and resistance levels, determine entry and exit points for trades, and manage risk effectively. Understanding how this popular indicator works can help traders make better-informed decisions when navigating financial markets.

Understanding Trade Channels in Technical Analysis

Technical analysts often use trade channels to identify potential support and resistance levels in a given security, which can help inform their trading decisions.

Trade channels are essentially two parallel trendlines that encompass the price action of an asset. The upper trendline represents the resistance level while the lower trendline represents the support level. Identifying trends is crucial when using trade channels in technical analysis as they help determine where these trendlines should be drawn.

Determining support and resistance levels is an important aspect of technical analysis as it provides traders with potential entry and exit points for their trades. Support levels are areas where buyers have historically entered the market, causing prices to bounce back up. Conversely, resistance levels are areas where sellers have historically entered the market, pushing prices back down.

By using trade channels to map out these levels, traders can gain a better understanding of how an asset may move in the future and adjust their trading strategy accordingly.

How the Trade Channel Indicator Works

The mechanism of the trade channel indicator involves analyzing historical price action data to identify upper and lower bands that act as dynamic support and resistance levels for traders to make informed entry and exit decisions. This tool is commonly used in forex trading, where traders can benefit from incorporating trade channels into their trading strategy.

To better understand how the trade channel indicator works, here are some key points to consider:

- The upper band represents a level of resistance where prices tend to bounce back down, while the lower band represents a level of support where prices tend to bounce back up.

- When prices approach either band, it signals a potential reversal in direction or a breakout from the current trend.

- Traders can use this information to set stop-loss orders or take-profit targets at strategic levels based on their risk tolerance and market analysis.

Overall, the trade channel indicator provides valuable insights into market trends and price movements that can help traders make more informed trading decisions.

Practical Examples of Using the Indicator

Exploring practical examples of utilizing this technical analysis tool can offer traders a deeper understanding of how to incorporate historical price data into their trading strategies. The Trade Channel Indicator for MT4 is an effective tool that can assist traders in identifying the trends and potential breakouts in the market. With real-time monitoring, traders can be alerted when the price action breaks above or below the channel, indicating a possible trend reversal or continuation.

Backtesting strategies using the Trade Channel Indicator can also help traders determine its effectiveness in different market conditions. For example, during a ranging market, where prices move within a tight range, traders may use the indicator to identify potential support and resistance levels. In contrast, during trending markets, they may look for breakouts above or below the channel as an indication of entering or exiting trades. Overall, incorporating the Trade Channel Indicator into one’s trading strategy can enhance decision-making capabilities and improve overall profitability.

| Scenario | Trading Strategy | Result | |

|---|---|---|---|

| Ranging Market | Buy at support level identified by lower bound of trade channel; sell at resistance level identified by upper bound of trade channel | Small profits with low risk | |

| Trending Market – Bullish | Buy when price breaks above upper bound of trade channel; sell when price crosses back below middle line | Potential for large profits with moderate risk | |

| Trending Market – Bearish | Short when price breaks below lower bound of trade channel; cover when price crosses back above middle line | Potential for large profits with moderate risk | |

| Choppy Market | Avoid trading using solely Trade Channel Indicator; consider other indicators such as oscillators to confirm trends before entering trades | Minimal losses due to false signals from indicator | Minimal losses due to false signals from indicator can be mitigated by incorporating additional confirmation tools and utilizing proper risk management techniques such as setting stop-loss orders. |

Conclusion

Trade channels are a vital component of technical analysis, and the trade channel indicator for MT4 can help traders identify potential trading opportunities. By understanding how price movements within a channel behave, traders can better predict future price movements and place trades accordingly.

The trade channel indicator works by plotting upper and lower trendlines around a security’s price movements. When prices approach these trendlines, it may indicate a potential reversal or breakout. Traders can use this information to identify entry and exit points for trades.

Practical examples of using the indicator include identifying support and resistance levels within a channel, as well as determining whether a security is in an uptrend or downtrend.

By utilizing the trade channel indicator in conjunction with other technical analysis tools, traders can increase their chances of success in the markets. Overall, understanding and implementing this indicator into one’s trading strategy can be beneficial for both novice and experienced traders alike.