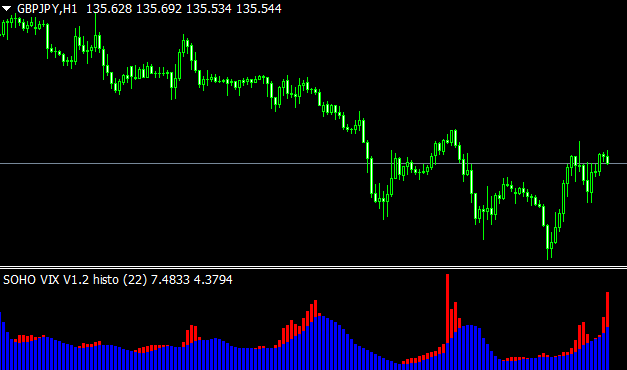

Soho Williams Vix Histogram Mt4 Indicator Review

The Soho Williams VIX Histogram MT4 indicator is a technical tool used in the foreign exchange market to evaluate market volatility. The indicator is a derivative of the VIX (Volatility Index), and it provides traders with an accurate representation of the market’s sentiment.

The Soho Williams VIX Histogram MT4 indicator is a reliable indicator that measures market volatility, and it is particularly useful in predicting potential trend reversals. The foreign exchange market is a highly volatile market, and traders are constantly seeking tools that can help them navigate the market.

Download Free Soho Williams Vix Histogram Mt4 Indicator

The Soho Williams VIX Histogram MT4 indicator is one such tool that can be used to predict market volatility and identify potential trend reversals. This indicator is an essential tool for forex traders, and it is particularly useful for those who trade in volatile markets.

The Soho Williams VIX Histogram MT4 indicator is easy to use and can be a helpful tool in a trader’s arsenal.

Overview of the Foreign Exchange Market

An understanding of the foreign exchange market is essential for individuals and organizations engaged in international trade, investment, or currency exchange. Forex trading involves the buying and selling of currencies, with the aim of making profits from the changes in exchange rates. Understanding forex trading basics is crucial for anyone looking to engage in the market, as it allows for better decision-making and risk management.

Several factors affect forex rates, including economic, political, and social factors. Economic factors such as inflation, interest rates, and economic growth can influence currency values. Political factors such as government stability and policies can also impact forex rates. Social factors such as natural disasters, wars, and social unrest can also play a role.

As a result, forex trading requires a thorough analysis of these factors to make informed decisions and mitigate risks.

Introduction to the Soho Williams VIX Histogram MT4 Indicator

The Soho Williams VIX Histogram MT4 Indicator is a tool used in the foreign exchange market to analyze market trends and make informed trading decisions.

The indicator is designed to help traders identify potential market reversals by analyzing the volatility index (VIX) and providing a visual representation of the data in histogram form.

Some key features and benefits of the Soho Williams VIX Histogram MT4 Indicator include its ease of use, accuracy, and ability to provide real-time market analysis.

Features and Benefits

This section outlines the various features and benefits of the Soho Williams VIX Histogram MT4 Indicator, providing a clear and detailed overview of its capabilities for potential users.

Firstly, the tool offers a range of advantages for traders, including the ability to accurately measure market volatility, identify potential trade entry and exit points, and monitor price trends over time. By using the VIX Histogram, traders can gain a deeper understanding of market dynamics and make informed decisions based on real-time data analysis.

In addition, the Soho Williams VIX Histogram MT4 Indicator has a range of applications, making it a versatile tool for traders in different markets and contexts. For example, the tool can be used to analyze stocks, commodities, forex, and other asset classes, providing a comprehensive overview of market trends and volatility levels.

Traders can also customize the indicator to suit their individual needs, adjusting the settings and parameters to optimize its performance for different trading strategies and styles.

Overall, the Soho Williams VIX Histogram MT4 Indicator offers a powerful tool for traders seeking to gain a competitive edge in the market, with its robust features and flexible applications making it an essential addition to any trader’s toolkit.

How it Works

Explaining the functionality of the tool, the current section provides an in-depth explanation of how traders can utilize the Soho Williams VIX Histogram MT4 Indicator to measure volatility and identify potential trade opportunities across various asset classes.

The indicator works by analyzing volatility trends and interpreting signals to provide traders with a clear picture of market conditions. By measuring the difference between the current VIX value and its moving average, the indicator generates a histogram that can be used to identify potential trading opportunities.

Traders can use the Soho Williams VIX Histogram MT4 Indicator to identify potential buy and sell signals. When the histogram is above the zero line, it indicates that the market is experiencing high volatility, which may present opportunities for traders to enter or exit positions.

Conversely, when the histogram is below the zero line, it indicates that the market is experiencing low volatility, which may suggest that traders should avoid entering or exiting positions. By analyzing volatility trends and interpreting indicator signals, traders can use the Soho Williams VIX Histogram MT4 Indicator to make informed trading decisions across a range of asset classes.

How to Use the Indicator

To effectively utilize the Soho Williams VIX Histogram MT4 Indicator, one must possess a comprehensive understanding of its operational mechanics in order to make informed decisions based on the results produced.

The indicator, which measures the volatility of the market, is designed to help traders identify potential market trends by analyzing the historical data of the VIX index.

Using the Soho Williams VIX Histogram MT4 Indicator can be helpful in developing trading strategies and techniques.

For example, when the VIX index is high, it indicates that the market is experiencing high volatility, which may result in unpredictable price movements.

In such situations, traders may choose to trade cautiously or avoid trading altogether.

On the other hand, when the VIX index is low, it may indicate that the market is stable, and traders may choose to take on more risk.

By monitoring the VIX index using the Soho Williams VIX Histogram MT4 Indicator, traders can make informed decisions and adjust their trading strategies accordingly.

Tips for Successful Forex Trading

This discussion will cover the essential tips for successful forex trading, including managing risk and reward, developing a trading plan, and staying informed about market trends.

Managing risk and reward is crucial in forex trading, as it enables traders to minimize losses and maximize profits.

Developing a trading plan helps traders make informed decisions and stick to a disciplined approach, while staying informed about market trends allows them to adapt to changing market conditions and seize opportunities.

Managing Risk and Reward

The effective management of risk and reward is crucial for successful trading and can evoke feelings of anxiety and uncertainty in even the most experienced traders. Risk management is an essential component of profitable trading strategies, and traders should aim to minimize losses while maximizing gains.

One way to achieve this is through the use of stop-loss orders, which allow traders to limit their potential losses by setting a predetermined price at which their position will be automatically closed.

Another useful strategy is to manage the trade’s reward-to-risk ratio, which is the ratio of the potential profit to the potential loss. Traders should aim for a positive reward-to-risk ratio by setting profit targets that are larger than the potential losses. This approach ensures that even if a trader experiences a string of losses, they will still be profitable in the long run.

Additionally, traders should remain disciplined and avoid emotional decision-making, which can lead to impulsive trades and unnecessary losses. By using a combination of risk management and profitability strategies, traders can achieve consistent success in the markets.

Developing a Trading Plan

In order to effectively manage risk and reward, it is important to have a well-developed trading plan.

This plan should include strategies for identifying patterns in the market, setting realistic goals, and determining when to enter and exit trades. By having a clear plan in place, traders can avoid making impulsive decisions based on emotions and instead rely on a disciplined approach to trading.

Identifying patterns in the market is an essential part of developing a trading plan. This involves analyzing historical price data and looking for trends and patterns that can provide insight into future market movements. By understanding these patterns, traders can make more informed decisions about when to enter and exit trades.

In addition, setting realistic goals is also important for developing a trading plan. This involves determining how much money you are willing to risk on each trade, as well as setting realistic targets for profits and losses. By setting achievable goals, traders can avoid taking on too much risk and stay focused on their long-term trading objectives.

Staying Informed About Market Trends

Keeping abreast of market trends is crucial for traders to make informed decisions, as it allows them to anticipate potential changes in market conditions and adjust their trading strategies accordingly. Staying informed about market trends provides traders with a better understanding of the market’s behavior, which can help them identify profitable trading opportunities.

By analyzing market trends, traders can identify patterns and trends that can help them predict future market movements. This information can be used to develop trading strategies that take advantage of these trends, allowing traders to make more profitable trades.

The benefits of staying informed about market trends are numerous. By keeping up-to-date with the latest market news and trends, traders can make more informed decisions about when to enter or exit trades. This can help them minimize their risks and maximize their profits.

Additionally, staying informed about market trends can help traders identify potential market disruptions or changes in market conditions that could impact their trading strategies. By anticipating these changes, traders can adjust their strategies accordingly, allowing them to stay ahead of the curve and make more profitable trades.

In conclusion, staying informed about market trends is essential for traders who want to succeed in the financial markets. By understanding the importance of market analysis and staying up-to-date with the latest market news and trends, traders can make more informed decisions and increase their chances of success.

Conclusion

The foreign exchange market is a complex and volatile environment that requires careful analysis and strategy to navigate successfully. The Soho Williams VIX Histogram MT4 Indicator is a tool that can help traders identify potential market trends and make informed decisions.

By providing a visual representation of market volatility, this indicator can guide traders in determining optimal entry and exit points for their trades.

To use the Soho Williams VIX Histogram MT4 Indicator, traders should first familiarize themselves with its features and settings. They should also consider incorporating additional technical analysis tools and fundamental analysis to gain a more comprehensive understanding of market conditions.

With proper utilization of this indicator and other tools, traders can increase their chances of success in the forex market.

In conclusion, the Soho Williams VIX Histogram MT4 Indicator is a valuable tool for traders looking to navigate the complex and volatile foreign exchange market. By providing a visual representation of market volatility, this indicator can assist traders in identifying potential trends and making informed trading decisions. However, it is important for traders to supplement this tool with additional analysis and strategy to maximize their chances of success.