Scalping Volatility Trading Strategy Review

The world of trading is dynamic, and traders are always on the lookout for new strategies to maximize their profits. One such strategy that has gained popularity in recent years is the scalping volatility trading strategy.

This approach involves taking advantage of short-term fluctuations in prices by entering and exiting positions quickly. Scalping volatility trading strategy requires a deep understanding of market dynamics and an ability to make quick decisions based on current trends.

Traders must analyze data from various sources, including charts, news articles, economic reports, and social media posts to identify potential opportunities for profit. This article will provide an in-depth overview of this trading technique, including its implementation and tips for success.

Download Free Scalping Volatility Trading Strategy

By the end of this article, readers will have a better understanding of how scalping volatility trading works and how they can incorporate it into their own trading practices.

Understanding the Scalping Volatility Trading Strategy

The present section delves into comprehending the methodology employed in exploiting short-term price fluctuations in the market by means of a specialized approach.

Scalping is an intraday trading technique that operates on the premise of capturing small gains from frequent trades taken within a brief time frame. Compared to swing trading, which involves holding positions for a few days or more, scalpers aim to profit from fast-moving market conditions that exist for only a few seconds or minutes.

Volatility and momentum are two key factors considered when executing scalping trades. Volatility refers to the degree of price variation observed over a given period, while momentum measures the rate at which prices change.

In this strategy, traders seek out highly volatile instruments with strong directional movements to capitalize on swift price changes. As volatility is often linked with liquidity, traders tend to focus on high-volume assets such as forex pairs or equity indexes where bid-ask spreads are tight and execution speed is critical.

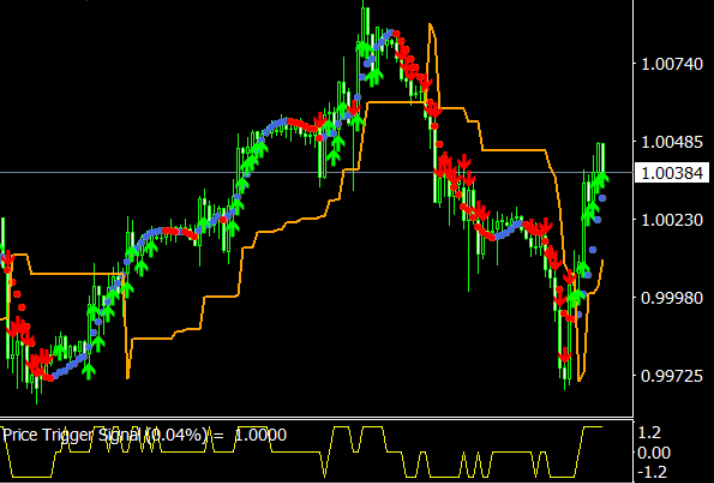

By leveraging technical analysis tools like moving averages and oscillators, scalp traders can attempt to identify favorable entry and exit points based on their interpretation of market signals.

Implementing the Scalping Volatility Trading Strategy

Identifying short-term price fluctuations is a crucial aspect of the scalping volatility trading strategy. Traders need to be able to distinguish between true market trends and temporary price movements in order to enter and exit positions effectively.

To assist with this, traders can use various indicators and analytical tools such as moving averages, Bollinger Bands, and stochastic oscillators.

Identifying Short-Term Price Fluctuations

This section focuses on the detection and analysis of rapid fluctuations in market prices for traders who aim to use scalping volatility trading strategy. Scalping is a short-term trading strategy that aims to make profits by taking advantage of small price movements over a short period, usually seconds or minutes. It differs from swing trading, which involves holding positions for several days or even weeks.

In scalping, traders execute multiple trades during the day, aiming to profit from frequent price changes. Identifying short-term price fluctuations is crucial in scalping as it helps traders identify patterns that may signal potential opportunities for profit. Traders can use various technical indicators such as Bollinger Bands, Moving Averages, and Relative Strength Index (RSI) to analyze market trends and detect potential entry and exit points.

However, rapid price movements can also pose risks such as slippage and execution errors. Therefore, risk management techniques are essential when implementing a scalping volatility trading strategy. These include setting stop-loss orders to minimize losses when trades go against expectations and using appropriate position sizing based on account size and risk tolerance levels.

Setting Entry and Exit Points

Establishing precise entry and exit points is a critical component in implementing a successful short-term trading approach that takes advantage of market fluctuations. A scalping volatility trading strategy requires traders to identify when the market is highly volatile and take advantage of price movements within a short time frame.

To effectively set entry and exit points, traders must first conduct thorough risk management analysis to determine their risk tolerance levels and develop an appropriate trade plan.

Once traders have established their risk management framework, they can begin analyzing the market to identify potential entry and exit points for their trades. Technical analysis tools such as moving averages, support and resistance levels, and trend lines can be used to analyze price movements over different time frames.

Additionally, fundamental analysis can provide insight into economic factors that may impact market volatility. By combining these analytical techniques with sound risk management practices, traders can confidently enter and exit trades at optimal times while minimizing potential losses.

Effective implementation of this trading strategy requires discipline, patience, and constant monitoring of market conditions to ensure profitable outcomes.

Using Indicators and Analytical Tools

The utilization of various technical indicators and analytical tools can aid traders in identifying potential market trends and price movements, providing them with a data-driven approach to making informed trading decisions.

When utilizing such tools for scalping volatility trading strategy, it is important to examine their effectiveness through using backtesting simulations. This involves analyzing historical data and testing the indicators or tools against it to see how well they would have performed in real-life trading scenarios.

One key aspect of using these indicators is comparing different options for scalping volatility trading strategy. There are numerous technical indicators available, including moving averages, Bollinger bands, and RSI (relative strength index), each with its own strengths and weaknesses.

Analyzing market volatility can also help identify entry points for trades based on the level of risk associated with the market at any given moment. Ultimately, employing these analytical techniques can help traders make more well-informed decisions when implementing their scalping volatility trading strategies.

Tips for Success with the Scalping Volatility Trading Strategy

Practice patience and discipline is key to success with the scalping volatility trading strategy. This means waiting for the right opportunities to present themselves, rather than jumping into trades impulsively.

Additionally, it’s important to stay informed and up-to-date on market conditions, news events, and other factors that can impact volatility in order to make more informed decisions.

Finally, managing risk and maintaining a long-term perspective are essential for minimizing losses while maximizing profits over time.

By following these tips, traders can increase their chances of success with this challenging but potentially lucrative trading strategy.

Practice Patience and Discipline

Exercising patience and discipline is essential for achieving success in the implementation of this particular approach to capturing market movements.

The scalping volatility trading strategy requires traders to make quick decisions based on short-term price fluctuations, which can be challenging without a clear mind and focused attention.

Developing focus and minimizing distractions are crucial components of practicing patience and discipline.

To develop focus, traders should create a trading plan that outlines their goals, strategies, risk management techniques, and exit points. This plan should be followed consistently to avoid impulsive decisions that could lead to losses.

Additionally, traders should limit their exposure to external factors that may distract them from their trading activities. For example, they should avoid checking social media or engaging in non-trading related conversations during active trading hours.

By maintaining a disciplined approach to trading and avoiding unnecessary distractions, traders can increase their chances of success with the scalping volatility strategy.

Stay Informed and Up-to-Date

Remaining informed and up-to-date is a critical aspect of implementing an effective approach to capturing market movements, as it enables traders to make well-informed decisions based on the latest market trends and developments.

Staying abreast of news sources and performing regular market analyses are central components of remaining knowledgeable about the current state of the markets. News sources can help traders understand how global events, such as economic shifts or political changes, may impact various financial instruments. For example, if there is an announcement that a country’s currency will undergo significant inflation due to new economic policies, this could have implications for forex traders who hold positions in that currency.

Market analysis provides another way for traders to stay informed about market movements. By analyzing technical indicators such as moving averages or trading volumes over specific time periods, traders can identify trends and patterns in price movements that may indicate future price changes. Fundamental analysis can also be employed by looking at company news releases or earnings reports to gauge how certain stocks may perform in the future.

This type of analysis allows traders to make more objective decisions about when to enter or exit trades based on concrete data rather than relying solely on intuition or emotions. In summary, staying informed through news sources and regular market analysis is essential for successful scalping volatility trading strategy implementation.

Manage Risk and Maintain a Long-Term Perspective

Effective risk management techniques and a long-term investment perspective are crucial for traders who seek to apply the scalping volatility trading strategy successfully.

The ever-changing nature of financial markets makes it impossible to avoid risks entirely; however, with proper risk management techniques, traders can minimize losses and maximize profits. Risk management involves identifying potential risks, evaluating their impact on the portfolio, and implementing measures to mitigate them. Traders must take into account factors such as leverage, liquidity, market volatility, and diversification when managing their risks.

Furthermore, maintaining a long-term investment perspective is essential in scalping volatility trading strategy since it helps traders avoid making impulsive decisions based on short-term fluctuations. By focusing on long-term trends rather than daily price movements or news events that may cause temporary spikes or dips in asset prices, traders can reduce the likelihood of reacting impulsively to market noise.

A long-term perspective also allows traders to identify opportunities as they arise and capitalize on them while avoiding panic selling during bearish periods. Overall, effective risk management techniques combined with a long-term investment perspective are critical components for successful implementation of scalping volatility trading strategies.

Conclusion

In conclusion, the Scalping Volatility Trading Strategy can be a lucrative approach for experienced traders who are comfortable with high-frequency trades and have solid risk management protocols in place.

By focusing on short-term price movements and using technical indicators to identify entry and exit points, traders can potentially capitalize on market fluctuations and generate profits.

It is important to keep in mind that this strategy requires discipline and patience, as well as continuous monitoring of market conditions.

Traders should also be aware of potential risks such as sudden price swings or slippage due to high volume trading.

Overall, the Scalping Volatility Trading Strategy can be a valuable tool for traders looking to diversify their portfolio and take advantage of market volatility.