Relative Momentum Index Mtf (Rmi) For Mt4 Review

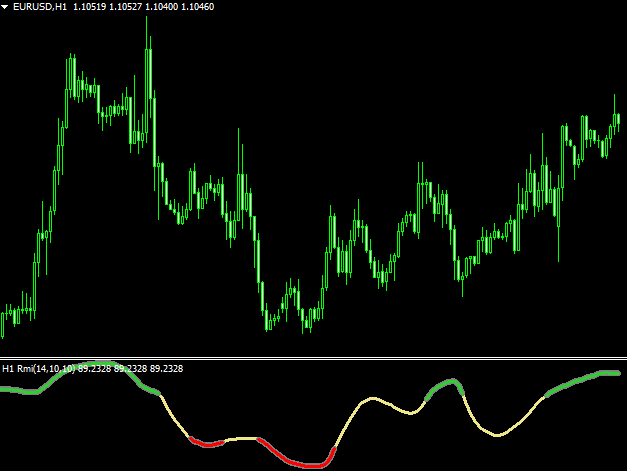

The Relative Momentum Index MTF (RMI) is a technical indicator used in trading to identify momentum shifts and potential price reversals. This indicator is available on the MetaTrader 4 (MT4) platform, which is a popular trading software used by many traders worldwide.

The RMI uses data from multiple timeframes to provide a more comprehensive view of market trends and help traders make informed decisions. The RMI calculates the relative strength of two moving averages to generate buy or sell signals. When the short-term moving average crosses above the long-term moving average, it indicates a bullish trend, while a cross below indicates a bearish trend.

Download Free Relative Momentum Index Mtf (Rmi) For Mt4

Additionally, the RMI can be used with multiple timeframes to provide an even clearer picture of market direction and help traders determine when to enter or exit trades. Overall, understanding how to use the RMI effectively can be beneficial for any trader looking to improve their strategy and increase profitability.

What is the Relative Momentum Index MTF (RMI) for MT4?

The present section provides an in-depth explanation of the Relative Momentum Index MTF (RMI) and its significance for traders who use the MT4 platform.

The RMI is a technical indicator that measures the strength of price momentum relative to a selected period. It is similar to other popular momentum indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), but with some unique features that make it useful for traders.

One of the benefits of using RMI is its calculation method, which adjusts for changes in volatility by incorporating Bollinger Bands into its formula. This feature makes it more stable than other momentum indicators and reduces false signals during periods of high volatility.

Moreover, RMI can be used in combination with other indicators to confirm or negate trading decisions. For example, when RMI crosses above or below its signal line, this may indicate a buy or sell signal respectively; however, traders should also consider other factors such as trend direction, support/resistance levels, and volume before making a final decision.

How to Use RMI to Improve Your Trading

Enhancing trading performance can be achieved through the effective utilization of the Relative Momentum Index, which provides insights into market trends and potential entry or exit points.

Traders can customize the RMI indicator by adjusting its parameters to suit their individual trading style. For instance, they could modify the time frame used for calculating moving averages or adjust oversold/overbought levels based on market volatility. By doing so, traders can fine-tune their analysis and receive more accurate signals that align with their preferred approach.

Moreover, backtesting strategies using historical data can help traders evaluate how well the RMI performs under different market conditions. This involves simulating trades based on predefined rules and analyzing their outcomes to determine whether a particular strategy is profitable in the long run.

Backtesting can reveal whether certain parameter settings generate too many false signals or fail to capture significant price movements. Based on this information, traders can make informed decisions about which settings to use in real-time trading situations and improve their overall success rate over time.

Tips for Using RMI Effectively

Effective utilization of the RMI indicator requires traders to fine-tune their analysis through customizing its parameters and conducting backtesting strategies to determine profitable trading settings.

One common mistake that traders make when using RMI is relying solely on its signals without considering other technical indicators or fundamental analysis.

As with any tool, the RMI should be used in conjunction with other analytical methods to confirm trade entries and exits.

Advanced strategies for using RMI may involve combining multiple time frames or incorporating price action patterns into one’s analysis.

Traders can also experiment with different periods and levels for the RMI indicator to find optimal settings for a particular market or asset.

Additionally, keeping track of news events and economic data releases can help traders anticipate potential changes in market sentiment and adjust their trading strategies accordingly when using the RMI.

Overall, effective utilization of the RMI indicator requires patience, discipline, and a willingness to continually refine one’s approach based on market conditions.

Conclusion

The Relative Momentum Index MTF (RMI) is a technical indicator designed for use in MetaTrader 4. It is based on the concept of relative strength and momentum, and can be used to identify potential trend reversals or continuations.

Traders can customize the RMI by adjusting the timeframes and smoothing parameters to suit their individual needs. When used effectively, the RMI can provide valuable insights into market trends and help traders make more informed decisions.

To use the RMI effectively, it is important to understand its underlying principles and how it works in conjunction with other technical indicators. Traders should also consider combining the RMI with other tools like moving averages or Bollinger Bands to confirm signals and reduce false positives.

It is also recommended that traders test different settings and strategies using demo accounts before implementing them in live trading environments. In conclusion, the Relative Momentum Index MTF (RMI) is a powerful tool that can enhance a trader’s ability to analyze market trends and make informed decisions.

By understanding its features, customizing its settings, and combining it with other tools, traders can improve their overall trading performance. However, it is important to exercise caution when using any technical indicator as no tool provides foolproof predictions of future market behavior.