Price Action Trend Indicator For Mt4 Review

Price action is one of the most fundamental components in technical analysis. It refers to the movement of security prices reflected through charts and patterns. Traders and investors use price action as a means of predicting future market trends, which helps them make informed decisions about when to buy or sell securities.

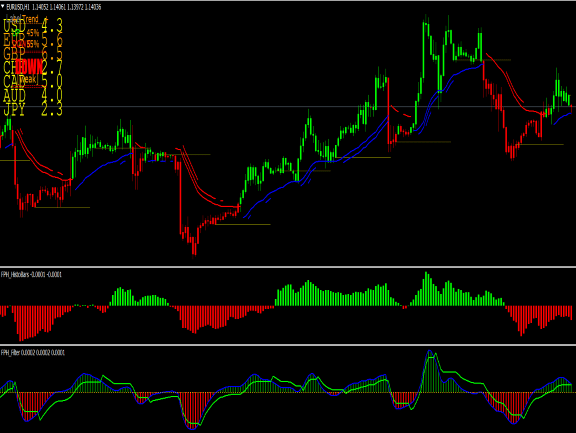

One tool that traders can use to help them analyze price action is the Price Action Trend Indicator for MT4. The Price Action Trend Indicator for MT4 is a powerful tool that displays key levels of support and resistance on a chart to help traders identify potential trend reversals or continuations. The indicator uses historical price data to calculate these levels, making it useful for both short-term and long-term trading strategies.

Download Free Price Action Trend Indicator For Mt4

By analyzing price movements over time, traders can gain valuable insights into market trends, which they can then use to make more informed trading decisions. In this article, we will explore what the Price Action Trend Indicator for MT4 is and how traders can use it effectively in their trading strategies.

What is the Price Action Trend Indicator for MT4?

The present section elucidates the precise nature and function of a technical analysis tool designed for deployment on the MetaTrader 4 platform, known as the Price Action Trend Indicator.

This indicator is a comprehensive tool that is used by traders to analyze price movements in real-time and identify potential trends. The indicator features customizable settings and can be tailored to suit individual trading needs.

The Price Action Trend Indicator uses candlestick charts to indicate market trends, making it an ideal tool for traders who prefer to use technical analysis in their trading strategies. It provides traders with a clear picture of support and resistance levels, as well as potential reversal points in the market.

In addition, it allows traders to set stop-loss orders at key levels to limit risk exposure. The customizable settings make it possible for traders to adjust the sensitivity of the indicator based on their preferences, allowing them to fine-tune their approach and maximize profitability in different market conditions.

How to Use the Price Action Trend Indicator for MT4

In this section, the utilization of the Price Action Trend Indicator for MT4 will be expounded on, providing users with a comprehensive understanding of how to integrate the indicator into their trading strategy.

The Price Action Trend Indicator is an effective tool that can assist traders in identifying trends and generating entry and exit signals based on price action.

To use the indicator, one must first install it in MetaTrader 4 and customize its settings to match their desired trading style. The customization options allow traders to adjust parameters such as period length and sensitivity levels, enabling them to tailor the indicator to their preferences.

Once customized, traders can begin using the Price Action Trend Indicator by monitoring its visual signals on their charts. The upward sloping blue line signifies an uptrend while a downward sloping red line indicates a downtrend.

Entry signals are generated when prices cross over or under these lines, while exit signals are produced when prices diverge from the trend lines. By incorporating this indicator into their trading strategy, traders can effectively identify trends and make informed trading decisions based on price action data.

Tips for Maximizing the Effectiveness of the Price Action Trend Indicator for MT4

In the world of trading, risk management is crucial to success. When using the Price Action Trend Indicator for MT4, it is important to consider proper risk management techniques such as setting stop loss and take profit levels.

Additionally, backtesting and optimization can help traders fine-tune their strategy and improve their chances of success.

Market analysis and staying up-to-date on news events can also play a significant role in maximizing the effectiveness of this indicator by providing valuable insights into market trends and potential opportunities.

Risk Management

Effective risk management is crucial in any trading strategy, and this section highlights the importance of implementing sound risk management practices when using the Price Action Trend Indicator for MT4.

One important aspect of risk management is position sizing. Traders should only risk a small percentage of their account balance on each trade, typically no more than 1-2%. This ensures that a string of losing trades does not wipe out the trader’s entire account.

Another key component of effective risk management is implementing stop loss strategies. Stop losses are used to limit potential losses by exiting a trade at a predetermined price level. Traders can use the price action trend indicator to identify areas where stop losses should be placed based on support and resistance levels.

The following list offers additional tips for effective implementation of stop loss strategies:

- Use trailing stops to lock in profits as the market moves in your favor.

- Adjust stop loss levels as market conditions change.

- Avoid setting stop losses too close to entry points, which increases the likelihood of being stopped out due to normal market volatility.

- Always use stop losses, even if you think you have a strong idea about how far prices will move in your favor – unexpected events can always occur that cause prices to reverse unexpectedly.

Backtesting and Optimization

The current section emphasizes the importance of backtesting and optimization in order to evaluate the effectiveness of a trading strategy using historical data and identify potential areas for improvement.

Backtesting refers to the process of testing a trading strategy against past market data to determine its performance. This process allows traders to gain insights into how their strategies would have performed in different market conditions, as well as identify any weaknesses or strengths.

Optimization strategies involve adjusting various parameters within a trading strategy, such as entry and exit points, stop-loss levels, and position sizing, in order to improve its performance. Performance metrics such as profitability, drawdowns, and risk-adjusted returns can be used to analyze the results of backtesting and optimization.

By fine-tuning their strategies through these processes, traders can increase their chances of success in real-world trading scenarios. However, it is important for traders to keep in mind that past performance does not guarantee future results and that ongoing analysis is necessary to adapt to changing market conditions.

Market Analysis and News Events

Market analysis and news events play a crucial role in informing traders about the underlying economic conditions, geopolitical events, and other factors that can influence market movements and impact the performance of their trading strategies.

Understanding the fundamental drivers behind price movements is essential for traders who employ price action trend indicators to make informed decisions. Traders should use various tools, such as technical analysis tools or an economic calendar, to keep track of news events that might impact their positions.

An economic calendar is a useful tool for traders looking to stay on top of upcoming news releases. It typically lists important macroeconomic indicators such as interest rate decisions, GDP reports, employment data releases, and other critical information that could move markets.

By monitoring these events closely, traders can adjust their trading strategies accordingly based on how they expect the market will react. Combining this with technical analysis tools helps traders get a better understanding of what is happening in the market and what trades may be worth taking.

Conclusion

In conclusion, the Price Action Trend Indicator for MT4 is a valuable tool for traders in analyzing trends and making informed decisions.

It provides clear visual representations of trend direction and potential entry/exit points, allowing traders to plan their trades accordingly.

By combining price action analysis with technical indicators, this tool can help identify key support and resistance levels, as well as potential trend reversals.

However, like any trading tool, it is important to use the Price Action Trend Indicator in conjunction with other forms of analysis and risk management strategies to maximize its effectiveness.

With proper use and understanding, the Price Action Trend Indicator can be an essential asset for traders seeking to improve their profitability and success in the markets.