Positive Volume Index Mt4 Indicator Review

The Positive Volume Index (PVI) MT4 Indicator is a technical analysis tool that measures the strength of buying pressure in the market. Introduced by Norman Fosback in 1993, this indicator is designed to help traders identify trends and potential reversals by analyzing volume data.

Unlike traditional volume indicators, which focus solely on the amount of trading activity, the PVI takes into account both price movements and volume changes. As a result, the PVI can provide valuable insights into market sentiment and investor behavior.

Download Free Positive Volume Index Mt4 Indicator

By tracking positive changes in volume alongside rising prices, traders can gain a better understanding of when buyers are gaining control and taking positions in a particular security or asset. In this article, we will explore how the PVI works, how to use it effectively in your trading strategy, and some tips for maximizing your results with this powerful indicator.

Understanding the Positive Volume Index MT4 Indicator

This section delves into the intricacies of the technical analysis tool that has garnered attention in the financial industry, highlighting its potential to provide valuable insights on market trends and movements through a systematic approach.

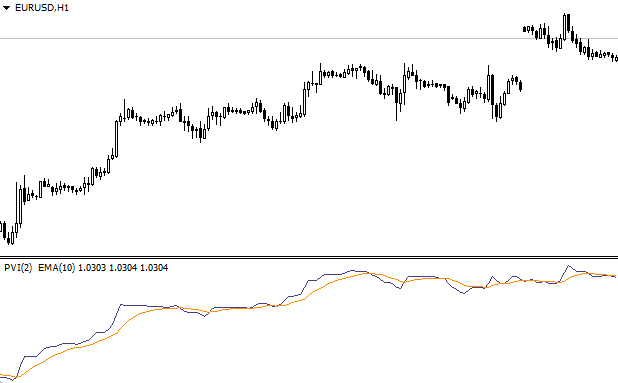

The Positive Volume Index (PVI) MT4 indicator is a popular tool used by traders to forecast future price changes in various financial markets. It works by calculating PVI values based on volume data, with upward trends indicating bullish market conditions and downward trends signaling bearish conditions.

Interpreting PVI trend lines can be useful for identifying potential entry and exit points for trades. When PVI values are rising, it indicates an increase in buying pressure and suggests that prices may continue to rise or remain stable. Conversely, falling PVI values indicate selling pressure and suggest that prices may decline or remain stagnant.

Traders also use convergence or divergence between price movements and PVI trend lines to identify possible market reversals. Overall, understanding how to interpret the PVI MT4 indicator can be a valuable tool for traders looking to make informed decisions based on market trends and movements.

Using the PVI MT4 Indicator in Your Trading Strategy

Implementing the PVI MT4 indicator into one’s trading strategy can potentially enhance decision-making by providing insights into market trends and movements.

The PVI calculation process involves comparing the current day’s volume to the previous day’s volume, and if it is higher, adding a percentage of the previous day’s PVI value to today’s PVI value.

If it is lower, subtracting a percentage of the previous day’s PVI value from today’s PVI value. This results in a line graph that shows whether buying or selling pressure is increasing or decreasing over time.

Backtesting a PVI strategy can provide valuable information about its effectiveness in different market conditions.

Traders can use historical data to simulate how their chosen strategy would have performed in various scenarios, allowing them to identify potential flaws or areas for improvement.

It is important to note that no trading strategy can guarantee profits, and past performance does not necessarily predict future results.

However, incorporating the PVI MT4 indicator into one’s overall analysis may provide additional insights and help traders make more informed decisions.

Tips for Maximizing Your Results with the PVI MT4 Indicator

Using the PVI MT4 indicator in conjunction with other technical analysis tools can help traders make more informed decisions.

By combining the PVI with indicators such as moving averages or trend lines, traders can gain a better understanding of market trends and potential entry and exit points.

Additionally, setting realistic trading goals and staying informed about market news and trends can also help maximize results when using the PVI MT4 indicator.

Using the Indicator with Other Technical Analysis Tools

By combining the insights derived from the positive volume index with other technical analysis tools like moving averages, Fibonacci retracements, and support and resistance levels, traders can develop a more nuanced understanding of market trends and make better-informed trading decisions.

For instance, by using a moving average in combination with the PVI MT4 indicator, traders can identify trends more accurately as moving averages provide a smooth representation of price movements over time. This helps to filter out short-term volatility noise that may be picked up by the PVI alone.

In addition to combining indicators, backtesting strategies can also be used to test the effectiveness of using the PVI MT4 indicator with other technical analysis tools. By inputting historical data into a trading platform that supports backtesting, traders can see how their chosen combination would have performed under different market conditions.

This allows them to refine their strategies without risking any real money until they are confident that their approach is sound. Overall, incorporating various technical analysis tools alongside the PVI MT4 indicator and testing these combinations through backtesting is crucial for developing profitable trading strategies.

Setting Realistic Trading Goals

Developing realistic trading goals requires a deep understanding of the market, including factors such as market trends, volatility, and risk management strategies. Successful traders use goal setting strategies that align with their trading style, experience level, and financial objectives. Measuring trading performance against these goals helps traders stay on track and make necessary adjustments to their strategies.

To set realistic trading goals, traders should consider the following factors:

| Factors | Description | Examples |

|---|---|---|

| Trading Style | The way a trader approaches the market | Day trading vs swing trading |

| Experience Level | A trader’s level of expertise in the market | Novice vs experienced trader |

| Financial Objectives | What a trader hopes to achieve financially through trading | Consistent profits vs long-term wealth building |

Before setting goals, traders should assess their current situation and determine what they hope to achieve through their trades. This includes evaluating their risk tolerance levels, available capital for investment, and time commitments. By establishing measurable targets based on these factors, traders can develop effective strategies that help them reach their desired outcomes over time. Regularly reviewing progress towards these goals enables traders to adjust their approach if necessary and continue improving overall performance in the market.

Staying Informed About Market Trends and News

Market analysis and news updates are vital for any trader who wants to stay ahead of the curve.

In order to set realistic trading goals, one must have a clear understanding of market trends and shifts. However, staying informed about these changes can be a daunting task, especially in today’s fast-paced market environment.

To ensure that traders remain up-to-date with the latest news and trends, it is crucial for them to develop a solid system for monitoring market developments. This might involve subscribing to financial news publications or using software tools such as real-time data feeds or social media platforms.

Additionally, traders should also make a habit of regularly reviewing economic indicators such as interest rates, inflation rates, and GDP growth figures. By doing so, they can gain valuable insights into how different markets are performing and identify potential opportunities for investment.

Ultimately, staying informed about market trends and news updates is an essential part of successful trading – helping traders to make more informed decisions and achieve their financial goals over the long term.

Conclusion

In conclusion, the Positive Volume Index (PVI) MT4 Indicator can be a useful tool for traders looking to analyze market trends and make informed decisions.

By tracking increases in volume alongside price movements, the PVI can help identify buying pressure and potential bullish trends.

However, it is important to remember that no indicator is foolproof and should be used in conjunction with other analysis techniques.

When implementing the PVI into your trading strategy, it is crucial to understand its limitations and potential drawbacks.

For example, relying solely on volume data may not accurately reflect market sentiment or activity.

Additionally, false signals can occur if there are sudden spikes in volume without corresponding price movements.

As with any technical indicator, it is important to use multiple tools and methods when analyzing markets to avoid making decisions based on incomplete information.

Overall, the PVI MT4 Indicator can be a valuable addition to a trader’s toolkit when used appropriately and in combination with other analysis methods.

It provides insight into market trends and helps identify potential buying opportunities while also highlighting areas of risk or uncertainty.

By understanding its strengths and weaknesses, traders can maximize their results when using this indicator as part of their overall trading strategy.