Pivot Points Indicator For Mt4 Review

The Pivot Points Indicator is a popular tool used by traders to identify potential levels of support and resistance in the market. It is based on a simple calculation that takes into account the high, low, and closing prices of the previous trading session.

This indicator can be particularly useful for short-term traders who are looking to make quick profits from price fluctuations. In this article, we will discuss the basics of the Pivot Points Indicator and how it can be used in MT4, one of the most widely-used trading platforms in the world.

Download Free Pivot Points Indicator For Mt4

We will also explore its benefits and drawbacks, as well as provide tips for effective use of this indicator. By gaining a deeper understanding of this tool, traders can improve their analysis and decision-making abilities when trading in volatile markets.

Understanding the Basics of the Pivot Points Indicator

A foundational understanding of the principles behind pivot point analysis is crucial for traders seeking to effectively implement this widely used technical analysis tool.

The pivot points indicator is a popular and powerful tool used in financial markets to determine levels of support and resistance, as well as potential price movements.

Pivot points are calculated using mathematical formulas that take into account the previous day’s high, low, and closing prices.

Traders use pivot points to identify key levels where the market may experience a reversal or breakout.

By analyzing historical performance of pivot points, traders can determine which levels are most significant and likely to have an impact on future price movements.

Additionally, some traders use multiple timeframes when calculating pivot points in order to gain a more comprehensive view of market trends and potential trading opportunities.

Overall, understanding how to calculate and interpret pivot points is essential for any trader looking to develop a successful trading strategy based on technical analysis.

How to Use the Pivot Points Indicator in MT4

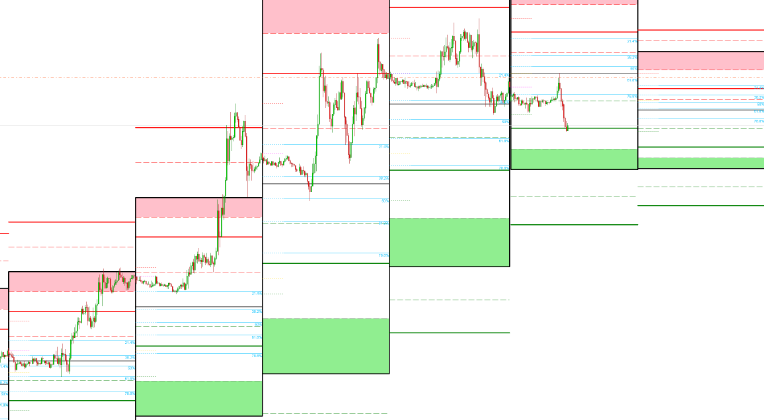

The application of pivot point analysis through the MetaTrader 4 platform can be effectively executed by following a systematic approach that involves identifying key levels of support and resistance within a given trading session.

Traders can customize their Pivot Points indicator settings in MT4 to suit their requirements. The Pivot Points calculation methods commonly used include Standard, Fibonacci, and DeMark.

To use the Pivot Points indicator in MT4, traders need to add the indicator from the navigator window onto their chart. Once added, they can customize the settings by right-clicking on the indicator and selecting ‘Properties.’

Here, traders can choose between different calculation methods or select custom values for support and resistance levels. In addition to this, traders may also adjust other parameters such as line colors and thicknesses to ensure that they are visually appealing and easy to read.

Overall, using the Pivot Points indicator in MT4 requires knowledge of its calculation methods as well as customization according to individual preferences.

Benefits and Drawbacks of Using the Pivot Points Indicator

This section provides an analysis of the advantages and disadvantages associated with the application of pivot point analysis in trading, allowing traders to make informed decisions regarding their use.

One of the primary advantages of using pivot points as a technical indicator is that they provide traders with clear support and resistance levels, which can help them identify potential entry and exit points for trades.

Pivot points are also easy to calculate, making them accessible even to novice traders.

However, there are also some drawbacks associated with using pivot point analysis.

One major limitation is that pivot points only provide information about the current day’s price action, meaning they may not be as useful for longer-term trades.

Additionally, because many traders use pivot points as a technical indicator, they can become self-fulfilling prophecies and lead to market movements that do not necessarily reflect underlying fundamentals or economic conditions.

Despite these limitations, many successful traders have utilized pivot point analysis in conjunction with other indicators to achieve consistent profits in real-life examples.

Tips for Effective Use of the Pivot Points Indicator

Effective use of the pivot point analysis requires traders to consider multiple timeframes, monitor price action closely, and utilize additional technical indicators as confirmation signals.

Pivot points trading strategies can be implemented across various time frames, including daily, weekly, and monthly charts. Traders should analyze these charts to identify key support and resistance levels that can help them determine potential entry and exit points.

For example, if a trader is using the daily chart for pivot point analysis, they may also want to review the weekly or monthly chart to identify any long-term trends or patterns that could impact their trading decisions.

Additionally, monitoring price action is essential when using the pivot points indicator. This involves watching for key levels of support and resistance as well as other price patterns such as breakouts or reversals. Traders should also look at volume data to confirm whether there is significant buying or selling activity at specific levels.

Finally, utilizing additional technical indicators such as moving averages or oscillators can provide further confirmation signals for traders when making decisions based on pivot point analysis. By incorporating these tips into their trading strategy, traders can effectively use the pivot points indicator in different time frames and make informed trading decisions with greater confidence.

Conclusion

In conclusion, the pivot points indicator is a powerful tool that can help traders identify potential price levels for entry and exit. By calculating support and resistance levels based on the previous day’s high, low, and closing prices, this indicator offers valuable insights into market trends and momentum.

However, it is important to note that like any technical analysis tool, the pivot points indicator has its limitations. Traders should be aware of the drawbacks of relying solely on this indicator for decision-making purposes. For instance, pivot points may not always accurately predict market movements during periods of high volatility or unexpected news events.

Nonetheless, when used in conjunction with other technical indicators and fundamental analysis tools, the pivot points indicator can be a useful addition to any trader’s toolbox.