Pivot Darma Indicator Mt4 Review

The Pivot Darma Indicator is a popular tool used by traders to analyze price movements in the financial markets. Developed by Darma Bahkti, this indicator is based on pivot points and helps traders identify key support and resistance levels.

The indicator can be customized to suit individual trading strategies and has proven useful in making informed trading decisions. In this article, we will explore the basics of the Pivot Darma Indicator and how it can be customized to meet your needs as a trader.

Download Free Pivot Darma Indicator Mt4

We will also discuss how you can use the indicator to make informed trading decisions based on key support and resistance levels. Whether you are new to trading or an experienced trader looking for new tools, understanding the Pivot Darma Indicator can help improve your chances of success in the markets.

Understanding the Basics of the Pivot Darma Indicator

This section provides a comprehensive overview of the fundamentals of using pivot points in technical analysis, including their historical context, calculation methodology, and practical applications.

Pivot points are used by traders to identify potential price levels for an asset and help them determine when to enter or exit a trade.

The concept of pivot points originated in floor trading, where traders would use the previous day’s high, low and close prices to calculate support and resistance levels for the current trading day.

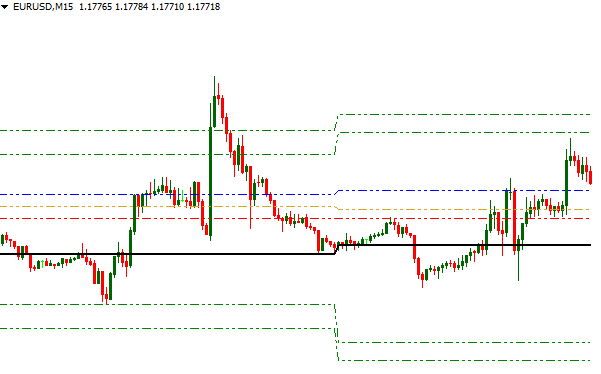

The application of the pivot darma indicator involves the use of four key price levels: the pivot point itself, two support levels below it, and two resistance levels above it.

These levels are calculated based on mathematical formulas that take into account the previous day’s high, low and close prices.

The advantage of using pivot darma indicator is its ability to provide clear signals about potential entry or exit points for trades.

It can also be used in conjunction with other technical indicators to confirm trends or reversals in market direction.

By identifying key price levels in advance, traders can place stop-loss orders or profit targets at these levels to manage their risk more effectively.

Customizing the Pivot Darma Indicator to Suit Your Needs

The process of customizing the Pivot Darma Indicator to meet specific trading needs involves adjusting the indicator settings, selecting charting styles, and experimenting with different timeframes.

The indicator settings can be modified by changing the input parameters such as period length, pivot type, and calculation method. These adjustments can help traders fine-tune their strategy based on their preferred trading style or market conditions.

Advanced Pivot Darma techniques involve using additional indicators in conjunction with the Pivot Darma Indicator to increase its effectiveness.

For example, traders may use momentum indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to confirm potential entry and exit points provided by the Pivot Darma Indicator.

Additionally, traders may experiment with different charting styles such as candlestick charts or bar charts to better visualize price action and identify key levels of support and resistance.

By customizing the Pivot Darma Indicator to suit individual trading needs, traders can gain a deeper understanding of market trends and make more informed trading decisions.

Using the Pivot Darma Indicator to Make Informed Trading Decisions

Identifying entry and exit points is crucial for successful trading. The Pivot Darma Indicator can assist in this endeavor by calculating pivot points based on historical data. This allows traders to identify potential support and resistance levels.

In addition to this, gauging market sentiment through the use of the Pivot Darma Indicator provides insight into market trends. This can help traders stay ahead of the curve and make informed trading decisions.

Identifying Entry and Exit Points

The process of determining optimal trade entry and exit points through comprehensive analysis of market trends and signals is a crucial aspect of successful trading strategies.

The Pivot Darma Indicator MT4 provides traders with an effective tool to identify potential turning points in the market, which can be used to enter or exit trades at favorable prices.

By combining the indicator with other technical analysis tools, such as Fibonacci retracement and trend analysis, traders can gain a deeper understanding of price movements and make more informed trading decisions.

One way to use the Pivot Darma Indicator MT4 to identify entry points is by waiting for a price reversal signal after a significant retracement level has been reached.

For example, if the market has been in an uptrend and reaches a key resistance level, traders can wait for a bearish reversal signal from the Pivot Darma Indicator before entering into a short position.

On the other hand, if the market has been in a downtrend and reaches a key support level, traders can wait for a bullish reversal signal from the indicator before entering into a long position.

Additionally, traders can use trend analysis alongside pivot point levels to confirm their entries and exits by looking out for candlestick patterns or chart formations that indicate potential trend reversals.

Gauging Market Sentiment

One critical component of successful trading strategies is the ability to gauge market sentiment accurately, as this can help traders make more informed decisions about potential entry and exit points.

Market analysis is a process that involves gathering relevant data and information about the current state of the market, including price trends, volume fluctuations, news events, and other factors that may affect asset prices.

Sentiment analysis, on the other hand, focuses on understanding how traders feel about a particular asset or market.

By combining market analysis with sentiment analysis, traders can gain a better understanding of how supply and demand dynamics are likely to play out in the near future.

For example, if sentiment is bullish but technical indicators suggest that demand for an asset may be waning, traders may choose to take a more cautious approach when entering or exiting trades.

Conversely, if sentiment is bearish but there are signs of strong support levels forming around certain price points, traders may see this as an opportunity to buy into oversold assets at bargain prices.

Ultimately, by gauging market sentiment accurately and incorporating it into their trading strategies, traders can improve their chances of success in volatile markets where quick decision-making is often required.

Staying Ahead of the Curve

Staying ahead of the curve in trading requires a constant effort to monitor and analyze trends, predict market changes, stay up-to-date with relevant news events, and actively seek out new sources of information to gain an edge over competitors.

One way traders can achieve this is by using the pivot darma indicator MT4, which is designed to help identify potential turning points in the market. The indicator plots support and resistance levels based on previous price action and uses these levels as reference points for future price movements.

The pivot darma indicator MT4 can be used to identify key levels where traders can enter or exit trades. By studying historical data and analyzing current trends, traders can use the indicator to determine where the market may be headed next. This allows them to make informed decisions about when to buy or sell assets, helping them stay ahead of their competitors by taking advantage of opportunities before they arise.

Overall, staying ahead of the curve requires a combination of analytical skills, strategic thinking, and access to reliable tools like the pivot darma indicator MT4.

Conclusion

In conclusion, the Pivot Darma Indicator is a versatile tool that can help traders make informed decisions by providing valuable insights into market trends. Understanding how to use this indicator and customizing it to meet specific needs can lead to more successful trades.

By analyzing pivot points, support and resistance levels, and trend lines, traders can gain a better understanding of market movements and identify potential entry and exit points. However, like any trading strategy or tool, it is important to combine the information provided by the Pivot Darma Indicator with other forms of analysis and risk management techniques to achieve optimal results.

Overall, the Pivot Darma Indicator provides a useful framework for traders who are looking for a simple yet effective way to analyze market trends and make informed trading decisions. As with any new tool or strategy, it may take some time to become familiar with its features and functions.

However, once mastered, the Pivot Darma Indicator has the potential to become an essential part of any trader’s toolkit. By constantly refining their approach using indicators such as these, traders can increase their chances of success in today’s fast-paced financial markets.