Murrey Math Lines Fmod Indicator Review

In the world of financial trading, technical analysis is a popular method for predicting market trends and making profitable trades. One tool in this arsenal of analytical techniques is the Murrey Math Lines Fmod Indicator. It is a mathematical model that helps traders to identify crucial support and resistance levels on price charts.

Developed by T.H. Murrey, the Murrey Math Lines Fmod Indicator is based on Gann angles theory which uses geometric calculations to predict future price movements in financial markets.

Download Free Murrey Math Lines Fmod Indicator

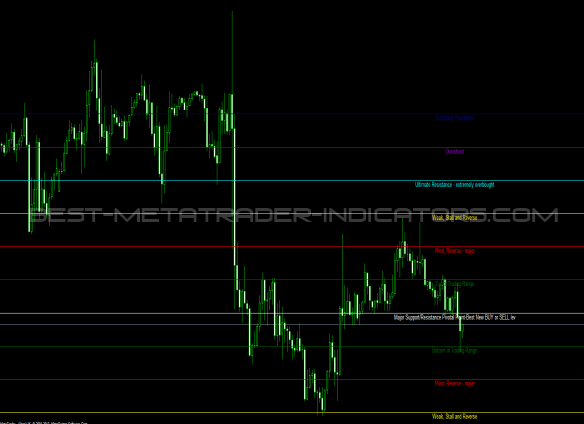

This indicator consists of 8 horizontal lines that represent key support and resistance levels, with each line representing a specific price range or ‘square’ in the geometric model. The indicator also includes two diagonal lines known as ‘Murray’s 1/8th’ and ‘Murray’s 8/8th,’ which are considered significant because they represent extreme levels of market pressure.

Overall, this tool provides traders with a clear visual representation of important levels that can be used to inform trading decisions.

Understanding the Murrey Math Lines Fmod Indicator

This section provides an explanation of a technical analysis tool that aids traders in identifying potential support and resistance levels within financial markets.

The Murrey Math Lines Fmod indicator is based on the work of T. Henning Murrey, who developed a mathematical system for identifying key levels within financial markets. The calculation process involves dividing the price range into nine equal parts, with each part representing a different level of support or resistance. These levels are based on the square root of 1/8 and are often referred to as ‘Murrey Math lines.’

The Murrey Math Lines Fmod indicator uses historical performance data to identify these key levels within financial markets. Traders can use this information to help make informed decisions about when to buy or sell assets, as well as where to set stop-loss orders.

The indicator can be used in conjunction with other technical analysis tools, such as moving averages and trendlines, to provide a more comprehensive view of market conditions. By understanding the underlying principles behind the Murrey Math Lines Fmod indicator, traders can gain valuable insights into market trends and potentially increase their chances of success in trading activities.

Applying the Murrey Math Lines Fmod Indicator in Trading

The application of a technical analysis tool in trading can potentially evoke emotions of confidence and reassurance for traders seeking to make informed decisions based on objective data.

Using Murrey Math Lines in day trading is one such tool that traders incorporate to identify key levels of support and resistance, as well as potential breakout points.

The Murrey Math Lines Fmod Indicator builds upon the traditional Murrey Math Lines by incorporating Fibonacci retracements to provide additional insight into market trends.

To incorporate Fibonacci retracements with Murrey Math Lines, traders can use the Fmod Indicator to plot horizontal lines that correspond with key Fibonacci levels, such as 38.2%, 50%, and 61.8%.

These lines can help identify potential reversal or continuation points within a given trend.

Additionally, the Fmod Indicator can be used in conjunction with other technical analysis tools, such as oscillators or moving averages, to further confirm potential trend changes or entry/exit points.

By using a combination of these tools, traders may have greater confidence in their decision-making process when executing trades based on objective data rather than emotional impulses.

Pros and Cons of Using the Murrey Math Lines Fmod Indicator

An evaluation of the potential benefits and drawbacks of implementing technical analysis tools, specifically those that incorporate Fibonacci retracements, in trading strategies can provide insights into the effectiveness and limitations of using objective data to inform decision-making processes.

One such tool is the Murrey Math Lines Fmod Indicator, which is based on a set of mathematical calculations that plot support and resistance levels on price charts.

One advantage of using this indicator is its ability to identify key levels where price may reverse or consolidate, allowing traders to enter or exit positions with greater precision.

However, there are also some disadvantages to consider when using the Murrey Math Lines Fmod Indicator.

Firstly, this tool relies heavily on past market data to generate its calculations, which means it may not be as effective during times of extreme volatility or unexpected news events that disrupt normal market activity.

Additionally, while the indicator can help traders identify potential entry and exit points, it does not provide any information about market sentiment or fundamental factors that could influence price movements.

As such, it should be used in conjunction with other technical and fundamental analysis tools to improve overall accuracy and reduce risk.

Conclusion

The Murrey Math Lines Fmod Indicator is a technical analysis tool that can assist traders in identifying potential price targets and support/resistance levels. By using the principles of the Murrey Math Lines, which are based on mathematical calculations and geometrical patterns, this indicator helps identify key levels where price may experience significant movement.

While the Murrey Math Lines Fmod Indicator can be useful in trading, it also has its limitations. Like any technical analysis tool, it should not be relied upon as the sole basis for making trading decisions. Additionally, it may not work well in all market conditions or with all financial instruments.

Overall, the Murrey Math Lines Fmod Indicator can be a valuable addition to a trader’s toolbox when used in conjunction with other indicators and analysis techniques. It provides a unique perspective on support/resistance levels and potential price targets that can help traders make more informed decisions.

However, like any tool, it should be used judiciously and with an understanding of its limitations.