Multiple Trading Indicators Divergence For Mt4 Review

In the world of trading, traders need to have access to various tools and strategies that can help them make informed decisions. One such tool is the use of multiple trading indicators, which can provide valuable insights into market trends and potential opportunities. However, with so many different indicators available, it can be challenging to know which ones to use and how to interpret their signals.

This is where multiple trading indicators divergence for MT4 comes in. This strategy allows traders to combine different indicators and analyze their divergences, providing a more comprehensive view of market conditions.

Download Free Multiple Trading Indicators Divergence For Mt4

By understanding this approach, traders can gain a deeper understanding of the market and potentially improve their chances of making profitable trades.

In this article, we will explore what multiple trading indicators are and how they work in conjunction with divergence analysis on the popular MT4 platform.

Understanding Multiple Trading Indicators

The comprehension of various technical indicators and their interactions is essential for analyzing the complex behavior of financial markets and making informed investment decisions.

In the world of trading, there are several common indicators used in MT4, including Moving Averages, Relative Strength Index (RSI), Bollinger Bands, and Stochastic Oscillator. Each indicator provides valuable information about market trends, momentum, volatility, and potential price reversals.

However, relying on a single indicator can be risky as it may not give a comprehensive picture of the market conditions. Examples of successful trading strategies using multiple indicators include using Moving Average Convergence Divergence (MACD) in combination with RSI or Bollinger Bands to identify trend reversals or entry points.

Another strategy involves combining Stochastic Oscillator with Fibonacci retracements to determine support and resistance levels. By utilizing multiple indicators simultaneously, traders can confirm signals from one indicator with others before making a decision to enter or exit a trade.

It is important to note that while using multiple indicators can improve accuracy in predicting market movements, it also increases the complexity of analysis and requires experience and expertise to interpret correctly.

What is Divergence?

An understanding of the concept of divergence is crucial for traders seeking to analyze price movements and make informed decisions based on market trends.

Divergence refers to a situation where the price action of an asset deviates from the direction indicated by one or more technical indicators.

There are two types of divergence: bullish and bearish.

Bullish divergence occurs when the price of an asset makes lower lows while the indicator makes higher lows, indicating that buying pressure may be increasing.

Conversely, bearish divergence arises when the price creates higher highs, while the indicator generates lower highs, suggesting that selling pressure may be intensifying.

The importance of divergence in trading cannot be overstated as it provides traders with valuable insights into market trends and momentum shifts.

By identifying divergences between price action and technical indicators, traders can anticipate potential trend reversals or continuations before they occur.

Moreover, divergences can help traders identify hidden support or resistance levels that may not be apparent in a traditional chart analysis.

Therefore, incorporating multiple trading indicators divergence for mt4 into trading strategies can enhance decision-making abilities and improve overall profitability.

How Multiple Trading Indicators Divergence for MT4 Works

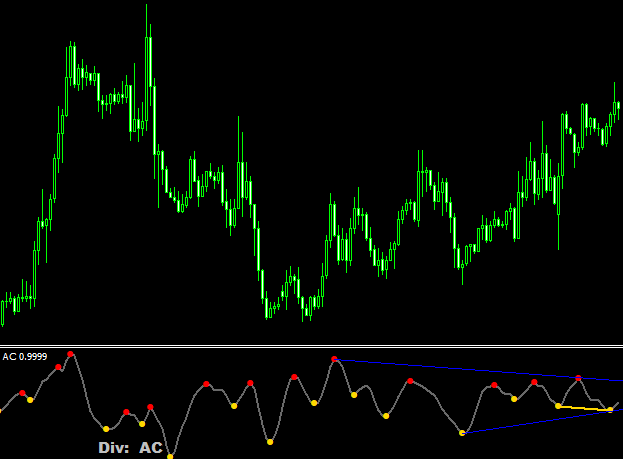

Multiple Trading Indicators Divergence for MT4 is a tool used in the financial market to identify potential trading opportunities by analyzing the divergence of different indicators.

Its features enable traders to analyze multiple indicators simultaneously, making it possible to generate better trading signals.

To use this tool, one needs to select the desired indicators and adjust their settings before analyzing the chart patterns for divergences.

Features and capabilities

This section highlights the various features and capabilities that assist traders in identifying potential market trends by analyzing discrepancies between different technical indicators.

Multiple Trading Indicators Divergence for MT4 is a tool that enables traders to identify divergences between multiple technical indicators such as Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Stochastic Oscillator. The tool compares the direction of price movements with those of the selected indicators, helping traders to spot potential trade opportunities.

One of the key advantages of Multiple Trading Indicators Divergence for MT4 over other divergence indicators is its ability to analyze several technical indicators simultaneously. This feature provides a more comprehensive view of market trends, allowing traders to make informed decisions based on multiple sources of data.

Additionally, examples of successful trades using this tool have demonstrated its efficacy in identifying profitable trading opportunities. By combining insights from different technical indicators, traders can gain an edge in highly competitive markets where small differences in timing or entry points can make a significant difference in overall profitability.

Step-by-step guide to using the tool

The following section presents a step-by-step guide to utilizing a technical analysis tool that facilitates the identification of market trends by comparing price movements with selected indicators.

To use this tool, first open the chart of the desired asset in MT4 and select ‘Indicators’ from the top menu. Then select ‘Custom’ and choose ‘Multiple Trading Indicators Divergence’.

Once the indicator is applied, traders can customize various parameters such as period, sensitivity, divergence type, and color scheme.

It is important to note that common mistakes when using this tool include not properly selecting the appropriate time frame or indicator parameters for a specific asset or market condition.

Additionally, troubleshooting tips include checking for any conflicting indicators or technical errors that may affect accuracy of results.

With proper usage and attention to detail, traders can effectively utilize multiple trading indicators divergence for MT4 to enhance their technical analysis toolkit and improve their overall trading strategy.

Benefits of Using Multiple Trading Indicators Divergence for MT4

The utilization of various complementary analytical tools in financial trading has been demonstrated to enhance the accuracy and reliability of market analysis, potentially increasing profits through a more comprehensive understanding of market trends.

One such tool is the Multiple Trading Indicators Divergence for MT4, which allows traders to analyze multiple indicators simultaneously and identify divergences between them. This tool provides several advantages over using single indicators, including increased accuracy in identifying trend changes and entry/exit points, as well as reduced risk by confirming signals across multiple indicators.

In addition to its advantages in accuracy and risk reduction, the Multiple Trading Indicators Divergence for MT4 also has a wide range of applications across different markets and timeframes. It can be used for short-term scalping strategies or long-term trend following approaches, as well as for analyzing stocks, futures, currencies, or any other tradable asset.

Moreover, it can complement both technical and fundamental analysis techniques by providing additional insight into market behavior that may not be immediately apparent from other methods. Overall, the use of Multiple Trading Indicators Divergence for MT4 can significantly improve a trader’s ability to make informed decisions based on a more comprehensive view of market trends and conditions.

Conclusion

Multiple trading indicators divergence for MT4 is an effective technique that traders use to analyze the markets. It involves using multiple technical indicators to identify divergences in price action, which can indicate potential trend reversals or continuations.

This approach provides traders with a more comprehensive view of market conditions, allowing them to make informed decisions about their trades. Divergence occurs when the price of an asset moves in one direction while the corresponding indicator(s) move in the opposite direction. By identifying these divergences, traders can gain valuable insights into market trends and potential trading opportunities.

Multiple trading indicators divergence for MT4 works by using a combination of different technical indicators, such as moving averages, RSI, MACD, and Bollinger Bands. These tools are used to generate signals that highlight potential areas of divergence between price and various technical indicators.

One of the main benefits of using multiple trading indicators divergence for MT4 is its ability to provide traders with a more comprehensive analysis of market conditions. By combining different technical indicators, traders can gain a clearer understanding of market trends and identify potential trading opportunities that may be missed by relying on just one indicator alone.

Additionally, this approach allows traders to better manage risk by providing them with more information about the underlying market conditions before entering a trade. Overall, multiple trading indicators divergence for MT4 is an effective tool that can help traders make better-informed decisions about their trades and improve their overall profitability in the markets.