Mtf Candlesticks Forex Mt4 Indicator Review

The forex market is known for its volatility and unpredictability, making it a challenging environment for traders. However, with the right tools and strategies, traders can navigate the market effectively and maximize their profit potential.

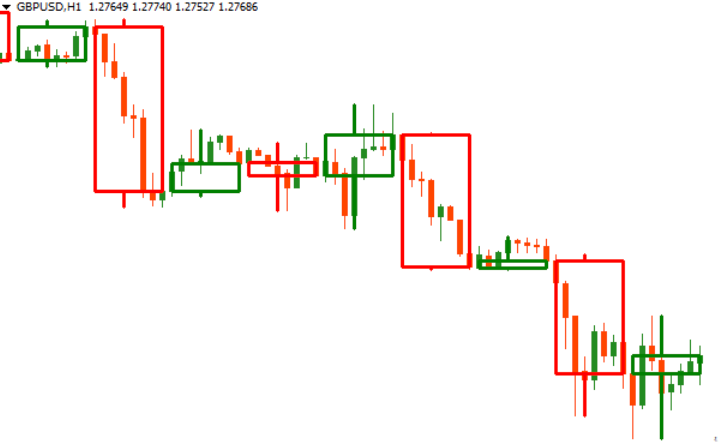

One such tool is the MTF Candlesticks forex MT4 indicator. Candlestick patterns have been used by traders for centuries to identify trends and predict future price movements. The MTF Candlesticks indicator takes this analysis to the next level by displaying multiple time frames on one chart, allowing traders to compare short-term and long-term trends simultaneously.

Download Free Mtf Candlesticks Forex Mt4 Indicator

This article will explore the benefits of using the MTF Candlesticks indicator in your trading strategy and how you can use it to increase your profitability in the forex market.

Understanding Candlestick Patterns

The ability to accurately interpret candlestick patterns is critical for successful trading in financial markets. Candlesticks provide a visual representation of price movements that traders use to identify trends and predict future market movements. By interpreting the various candlestick patterns, traders can gauge market sentiment, which is essential for making informed decisions.

One of the primary benefits of using candlesticks is the ability to recognize market sentiment. Candlestick patterns have unique shapes and formations that signify bullish or bearish conditions in the market. For instance, a long green candlestick indicates that buyers are dominating the market, while a long red candlestick signifies that sellers have taken control.

Understanding these patterns can help traders determine when to enter or exit trades based on their predictions about future price movements. Overall, mastering candlestick pattern analysis is an essential skill for anyone looking to trade successfully in financial markets.

Using the MTF Candlesticks Indicator

This section provides valuable insights into effectively utilizing the MTF Candlesticks forex MT4 indicator discussed in previous sections, enhancing one’s trading skills and increasing profitability. As a technical analysis tool, the MTF Candlesticks Indicator is designed to help traders analyze price action across multiple time frames, giving them a better understanding of market trends and potential opportunities for profitable trades.

To effectively use this tool, traders should consider backtesting strategies to determine the best settings for their preferred trading style. This involves using historical data to test different combinations of parameters and identify those that produce the most accurate signals.

Additionally, it is essential to pay attention to key candlestick patterns and use them as confirmation signals when making trading decisions. By combining these techniques with sound risk management practices, traders can increase their chances of success in the highly competitive forex market.

Analyzing price action across multiple time frames can provide a more comprehensive view of market trends. This can help identify potential entry and exit points for trades. It also helps reduce false signals by confirming trends on different time frames.

Backtesting strategies can help determine optimal settings for the MTF Candlesticks Indicator. This involves testing various parameter combinations using historical data. Identifying the most accurate signal configurations can improve decision-making in real-time trading scenarios.

Combining knowledge of candlestick patterns with technical analysis tools such as the MTF Candlesticks Indicator enhances traders’ ability to make informed decisions about when to enter or exit trades. This ultimately leads to increased profitability and reduced risks in the volatile world of financial markets.

Incorporating the Indicator into Your Trading Strategy

The MTF Candlesticks Indicator is a useful tool in identifying trends and patterns in the forex market. Its ability to display multiple timeframes at once allows traders to see both short-term and long-term trends, giving them a better understanding of market movements.

By incorporating this indicator into their trading strategy, traders can also improve their timing of entry and exit points, which can be crucial for maximizing profits. Additionally, risk management techniques such as setting stop-loss orders can be implemented with the help of this indicator to minimize potential losses.

Identifying Trends and Patterns

By analyzing trends and patterns, traders are able to make informed decisions that can potentially lead to successful trades. The mtf candlesticks forex mt4 indicator provides crucial information for identifying reversals and analyzing market volatility, which are essential in recognizing trends and patterns. With this tool, traders can easily spot potential trend changes or continuation points based on the behavior of the candles.

The nested bullet point list below outlines how the mtf candlesticks forex mt4 indicator helps identify trends and patterns:

- Allows traders to analyze multiple time frames simultaneously

- This feature enables traders to see different perspectives of price movements across various time frames.

- Provides clear visual representations of price action

- The indicator displays candlestick charts with different colors for bullish and bearish candles, making it easy for traders to identify trend changes.

- Helps determine support and resistance levels

- By using the indicator’s settings, traders can customize the display of support and resistance levels based on their trading strategies.

Overall, incorporating the mtf candlesticks forex mt4 indicator into a trading strategy provides valuable insights into market movements by identifying trends and patterns. It is an excellent tool that enhances decision-making processes through its advanced features, allowing traders to stay ahead of market trends and capitalize on profitable opportunities.

Timing Entry and Exit Points

Timing entry and exit points is a crucial aspect of trading that requires careful consideration and analysis, as it can significantly impact the success or failure of trades. One of the key factors to consider when timing entry and exit points is analyzing market volatility, which refers to the degree of variation in price movements over time.

High market volatility indicates greater potential for profits but also higher risk, while low volatility suggests lower risk but limited earning potential. Traders need to be able to identify patterns in market volatility and adjust their strategies accordingly.

Another important tool for determining entry and exit points is backtesting trading strategies. This involves using historical data to simulate how a particular strategy would have performed in past market conditions. By examining past performance, traders can identify strengths and weaknesses in their strategies and make appropriate adjustments before entering live trades.

Backtesting can also provide valuable insight into the types of market conditions where a particular strategy is most effective, allowing traders to optimize their approach based on current trends. Overall, timing entry and exit points requires careful analysis of both current market conditions as well as historical data to inform effective trading decisions.

Risk Management Techniques

Effective risk management techniques are essential for traders to minimize potential losses and maximize profits in the volatile trading market. The first step in managing risks is identifying them. Traders should conduct a thorough analysis of the market volatility, assessing factors such as economic indicators, political events, and global news that could impact their trades. This helps traders anticipate possible market downturns and take appropriate measures to mitigate losses.

One of the most effective risk mitigation strategies is implementing stop-loss orders. These orders automatically close trades at a predetermined price level if they move against the trader’s position. This technique minimizes potential losses by setting a limit on how much capital can be lost on a single trade.

Additionally, traders may also consider diversifying their portfolio by investing in different instruments or currencies to spread out their risk exposure. By incorporating these measures into their trading strategy, traders can effectively manage their risks and improve their chances of success in the forex market.

Maximizing Your Profit Potential

To optimize the potential for profit in trading, it is important to carefully consider various strategies and techniques that can be implemented in order to increase returns on investments.

One effective strategy is to focus on trade psychology, which involves understanding how emotions may impact your decision-making process. By developing a strong sense of discipline and remaining objective when making trades, traders can reduce the likelihood of making impulsive decisions based on emotional reactions.

Additionally, market analysis plays a crucial role in maximizing profit potential as it allows traders to identify trends and patterns within the market that can be used to make informed investment decisions.

Incorporating technical analysis into your trading strategy can also help maximize profit potential by providing insights into market trends and price movements. This type of analysis involves examining historical price data in order to identify key levels of support and resistance, as well as other indicators that may signal potential changes in market direction.

By combining both fundamental and technical analysis techniques, traders can gain a more comprehensive understanding of the markets they are investing in while minimizing risk through careful planning and execution.

Ultimately, maximizing profit potential requires a combination of skillful execution, disciplined decision-making processes, and an ongoing commitment to learning about the markets you are invested in.

Frequently Asked Questions

What other indicators can be used in conjunction with the MTF Candlesticks Indicator?

Using MTF candlesticks with multiple time frame analysis and combining them with price action analysis can provide traders with a more comprehensive understanding of the market trends.

Multiple time frame analysis involves examining different time frames to identify trend direction, while price action analysis focuses on identifying patterns and signals in price movements.

By using MTF candlesticks alongside these techniques, traders can better determine entry and exit points for trades based on the most reliable trends and patterns.

Additionally, incorporating other indicators such as moving averages or stochastic oscillators can complement MTF candlestick analysis by providing additional confirmation of trend direction or potential reversals.

Ultimately, a combination of technical indicators should be used to support informed trading decisions based on a variety of factors affecting the market.

Can the MTF Candlesticks Indicator be used on other trading platforms besides MT4?

When considering the use of MTF Candlesticks on non MT4 platforms, it is important to assess the compatibility with other indicators.

While some trading platforms may not offer MTF Candlesticks as a native indicator, there are often third-party options available that can be integrated into the platform.

It is also important to note that the functionality and accuracy of MTF Candlesticks may vary depending on the specific trading platform being used.

In order to fully utilize this indicator, traders should carefully research and test its performance on their chosen platform before incorporating it into their trading strategy.

Additionally, they should consider how it interacts with other indicators they plan to use in conjunction with MTF Candlesticks for a comprehensive analysis of market trends and potential opportunities.

How often should traders check the MTF Candlesticks Indicator for new signals?

Traders who use the MTF Candlesticks indicator should check for new signals regularly to optimize their trading strategy. However, it is important to note that checking too frequently can lead to overtrading and impulsive decision-making.

To avoid this common mistake, traders should establish a set schedule for checking the indicator and stick to it consistently. Additionally, traders can optimize their use of the MTF Candlesticks indicator by combining it with other technical analysis tools and using multiple timeframes to confirm signals.

By avoiding common mistakes and utilizing effective strategies, traders can increase their chances of success when using the MTF Candlesticks indicator in their trading activities.

Are there any specific market conditions where the MTF Candlesticks Indicator is more effective?

The effectiveness of any technical indicator is dependent on market conditions. The best timeframes for using the MTF candlesticks indicator vary from trader to trader, as it depends on their trading style and goals.

However, in general, larger timeframes such as the daily or weekly charts tend to yield more accurate signals because they reflect a longer-term view of the market.

Common mistakes made by traders when using this indicator include relying solely on it without considering other indicators or market factors, and entering trades based solely on one timeframe instead of analyzing multiple timeframes.

It is important for traders to understand that no single indicator can guarantee success in the forex market and they should utilize various tools and strategies to make informed decisions.

How can traders use the MTF Candlesticks Indicator to identify potential trend reversals?

Traders can utilize the MTF candlesticks indicator for forex trading by understanding candlestick patterns for trend reversals.

Candlestick patterns are graphical representations of price movements in which traders use to identify potential market trends and reversals.

By analyzing the MTF candlesticks indicator, traders can observe multiple timeframes simultaneously, which provides a better overview of market conditions and improves decision-making abilities.

For instance, if a trader notices bearish engulfing patterns on higher timeframes, it may indicate an upcoming downtrend while bullish engulfing patterns may suggest an uptrend.

Therefore, using the MTF candlesticks indicator in conjunction with technical analysis tools such as support and resistance levels or moving averages can help traders make informed trading decisions and increase their chances of success in forex trading.

Conclusion

Candlestick patterns are a popular method for analyzing financial data in order to predict market trends. The MTF Candlesticks Indicator is a valuable tool that can help traders better understand these patterns, as it provides multiple time frame analysis in one chart. By incorporating this indicator into their trading strategy, traders can make more informed decisions with regards to when to enter or exit the market.

However, it is important to note that no single indicator can guarantee success in the forex market. Traders must also consider other factors such as economic news and global events that may impact currency values. Additionally, risk management is crucial when trading forex; traders should only risk an amount they are comfortable losing and always use stop loss orders.

In conclusion, while the MTF Candlesticks Indicator can be a helpful tool for forex traders looking to analyze candlestick patterns across multiple time frames, it should not be relied upon solely for making trading decisions. Successful trading requires a combination of technical analysis, fundamental analysis, and proper risk management techniques. By utilizing all of these tools together, traders can maximize their profit potential while minimizing their risk exposure.