Monster Oscillator Mt4 Indicator Review

The Monster Oscillator MT4 Indicator is a technical analysis tool designed to help traders identify potential trends in the market. It is a popular indicator among forex traders due to its ability to provide useful insights into both short-term and long-term price movements.

The indicator works by analyzing the relationship between two moving averages, with one being slower than the other. The Monster Oscillator provides traders with a clear picture of market trends and momentum, which can be crucial for making informed trading decisions.

Download Free Monster Oscillator Mt4 Indicator

By using this indicator, traders can identify potential entry and exit points for trades, as well as determine when it may be best to hold onto positions or cut losses. However, like any technical analysis tool, it should not be relied upon solely and should be used in conjunction with other indicators and fundamental analysis techniques to develop a comprehensive trading strategy.

Understanding the Monster Oscillator MT4 Indicator

The current section provides an in-depth understanding of a technical analysis tool used in trading that measures the difference between two moving averages.

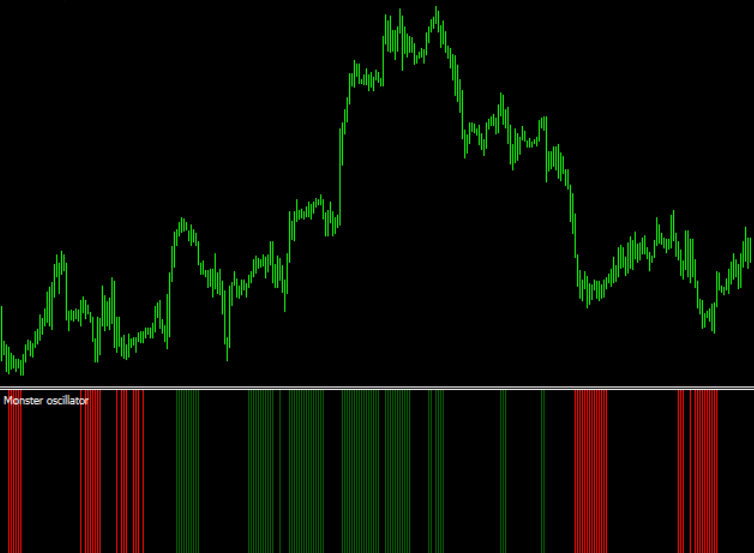

The Monster oscillator MT4 indicator is a custom-built oscillating indicator that shows the difference between two exponential moving averages (EMAs) of different periods. It helps traders identify possible trend reversals and generates buy or sell signals.

The Monster oscillator calculation involves subtracting the value of a longer-term EMA from that of a shorter-term EMA. The resulting value is then plotted on a chart, creating an oscillating line above and below zero.

When the oscillator crosses above zero, it is considered to be bullish, indicating that the price may be rising, while crossing below zero is bearish and implies that prices may fall. Interpreting oscillator signals requires careful attention to its behavior over time as well as other indicators such as volume or support/resistance levels to confirm potential trade setups.

Using the Monster Oscillator in Trading

The use of the Monster Oscillator MT4 Indicator in trading has been found to be beneficial for traders who employ various trading strategies.

The indicator’s ability to identify market trends and divergence patterns can provide valuable insights into potential price movements, allowing traders to make informed decisions on entry and exit points.

By analyzing multiple timeframes, the Monster Oscillator can help traders avoid false signals and increase their chances of success.

Moreover, combining the Monster Oscillator with other technical analysis tools such as moving averages or trend lines may further enhance its effectiveness in identifying profitable trades.

For example, using the oscillator alongside a moving average crossover strategy may yield better results by confirming trend changes and providing additional support levels for stop-loss orders.

However, it is important to note that no single indicator or tool can guarantee profitability in trading and that proper risk management practices should always be followed to minimize losses.

Tips for Maximizing the Benefits of the Monster Oscillator

When using the Monster Oscillator for trading, it is important to consider three key factors: backtesting and optimizing settings, monitoring market conditions, and practicing risk management.

Backtesting and optimizing settings will help traders identify the best parameters to use with the indicator based on historical data.

Monitoring market conditions will allow traders to adjust their strategies accordingly as market trends change.

Practicing risk management can help minimize potential losses while maximizing profits when using the Monster Oscillator in trading.

Backtesting and Optimizing Settings

Optimizing and backtesting settings is an essential step in determining the effectiveness of the Monster Oscillator MT4 indicator.

Through optimizing parameters, traders can adjust the indicator to fit their trading style and preferences. For instance, they can modify its sensitivity, period, or smoothing factors for more accurate signals.

With optimized settings, the Monster Oscillator can produce better trading signals that align with market conditions and improve trading outcomes.

Historical performance analysis is also crucial in backtesting settings to evaluate the reliability of the Monster Oscillator over various market conditions.

Traders can use historical data to test different parameter combinations and identify which ones provide higher win rates or profits per trade.

By analyzing past trades, traders can also determine whether certain parameters are too sensitive or not sensitive enough for a particular asset class or time frame.

Ultimately, optimizing and backtesting settings allow traders to fine-tune their technical analysis tools like the Monster Oscillator MT4 indicator for better accuracy and profitability in live trading situations.

Monitoring Market Conditions

Monitoring market conditions is an important step in evaluating the effectiveness of technical analysis tools, as it allows traders to identify shifts in market trends or volatility that may impact their trading strategies.

Analyzing trends and identifying key indicators can provide valuable insights into the behavior of a particular currency pair or asset, helping traders make more informed decisions about when to buy or sell.

One way to monitor market conditions is by using an indicator such as the Monster Oscillator MT4 Indicator. This tool measures the momentum of a currency pair or asset, allowing traders to identify potential buying or selling opportunities.

By analyzing multiple time frames, traders can get a more comprehensive view of market conditions and adjust their strategies accordingly. However, it is important to remember that no indicator can predict future price movements with 100% accuracy, so it is crucial for traders to also consider other factors such as economic news and political events before making any trades.

Practicing Risk Management

Practicing effective risk management is crucial for traders to minimize potential losses and protect their trading capital.

One of the most common risk management techniques employed by traders is setting stop loss levels. Stop loss orders are designed to limit the amount of money a trader can lose on a single trade, by automatically closing out the position if prices move against them beyond a predetermined level. This helps to prevent large losses that could potentially wipe out an entire trading account.

In addition to setting stop loss levels, traders also need to consider other risk management techniques such as diversification, position sizing and maintaining adequate liquidity.

Diversification involves spreading investments across different asset classes or markets to reduce exposure to any one particular market or instrument. Position sizing refers to determining the appropriate amount of money to allocate for each trade based on factors such as account size, risk tolerance, and market conditions.

Finally, maintaining adequate liquidity ensures that traders have enough cash reserves available in case of unexpected losses or opportunities for profitable trades arise. By employing these risk management techniques consistently over time, traders can improve their chances of long-term success in the financial markets while minimizing potential losses along the way.

Conclusion

In conclusion, the Monster Oscillator MT4 Indicator is a powerful technical analysis tool that can assist traders in identifying potential price reversal points. Its ability to track multiple timeframes and provide clear signals makes it an attractive option for both novice and experienced traders.

However, like any other indicator, it should be used in conjunction with other tools and market analysis to make informed trading decisions. To maximize the benefits of the Monster Oscillator, traders should consider using it alongside other indicators such as moving averages or trend lines to confirm signals.

Additionally, keeping an eye on market news and events that may impact price movements can help avoid false signals and reduce risk. Overall, incorporating the Monster Oscillator into a well-rounded trading strategy may increase the chances of success in the forex market.