Market Profile Indicator For Mt4 Review

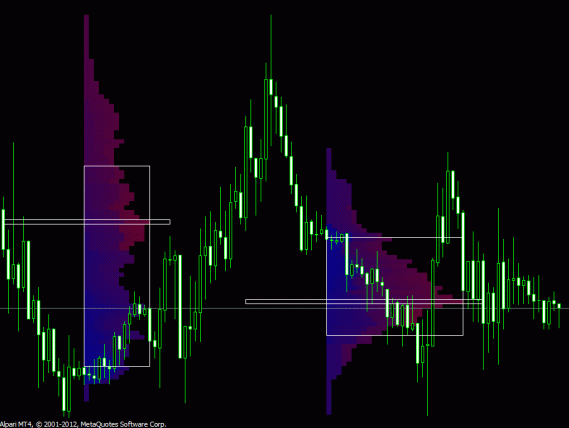

The Market Profile Indicator is a powerful tool for traders looking to gain insight into market dynamics and price behavior. It provides a visual representation of the distribution of trading activity over time, allowing traders to identify key levels of support and resistance, as well as potential areas of price reversal.

In this article, we will explore the Market Profile Indicator in depth, discussing its features and benefits, as well as how to implement it in MT4.

Download Free Market Profile Indicator For Mt4

We will also examine some practical examples of how traders can use this indicator to analyze market trends and make informed trading decisions. Whether you are a seasoned trader or just starting out, understanding the Market Profile Indicator can help you gain an edge in today’s fast-paced financial markets.

Understanding the Market Profile Indicator

The present section provides an in-depth understanding of the Market Profile Indicator, a tool utilized for displaying the distribution of price and volume over a specific period. The indicator aids traders in identifying market trends and making informed trading decisions.

The history and development of this indicator can be traced back to J. Peter Steidlmayer, who introduced it in the 1980s as a way to analyze market volatility and provide insights into price movements.

The Market Profile Indicator is unique compared to other indicators because it does not focus solely on price or volume, but instead combines both elements. Traditional technical analysis tools may overlook important information provided by volume data.

However, with this indicator’s help, traders can better understand how prices move based on supply and demand dynamics. Moreover, this approach provides a visual representation of market activity that allows traders to identify areas of support and resistance quickly.

Overall, the Market Profile Indicator is an essential tool for any trader looking to gain deeper insights into market trends while minimizing risk exposure through informed decision-making processes.

Using the Market Profile Indicator for Analysis

By incorporating the multi-dimensional data analysis capabilities of the Market Profile Indicator, traders can gain a more comprehensive understanding of market dynamics and make informed trading decisions.

The indicator provides insights into price distribution, volume activity, and time spent at different price levels. By analyzing these variables, traders can identify key areas of support and resistance, as well as potential breakout points.

Real world examples demonstrate the effectiveness of using the Market Profile Indicator for analysis. For instance, in a trending market, traders can use the indicator to identify value areas where buyers and sellers converge. This information can be used to enter trades at optimal prices or exit positions before reversals occur.

However, it is important to note that there are limitations and drawbacks to using this tool. One limitation is that it may not work well in markets with low liquidity or abnormal price movements. Additionally, interpreting the data requires a degree of expertise and experience in technical analysis.

Benefits of the Market Profile Indicator

Traders can reap significant benefits from incorporating the market profile indicator in their trading strategies. This technical tool offers a unique perspective of the market by presenting multi-dimensional data analysis capabilities, which facilitate a more comprehensive understanding of market dynamics and informed trading decisions.

The advantages of using this tool are numerous, including its ability to identify key support and resistance levels, detect market trends and momentum shifts, as well as provide insights into price discovery processes.

The applications of the market profile indicator are vast, making it an essential tool for traders across various asset classes and timeframes. It is particularly useful in analyzing markets with low liquidity or those that exhibit erratic price movements.

Moreover, its visual representation of volume at price levels helps traders to determine areas where there is high buying or selling pressure and where prices may turn around. Overall, the market profile indicator allows traders to gain a deeper understanding of market structure and behavior while providing valuable information that can be used to improve their trading strategies and outcomes.

How to Implement the Market Profile Indicator in MT4

Implementing the multi-dimensional data analysis capabilities of the Market Profile indicator into one’s trading strategy in the MetaTrader 4 platform can offer a unique perspective and deeper understanding of market dynamics, potentially leading to more informed decision-making processes.

The first step to implementing this tool is to download and install it onto the MT4 platform. Once installed, traders can begin customizing settings such as session times, market direction, and volume displays to fit their specific trading style.

It is important for traders to note that while the Market Profile indicator can provide valuable insights into market activity, it should not be relied upon solely for trading decisions. Instead, it should be used in conjunction with other technical indicators and fundamental analysis methods.

By comparing the information provided by different indicators, traders can gain a more comprehensive view of market trends and make better-informed decisions regarding their trades.

Overall, incorporating the Market Profile indicator into one’s MT4 platform provides an additional layer of analysis that can enhance a trader’s understanding of market dynamics and ultimately lead to more successful trades.

Conclusion

The market profile indicator is a powerful tool in technical analysis that helps traders visualize market activity and identify key areas of support and resistance. By displaying the distribution of price within a given time period, the indicator provides valuable insights into market sentiment and potential trends.

When used in conjunction with other indicators and analysis techniques, the market profile can be an effective tool for making informed trading decisions. To use the market profile indicator effectively, it is important to understand its components and how they relate to market behavior. Traders should also take care to consider multiple time frames when analyzing data, as this can provide a more comprehensive view of overall trends and patterns in the market.

Overall, the market profile indicator offers numerous benefits for traders seeking to gain deeper insights into price action and make more informed trading decisions. Whether used alone or in combination with other tools and strategies, this versatile indicator can be an invaluable resource for anyone looking to succeed in today’s dynamic financial markets.

With careful implementation and thoughtful analysis, traders can leverage the power of the market profile to unlock new opportunities for growth and success.