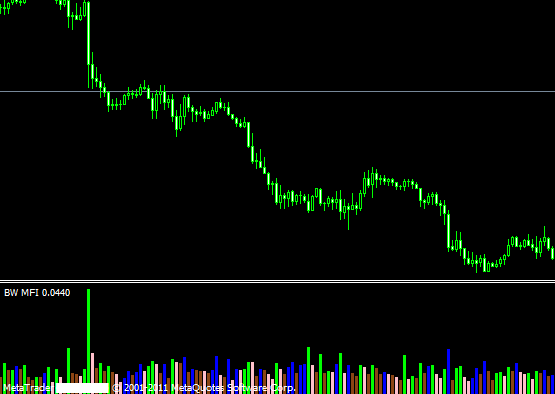

Market Facilitation Index (Bw Mfi) Mt4 Review

The Market Facilitation Index (MFI) is a technical indicator that measures the strength of market movements by analyzing changes in volume and price.

Developed by Bill Williams, the MFI is designed to help traders identify trends and potential reversals in the market.

The BW MFI, specifically designed for use with MetaTrader 4 (MT4), is a popular version of this indicator used by many traders.

Download Free Market Facilitation Index (Bw Mfi) Mt4

The BW MFI calculates the difference between the high and low prices for each period and multiplies it by the volume for that period.

This calculation results in a value that represents how much activity there was during that period.

By analyzing these values over time, traders can gain insight into whether buyers or sellers are dominating the market and whether momentum is building or waning.

In this article, we will explore how to use BW MFI to identify trends, incorporate it into your trading strategy, and maximize its effectiveness as a tool for technical analysis.

Understanding the Basics of the Market Facilitation Index

This section provides a comprehensive introduction to the fundamental principles of the technical analysis tool that measures market efficiency and liquidity by analyzing changes in price and volume, commonly known as Market Facilitation Index.

The BW MFI indicator was developed by Bill Williams and is based on his belief that analyzing changes in volume can help traders identify trends and reversals in a more accurate manner than just looking at price movements.

The market facilitation index attempts to measure four key aspects of trading activity:

1) ease of price movement,

2) volume change,

3) spread change, and

4) transaction size.

Calculating BW MFI values involves combining both price action and volume data into one single metric.

The index uses a simple formula that takes into account the difference between today’s high-low range relative to yesterday’s range multiplied by today’s volume.

Interpreting BW MFI signals can be done through observing whether it is increasing or decreasing over time.

A rising BW MFI value indicates an increase in buying or selling pressure while a falling value suggests there is less interest in trading activity.

Traders use these signals to identify potential trade opportunities based on changes in market conditions.

Using BW MFI to Identify Market Trends

The identification of market trends is a crucial aspect in trading, and utilizing the BW MFI indicator can aid traders in interpreting shifts in buying or selling pressure. By analyzing the signals provided by the BW MFI, traders can gain insight into market trends and make informed decisions about their trading strategies.

One way to use the BW MFI for trend identification is through historical analysis. Traders can look at past movements of the indicator to identify patterns and correlations with price movements.

For example, if there is a consistent increase in buying pressure as indicated by rising BW MFI values over a period of time, this could suggest an uptrend in the market. On the other hand, consistently decreasing values may indicate a downtrend.

Additionally, traders can use support and resistance levels alongside the BW MFI to further confirm trend identification. By combining these analytical tools, traders can improve their understanding of market trends and make more informed trades.

Incorporating BW MFI into Your Trading Strategy

Integrating the BW MFI indicator into a trading strategy involves identifying key entry and exit points by observing the relationship between price movements and the fluctuations in buying and selling pressure, as indicated by the indicator. To incorporate BW MFI into a trading strategy, traders can use it to confirm trends or identify trend reversals. Additionally, traders may utilize backtesting BW MFI as part of their overall strategy development process. By comparing BW MFI to other technical indicators such as Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), or Stochastic Oscillator, traders may gain further insight into market trends.

The following table outlines some ways that traders can incorporate BW MFI into their trading strategies:

| Strategy | Description | Example |

|---|---|---|

| Confirm Trends | Use the BW MFI to confirm an existing trend before entering a position | If the price is trending upwards and the BW MFI is above 50, this may indicate bullish momentum |

| Identify Trend Reversals | Observe divergences between price movements and changes in buying/selling pressure on the BW MFI to predict trend reversals | If prices are rising but buyers are losing strength according to the BW MFI, this could signal an upcoming downtrend |

| Backtesting | Traders can test their strategies using historical data while incorporating the use of BW MFI for better performance results. This will help increase confidence when taking trades based on specific indicators. | A trader tests different combinations of technical indicators including BWMFI with historic data from 2010-2020 |

By incorporating these methods into their overall trading strategies, traders may be able to increase their chances of making profitable trades while minimizing risk exposure.

Tips for Maximizing the Effectiveness of BW MFI

To optimize the effectiveness of the BW MFI indicator, traders may consider adjusting the time frame and combining it with other technical indicators to gain a more comprehensive understanding of market trends.

One common mistake that traders make is solely relying on one indicator for their analysis. While BW MFI can provide valuable information about market momentum and possible trend reversals, it should not be used as the sole basis for trading decisions. Instead, traders can use other indicators such as moving averages or trendlines to confirm signals provided by BW MFI.

Another advanced technique that can maximize the effectiveness of BW MFI is using it in conjunction with support and resistance levels. By identifying key levels where prices have previously reversed, traders can wait for confirmation from BW MFI before entering a trade. This can increase the likelihood of success as traders are able to enter trades at optimal levels with strong momentum behind them.

Additionally, backtesting different combinations of indicators and time frames can help traders find a strategy that works best for their individual trading style and preferences.

Conclusion

In conclusion, the Market Facilitation Index (BW MFI) is a useful technical indicator that can aid traders in identifying market trends and making informed trading decisions.

By analyzing the changes in volume and price movements, the BW MFI provides insights into the strength of market momentum, helping traders to identify potential entry or exit points.

Although it is important to note that no single indicator can guarantee successful trades, incorporating the BW MFI into your trading strategy can provide valuable information for making well-informed decisions.

Remember to always practice risk management strategies and consider other factors such as market news and economic data when using any technical indicator.

With careful analysis and a disciplined approach, traders can maximize the effectiveness of BW MFI in their trading endeavors.