Macd Buy Sell Alerts V2 Indicator Mt4 Review

The Macd Buy Sell Alerts V2 Indicator MT4 is a popular trading tool used by traders to identify trends and potential entry and exit points in the market.

This indicator is based on the Moving Average Convergence Divergence (MACD) oscillator, which measures the difference between two moving averages of price.

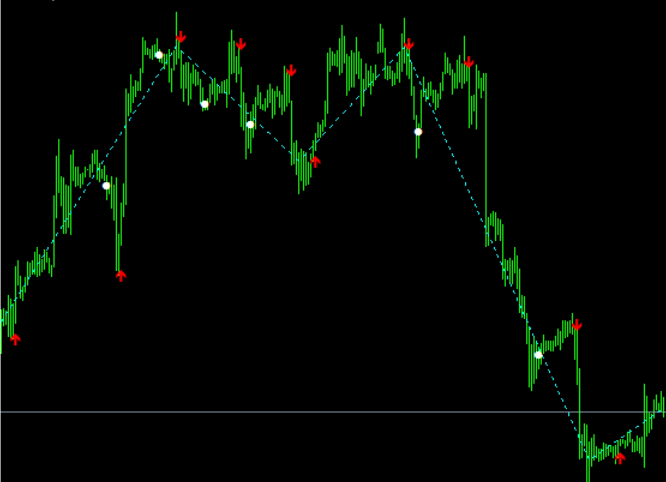

The Macd Buy Sell Alerts V2 Indicator MT4 provides visual alerts when there is a crossover between the MACD line and signal line, indicating a change in momentum that may signal a buy or sell opportunity.

Download Free Macd Buy Sell Alerts V2 Indicator Mt4

One advantage of using the Macd Buy Sell Alerts V2 Indicator MT4 is its ability to provide real-time notifications for traders, allowing them to react quickly to changes in market conditions.

This can help traders avoid missed opportunities and minimize losses. Additionally, the indicator’s simplicity and ease of use make it accessible to both novice and experienced traders alike.

How the Macd Buy Sell Alerts V2 Indicator Works

This section provides an overview of the operational mechanisms underlying the Macd Buy Sell Alerts V2 Indicator for MetaTrader 4.

The indicator is designed to identify potential buy and sell signals based on the Moving Average Convergence Divergence (MACD) technical analysis tool. It accomplishes this by tracking two moving averages, a fast one and a slow one, and calculating the difference between them, which is then displayed as a histogram on a chart.

When using the Macd Buy Sell Alerts V2 Indicator, traders can customize various parameters such as the length of the moving averages used or the threshold values for triggering alerts.

However, it is important to note that even with such customization options available, trading psychology still plays a critical role in determining how successful traders will be when using this indicator.

Traders should always use proper risk management techniques and avoid over-relying on any single indicator or signal in their decision-making process.

Benefits of Using the Macd Buy Sell Alerts V2 Indicator

The benefits of utilizing the Macd Buy Sell Alerts V2 Indicator in trading strategies are numerous. This technical analysis tool can help traders identify potential market trends and make informed decisions regarding their investment strategies.

As an indicator, it provides a visual representation of the moving average convergence divergence (MACD) by plotting two lines – a fast and a slow one – that move according to the price movement of an underlying asset. When these lines cross over or under each other, it signals a change in momentum, which can be used as a buy or sell signal.

Another benefit of using this indicator is its customization options. Traders can adjust the parameters according to their preferences and risk tolerance levels, such as changing the length of the moving averages or adding filters to avoid false signals.

Moreover, its compatibility with MetaTrader 4 (MT4) platform allows for easy integration into existing trading systems and automation through expert advisors (EAs). Overall, incorporating the Macd Buy Sell Alerts V2 Indicator into technical analysis can enhance trading strategies by providing timely and accurate signals based on market trends and conditions.

Tips for Maximizing the Effectiveness of the Macd Buy Sell Alerts V2 Indicator

Setting appropriate parameters is crucial in maximizing the effectiveness of the Macd Buy Sell Alerts V2 Indicator.

Traders need to take into account different market conditions and adjust parameters accordingly.

Additionally, using this indicator in conjunction with other complementary tools can help traders confirm signals and make more informed trading decisions.

Lastly, regularly monitoring and adjusting trading strategies based on market changes is essential in ensuring consistent profitability when using this indicator.

Setting Appropriate Parameters

Optimizing the parameters of the MACD buy-sell alert system is a crucial step towards improving its effectiveness in providing timely and accurate signals for trading decisions.

The indicator’s default parameters may not be suitable for all market conditions, so it is important to customize them according to one’s preferred trading style and risk tolerance.

Traders can adjust the values of the fast and slow moving averages, as well as the signal line, to better capture price trends and changes in momentum.

A shorter period setting for the moving averages can generate more responsive signals but may also result in more false positives, while a longer period setting can reduce noise but delay signals.

Moreover, optimizing performance also involves selecting an appropriate time frame for analysis.

Short-term traders may prefer using lower time frames such as 15-minute or 30-minute charts to identify intraday trends and opportunities, while long-term investors may rely on daily or weekly charts to gauge overall market direction.

It is advisable to test different combinations of parameter settings and time frames on historical data before implementing them in real-time trading.

By doing so, traders can evaluate their strategies’ historical performance metrics such as win rate, average profit/loss per trade, drawdowns, etc., and make informed decisions based on evidence rather than intuition or guesswork.

Using in Conjunction with Other Tools

Incorporating the MACD into a broader technical analysis framework that includes other tools such as trendlines, support and resistance levels, and volume indicators can provide additional confirmation or divergence signals and enhance the overall accuracy of trading decisions.

One way to use the MACD in conjunction with other tools is to pair it with Fibonacci levels. When used together, traders can identify potential areas of support or resistance based on key Fibonacci retracement levels. For example, if there is a bullish crossover on the MACD at a Fibonacci retracement level, this could suggest that there is strong support at that level and may be a good entry point for a long position.

Another tool that traders often use in conjunction with the MACD is the RSI indicator. The RSI measures overbought and oversold conditions in an asset by comparing the size of recent gains to recent losses. When paired with the MACD, traders can look for divergences between these two indicators to help identify potential reversals.

For example, if prices are making higher highs but the RSI is making lower highs while also showing bearish divergence from the MACD histogram, this could indicate that price momentum is weakening and potentially reversing soon.

Overall, using multiple indicators in combination with one another can provide more robust signals for trading decisions than relying solely on one indicator alone like Macd Buy Sell Alerts V2.

Regularly Monitoring and Adjusting Trading Strategies

To ensure consistent profitability, it is necessary for traders to regularly monitor and adjust their trading strategies based on changing market conditions and the performance of their chosen combination of technical analysis tools.

One way to do this is by journaling trades, which allows traders to track their progress over time and identify areas for improvement. This can include noting the reasons behind each trade, the entry and exit points, as well as any emotions or biases that may have influenced the decision-making process.

Additionally, seeking outside advice from other experienced traders or financial professionals can provide valuable insights and perspectives that may not have been considered otherwise. This can be especially helpful during periods of uncertainty or volatility in the markets when making informed decisions becomes even more critical.

By staying vigilant and adaptable in their approach, traders can increase their chances of success and remain competitive in an ever-changing landscape.

Conclusion

In conclusion, the Macd Buy Sell Alerts V2 Indicator is a useful tool for traders who want to maximize their profits in the financial markets. This indicator works by analyzing trends and momentum in price movements to provide signals on when to buy or sell.

By using this indicator, traders can enter and exit trades at optimal times, minimizing losses and maximizing gains. The benefits of using the Macd Buy Sell Alerts V2 Indicator include its ability to help traders make informed decisions based on market data.

Additionally, this indicator is user-friendly and easy to use, making it accessible for both novice and experienced traders alike. To maximize the effectiveness of this indicator, traders should combine it with other technical analysis tools and strategies such as support and resistance levels, trend lines, and candlestick patterns.

Overall, the Macd Buy Sell Alerts V2 Indicator can be a valuable addition to any trader’s toolkit when used properly.