Linear Regression Channel Breakout For Mt4 Review

The Linear Regression Channel Breakout Indicator is a technical analysis tool that is used by traders to identify potential breakout opportunities in the market.

This indicator measures the trend of price movements over a specified period, and it helps traders determine whether to buy or sell an asset.

The Linear Regression Channel Breakout Indicator is commonly applied in financial markets such as stocks, forex, and commodities.

In this article, we will explore how to use the Linear Regression Channel Breakout Indicator in MT4 (MetaTrader 4) trading platform.

Download Free Linear Regression Channel Breakout For Mt4

We will discuss what this indicator is, how it works, and its significance in trading activities.

Additionally, we will provide best practices for using this tool effectively and maximizing profit potential while minimizing risk exposure.

By understanding the principles behind this indicator and applying them appropriately during trading activities, traders can develop strategies that increase their chances of success in financial markets.

Understanding the Linear Regression Channel Breakout Indicator

The present section provides a comprehensive understanding of an indicator that facilitates the identification of potential trade opportunities through the analysis of price trends, providing traders with a rational and systematic approach to decision-making.

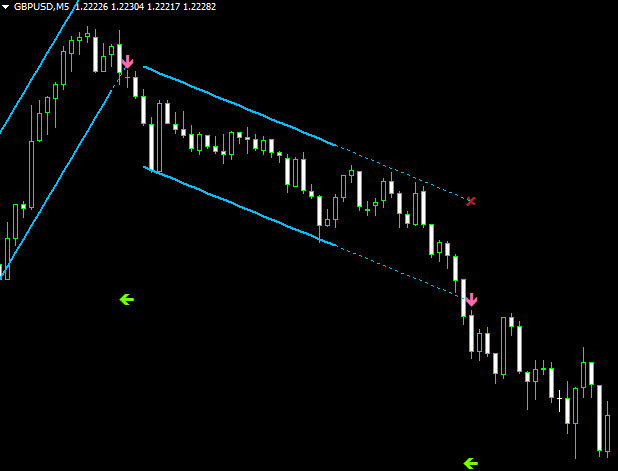

The Linear Regression Channel Breakout Indicator (LRCBI) is a technical analysis tool that calculates linear regression lines for a specific period. It then creates channels around these lines, helping traders identify breakouts in the price trend.

The LRCBI is widely used among traders who employ common trading strategies such as trend-following or breakout trading. Its ability to provide reliable signals based on historical performance analysis makes it an effective indicator for both short-term and long-term trades.

Traders can use this tool to identify trending markets where they could enter trades in the direction of the trend or wait for pullbacks before entering trades. In addition, traders can also use this indicator to identify potential reversals in the market when prices break out of the channel in the opposite direction.

Applying the Linear Regression Channel Breakout Indicator

Applying the Linear Regression Channel Breakout Indicator requires proper setup on MT4, which involves selecting the appropriate settings for the indicator.

Interpreting the indicator’s signals involves identifying when prices break through the upper or lower channels of the regression line, indicating a potential trend reversal.

To use this indicator effectively, traders should consider using it in conjunction with other technical analysis tools and implementing proper risk management techniques.

Setting Up the Indicator on MT4

To properly configure the linear regression channel breakout indicator on MT4, users must navigate to the ‘Indicators’ tab within the platform and select ‘Custom.

From there, they can select ‘Linear Regression Channel Breakout’ and customize its settings as desired. Users can adjust parameters such as the period length, deviation multiplier, and offset value to fine-tune their strategy.

It is important for users to backtest their strategies with this indicator before implementing them in live trading. By using historical data to test different parameter combinations, traders can gain insight into how the indicator performs under different market conditions.

This allows them to refine their strategy and make more informed decisions when trading with real money. Overall, proper setup and backtesting are crucial steps for any trader looking to use the linear regression channel breakout indicator effectively on MT4.

Interpreting the Indicator’s Signals

Interpreting the signals of the indicator requires an understanding of how it functions, as well as a contextual analysis of price action and market trends. The linear regression channel breakout for MT4 generates signals based on the price breaking out of the upper or lower boundaries of the linear regression channel. When the price breaks out above the upper boundary, it indicates a bullish signal, while a break below the lower boundary represents a bearish signal. However, these signals need to be confirmed using signal confirmation techniques to avoid false breakouts.

One way to confirm signals is by analyzing volume levels during the breakout. High volume levels can indicate strong confirmation of the breakout, while low volume may suggest weak confirmation that could lead to false breakouts. Additionally, traders can use other technical indicators such as moving averages or oscillators to confirm signals generated by this indicator. It is also important to identify false breakouts, which occur when prices quickly reverse direction after breaking out of one side of the channel. False breakouts are more likely in volatile markets and can result in losses if not identified early on. Traders can use stop-loss orders or set conservative profit targets to minimize potential losses from false breakouts.

| Signal Confirmation Techniques | Identifying False Breakouts | ||

|---|---|---|---|

| Analyzing Volume Levels | Use Stop-Loss Orders | ||

| Using Other Technical Indicators | Set Conservative Profit Targets | ||

| Assessing Market Volatility | Stay Vigilant During High Volatility Periods | ||

| Monitoring Price Action After Breakout | Practice Risk Management Strategies | ||

| Combining Multiple Signals for Confirmation | Continuously Learn and Adapt Trading Strategies | Utilize Technical Analysis Tools and Indicators |

Tips for Using the Indicator Effectively

To maximize the potential of the linear regression channel breakout indicator, it is important to follow certain tips that can help traders use it effectively.

One of the most essential tips is to backtest trading strategies using historical data to identify patterns and improve accuracy. Backtesting strategies can provide insights into how well a trading strategy performs in various market conditions, which can help traders make informed decisions about when to enter or exit trades.

Another important tip for using the indicator is to implement risk management techniques. This involves setting stop-loss orders and taking profits at appropriate levels based on the trader’s risk appetite and market conditions. Risk management helps limit losses and protect profits, which are key aspects of successful trading strategies.

By following these tips, traders can effectively use the linear regression channel breakout indicator in their trading strategies and increase their chances of success in the forex markets.

Best Practices for Trading with the Linear Regression Channel Breakout Indicator

Maximizing the potential of the Linear Regression Channel Breakout indicator requires a disciplined approach to trading that prioritizes risk management and careful consideration of market conditions. Traders should keep in mind that the indicator is not infallible and can generate false signals, leading to losses if proper risk management strategies are not employed.

Below are some best practices for using the Linear Regression Channel Breakout indicator:

- Use multiple timeframes: It is advisable to use several timeframes when making trading decisions with this indicator. This will help traders get a better understanding of overall market trends and identify potential breakout opportunities.

- Incorporate other indicators: The Linear Regression Channel Breakout indicator works best when used in conjunction with other technical indicators such as moving averages, Fibonacci retracements, or support and resistance levels. This can help confirm signals generated by the channel breakout and increase the accuracy of trading decisions.

- Employ backtesting strategies: Before incorporating any new trading strategy or tool into their workflow, traders should conduct extensive backtesting to ensure its efficacy in different market scenarios.

- Manage risk effectively: As with any trading strategy or tool, effective risk management is crucial when using the Linear Regression Channel Breakout indicator. Traders should set stop-loss orders at reasonable levels based on their risk tolerance and always be prepared for unexpected market movements that could result in losses.

Conclusion

The Linear Regression Channel Breakout Indicator is a valuable tool for traders seeking to identify potential breakouts in the market. By utilizing regression analysis, this indicator can provide insights into possible price movements and help traders make informed decisions about opening or closing positions.

When applying this indicator, it is important to consider various factors such as market conditions, volatility, and risk management strategies. Traders should also be mindful of false signals and use additional technical indicators or fundamental analysis to confirm potential breakouts.

Overall, the Linear Regression Channel Breakout Indicator can be a useful addition to any trader’s toolbox when used in conjunction with other analytical tools and best practices for trading. By staying disciplined and vigilant in their approach, traders can enhance their chances of success in the dynamic world of financial markets.