Keltner Atr Bands Mt4 Indicator Review

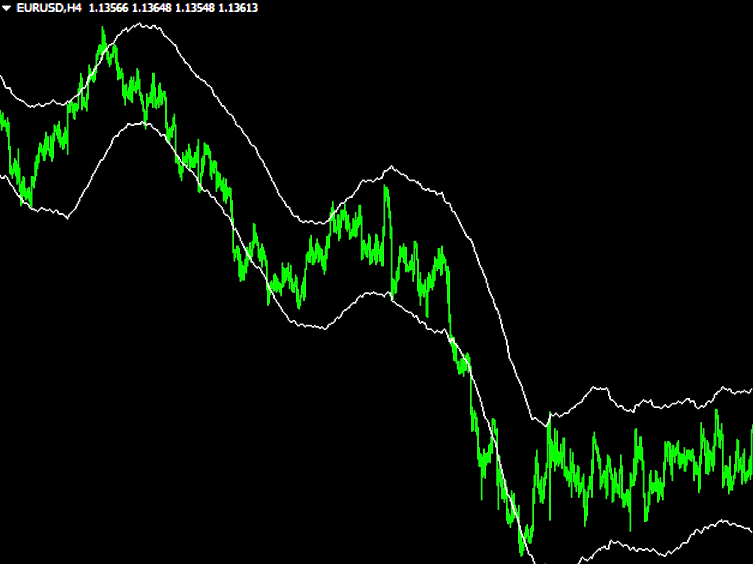

The Keltner ATR Bands MT4 Indicator is a technical analysis tool used to identify potential trading opportunities in the financial markets. The indicator combines two popular indicators, the Average True Range (ATR) and the Keltner Channel, to create a band that shows how volatile an asset is. This can be useful for traders looking to enter or exit trades at key price levels.

The Keltner ATR Bands MT4 Indicator was developed by Chester W. Keltner in the 1960s as a way to measure volatility in commodities markets. Since then, it has become widely used among traders of all types of assets, including stocks, futures, and forex. By using this indicator, traders can gain insight into market conditions and make more informed decisions about when to buy or sell assets.

Download Free Keltner Atr Bands Mt4 Indicator

In this article, we will explore the basics of this powerful indicator and provide tips on how to integrate it into your trading strategy for maximum profits.

Understanding the Basics of the Keltner ATR Bands MT4 Indicator

The section at hand provides an introductory overview of the Keltner ATR Bands MT4 Indicator, which is a technical tool designed to analyze market volatility and identify potential trading opportunities.

The indicator is based on two main components: the Average True Range (ATR) and the Keltner Channel.

To calculate the Keltner ATR Bands, we first need to determine the ATR value for a given period, which reflects the average range of price movements over that period.

This value is then used to construct upper and lower bands around a moving average line, known as the Keltner Channel.

The width of these bands depends on the level of market volatility, with wider bands indicating higher volatility levels.

Traders can interpret signals from this indicator by monitoring price movements in relation to these bands.

When prices move outside of or towards one of these bands, it can signal potential buy or sell opportunities depending on whether prices are trending upwards or downwards.

Identifying Potential Trading Opportunities

Through a systematic approach to market analysis, this section identifies potential trading opportunities utilizing the Keltner ATR Bands MT4 indicator.

One of the primary uses of this tool is for risk management. The Keltner ATR Bands help traders identify potential volatility in the market by measuring price movements over a specific period. This allows traders to set stop-losses and take-profit levels more effectively, as they can adjust their positions based on market conditions.

Furthermore, combining the Keltner ATR Bands with other technical indicators can provide more accurate signals for trading opportunities. For example, some traders may use moving averages or oscillators to confirm the signals generated by the Keltner ATR Bands.

By considering multiple indicators simultaneously, traders can reduce false signals and increase their profitability over time. However, it is important to note that no technical tool is foolproof and should always be used in combination with sound risk management strategies and proper money management techniques.

Integrating the Indicator into Your Trading Strategy

Incorporating the Keltner ATR Bands MT4 Indicator into one’s trading strategy can be a useful tool for traders who want to make more informed and accurate decisions. One important aspect of using this indicator is risk management. It is essential to understand that no trading system or indicator is perfect, and there will always be risks involved in trading. Therefore, it is crucial to set strict stop-loss orders and adhere to them strictly. This will help minimize potential losses when market conditions change unexpectedly.

Another way to utilize the Keltner ATR Bands MT4 Indicator effectively is through backtesting strategies. Backtesting involves analyzing past data on different assets and testing various trading strategies based on historical trends and patterns. By doing so, traders may gain insights into how the market behaves under certain conditions and identify which strategies work best with this particular indicator.

Utilizing backtesting can help traders refine their approach over time, leading to more profitable trades in the long run.

Tips for Maximizing Your Trading Profits

Maximizing trading profits can be achieved by implementing effective risk management strategies and utilizing backtesting to refine trading approaches based on historical trends and patterns.

Risk management is crucial in any trading strategy, as it helps traders avoid catastrophic losses that could wipe out their account balance. This involves setting stop-loss orders, which automatically close a trade when a certain price level is reached, limiting the potential loss.

Additionally, traders can use position sizing techniques to determine the appropriate amount of capital to allocate to each trade based on their account size and risk tolerance.

Analyzing market trends is another key factor in maximizing trading profits. By studying past market data, traders can identify patterns and develop strategies that have historically produced successful trades.

A common approach is to use technical analysis tools such as the Keltner ATR Bands MT4 Indicator to identify trend direction and potential entry/exit points. However, it’s important for traders not to rely solely on past performance when making decisions about future trades – external factors such as news events or changes in market conditions can also impact price movements.

Therefore, it’s essential for traders to stay up-to-date with current events and adjust their strategies accordingly.

Conclusion

The Keltner ATR Bands MT4 Indicator is a powerful tool for traders looking to identify potential trading opportunities and maximize their profits. By understanding the basics of this indicator, traders can gain valuable insights into market trends and make informed decisions about when to enter or exit trades.

One of the key benefits of the Keltner ATR Bands MT4 Indicator is its ability to identify potential trading opportunities based on changes in volatility. As prices move outside the bands created by the indicator, traders can use this information to make informed decisions about when to buy or sell assets.

Additionally, by integrating this indicator into their overall trading strategy, traders can create a more comprehensive approach that accounts for both technical indicators and fundamental analysis.

To maximize profits using the Keltner ATR Bands MT4 Indicator, it’s important to be patient and disciplined in your approach. This means waiting for clear signals from the indicator before making any trades, as well as being willing to cut losses quickly if necessary.

It’s also important to continuously monitor market conditions and adjust your strategy accordingly, taking advantage of new opportunities as they arise.

Overall, the Keltner ATR Bands MT4 Indicator is a valuable tool for traders looking to improve their performance in today’s fast-paced markets. By understanding how it works and integrating it into your trading strategy effectively, you can gain an edge over other market participants and achieve greater success in your investments.