Ichimoku Kinko Hyo With Atr Ratio Mt4 Indicator Review

Ichimoku Kinko Hyo is a technical analysis tool that originated in Japan. It is a complex indicator that provides traders with multiple data points to analyze market trends and predict future price movements. The indicator consists of five lines: the Tenkan-Sen, Kijun-Sen, Chikou Span, Senkou Span A and Senkou Span B. These lines provide information on support and resistance levels, trend direction, momentum, and potential reversal points.

The ATR Ratio MT4 Indicator is another technical analysis tool that measures volatility in the market. It calculates the average true range (ATR) over a certain period of time and divides it by the closing price. This creates an indicator that shows how much price movement can be expected relative to recent volatility levels.

Download Free Ichimoku Kinko Hyo With Atr Ratio Mt4 Indicator

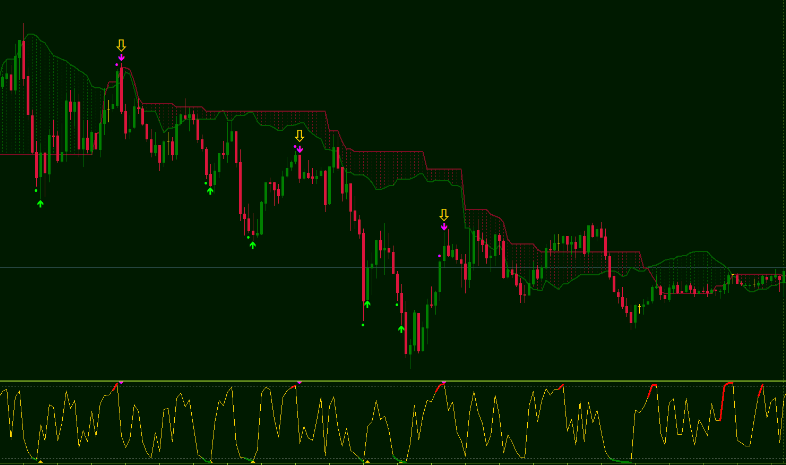

Combining Ichimoku Kinko Hyo with the ATR Ratio MT4 Indicator can help traders make more informed decisions based on both trend direction and volatility levels. In this article, we will explore how these two indicators work together to create a powerful trading strategy for forex traders.

Understanding Ichimoku Kinko Hyo

The section currently being discussed provides an in-depth understanding of the technical analysis tool known as Ichimoku Kinko Hyo. This Japanese charting technique was developed by a journalist named Goichi Hosoda in the late 1930s, and it has become increasingly popular among traders around the world.

Ichimoku Kinko Hyo comprises five components:

- Tenkan-sen (the conversion line)

- Kijun-sen (the base line)

- Senkou Span A (the leading span A)

- Senkou Span B (the leading span B)

- Chikou Span (the lagging span).

Ichimoku Kinko Hyo trading strategies typically involve looking for signals that indicate bullish or bearish market sentiment. For example, if the price is above the cloud formed by Senkou Span A and Senkou Span B, this is considered a bullish signal. On the other hand, if the price is below this cloud, it is seen as a bearish signal. Additionally, traders may look for crossovers between the Tenkan-sen and Kijun-sen lines to identify potential entry or exit points.

Overall, understanding these components and trading strategies can be helpful for those interested in using Ichimoku Kinko Hyo as part of their technical analysis toolkit.

Introducing the ATR Ratio MT4 Indicator

In this section, a new tool will be presented that can aid in analyzing market volatility and potential price movements. The ATR Ratio MT4 Indicator is a technical analysis tool that measures the ratio between the average true range (ATR) and the price of an asset. This indicator can be used in conjunction with Ichimoku Kinko Hyo to adjust stop loss levels and confirm trends.

Here are four ways to use the ATR Ratio MT4 Indicator:

- Adjusting Stop Loss: By calculating the average true range of an asset, traders can determine how much volatility there is in the market and adjust their stop loss accordingly. Using the ATR Ratio MT4 Indicator allows traders to set stop losses at levels that are proportional to current market conditions.

- Confirming Trends: The ATR Ratio MT4 Indicator can also be used as a trend confirmation tool. When prices are trending up, but volatility remains low, it may indicate a weak uptrend. Conversely, when prices are trending up and volatility is high, it may indicate a strong uptrend.

- Identifying Breakouts: Traders can use this indicator to identify potential breakouts by looking for periods where the ratio between ATR and price diverges from its historical average.

- Trading Range Markets: In markets where prices are trading within a range, traders can use the ATR Ratio MT4 Indicator to identify areas of support or resistance based on where price moves relative to its historical average true range value.

Combining Ichimoku Kinko Hyo and ATR Ratio MT4 Indicator

By combining a technical analysis tool that measures market volatility with a trend-following indicator, traders can gain insight into potential price movements and adjust their trading strategies accordingly.

The ATR Ratio MT4 Indicator is an excellent tool for measuring market volatility, while the Ichimoku Kinko Hyo Indicator is popular among traders for its ability to identify trends and potential support/resistance levels.

When used together, these two indicators can provide valuable information about market conditions.

One way to combine the ATR Ratio MT4 indicator and the Ichimoku Kinko Hyo indicator is by customizing the Ichimoku Kinko Hyo settings.

For example, traders can adjust the Tenkan-Sen (Conversion Line) and Kijun-Sen (Base Line) parameters to suit their preferences and trading style.

Additionally, they can use the ATR Ratio application to determine appropriate stop-loss levels based on current market volatility.

With this combination of tools, traders can make more informed decisions about entering or exiting trades, managing risk, and maximizing profits in various market conditions.

Tips for Successful Trading with Ichimoku Kinko Hyo and ATR Ratio MT4 Indicator

Successful trading with Ichimoku Kinko Hyo and ATR Ratio MT4 Indicator requires a disciplined approach that encompasses setting realistic goals, practicing patience, and continuously learning and adapting to market conditions.

Traders must be mindful of the risks involved in trading and not set unrealistic expectations for themselves.

Patience is key when using these indicators as they are designed to provide long-term analysis and may not yield immediate results.

Finally, traders must remain open to new information and continuously educate themselves on market trends in order to adapt their strategies accordingly.

Setting Realistic Goals

The section on setting realistic goals provides a framework for establishing achievable and measurable objectives in the context of utilizing technical analysis tools such as Ichimoku Kinko Hyo and ATR Ratio MT4 Indicator. Setting achievable targets is essential to successful trading, as it helps traders manage their expectations and avoid taking unnecessary risks. By setting realistic goals, traders can focus on making consistent gains over time instead of trying to hit unrealistic targets that could ultimately lead to losses.

To set achievable targets, traders should consider the following:

- Analyze past performance: By reviewing past trades, traders can identify patterns in their trading behavior and adjust accordingly.

- Take market conditions into account: Market volatility can greatly affect trading outcomes, so it’s important to factor in current market conditions when setting targets.

- Consider risk tolerance: Traders must determine how much risk they are willing to take on before entering any trade. This will help them set appropriate stop-loss levels and target profits.

By taking these factors into account when setting goals, traders can increase their chances of success with Ichimoku Kinko Hyo and ATR Ratio MT4 Indicator. Ultimately, the key to achieving long-term profitability is not hitting big wins but rather making steady gains over time through disciplined trading practices.

Practicing Patience and Discipline

Developing patience and cultivating discipline are two crucial qualities that traders need to possess in order to achieve long-term profitability. The world of trading can be fast-paced, which often leads traders to make impulsive decisions and act on their emotions rather than following a well-planned strategy. When traders lack patience, they may jump into trades too quickly or exit them prematurely, leading to missed opportunities or unnecessary losses. Similarly, without the discipline to follow a set of rules and stick with a plan, traders may find themselves making mistakes that compromise their overall performance.

One way for traders to develop these qualities is by using technical analysis tools such as the ichimoku kinko hyo and ATR ratio MT4 indicator. These indicators help traders identify trends in the market and determine entry and exit points based on data analysis rather than emotional impulses. By incorporating these tools into their trading strategies, traders can practice patience by waiting for clear signals before entering or exiting trades while also cultivating discipline by sticking with predetermined rules for trade management. The table below outlines some key aspects that go hand-in-hand with developing patience and discipline in trading:

| Patience | Discipline |

|---|---|

| Waiting for clear signals before entering trades | Following predetermined trade management rules |

| Avoiding impulsive decision-making | Sticking with a well-planned strategy |

| Accepting losses as part of the process | Avoiding emotional decision-making |

| Holding positions even in times of uncertainty | Keeping track of progress and learning from mistakes |

| Understanding that success takes time | Maintaining focus through distractions |

Ultimately, developing patience and cultivating discipline requires consistent effort over time. Traders who prioritize these qualities will have an advantage over those who do not because they are more likely to make rational decisions based on data analysis rather than succumbing to emotions or acting impulsively.

Continuously Learning and Adapting to Market Conditions

Traders who wish to remain competitive in the fast-paced world of trading must continuously learn and adapt to market conditions. This includes staying up-to-date on the latest news and economic indicators that can impact market movements, as well as regularly analyzing price charts using technical analysis tools such as ichimoku kinko hyo and atr ratio mt4 indicator. By doing so, traders can gain a better understanding of current market trends, identify potential entry and exit points for trades, and make informed decisions based on data rather than emotions.

Here are four ways that traders can continue learning and adapting to market conditions:

- Attend trading seminars or webinars hosted by industry experts

- Read books and articles written by successful traders

- Join online trading communities to discuss strategies and share ideas with other traders

- Regularly review past trades to analyze successes and areas for improvement

In addition to constantly learning about the markets, it is also essential for traders to practice effective risk management techniques. This involves setting stop-loss orders to minimize losses in case a trade goes against them, as well as using position sizing strategies to ensure that they are only risking a small percentage of their account balance on each trade. By combining ongoing market analysis with sound risk management practices, traders can increase their chances of success in the volatile world of trading.

Conclusion

Ichimoku Kinko Hyo is a popular technical analysis tool used by traders to identify trends in the market and potential trading opportunities. It consists of five different indicators that work together to provide a comprehensive view of price action.

The ATR Ratio MT4 Indicator is another powerful tool that can be used in conjunction with Ichimoku Kinko Hyo for even more accuracy. By combining these two indicators, traders can gain an even deeper understanding of market trends and make more informed trading decisions.

The ATR Ratio MT4 Indicator measures volatility, while Ichimoku Kinko Hyo provides a holistic view of price action. Together, they can help traders identify key support and resistance levels and determine entry and exit points.

To successfully use these tools together, it is important to have a solid understanding of both Ichimoku Kinko Hyo and the ATR Ratio MT4 Indicator. Traders should also keep in mind that no indicator or combination of indicators can guarantee success in the markets.

However, by using these tools as part of a larger trading strategy, traders may be able to increase their chances of success over time. In conclusion, Ichimoku Kinko Hyo and the ATR Ratio MT4 Indicator are powerful tools for analyzing market trends and identifying potential trading opportunities.

By using them together, traders can gain valuable insights into price action and make more informed decisions about when to enter or exit trades. While no tool or combination of tools is foolproof, incorporating these indicators into a larger trading strategy may improve overall performance over time.