I-Adx Advanced Histo Mt4 Indicator Review

The I-ADX Advanced Histo MT4 Indicator is a technical analysis tool that can assist forex traders in making informed trading decisions. It is an advanced version of the Average Directional Index (ADX) indicator, which measures the strength of a trend.

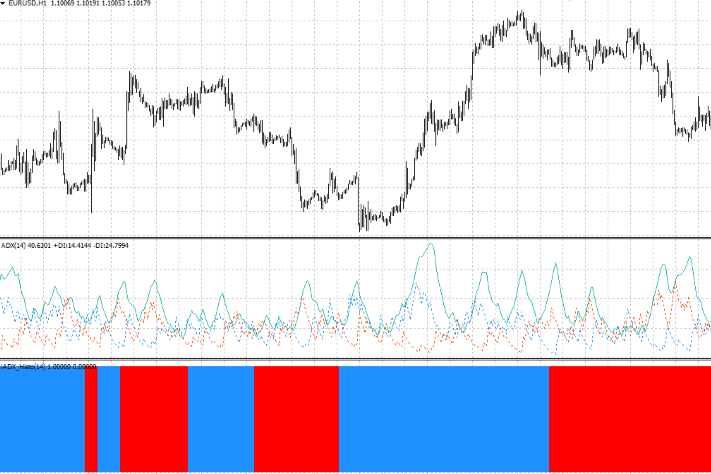

The I-ADX Advanced Histo MT4 Indicator takes this one step further by providing a visual representation of the ADX line and indicating when it crosses certain thresholds.

Download Free I-Adx Advanced Histo Mt4 Indicator

This article aims to provide an overview of the I-ADX Advanced Histo MT4 Indicator, how it works, and its benefits for forex traders. By understanding this indicator’s function, traders can incorporate it into their strategies to make more informed trading decisions based on market trends and conditions.

Additionally, this article will explore ways to use the I-ADX Advanced Histo MT4 Indicator alongside other indicators to strengthen your overall technical analysis approach.

Overview of the I-ADX Advanced Histo MT4 Indicator

This section provides a concise yet thorough overview of the I-ADX Advanced Histo MT4 Indicator, which is a technical analysis tool used to generate trading signals. The indicator is designed to help traders identify trends in the market and determine when to enter or exit trades based on those trends.

It does this by calculating the average directional movement index (ADX) and displaying it as a histogram on the chart. The I-ADX Advanced Histo MT4 Indicator offers several potential benefits for traders who use it correctly.

For one, it can provide valuable insights into market trends that may not be immediately apparent through other forms of analysis. Additionally, because it generates clear signals based on specific thresholds, traders can use these signals to make more informed decisions about where to place their trades and at what point to exit them.

Overall, the I-ADX Advanced Histo MT4 Indicator is a powerful tool that can help traders improve their technical analysis skills and make more profitable trades over time.

How the Indicator Works

This subtopic discusses how the i-ADX Advanced Histo MT4 Indicator works by using a combination of the ADX indicator, RSI, and Stochastic Oscillator.

The ADX indicator is used to identify trend strength, while the RSI and Stochastic Oscillator are used to identify overbought or oversold conditions.

The resulting histogram can then be interpreted to provide insight into potential market trends and changes in momentum.

Using the ADX Indicator

The section at hand delves into the practical application of a technical analysis tool aimed at measuring the strength and directionality of a market trend, which can aid traders in making informed decisions about potential entry and exit points.

The ADX indicator is one such tool that has gained popularity among traders for its ability to identify when a market is trending and how strong that trend is. This technical analysis tool consists of three lines: the ADX line, which measures the strength of the trend; the +DI line, which shows bullish pressure; and the -DI line, which shows bearish pressure.

When using ADX, traders can look for several signals to determine whether or not a trade should be made. One such signal is when the ADX line rises above 25, indicating that there is a strong trend in place. Traders may then use this information to enter or exit trades based on their trading strategy.

Another signal to watch out for is when the +DI crosses over the -DI, indicating that there may be bullish pressure building up in the market. On the other hand, if -DI crosses over +DI, it could indicate bearish pressure building up instead.

By paying attention to these signals and incorporating them into their overall trading strategy, traders can make more informed decisions about when to enter or exit trades with greater confidence.

Incorporating the RSI and Stochastic Oscillator

The current section introduces two commonly used technical analysis tools, namely the RSI and Stochastic Oscillator, which can provide traders with valuable insights into market momentum and potential entry or exit points.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100, where readings above 70 are considered overbought and readings below 30 are considered oversold. Traders often use RSI to identify potential trend reversals or confirm existing trends by looking for divergences between price movements and RSI values.

On the other hand, the Stochastic Oscillator is another popular indicator that measures the strength of price action by comparing an asset’s closing price to its price range over a certain period of time. It also ranges from 0 to 100, where readings above 80 indicate overbought conditions and readings below 20 indicate oversold conditions. Traders often use Stochastic integration with other indicators such as trend lines or moving averages to generate trading signals based on crossovers or divergences between stochastic lines and price movements.

Overall, incorporating RSI Stochastic integration in technical analysis can provide traders with additional confirmation signals when making trading decisions based on market momentum and potential entry or exit points.

Interpreting the Histogram

Understanding how to interpret the histogram in technical analysis can provide traders with valuable insights into market trends and potential entry or exit points, making it a useful tool for informed decision-making. The histogram is a visual representation of the difference between two moving averages, indicating whether the market trend is bullish or bearish.

Here are some key points to keep in mind when interpreting the histogram:

- When the histogram is above zero, it indicates a bullish trend.

- When the histogram is below zero, it indicates a bearish trend.

- The height of the bars on either side of zero reflects the strength of the trend.

- A wider spread between two bars suggests that there may be more volatility in the market.

It’s important to consider other indicators and price action alongside histogram interpretation for a comprehensive understanding of market trends.

By analyzing histograms in conjunction with other technical indicators and price actions, traders can gain deeper insights into market trends and make informed decisions about their trading strategies. However, it’s important to note that no single indicator should be relied upon exclusively, and all signals should be confirmed through multiple sources before entering or exiting trades.

Benefits of Using the I-ADX Advanced Histo MT4 Indicator

The I-ADX Advanced Histo MT4 Indicator is a powerful tool that can provide traders with comprehensive market analysis, enabling them to make informed trading decisions. By providing real-time data on market trends and potential price movements, this indicator allows traders to identify profitable opportunities and act quickly on them.

As a result, utilizing the I-ADX Advanced Histo MT4 Indicator can lead to increased profitability and success in the forex market.

Comprehensive Market Analysis

This section provides a holistic analysis of the market, encompassing various factors that could potentially affect price movements.

The I-ADX Advanced Histo MT4 Indicator is an effective tool for technical analysis and developing trading strategies. It offers comprehensive information on market trends and potential price movements by analyzing historical data, identifying support and resistance levels, and measuring volatility.

By using this indicator in conjunction with other technical indicators, traders can develop a better understanding of market conditions and make well-informed trading decisions.

The I-ADX Advanced Histo MT4 Indicator also allows traders to monitor multiple currency pairs simultaneously, providing a more complete view of the forex market.

Overall, the comprehensive analysis provided by this indicator makes it an indispensable tool for traders looking to maximize their profits while minimizing risk.

Informed Trading Decisions

In the previous subtopic, we discussed comprehensive market analysis. This involves using various analysis techniques to gather data and insights on market trends. With this information, traders can make informed decisions that align with their trading strategies.

One tool that traders can use to aid in their decision-making process is the i-adx advanced histo MT4 indicator. This indicator is designed to display the strength of a trend by measuring the Average Directional Index (ADX) and displaying it as a histogram. By interpreting this data, traders can identify potential entry and exit points for trades based on whether a trend is strengthening or weakening. Furthermore, they can use this information to adjust their risk management strategies accordingly.

Overall, informed trading decisions require careful consideration of multiple factors such as market analysis, risk management strategies, and technical indicators like the i-adx advanced histo MT4 indicator. As markets continue to evolve and become more complex, it is essential for traders to leverage all available resources at their disposal in order to stay ahead of competition and increase profitability.

Increased Profitability

Maximizing returns in trading is a key goal for any investor, and it can only be achieved through careful analysis of market trends and the use of effective tools. One such tool is the i-adx advanced histo mt4 indicator, which provides valuable insights into market movements and helps traders make informed decisions. By using technical analysis techniques, this indicator allows investors to identify potential entry and exit points in a trade, as well as to determine trend direction and strength.

To fully utilize the i-adx advanced histo mt4 indicator for increased profitability, traders need to understand how it works and how to interpret its signals correctly. Here are some tips that can help traders maximize their profits when using this tool:

- Use multiple time frames: Analyzing different time frames can provide a more comprehensive view of the market trends and help avoid false signals.

- Combine with other indicators: Using the i-adx advanced histo mt4 indicator together with other technical indicators can provide additional confirmation of trends.

- Set stop-losses: Setting stop-losses can help limit losses in case of unexpected reversals in market trends.

- Practice proper money management: Properly managing risk by allocating capital wisely and avoiding over-leveraging positions is essential for long-term success in trading.

How to Incorporate the Indicator into Your Trading Strategy

The present section delineates a method for seamlessly integrating the i-adx indicator into one’s trading methodology, thereby facilitating more informed and astute investment decisions that may ultimately engender a sense of confidence and satisfaction in traders. To begin with, the i-adx advanced histo MT4 indicator can be used for scalping by identifying short-term trends in the market. Traders can use this information to enter and exit trades quickly, maximizing profits while minimizing risks.

In addition to scalping, swing trading techniques with the i-adx advanced histo MT4 indicator have also proven to be effective. By focusing on longer-term trends in the market, traders can hold positions for days or even weeks depending on their specific trading strategy. This approach allows traders to capture larger price movements while also minimizing the impact of minor fluctuations in the market. Ultimately, incorporating the i-adx advanced histo MT4 indicator into one’s trading methodology can enhance profitability and provide a competitive advantage in today’s dynamic financial markets.

| Trading Technique | Advantages | Disadvantages |

|---|---|---|

| Scalping with I ADX Advanced Histo MT4 Indicator | Fast profit generation; minimizes risk exposure | Requires significant time commitment; requires rapid decision-making skills |

| Swing Trading with I ADX Advanced Histo MT4 Indicator | Captures large price movements; minimizes impact of minor fluctuations | Longer holding periods may increase risk exposure; requires patience and discipline. |

Conclusion

The I-ADX Advanced Histo MT4 Indicator is a powerful tool for traders looking to improve their technical analysis. This indicator uses advanced algorithms to analyze market trends and identify potential trading opportunities.

By providing clear signals of when to buy or sell, the I-ADX Advanced Histo MT4 Indicator helps traders make more informed decisions. Additionally, its user-friendly interface makes it easy for traders of all experience levels to incorporate into their trading strategy.

Overall, the I-ADX Advanced Histo MT4 Indicator is an excellent choice for traders looking to gain an edge in the markets. Its advanced algorithms and user-friendly interface make it an ideal tool for both novice and experienced traders alike.

By incorporating this indicator into your trading strategy, you can improve your technical analysis skills and increase your chances of success in the markets. So why not give the I-ADX Advanced Histo MT4 Indicator a try today? You may be surprised at just how much it can help you improve your trading results.