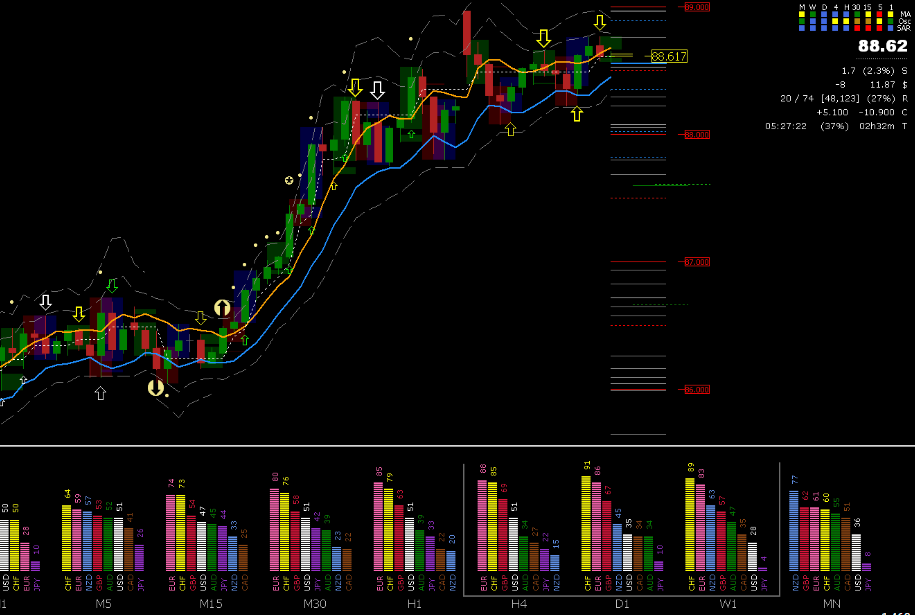

History Info Indicator Mt4 Review

The History Info Indicator MT4 is a versatile tool that can assist traders in gaining valuable insights into market trends and patterns. This indicator provides users with detailed information about their trading history, including the number of trades executed, profit and loss figures, and other critical data points.

By analyzing this information, traders can develop more effective trading strategies and improve their overall performance. One of the key benefits of using the History Info Indicator MT4 is its ability to provide users with an accurate picture of their past trading activities.

Download Free History Info Indicator Mt4

This information can be used to identify areas where improvements need to be made and to make informed decisions about future trades. Additionally, this indicator can help traders track their progress over time, which can be particularly useful for those who are just starting out or who are looking to refine their skills.

Overall, the History Info Indicator MT4 is a powerful tool that can help traders achieve better results in the forex market.

Benefits of Using the History Info Indicator MT4

The advantages of utilizing a tool that provides historical data in the MetaTrader 4 platform can enhance the analytical capabilities of traders and potentially improve their decision-making processes.

The History Info Indicator MT4 is one such tool that enables traders to access information on past price movements, enabling them to analyze patterns and identify trends.

By having access to historical data, traders can conduct technical analysis with greater accuracy. They can identify support and resistance levels, key chart patterns, and momentum indicators more effectively.

Traders can also use this information to spot potential trading opportunities based on past market behavior. This means they can make informed decisions when it comes to entering or exiting trades, managing risk, and setting stop-loss levels.

Overall, the History Info Indicator MT4 helps traders gain a deeper understanding of market dynamics by providing them with valuable insights into past price movements.

How to Use the History Info Indicator MT4

Installing the History Info Indicator MT4 is a straightforward process that involves downloading and saving the indicator file to your computer, then installing it on your MT4 platform.

Interpreting the historical performance data provided by the indicator requires an understanding of its key metrics, such as success rate and reward-to-risk ratio.

Incorporating the History Info Indicator into your trading strategy can provide valuable insights into past market behavior and help inform future trading decisions.

Installing the Indicator on Your MT4 Platform

By following the steps outlined in this section, traders can seamlessly integrate a powerful tool into their trading platform that provides valuable insights and analysis on past market trends.

Installing the History Info Indicator MT4 is a straightforward process that requires only a few simple steps.

Firstly, traders need to download the indicator file from a reliable source such as the MetaTrader 4 Market or an online forum.

Once downloaded, they can proceed to install it by navigating to their MT4 platform’s ‘File’ menu and selecting ‘Open Data Folder.’

From there, traders should locate the ‘MQL4’ folder and open it before selecting ‘Indicators’ folder.

They can then paste or drag-and-drop the downloaded indicator file into this folder and restart their MT4 platform to see it appear in their custom indicators list.

At this point, traders may customize settings such as color schemes, timeframes displayed, and other parameters to suit their preferences.

In case of any troubleshooting issues during installation or use of the History Info Indicator MT4, traders should refer to relevant online resources or seek help from technical support personnel.

- Ensure that you have downloaded the correct version of the indicator compatible with your MT4 platform.

- Verify that you have properly installed the indicator file into your Indicators folder.

- Familiarize yourself with various customization options available for tweaking your preferred settings.

- Keep track of any error messages or other system notifications that may indicate potential issues while using this tool.

Interpreting the Historical Performance Data

Understanding the past performance of financial markets is a crucial aspect of trading. The ‘history info indicator mt4′ provides traders with historical trend data that can be used to analyze past performance and make informed trading decisions.

The tool displays information such as open, high, low, and close prices for specified timeframes. Traders can use this information to identify patterns in market trends and potentially predict future price movements.

When interpreting the historical performance data provided by the ‘history info indicator mt4,’ it is important to consider various factors such as market volatility and economic events that may have influenced price movements. Additionally, traders should compare data from multiple timeframes to get a more comprehensive understanding of market trends.

By analyzing past performance through the installed tool, traders can gain valuable insights into market dynamics, which could help them make better-informed trading decisions.

Incorporating the Indicator into Your Trading Strategy

Incorporating a tool that provides historical trend data into one’s trading strategy can potentially enhance their ability to make informed decisions based on past market performance. The history info indicator in MT4 is one such tool that is designed to provide traders with valuable insights into the historical performance of an asset.

By analyzing backtesting results, traders can identify patterns and trends in price movements that might not be immediately apparent through simple chart analysis. However, it is important for traders to approach the use of this tool with caution and consider trading psychology considerations.

While past performance can provide useful information, it is not a guarantee of future success. Traders should avoid becoming over-reliant on historical data and instead focus on using the information as just one aspect of their overall decision-making process.

Additionally, traders must remain disciplined when incorporating this type of tool into their strategies and avoid making impulsive trades based solely on previous performance data. Overall, by keeping these factors in mind when using the history info indicator in MT4, traders can potentially improve their overall trading outcomes.

Tips for Maximizing the Benefits of the History Info Indicator MT4

Using the History Info Indicator MT4 in conjunction with other technical analysis tools can enhance your overall trading strategy.

By staying up-to-date with market news and events, you can better anticipate potential changes in market trends and adjust your trades accordingly.

Continuously evaluating and adjusting your trading strategy is crucial for long-term success and profitability when using the History Info Indicator MT4.

Using the Indicator in Conjunction with Other Technical Analysis Tools

Applying the history information indicator in conjunction with additional technical analysis tools may enhance the accuracy and reliability of trading decisions. Technical analysis integration can provide a comprehensive view of market trends, support and resistance levels, and other critical factors that influence price movements. When used in tandem with the history info indicator, traders can obtain more detailed insights into historical price patterns, volatility trends, and other indicators that impact market performance.

Here are several ways to integrate the history info indicator with other technical analysis tools:

- Use moving averages to identify trend direction: Moving averages are one of the most popular technical indicators for identifying trends. By comparing current prices to historical averages, traders can determine whether a market is in an uptrend or downtrend.

- Combine chart patterns with historical data: Chart patterns like head-and-shoulders or double tops/bottoms can provide valuable insights into potential price reversals. Combining these patterns with historical data from the history info indicator can help traders identify key support/resistance levels and potential entry/exit points.

- Analyze volume trends alongside price movements: Volume is often considered a leading indicator for price movements since it reflects market activity and investor sentiment. Traders can use volume indicators like on-balance volume (OBV) or volume-weighted average price (VWAP) to confirm trends identified by the history info indicator.

- Monitor momentum oscillators for overbought/oversold conditions: Momentum oscillators like the relative strength index (RSI) or stochastic oscillator can help traders identify overbought/oversold conditions in a market. By combining these indicators with historical data from the history info indicator, traders can gauge whether a market has reached extreme levels that could lead to a reversal in trend direction.

Staying Up-to-Date with Market News and Events

Staying up-to-date with market news and events is essential for traders to make informed decisions and adjust their strategies accordingly.

There are various sources where traders can get the latest news related to trading, such as financial newspapers, online news portals, social media platforms, and specialized trading websites.

Keeping an eye on relevant economic indicators such as GDP, inflation rates, interest rates, and employment figures can help a trader evaluate the overall health of an economy. Furthermore, tracking significant geopolitical events like elections or global trade tensions could also provide valuable insights into market trends.

The importance of market events in trading cannot be overstated as they can significantly impact asset prices. For instance, a central bank’s monetary policy decision can have a profound impact on currency pairs’ exchange rate or stock indexes. Similarly, natural disasters or pandemics could adversely affect commodity prices like oil or gold.

Staying informed about these events could enable traders to anticipate possible price movements and position themselves accordingly through technical analysis tools like the history info indicator MT4. Therefore, it is crucial for traders to stay abreast of all relevant market information to maximize their chances of success in the highly competitive world of trading.

Continuously Evaluating and Adjusting Your Trading Strategy

In the world of trading, continuously evaluating and adjusting one’s strategy is critical to achieving long-term success as market conditions are always evolving.

One way traders can ensure their strategy remains effective is through backtesting techniques. Backtesting involves using historical data to test a trading strategy and gauge its performance under different market conditions. This technique helps traders identify potential weaknesses in their strategy and make necessary adjustments.

Trading plan optimization is another important aspect of continuously evaluating and adjusting one’s trading strategy. A trading plan outlines a trader’s goals, entry and exit points, risk management strategies, and more.

As market conditions change, it is essential to update the trading plan accordingly to ensure it remains relevant and effective. Traders should regularly review their plan and adjust it based on current market trends or personal experience gained from executing trades.

By continually optimizing their trading plans, traders can ultimately achieve greater success in the markets over time.

Conclusion

The History Info Indicator MT4 is a useful tool for traders who want to analyze their past trading performance. This indicator displays important information about the trades that have been executed on the account, such as the number of profitable and losing trades, the average profit and loss, and the total amount of profit or loss.

By using this information, traders can identify patterns in their trading behavior and make adjustments to improve their overall profitability.

To use the History Info Indicator MT4, traders must first download it from a reputable source and install it onto their MetaTrader 4 platform. Once installed, they can customize the settings to display specific information about their trading history.

The indicator will then automatically update with each new trade so that traders can track their progress over time.

To maximize the benefits of this indicator, traders should regularly review their trading history and use it as a tool for self-reflection. They should look for patterns in their winning and losing trades and try to identify any mistakes or missed opportunities.

With this knowledge, they can adjust their trading strategy accordingly and hopefully achieve greater success in future trades.

In conclusion, the History Info Indicator MT4 is a valuable resource for traders who want to take a data-driven approach to improving their performance. By providing detailed information about past trades, this indicator empowers traders to make informed decisions about how to adjust their strategies going forward.

While it may not guarantee success in every trade, using this indicator can certainly help traders become more confident and consistent in their decision-making processes.