Harmonic Patterns & Fibo Levels Indicator For Mt4 Review

The world of trading is a complex and ever-changing environment, where investors are constantly searching for new ways to identify profitable trades. One such method involves the use of harmonic patterns and Fibonacci levels in technical analysis.

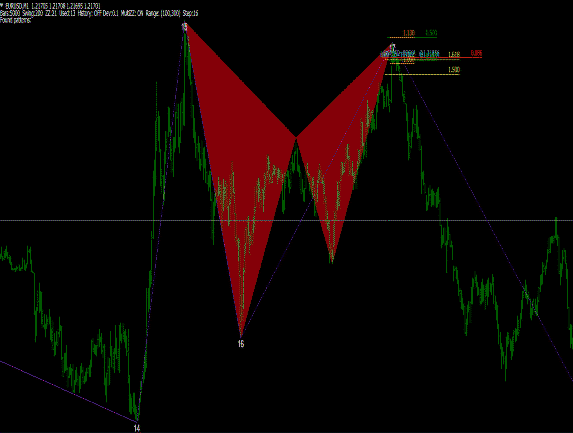

Harmonic patterns refer to specific price formations that indicate potential trend reversals or continuations, while Fibonacci levels are used to identify potential areas of support or resistance based on key ratios derived from the Fibonacci sequence.

Download Free Harmonic Patterns & Fibo Levels Indicator For Mt4

The combination of these two tools can provide traders with a powerful means of identifying potential trading opportunities and managing risk. The Harmonic Patterns & Fibo Levels Indicator for MT4 is a popular tool among traders that incorporates both techniques into an easy-to-use indicator for the MetaTrader 4 platform.

In this article, we will examine the principles behind harmonic patterns and Fibonacci levels, explore their applications in trading, and discuss how the Harmonic Patterns & Fibo Levels Indicator can help traders make informed decisions in today’s volatile markets.

Understanding Harmonic Patterns in Trading

This section provides an in-depth analysis of the use and significance of certain mathematical ratios in trading, which can be used to identify potential market reversal points.

Harmonic patterns are a type of technical analysis tool that traders use to predict future price movements by analyzing past price data. The concept behind harmonic patterns is based on the idea that markets move in predictable cycles and that these cycles can be identified using specific geometric shapes.

There are several different harmonic pattern strategies that traders can use to identify potential market reversals. Some of the most common harmonic patterns include the Gartley pattern, the Bat pattern, and the Butterfly pattern.

These patterns are all based on specific Fibonacci ratios, which have been found to occur frequently in financial markets. By identifying these ratios within a chart, traders can spot potential reversal points and enter trades with a higher probability of success.

Overall, understanding harmonic patterns is essential for any trader looking to improve their ability to identify profitable trading opportunities.

The Importance of Fibonacci Levels in Trading

The incorporation of Fibonacci levels into trading strategies has gained significant importance in recent years, as it provides traders with a mathematical approach to identifying potential support and resistance levels based on historical price movements.

The Fibonacci retracement strategy involves the use of key levels derived from the Fibonacci sequence to identify areas where price may experience a reversal or bounce-back.

Traders can use these levels to set stop-loss orders or take-profit targets, and also to determine entry and exit points for trades.

Another important aspect of Fibonacci levels in trading is the use of Fibonacci extensions.

These extensions are used to identify potential price targets beyond the initial retracement level.

By projecting these extensions, traders can anticipate potential future price movements and adjust their trading strategies accordingly.

Overall, incorporating both Fibonacci retracements and extensions into a trading strategy can provide traders with valuable insight into market trends and potential price movements, helping them make more informed decisions and achieve greater success in financial markets.

The Benefits of Using Harmonic Patterns and Fibo Levels Indicator for MT4

When it comes to trading, utilizing tools that can provide valuable insights into market trends and potential price movements is crucial for achieving success, and one such tool that has gained significant attention in recent years is the combination of harmonic patterns and Fibonacci levels indicator for MT4.

By combining multiple indicators, traders can gain a more comprehensive understanding of the market’s direction, which can help them make better-informed decisions. The harmonic pattern identifies repeating price structures that have demonstrated high accuracy in predicting future price movements. Meanwhile, the Fibonacci levels indicator uses mathematical calculations based on the golden ratio to identify potential support and resistance levels.

One of the most significant benefits of using harmonic patterns and Fibonacci levels indicator for MT4 is their ability to backtest strategies effectively. Traders can use historical data to test their strategies under different market conditions, allowing them to fine-tune their approach before implementing it in live trading.

This helps traders identify potential risks and improve their overall risk management strategy while also providing a deeper understanding of how these indicators work together to provide a more holistic view of the market. By taking advantage of these tools’ full range of capabilities, traders can maximize their chances for success in today’s highly competitive financial markets.

Using Harmonic Patterns and Fibo Levels Indicator for MT4

Installation and set up of the Harmonic Patterns and Fibo Levels Indicator for MT4 requires downloading the indicator files, opening MetaTrader 4, and accessing the ‘Navigator’ window to add the indicator to a chart.

Interpreting indicator signals involves identifying specific patterns such as Gartley, Butterfly, or Bat formations along with Fibonacci retracement levels which signal potential trend reversals or continuation.

Best practices for trading with this indicator involve using it in conjunction with other technical analysis tools, placing stop-loss orders to manage risks, and avoiding over-reliance on the indicator alone.

Installation and Set Up

This section provides clear and concise steps for successfully integrating harmonic patterns and fibo levels indicator for MT4 into one’s trading platform. By following these steps, traders can access valuable insights that aid in informed decision-making.

The installation process is straightforward and requires the following steps:

- Download the harmonic patterns and fibo levels indicator file from a reputable source.

- Open your MT4 trading platform and click on ‘File’ in the top left corner of the screen.

- Select ‘Open Data Folder’ from the dropdown menu.

- Copy and paste the downloaded file into the ‘MQL4/Indicators’ folder within your data folder.

- Restart your MT4 trading platform to apply changes.

Configuring parameters can help optimize performance specific to individual preferences. It’s important to note that parameters may vary depending on market conditions, so regular adjustments are recommended to achieve optimal results.

To troubleshoot common issues, traders should ensure that they have installed all necessary files correctly and recheck their settings if they encounter any discrepancies or errors during installation.

Overall, it is important to follow each step carefully when installing harmonic patterns and fibo levels indicator for MT4 as this will allow traders to fully utilize its benefits in their trading strategies.

How to Interpret Indicator Signals

The interpretation of signals from the integrated trading tool in MT4 can provide traders with valuable insights to aid in making informed decisions. Analyzing trends is crucial for traders, and harmonic patterns & fibo levels indicator can help identify potential trend reversals or continuations.

The indicator identifies specific price levels that have a higher probability of being key support or resistance zones based on Fibonacci retracement levels. Recognizing market volatility is also an essential aspect of interpreting signals from this indicator.

A volatile market can lead to false breakouts, which may result in significant losses for traders. However, harmonic patterns & fibo levels indicator can help mitigate risk by identifying potential entry and exit points based on the identified support and resistance areas.

It is important to note that while the indicator can provide valuable insights, it should not be solely relied upon when making trading decisions. Traders must still conduct their own analysis and incorporate other tools to confirm signal accuracy before executing trades.

Best Practices for Trading with the Indicator

To achieve success in trading with the integrated tool, it is imperative to adhere to best practices that involve conducting thorough market analysis, incorporating other tools to confirm signal accuracy, and avoiding over-reliance on the indicator.

Risk management is an essential aspect of trading that must be taken into consideration when using harmonic patterns & fibo levels indicator for MT4. Traders must understand their risk tolerance level and set stop-loss orders accordingly. Additionally, traders should not enter a trade if the potential reward is less than the potential risk.

Backtesting strategies can also assist traders in determining the effectiveness of harmonic patterns & fibo levels indicator for MT4. By analyzing historical data, traders can determine which market conditions are most conducive to generating accurate signals and identify any weaknesses or limitations of the indicator.

Furthermore, incorporating other technical analysis tools such as trend lines or oscillators can provide additional confirmation before entering a trade based solely on the indicator’s signals. Ultimately, by following these best practices and utilizing various analytical techniques, traders can increase their chances of success when using harmonic patterns & fibo levels indicator for MT4 in their trading strategies.

Conclusion

In conclusion, the use of harmonic patterns and Fibonacci levels indicator for MT4 can greatly enhance trading strategies.

Harmonic patterns provide a framework for identifying potential market reversals and can be used in conjunction with other technical analysis tools.

The use of Fibonacci levels in trading is based on the principle of natural retracements that occur in markets.

By combining both methods, traders can have a more comprehensive view of market trends and identify potential trade opportunities.

The benefits of using harmonic patterns and Fibonacci levels indicator for MT4 include increased accuracy in identifying potential turning points in the market, better risk management through precise entry and exit points, and improved decision-making abilities.

However, it is important to note that no trading strategy is foolproof, and traders should always exercise caution when making trades.

Overall, incorporating harmonic patterns and Fibonacci levels into trading strategies can help traders make informed decisions and increase their chances of success in financial markets.