Harmonic Pattern Recognition Indicator Mt4 Review

The world of trading is constantly evolving, with new tools and technologies emerging to help traders make informed decisions. One such tool is the Harmonic Pattern Recognition Indicator MT4, which has gained popularity among traders looking for an edge in the market.

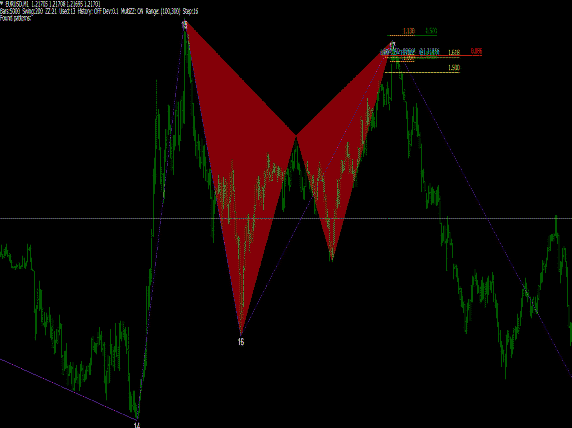

This indicator is designed to identify harmonic patterns in price movements, helping traders anticipate future price movements and make profitable trades. Harmonic patterns are a type of technical analysis used by traders to predict future price movements based on previous patterns. These patterns occur when certain ratios between price levels repeat themselves over time, creating predictable trends that can be used to inform trading decisions.

Download Free Harmonic Pattern Recognition Indicator Mt4

The Harmonic Pattern Recognition Indicator MT4 uses these patterns to identify potential opportunities for profit, allowing traders to take advantage of market trends and maximize their returns. In this article, we will explore how this indicator works and its benefits for traders looking to improve their trading strategies.

Understanding Harmonic Patterns in Trading

The identification and interpretation of recurring price movements in financial markets, known as harmonic patterns, have gained popularity among technical traders due to their potential to forecast future market trends. These patterns are based on the idea that price movements follow predictable geometric structures or ratios. Identifying market trends is a crucial aspect of trading as it enables traders to make informed decisions and maximize profits.

Harmonic patterns provide an analytical framework for predicting future price movements by identifying key levels of support and resistance. There are several common harmonic patterns in forex trading, including the butterfly pattern, crab pattern, bat pattern, and Gartley pattern. Each pattern is identified using specific criteria such as Fibonacci retracements and extensions, swing highs and lows, and trend lines.

The effectiveness of harmonic pattern recognition indicators MT4 depends on the trader’s ability to accurately identify these patterns and interpret them correctly. While these patterns can provide valuable insights into market trends, they should not be used as standalone indicators but should be used alongside other technical analysis tools for more accurate predictions.

How the Harmonic Pattern Recognition Indicator MT4 Works

This section explores the operation and functionality of a tool that identifies recurring market movements to aid traders in making informed decisions.

The Harmonic Pattern Recognition Indicator MT4 is a technical analysis tool that scans the market for harmonic patterns and alerts traders when it finds one. It uses complex algorithms to detect the patterns, which are based on Fibonacci retracements and extensions.

Indicator accuracy is essential in trading, and the Harmonic Pattern Recognition Indicator MT4 has proven its worth in this regard. It has undergone backtesting performance tests where it demonstrated an impressive level of accuracy in identifying profitable trades.

Additionally, it offers customizable settings allowing traders to adjust their strategy according to their preferences. Overall, the Harmonic Pattern Recognition Indicator MT4 provides a reliable method of identifying recurring market movements that can provide valuable insights into potential trading opportunities.

Benefits of Using the Indicator

Employing a technical analysis tool that identifies recurring market movements can yield notable advantages for traders, including improved accuracy in identifying profitable trades and customized settings to adapt trading strategies. The Harmonic Pattern Recognition Indicator MT4 is one such tool that enables traders to identify potential harmonic patterns in the market, which are based on Fibonacci retracements and extensions.

By using this indicator, traders can gain an edge in their trading decisions by recognizing reliable entry and exit points. One of the main benefits of using the Harmonic Pattern Recognition Indicator MT4 is its ability to provide traders with clear signals about potential trades. For example, when a bullish or bearish pattern appears on the chart, it indicates that there could be a high probability of a price reversal at that level.

Additionally, because this indicator uses Fibonacci levels as part of its analysis, it helps traders find more accurate targets for their profit-taking orders or stop-loss orders. Moreover, the customizable settings allow traders to adjust their strategies according to their risk appetite and preferred timeframes. Thus, by using this tool effectively, traders can increase their chances of making profitable trades while minimizing risks along the way.

Tips for Using the Indicator Effectively

Combining the harmonic pattern recognition indicator with other technical analysis indicators can provide a comprehensive view of market trends and signals.

Analyzing multiple timeframes can offer more accurate insights into a security’s price movements, helping traders to make informed decisions.

Regular monitoring and adjustment of the indicator settings is crucial to ensure its effectiveness in recognizing patterns and providing reliable trade signals.

Combining with other indicators

Integrating additional technical indicators with the harmonic pattern recognition tool can provide traders with a more comprehensive understanding of market trends and potential entry/exit points.

For instance, combining the tool with moving averages can help identify key support and resistance levels, as well as confirm trend direction.

Similarly, using oscillators such as RSI or MACD in conjunction with the indicator can offer further confirmation of potential trade setups.

Indicator customization is another useful strategy to enhance the effectiveness of harmonic pattern recognition indicator MT4.

The tool allows users to adjust parameters such as minimum and maximum retracement levels, as well as target prices for optimal precision in identifying patterns that fit their trading style.

Additionally, backtesting strategies can help traders evaluate how well their chosen combination of indicators perform in different market conditions over time.

This approach enables them to fine-tune their strategy based on historical data and gain confidence before implementing it live in real-time trading scenarios.

Analyzing multiple timeframes

Analyzing multiple timeframes can provide traders with a more comprehensive view of market trends and potential entry/exit points, allowing them to make informed decisions based on the broader context of the market.

Traders using harmonic pattern recognition indicators in MT4 can benefit from analyzing multiple timeframes, as it helps them confirm or invalidate patterns observed on a single timeframe.

For example, if a bullish harmonic pattern is observed on the hourly chart, but the same pattern shows bearish signals on a larger timeframe such as daily or weekly, then it may be wise for traders to avoid taking long positions.

Moreover, selecting appropriate timeframes is crucial when analyzing harmonics patterns because certain factors affect their accuracy.

These factors include volatility, liquidity, and news events that could impact price action.

Therefore, traders should choose timeframes that match their trading style and account for these factors before making any decisions based on harmonic pattern recognition indicators in MT4.

By doing so, they can increase the probability of success in their trades and minimize risk exposure.

Regular monitoring and adjustment

To ensure continual success in trading, it is important to regularly monitor the market and make adjustments based on changing conditions.

This is especially true when using a harmonic pattern recognition indicator MT4, as these indicators rely heavily on market movements and patterns.

Traders should track their progress over time, analyzing their past trades and identifying any patterns or trends in their successes or failures.

In addition to tracking progress, traders should also fine-tune their strategy as needed. This may involve adjusting their risk management approach, refining entry and exit points, or experimenting with different indicators.

By continually monitoring the market and making adjustments accordingly, traders can stay ahead of changing conditions and increase their chances for long-term success with harmonic pattern recognition trading strategies.

Conclusion

In conclusion, the Harmonic Pattern Recognition Indicator MT4 is a powerful tool for traders who seek to identify potential market reversals and capitalize on them.

The indicator uses complex algorithms to detect harmonic patterns in price action, including Gartley, Butterfly, Bat, and Crab patterns.

By taking advantage of these patterns, traders can enter trades with greater accuracy and confidence.

However, it is important to note that no indicator or trading strategy is foolproof.

Traders must still exercise caution and discipline when using the Harmonic Pattern Recognition Indicator MT4.

Additionally, it may be beneficial to use multiple indicators or technical analysis tools in conjunction with this indicator for a more comprehensive approach to trading.

With proper use and risk management techniques implemented, the Harmonic Pattern Recognition Indicator MT4 has the potential to enhance a trader’s overall success in the markets.