Gfk Forex Indicator Review

The foreign exchange (forex) market is one of the most actively traded financial markets in the world. It involves buying and selling different currencies with the aim of making a profit from fluctuations in their exchange rates.

However, forex trading can be challenging, especially for beginners who lack experience and knowledge. This is where trading indicators come in handy as they help traders analyze market trends, identify patterns, and make informed decisions.

Download Free Gfk Forex Indicator

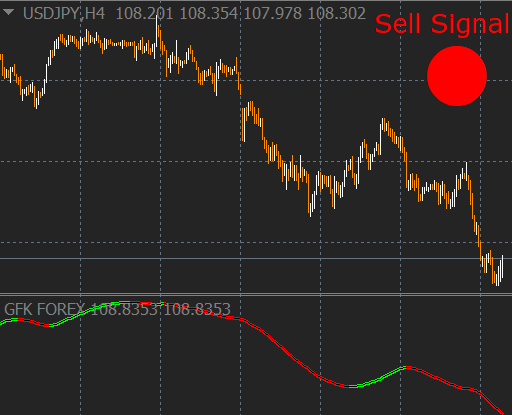

One such indicator is the GFK Forex Indicator, which has gained popularity among forex traders due to its ability to provide accurate signals about potential price movements. The GFK Forex Indicator uses a combination of technical analysis tools to generate buy and sell signals based on market conditions.

In this article, we will discuss the basics of forex trading, introduce the GFK Forex Indicator and provide tips on how to use it effectively to improve your trading performance.

Understand the Basics of Forex Trading

The present section aims to provide a comprehensive understanding of the fundamental principles that underpin foreign exchange trading. Forex trading is a global decentralized market where currencies are exchanged between buyers and sellers. The aim of forex trading is to make profits through buying low and selling high or selling high and buying low.

In order to achieve this, traders need to have an in-depth knowledge of the market, including its structure, functioning, and dynamics. Trading psychology plays a crucial role in forex trading. Traders need to be disciplined, patient, and emotion-free while making decisions about buying or selling currencies. They must also have realistic expectations and avoid getting carried away by greed or fear.

Risk management is another essential factor that traders must consider while engaging in forex trading. It involves identifying potential risks associated with currency pairs and implementing strategies to minimize them. Effective risk management can help traders protect their capital and maximize their profits over time.

Introducing the GFK Forex Indicator

This section provides an introduction to the GFK Forex Indicator, a tool used in foreign exchange trading. This indicator is designed to help traders identify potential market trends and make informed decisions about when to buy or sell currency pairs.

It is based on a complex algorithm that analyzes multiple indicators and factors, including price action, volume, market sentiment, and technical analysis. One of the key features and benefits of the GFK Forex Indicator is its accuracy and reliability.

Unlike other forex indicators that can often give false signals or provide incomplete information, this indicator has been extensively tested and proven to be highly effective in predicting market movements. Additionally, it is user-friendly and easy to use for both novice and experienced traders alike.

Another advantage of using this tool is its flexibility; it can be customized according to individual preferences or trading styles. Overall, the GFK Forex Indicator offers a unique approach to foreign exchange trading that sets it apart from other indicators on the market today.

Tips for Using the GFK Forex Indicator

This section will explore some practical tips for using the GFK Forex Indicator effectively.

Firstly, it is important to set realistic expectations when using any trading tool, including this indicator.

Secondly, traders can combine the GFK Forex Indicator with other strategies to enhance their overall trading approach.

Finally, understanding how to use the indicator in different market conditions can help traders make more informed decisions and improve their profitability over time.

By considering these key points, traders can maximize the potential of the GFK Forex Indicator as a valuable addition to their trading toolkit.

Setting Realistic Expectations

Achieving attainable goals is crucial when using any technical tool in the financial market, and this section emphasizes the importance of setting realistic expectations while utilizing the GFK indicator.

Traders should not expect the GFK indicator to provide them with a guaranteed profit or entirely eliminate all losses. Instead, they should use it as a guide to make informed trading decisions.

To set realistic expectations for using the GFK indicator, traders must keep in mind that managing emotions and risk management are essential components of successful trading.

First, traders need to manage their emotions and avoid making impulsive trades based solely on their feelings.

Secondly, risk management is necessary to protect capital from substantial losses.

With these factors in mind, traders can realistically assess the performance of the GFK indicator and use it as an aid rather than a solution for profitable trading strategies.

Combining the Indicator with Other Strategies

A comprehensive trading strategy often involves combining technical indicators with other strategies to increase the accuracy of trading decisions and minimize risks. The GFK forex indicator is a popular tool for identifying trends in foreign exchange markets. However, traders should not rely solely on this indicator as it may produce false signals or fail to account for certain market conditions.

To enhance its effectiveness, traders can combine the GFK forex indicator with other technical indicators such as moving averages, relative strength index (RSI), and stochastic oscillator.

Backtesting results can help traders determine which combinations of indicators work best for different currency pairs and timeframes. Combining the GFK forex indicator with price action analysis can also provide valuable insights into market behavior and improve decision-making. By analyzing past price movements and chart patterns, traders can identify potential support and resistance levels, trend reversals, as well as entry and exit points.

Overall, combining the GFK forex indicator with other technical tools and strategies can lead to more accurate predictions of future market trends and better risk management practices.

Using the Indicator in Different Market Conditions

The effectiveness of technical indicators in the forex market can vary depending on prevailing market conditions, and as such, traders need to understand how to use them effectively in different situations.

The GFK forex indicator is no exception, and it can be used in various market conditions to generate profitable trading signals. For instance, when markets are volatile, the GFK indicator can be useful in identifying short-term trends that traders could capitalize on.

Moreover, traders can use the GFK indicator in long-term or short-term trading strategies. For example, long-term traders may use the indicator to identify significant trend changes over a more extended period. On the other hand, short term-traders may use it for quick trades during intraday volatility.

However, irrespective of whether one uses this indicator for long or short term trading strategies or in volatile markets; proper risk management should always be observed to avoid unnecessary losses.

Improving Your Trading Performance with the GFK Forex Indicator

This section provides valuable insights on how traders can enhance their trading performance by using the GFK Forex Indicator. This tool offers accurate signals and helps to identify profitable opportunities in the market. By understanding how to interpret GFK signals, traders can make informed decisions that align with their trading strategies.

One effective approach is to use GFK in conjunction with price action analysis. This involves analyzing charts and identifying patterns that show the behavior of buyers and sellers. Traders can then use GFK signals in combination with these patterns to confirm their trades or wait for better opportunities.

Another way to improve trading performance is by using risk management techniques such as stop-loss orders, which help prevent significant losses in case a trade goes wrong.

In conclusion, incorporating the GFK Forex Indicator into one’s trading strategy can lead to improved performance if used correctly alongside other tools and techniques.

Benefits of Using GFK:

- Offers accurate signals

- Identifies profitable opportunities

Ways to Enhance Trading Performance:

- Use price action analysis alongside GFK

- Incorporate risk management techniques like stop-loss orders

Frequently Asked Questions

What is the success rate of the GFK Forex Indicator?

Success rate analysis is a crucial aspect of evaluating the effectiveness of any forex indicator. It involves examining real-life case studies to determine how often the indicator generates profitable trades.

The success rate of an indicator can vary depending on several factors, including market conditions, trading strategy, and risk management. In addition, it is important to note that past performance does not guarantee future success.

Therefore, when analyzing the success rate of any forex indicator, it is crucial to consider all these factors and conduct a thorough evaluation before making any investment decisions.

Can the GFK Forex Indicator be used for other financial markets besides forex trading?

The GFK indicator, originally designed for Forex trading, has gained attention among traders who are exploring its potential use in other financial markets such as cryptocurrencies and stocks.

When it comes to cryptocurrency trading, the GFK indicator can be used to identify trends and potential buying or selling opportunities based on specific market conditions. However, it is important to note that cryptocurrency markets are highly volatile and subject to sudden price fluctuations, which may affect the accuracy of any technical analysis tool.

In terms of stock trading, the GFK indicator should be compared with other commonly used technical indicators such as moving averages and relative strength index (RSI) to determine its effectiveness in identifying profitable trades.

Overall, using the GFK indicator in different financial markets requires a thorough understanding of market dynamics and risk management strategies to optimize its potential benefits.

Is the GFK Forex Indicator suitable for beginners or only experienced traders?

When it comes to trading, beginners often have a difficult time navigating the complex and ever-changing landscape of financial markets. While the GFK Forex Indicator may be a helpful tool for experienced traders, it may not be suitable for those just starting out.

There are pros and cons to using any type of indicator or strategy, and the learning curve associated with the GFK Forex Indicator may be steep for beginners. It is important to thoroughly research and understand any tool or strategy before implementing it into your trading routine.

Ultimately, whether or not the GFK Forex Indicator is suitable for beginners will depend on various factors such as individual experience level, risk tolerance, and market conditions.

How frequently should the GFK Forex Indicator be checked for trading signals?

The frequency of checking trading signals is an important aspect in the process of making informed decisions while trading. Timing plays a crucial role in ensuring that one captures the right market conditions to maximize profits and minimize losses.

It is, therefore, imperative to have a clear understanding of the various indicators used and their optimal usage to ensure effective decision-making. This requires extensive research and analysis of market trends as well as keeping abreast with changing economic conditions.

In conclusion, regular monitoring of trading signals is essential for successful forex trading, which can be achieved through proper utilization of tools such as GFK Forex Indicator.

Are there any additional resources or support available for users of the GFK Forex Indicator?

For users of any financial tool or strategy, it is essential to have access to additional resources and support to ensure effective implementation. The user community can be an invaluable resource as it allows traders to discuss their experiences, exchange ideas and strategies, and ask questions. It provides a platform for sharing knowledge that can enhance the trading experience of all participants.

In addition, a troubleshooting guide can be beneficial in identifying common issues that may arise during usage. A comprehensive guide should provide step-by-step solutions for addressing these problems effectively. These resources can help traders navigate any challenges they encounter while using the GFK Forex Indicator or any other trading tool, ultimately leading to more successful trades and improved financial outcomes.

Conclusion

Forex trading is an intricate business that requires expertise and knowledge. The GFK Forex Indicator is a tool that helps traders to analyze the market trend and make informed decisions. It’s important to understand the basics of forex trading before using this indicator, as it can be difficult for beginners to interpret its results accurately.

The GFK Forex Indicator uses complex algorithms to determine potential entry and exit points in the market. Traders must use their experience and skill to interpret these signals correctly. One tip for using this indicator effectively is to combine it with other technical analysis tools such as candlestick charts or moving averages.

By following these tips, traders can improve their performance in forex trading with the help of the GFK Forex Indicator. This tool can assist them in making more profitable trades by providing accurate data about market trends and potential price movements.

As always, successful trading requires discipline, patience, and constant learning – but with the right tools like the GFK Forex Indicator, traders can achieve their goals more efficiently.