Gann Fibonacci Forex Mt4 Indicator Review

The world of forex trading is constantly evolving, with new tools and techniques being developed to help traders make more informed decisions. One such tool is the Gann Fibonacci Forex MT4 Indicator, which combines two popular technical analysis methods – Gann and Fibonacci – to provide a comprehensive overview of market trends and price action.

Download Free Gann Fibonacci Forex Mt4 Indicator

Gann analysis involves using geometrical principles to identify patterns and trends in market movements, while Fibonacci retracements are based on the idea that prices tend to retrace a predictable portion of a move before continuing in the original direction. By combining these two methods, the Gann Fibonacci Forex MT4 Indicator offers traders a powerful tool for identifying potential entry and exit points in the market.

But how exactly does this indicator work, and how can you use it to your advantage? Let’s take a closer look.

Understanding the Principles of Gann and Fibonacci

The principles discussed in the current section provide a comprehensive understanding of the mathematical and geometrical concepts that underpin technical analysis in financial markets. Two of the most famous tools used by traders in technical analysis are Gann’s trading strategies and Fibonacci retracement levels.

William Delbert Gann was an American trader who developed a unique approach to trading that combined geometry, astrology, and mathematics. His trading strategies are based on his belief that price movements follow specific geometric patterns.

On the other hand, Fibonacci retracement levels are charting tools used to identify potential areas of support or resistance during a price trend. These levels are calculated by taking key high and low prices on a chart and dividing them into ratios based on the Fibonacci sequence (1, 1, 2, 3, 5, 8, 13…).

Traders use these levels to determine where to enter or exit trades based on potential reversal points in the market. By combining Gann’s trading strategies with Fibonacci retracement levels, traders can develop powerful tools for analyzing market trends and making informed decisions about when to buy or sell assets.

Key Features of the Gann Fibonacci Forex MT4 Indicator

This section will explore the key features of the Gann Fibonacci Forex MT4 Indicator. Specifically, it will focus on identifying support and resistance levels, predicting entry and exit points, and analyzing market trends. These features are crucial to successful trading as they allow traders to make informed decisions based on market analysis and technical indicators.

Through a detailed examination of these features, traders can gain a deeper understanding of how the Gann Fibonacci Forex MT4 Indicator can be used to enhance their trading strategies.

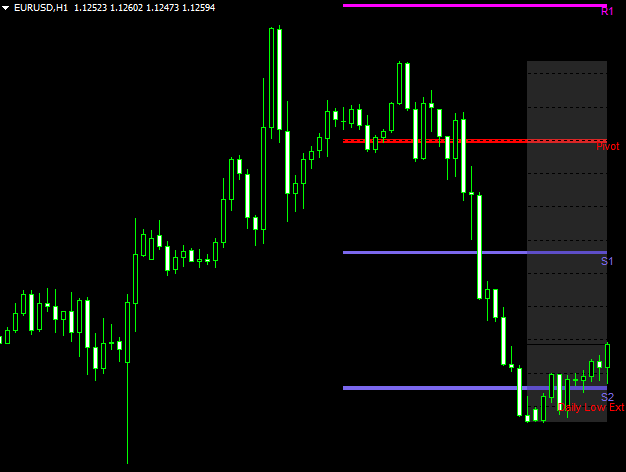

Identifying Support and Resistance Levels

Identifying key levels of support and resistance is a crucial aspect of successful trading, and the current section focuses on methods for effectively identifying these levels. The Gann Fibonacci Forex MT4 Indicator can be used to identify potential support and resistance levels by analyzing price patterns.

Here are three ways to use this indicator for identifying support and resistance:

- Look for areas where the price has previously reversed: By examining past price movements, traders can identify areas where the price has historically reversed direction. These areas may serve as potential support or resistance levels in future trades.

- Identify swing highs and lows: Swing highs occur when a high point on a chart is followed by two lower points, while swing lows occur when a low point is followed by two higher points. These swings may indicate potential turning points in the market and can be used as support or resistance levels.

- Use Fibonacci retracement levels: The Gann Fibonacci Forex MT4 Indicator includes several retracement levels that are based on the Fibonacci sequence. Traders can use these levels to identify potential areas of support or resistance based on how far the price has retraced from its previous trend.

Overall, effectively identifying key levels of support and resistance is essential for successful trading using the Gann Fibonacci Forex MT4 Indicator. By utilizing different methods such as examining previous price movements, identifying swing highs and lows, and using Fibonacci retracements, traders can make better-informed decisions about their trades.

Predicting Entry and Exit Points

To increase the likelihood of profitable trades, traders can utilize various methods for predicting entry and exit points when using technical indicators. One popular technique is using the Gann Fibonacci Forex MT4 indicator. This tool applies a mathematical formula to identify potential support and resistance levels, allowing traders to make informed decisions about when to enter or exit a trade.

Using the indicator with different currency pairs can provide valuable insights into market trends and potential trading opportunities. However, it is important to note that no single indicator should be relied upon exclusively for making trading decisions. Combining the Gann Fibonacci Forex MT4 indicator with other technical analysis tools such as moving averages or price action patterns can help confirm signals and improve overall accuracy in predicting entry and exit points. By utilizing multiple indicators in conjunction with one another, traders can better navigate the complexities of the forex market and increase their chances of success.

| Column 1 | Column 2 | Column 3 |

|---|---|---|

| Pros: | Cons: | Emotional Response: |

| Provides clear support/resistance levels | May not work well in volatile markets | Confidence in trade decisions |

| Can be used across multiple timeframes | Can produce false signals at times | Frustration when signals are inaccurate |

| Easy to use for both novice and experienced traders | Should not be solely relied upon for trading decisions | Excitement over potentially profitable trades |

The table above illustrates some of the advantages, disadvantages, and emotional responses associated with using the Gann Fibonacci Forex MT4 indicator as a means of predicting entry and exit points. While this tool certainly has its strengths, it is important to approach it with caution and combine it with other methods of technical analysis when making trading decisions. Ultimately, successful trading requires careful consideration of numerous factors – including economic news events, geopolitical developments, market sentiment – in addition to technical indicators like the Gann Fibonacci Forex MT4.

Analyzing Market Trends

Analyzing market trends is an essential aspect of successful trading, as it enables traders to identify and understand the market patterns that exist.

There are various methods of technical analysis that traders use to analyze the market, such as using historical data to inform their analysis. By analyzing past market behavior, traders can uncover potential entry and exit points for trades.

One popular tool used in technical analysis is the Gann Fibonacci Forex MT4 indicator. This indicator uses mathematical calculations based on the principles of the Fibonacci sequence to identify potential price levels for support and resistance in the market.

By combining this tool with other technical indicators and chart patterns, traders can gain a comprehensive understanding of current market conditions and make informed decisions about their trades.

Ultimately, analyzing market trends allows traders to stay ahead of changing conditions in the markets and make strategic decisions that lead to success in trading.

How to Use the Gann Fibonacci Forex MT4 Indicator

This section will discuss how to use the Gann Fibonacci Forex MT4 Indicator, focusing on three key points:

- Installing the indicator on MT4

- Customizing its settings

- Interpreting its signals

To begin with, we will outline the steps required for successfully installing the indicator on your trading platform.

Next, we will explore the various customization options available within the indicator and how they can be tailored to suit individual trading preferences.

Finally, we will delve into interpreting the signals generated by this powerful technical analysis tool and how they can inform your trading decisions.

Installing the Indicator on MT4

The process of installing the Gann Fibonacci forex MT4 indicator is a necessary step for traders who want to use it for technical analysis. This indicator can be downloaded from various online sources and then installed on MT4, which is a popular trading platform used by many forex traders.

However, some traders may encounter issues when trying to install the indicator on their MT4 platform. Common troubleshooting steps include:

- Ensuring that the file is properly downloaded and saved in the correct folder

- Checking if there are any compatibility issues with other indicators or software

- Restarting both the computer and the platform after installation

By following these steps, traders can effectively install and use this powerful tool for analyzing market trends and making informed trading decisions.

Customizing the Settings

To fully utilize the potential of the Gann Fibonacci MT4 indicator, traders must customize its settings according to their individual trading strategies and preferences. The customization options available in this tool allow traders to optimize its performance by adjusting various parameters such as timeframes, price levels, and chart types.

One important setting that traders can customize is the timeframe used for analysis. By selecting a shorter or longer timeframe, traders can adjust the sensitivity of the indicator and tailor it to their specific trading style.

Another key customization option is choosing which price levels to include in the analysis. Traders can select from a range of different Fibonacci retracement levels depending on their preference and risk tolerance.

Finally, chart type selection is also an important consideration when customizing this tool. Depending on whether a trader prefers candlestick charts or line charts, they may need to adjust certain settings accordingly in order to obtain accurate readings from the indicator.

Overall, customizing these settings allows traders to gain a more precise understanding of market trends and make better-informed trading decisions based on their individual preferences and strategies.

Interpreting the Indicator’s Signals

Understanding and interpreting the signals generated by the Gann Fibonacci Forex MT4 Indicator is crucial for traders to effectively utilize its potential and make informed trading decisions. Day traders who use this indicator need to know how to read it correctly, especially when identifying false signals.

One common mistake that beginners make is relying solely on the signals without considering other market factors such as news releases or price movements. To avoid falling into this trap, traders should first understand that the Gann Fibonacci Forex MT4 Indicator generates two types of signals: buy and sell. A buy signal shows an uptrend while a sell signal indicates a downtrend in the market. However, traders should not take these signals at face value since they can be misleading at times. Identifying false signals in the Gann Fibonacci Forex MT4 Indicator requires a deeper understanding of price action and trend analysis.

To help traders better interpret the indicator’s signals, here are two sub-lists:

- Emotion-evoking sub-list 1:

- Avoid over-analyzing or second-guessing yourself when using this indicator.

- Use it as part of your overall trading strategy instead of relying solely on it.

- Emotion-evoking sub-list 2:

- Keep track of news releases or economic events that may affect your trades.

- Combine technical analysis with fundamental analysis to get a more comprehensive picture of market conditions.

By following these tips, traders can improve their accuracy in interpreting the Gann Fibonacci Forex MT4 Indicator’s signals and avoid making costly mistakes in day trading.

Tips for Maximizing Your Success with the Gann Fibonacci Forex MT4 Indicator

This section offers practical advice on how to maximize the efficiency of the Gann Fibonacci Forex MT4 Indicator and avoid common mistakes that could negatively impact your trading outcomes.

Firstly, it is essential to understand that this tool should be used in conjunction with other technical analysis tools and not solely relied upon for decision-making. Combining indicators such as moving averages, trend lines, and support/resistance levels can provide a more comprehensive analysis of market movements.

Secondly, it is crucial to use the Gann Fibonacci Forex MT4 Indicator correctly. This includes setting appropriate timeframes and parameters that align with your trading strategy goals.

It’s also important to use caution when interpreting signals generated by the indicator as false positives or negatives may occur. By taking these steps, traders can increase their chances of success while using this tool and reduce the risk of making costly errors.

Frequently Asked Questions

What other indicators work well in conjunction with the Gann Fibonacci Forex MT4 Indicator?

Combining indicators is a popular practice among traders to optimize their trading strategies. By utilizing multiple indicators that complement each other, traders can receive more accurate signals and make informed decisions.

Some commonly used indicators in conjunction with others are Moving Averages, Relative Strength Index (RSI), Stochastic Oscillator, and Bollinger Bands.

Moving Averages provide a smoothed-out trend line indicating the direction of the market. RSI helps determine overbought or oversold conditions, while Stochastic Oscillator is useful for identifying potential turning points in the market.

Bollinger Bands indicate volatility and provide signals for entry and exit points. Traders should experiment with different combinations of these indicators to find what works best for their specific trading strategy.

Can this indicator be used for trading cryptocurrencies or other assets?

Cryptocurrencies have become increasingly popular among traders and investors, and the use of technical indicators has become a common practice in trading strategies. The Gann Fibonacci indicator is one such tool that can be used for cryptocurrency trading. However, it is important to note that no single indicator can guarantee success in trading.

Traders must consider multiple indicators and market conditions to make informed decisions. A comparison of the Gann Fibonacci with other popular cryptocurrency indicators, such as the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI), may provide insights into which tools work best together for effective trading strategies in different market environments.

Are there any specific timeframes that this indicator works best with?

When considering the best timeframes to use for trading with an indicator, it is important to evaluate its performance across different periods of time.

The effectiveness of a trading strategy can vary based on the duration of trades and market conditions, so determining optimal timeframes requires careful analysis.

Factors such as volatility, liquidity, and trends can all impact the suitability of a timeframe for a particular indicator.

As such, traders should assess their own risk tolerance and goals when selecting the ideal timeframe to use with any given indicator.

Ultimately, successful trading depends on finding a balance between historical performance data and real-time market analysis to make informed decisions that generate profitable outcomes.

Is it necessary to have extensive knowledge of Gann and Fibonacci principles to use this indicator effectively?

Novice traders seeking an effective tool to analyze the forex market may find Gann Fibonacci Forex MT4 Indicator helpful. The indicator utilizes the principles of Gann and Fibonacci to identify potential price movements, making it easier for traders to make informed decisions on their trades.

While extensive knowledge of these principles can prove useful in developing advanced trading strategies with the indicator, it is not a prerequisite for using it effectively. The benefits of using this indicator lie in its ability to simplify complex market data and provide clear signals that can be acted upon by traders at any level of expertise.

How can I backtest this indicator to see how it would have performed in the past?

Visualization techniques and historical market analysis are essential tools for backtesting a trading indicator. Backtesting involves using past market data to simulate the performance of a trading strategy or indicator, providing valuable insights into its effectiveness under different market conditions.

Visualization techniques such as charts and graphs can help traders identify patterns and trends in the data, while historical market analysis allows them to see how the indicator would have performed in previous market scenarios. By analyzing this information, traders can make informed decisions about whether to use the Gann Fibonacci Forex MT4 Indicator in their trading strategies and how best to optimize its settings for maximum profitability.

Conclusion

The Gann Fibonacci Forex MT4 Indicator is a powerful tool for traders looking to predict future market movements. By combining the principles of Gann and Fibonacci, this indicator can identify key levels of support and resistance, as well as potential entry and exit points for trades.

With its user-friendly interface and customizable settings, the Gann Fibonacci Forex MT4 Indicator is suitable for both novice and experienced traders alike. To maximize success with this indicator, it is important to have a solid understanding of the underlying principles of Gann and Fibonacci.

Additionally, traders should take advantage of all available features and settings within the indicator to tailor it to their specific trading strategies. It is also recommended to use the indicator in conjunction with other technical analysis tools for a more comprehensive view of market trends.

Overall, the Gann Fibonacci Forex MT4 Indicator offers traders a valuable resource for analyzing market movements and making informed trading decisions. However, like any technical analysis tool, it should be used in conjunction with sound fundamental analysis practices and risk management strategies.

With proper use and interpretation, the Gann Fibonacci Forex MT4 Indicator can be an effective addition to any trader’s toolkit.