3 Bar Stop Loss Mt4 Indicator Review

The foreign exchange market is a highly volatile and unpredictable arena, with traders often facing the challenge of minimizing losses while maximizing profits. One strategy employed by traders to manage risks is through the use of stop-loss orders, which automatically close out trades when predetermined price levels are reached.

The 3 Bar Stop Loss MT4 Indicator is a tool designed to assist traders in setting appropriate stop-loss levels based on three consecutive bars’ performance. This article aims to provide an in-depth understanding of the 3 Bar Stop Loss MT4 Indicator, including its function, benefits, and how it can be used effectively.

Download Free 3 Bar Stop Loss Mt4 Indicator

Through a thorough examination of this powerful indicator’s features and capabilities, traders will gain valuable insights into developing sound risk management strategies that can help them navigate the dynamic foreign exchange market with greater confidence.

What is the 3 Bar Stop Loss MT4 Indicator?

The 3 Bar Stop Loss MT4 Indicator is a technical analysis tool utilized in financial markets to assist traders in identifying potential entry and exit points based on historical price movements.

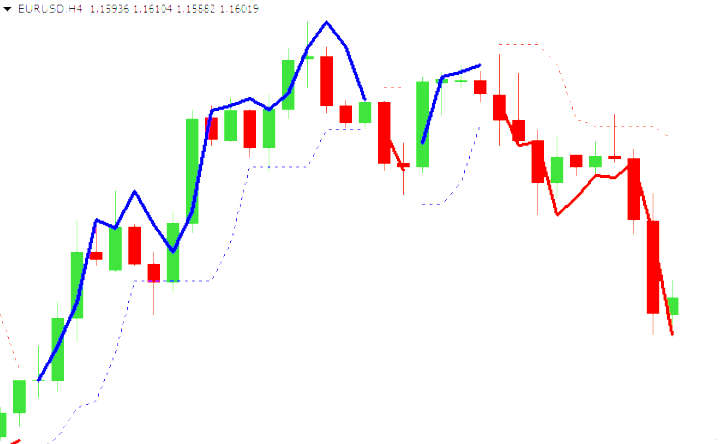

Understanding the significance, application, and benefits of the 3 bar stop loss MT4 indicator can help traders improve their risk management strategies. This indicator works by placing three bars as a visual representation of where a trader should place their stop loss level. The first bar represents the current market price, while the second and third bars represent two different levels at which a trader may consider placing their stop loss.

Exploring the functionality of the indicator reveals that it is designed to help traders make informed decisions about when to enter or exit trades based on past price trends. By using this tool, traders can avoid taking unnecessary risks and minimize losses through effective risk management strategies.

The 3 Bar Stop Loss MT4 Indicator is an essential tool for any trader looking to improve their trading performance by managing risk more effectively. It provides valuable insights into market trends, helping traders identify potential entry and exit points with greater accuracy, making it an indispensable part of any successful trading strategy.

How Does the Indicator Work?

The 3 Bar Stop Loss MT4 Indicator works by analyzing three consecutive bars and determining logical exit points for traders. This subtopic will delve into the details of how this process is carried out.

By examining the intricacies of the indicator, traders can gain a better understanding of how to use it effectively in their trading strategies.

Analyzing Three Consecutive Bars

Examining the sequential behavior of three consecutive bars in a market trend can provide traders with valuable insights into price movements. Pattern recognition and trend analysis are key skills that traders use to identify potential trends, either bullish or bearish. By analyzing the open, close, high, and low prices of each bar, traders can gain a better understanding of the market’s direction and determine whether it is entering an uptrend or downtrend.

Three consecutive bars can also help traders identify potential support and resistance levels. If the first two bars in a sequence show upward movement followed by a downward move in the third bar, this may indicate that buyers have reached their limit at a certain price level. Conversely, if there are three consecutive bars with upward movement, this may suggest that buyers are continuing to enter the market and push prices higher.

Overall, analyzing three consecutive bars can be a useful tool for traders seeking to make informed decisions based on current market trends. The behavior of three consecutive data points in a market trend through pattern recognition and trend analysis is essential for traders as it provides crucial insights into price movements. Analyzing open, close, high and low prices of each bar helps gain an understanding of the market’s direction while identifying potential support and resistance levels. Hence examining these sequential patterns allows informed decisions to be made concerning entry/exits from trades based on current market trends- making it an invaluable tool for all types of traders alike!

Determining Logical Exit Points

Determining logical exit points is a crucial aspect of successful trading as it enables traders to maximize profits and minimize losses. Exit strategies are essential tools in risk management, which plays a significant role in the success of any trader. They help traders avoid losing too much money on trades that go against them, while also protecting their gains from profitable trades.

There are various exit strategies that traders use depending on their preferences and market conditions. Some common ones include trailing stop-loss orders, fixed profit targets, and time-based exits.

Trailing stop-loss orders allow traders to set a specific percentage or dollar amount below the current market price at which they will sell their position if the price drops.

Fixed profit targets enable traders to set an exact price at which they will take profits regardless of how high the price goes afterward.

Time-based exits involve closing out positions after a specific period has elapsed, regardless of whether they are profitable or not.

By using these exit strategies, traders can manage their risks more effectively and increase their chances of success in the markets.

Benefits of Using the Indicator

Exploring the advantages of utilizing the bar stop loss MT4 indicator can provide traders with a comprehensive understanding of how it can enhance their trading strategies.

One of the primary benefits is its effectiveness in managing risks. The indicator helps traders identify potential exit points that are crucial in minimizing losses and maximizing profits. By setting stop-loss orders, traders can limit their exposure to market volatility and prevent significant losses.

Another advantage of using the bar stop loss MT4 indicator is its ability to streamline decision-making processes. It provides clear signals for when to exit trades, eliminating emotional biases that may lead to poor trading decisions.

This tool enables traders to make well-informed choices based on objective data, reducing errors caused by subjective judgment or intuition. Overall, incorporating this tool into one’s trading strategy can improve risk management and enhance overall performance by providing logical entry and exit points.

How to Use the Indicator

This section presents a guide on effectively utilizing the 3 bar stop loss MT4 indicator for effective risk management and improved trading performance. By using this tool, traders can set up their trades with more precision, reducing the chances of incurring losses due to sudden market fluctuations.

Here are three ways to use the indicator for optimal performance:

- Determine stop loss levels: The first step in using the 3 bar stop loss MT4 indicator is to determine your desired stop loss level. This can be done by analyzing price trends and setting a limit that aligns with your trading strategy.

- Set up the indicator: Once you have determined your stop loss level, it’s time to set up the indicator on your trading platform. Simply drag and drop the tool onto your chart and adjust its settings according to your preferences.

- Monitor market conditions: Finally, it’s important to monitor market conditions constantly while using this tool to ensure that you’re making informed decisions based on current trends.

By following these steps, traders can use the 3 bar stop loss MT4 indicator effectively for improved risk management and better overall performance in their trades.

Conclusion

The 3 Bar Stop Loss MT4 Indicator is a technical analysis tool that helps traders to manage their risk by setting stop loss levels after observing three consecutive bars moving in the same direction.

This indicator is widely used by forex traders who want to automate their trading decisions while minimizing potential losses. By allowing traders to set stop loss levels based on market trends, this indicator can help to protect against sudden price changes and unexpected market movements.

To use the 3 Bar Stop Loss MT4 Indicator, one must first install it on the MetaTrader 4 platform. Once installed, traders can customize the settings of the indicator according to their preferences. The indicator will then automatically display potential stop loss levels based on market trends and recent price movements.

Using this indicator has several benefits for traders, including better risk management and increased profitability through reduced losses. Traders who use this tool can also benefit from greater confidence in their trading strategies and an improved ability to make informed decisions based on market analysis.

In conclusion, the 3 Bar Stop Loss MT4 Indicator is a useful tool for forex traders who want to minimize potential losses and improve their overall trading performance. By providing automated stop loss levels based on market trends, this indicator allows traders to make informed decisions without relying solely on intuition or guesswork. With its proven track record of success, this tool has become an essential part of many successful forex trading strategies.