Forex Signals Indicator Mt4 Review

The Forex Signals Indicator MT4 is a tool that traders use to make informed decisions when trading in the forex market. This indicator gives traders an edge by providing them with real-time information about price movements and trends, allowing them to enter or exit trades at the right time.

The MT4 platform is widely used by forex traders around the world, making this indicator a popular choice for those looking to improve their trading strategies. In this article, we will explore the features of the Forex Signals Indicator MT4 and how it can be used to enhance your trading strategy.

Download Free Forex Signals Indicator Mt4

We will also provide tips on how to maximize its effectiveness and discuss its limitations. By understanding how this powerful tool works, you can become more confident in your trades and increase your chances of success in the competitive world of forex trading.

Understanding the Forex Signals Indicator MT4

This section delves into a comprehensive understanding of the technical analysis tool used in trading, specifically in the forex market, which is the Forex Signals Indicator MT4.

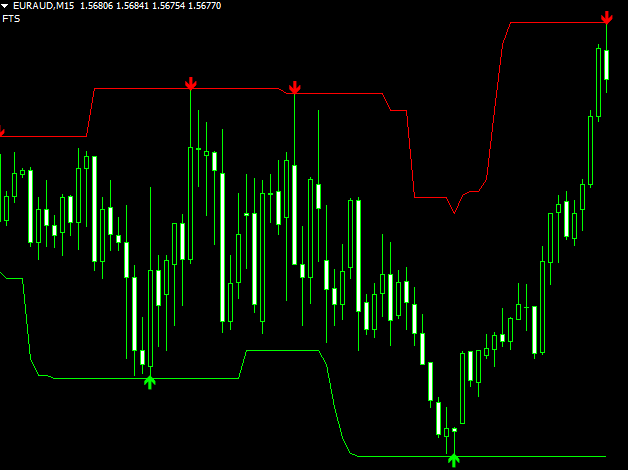

This tool is a custom indicator that provides traders with real-time signals for buy and sell positions. It uses various technical indicators such as moving averages, stochastic oscillators, and relative strength index to identify potential trade opportunities.

The Forex Signals Indicator MT4 offers traders flexibility as it can be customized to suit their individual preferences. Traders can adjust parameters such as signal sensitivity, time frames, and pair selection to optimize performance based on their preferred trading style.

Additionally, it offers visual representations of trends which help traders make informed decisions when entering or exiting trades. Understanding how to customize this indicator is crucial for successful trading in the forex market.

Using the Indicator for Your Trading Strategy

Setting up the forex signals indicator on MetaTrader 4 involves downloading and installing the software, selecting the appropriate currency pairs to analyze, and adjusting the indicator settings to suit your trading style.

Interpreting signals for buy or sell decisions requires an understanding of how the indicator works, including its calculation methodology and any relevant technical analysis principles.

Traders must also consider market conditions, news events, and other factors that could influence currency prices when making trading decisions based on indicator signals.

Setting up the indicator on MetaTrader 4

To enable the efficient utilization of technical analysis tools, MetaTrader 4 provides a user-friendly interface that allows traders to easily install and configure custom indicators.

Here are some steps to set up the forex signals indicator on MetaTrader 4:

- Download the indicator file from a reputable source and save it on your computer.

- Open MetaTrader 4 platform and click ‘File’ then select ‘Open Data Folder’.

- Locate the ‘MQL4’ folder, then open the ‘Indicators’ folder, and copy/paste the downloaded file into this folder.

Once you have installed the forex signals indicator, you can customize its settings to suit your trading strategy. For instance, you can adjust its timeframes, colors, and alerts notifications via the ‘Inputs’ tab in MT4’s terminal window.

However, if you encounter any issues while setting up or using this indicator (such as missing data or wrong signals), consider troubleshooting common problems by checking your internet connection or updating your MT4 platform version.

Interpreting signals for buy or sell decisions

Interpreting signals is crucial for making informed buy or sell decisions in the foreign exchange market and can be achieved by understanding technical analysis tools provided by trading platforms.

Forex signal interpretation techniques vary, but some common ones include trendline analysis, moving averages, and chart patterns. Trendline analysis involves drawing lines that connect the highs or lows of currency pairs over a specific period to identify trends. Moving averages smooth out price fluctuations to reveal trends more clearly. Chart patterns are visual representations of price movements that traders use to predict future market movements.

Market analysis strategies can also help interpret forex signals for buy or sell decisions. One such strategy is fundamental analysis, which involves examining economic data and news events that may impact the market’s performance. Another strategy is sentiment analysis, which gauges investor attitudes towards a currency pair using social media feeds and other online sources.

Technical analysts also use indicators such as relative strength index (RSI) and stochastic oscillators to determine whether a currency pair is oversold or overbought, indicating when traders should enter or exit trades respectively. Ultimately, interpreting forex signals requires knowledge of various technical indicators and market analysis strategies to make informed trading decisions in the dynamic foreign exchange markets.

Tips for Maximizing the Effectiveness of the Forex Signals Indicator MT4

For traders seeking to optimize their trading strategies, implementing various technical indicators alongside the Forex Signals Indicator MT4 can aid in identifying potential market trends and price movements.

However, it is important to understand that relying solely on signals is not enough for a successful trade. Traders should have a solid understanding of the market, its behavior and the impact of economic events on price fluctuations.

To maximize profits when using the Forex Signals Indicator MT4, traders should also consider risk management strategies. This includes setting stop-loss orders to limit potential losses and ensuring that trades are well-balanced in terms of risk-to-reward ratios.

Additionally, traders should avoid over-trading or taking positions based solely on emotion rather than sound analysis. By incorporating these techniques into their trading strategy, traders can effectively utilize the Forex Signals Indicator MT4 and increase their chances of success in the forex market.

Final Thoughts on the Forex Signals Indicator MT4

The Forex Signals Indicator MT4 has both advantages and disadvantages when used in trading. While it can provide traders with accurate signals, it also requires careful interpretation and analysis to avoid false signals that may result in losses.

Real-world examples of successful trades using the indicator can help traders understand its potential but should be taken with caution as market conditions and individual strategies may vary.

Pros and cons of using the indicator

Analyzing the advantages and disadvantages of utilizing the Forex Signals Indicator MT4 is crucial for traders who wish to make informed decisions.

One significant advantage of using this tool is its ability to provide real-time signals, which can be beneficial in quick decision-making.

Traders can customize the settings according to their preferences and risk appetite, making it suitable for both novice and experienced traders. Additionally, the indicator’s simplicity makes it easy to use for beginners in forex trading.

On the other hand, there are some limitations to using this particular indicator.

While forex signals may be helpful in guiding a trader’s decision-making process, they should not be solely relied upon as they are subject to market volatility and unpredictability.

Moreover, there may be alternative indicators that could provide more accurate signals than the Forex Signals Indicator MT4, depending on one’s trading strategy and goals.

Therefore, it is essential for traders to conduct thorough research before deciding which tools or indicators best suit their needs.

Real-world examples of successful trades using the indicator

Analyzing the performance of a forex signals indicator MT4 can be helpful in determining its efficacy. While there are potential drawbacks to using such an indicator, it can still be a valuable tool in making informed trading decisions.

In this section, we will explore real-world examples of successful trades using the indicator.

Four examples of successful trades using the forex signals indicator MT4 are:

- A trader used the indicator to identify a trend reversal and made a profitable trade.

- Another trader utilized the indicator to confirm their analysis and entered into a position with increased confidence, resulting in a successful trade.

- A third trader used the indicator to highlight potential entry points for long-term positions, leading to significant profits over time.

- Lastly, a novice trader relied heavily on the forex signals indicator MT4 and was able to make consistent gains while they developed their skills as a trader.

These examples demonstrate that while there are potential risks associated with relying solely on an indicator for trading decisions, it can still be useful when combined with other forms of analysis. As with any trading strategy, it is important to use caution and carefully consider all factors before making any investment decisions.

Conclusion

In conclusion, the Forex Signals Indicator MT4 can be a valuable tool for traders looking to improve their trading strategy. By providing real-time signals and technical analysis, it allows traders to make informed decisions based on market trends and conditions.

However, it is important to note that the indicator should not be relied upon solely and should be used in conjunction with other tools and analysis methods.

To maximize its effectiveness, traders should take the time to understand how the indicator works and customize its settings to fit their specific trading style. Additionally, keeping up-to-date with market news and events can help inform trading decisions when using the indicator.

With proper use and analysis, the Forex Signals Indicator MT4 has the potential to greatly enhance a trader’s success in the forex market.