Forex Overbought Oversold Indicator Review

The foreign exchange market, also known as the forex market, is one of the most liquid and dynamic financial markets in the world. With trillions of dollars traded daily, it presents tremendous opportunities for traders to profit from fluctuations in currency prices.

However, understanding and predicting these price movements requires a certain level of technical knowledge and analysis. One such tool that traders use to identify potential trading opportunities is the forex overbought oversold indicator.

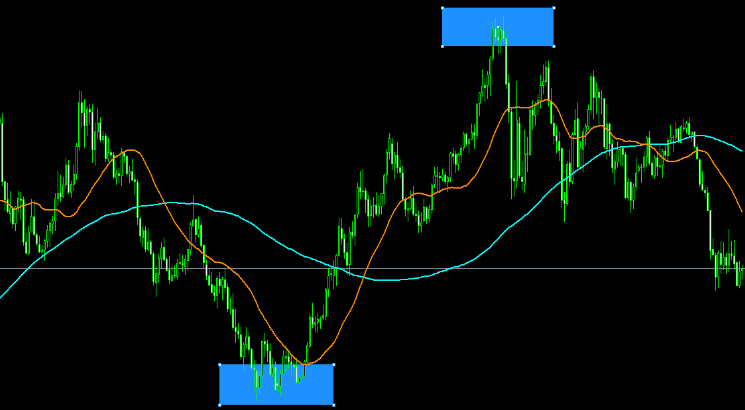

The forex overbought oversold indicator is a technical analysis tool used by traders to identify potential buying or selling opportunities in the market by measuring whether a particular currency pair is overbought or oversold. This indicator helps traders determine when prices may be reaching extreme levels and are likely to reverse direction.

Download Free Forex Overbought Oversold Indicator

It uses various mathematical calculations based on price trends and historical data to generate signals that can help traders make informed decisions about their trades. By using this indicator effectively, traders can improve their chances of success in the highly competitive forex market.

Understanding the Forex Market

An in-depth understanding of the foreign exchange market requires a comprehensive grasp of the underlying economic and geopolitical factors that influence currency valuations, as well as an awareness of the various tools and strategies used by traders to analyze and interpret market trends.

Forex trading strategies are varied, ranging from technical analysis to fundamental analysis, with each approach focusing on different aspects of the market. Technical analysis is based on the study of past price patterns to predict future trends, while fundamental analysis involves looking at economic indicators such as interest rates, inflation rates, and political events to make trading decisions.

Market trend analysis is a crucial component of forex trading strategies since it allows traders to identify potential opportunities for profit. By analyzing historical price data through charts and other graphical representations, traders can identify patterns that indicate overbought or oversold conditions in currency pairs.

Overbought conditions suggest that demand for a particular currency has increased beyond its intrinsic value, while oversold conditions suggest that supply has exceeded demand. These indicators can help traders make informed decisions about when to buy or sell currencies based on their expected movements in value over time.

What is the Forex Overbought Oversold Indicator?

The Forex Overbought Oversold Indicator is a technical analysis tool used to identify potential market reversals. It works by comparing the current price of an asset to its historical average and signaling when it becomes overbought or oversold.

Key features of this indicator include customizable parameters, compatibility with various trading platforms, and the ability to generate alerts for traders. Its benefits include improved market timing, increased accuracy in trading decisions, and reduced risk of losses due to false signals.

How it works

In order to understand the functioning of this mechanism, it is necessary to consider the market conditions and the relevant price movements.

The forex overbought oversold indicator works by measuring the momentum of a currency pair’s price movement.

When prices rise or fall too quickly, they may reach a point where there are no more buyers or sellers left in the market. This creates a state of overbought or oversold conditions, which can be identified using certain indicator settings.

The forex overbought oversold indicator operates on a scale from 0 to 100, with 70 as an upper limit for overbought territory and 30 as a lower limit for oversold territory.

It is important to keep in mind that these levels are not fixed and depend on various factors such as market volatility, trend direction, and timeframe used.

Common mistakes made while using this indicator include relying solely on it without considering other technical analysis tools, trading against the dominant trend based on its readings alone, and failing to adjust its parameters according to changing market conditions.

Key features and benefits

This section highlights the key features and benefits of the momentum-measuring tool that operates on a scale from 0 to 100, with specific overbought and oversold thresholds, while emphasizing the importance of avoiding common mistakes to make informed trading decisions.

One of its primary benefits is that it provides traders with an objective measurement of market conditions, allowing them to identify potential buying or selling opportunities based on overbought or oversold levels. The indicator can be used in various trading strategies, such as trend following or mean reversion approaches.

Another key feature of this indicator is that it can help traders avoid common mistakes in market analysis by providing a clear picture of price trends and potential reversals. For example, if a currency pair has reached an overbought level above 70, it may indicate an upcoming downward trend reversal, suggesting that traders should sell their position before the price drops further. Similarly, if a pair reaches an oversold level below 30, it may suggest an upward trend reversal is imminent, indicating that traders should buy their position before the price starts rising again.

Overall, using forex overbought oversold indicators correctly can improve trading outcomes for both novice and experienced traders alike by providing insights into market conditions and helping them make more informed decisions.

How to Use the Forex Overbought Oversold Indicator

By understanding the principles of market momentum and analyzing price movements, traders can effectively incorporate the overbought/oversold indicator into their technical analysis to identify potential trend reversals or entry/exit points.

The forex overbought oversold indicator is a technical tool that measures the relative strength of an asset’s price in relation to its recent performance. It calculates whether an asset is trading above or below its mean value and signals when it may be due for a reversal.

To use this indicator effectively, traders should first understand the concept of overbought and oversold conditions. Overbought refers to a situation where an asset’s price has risen sharply in a short period, indicating that buyers have pushed up the price too far too fast, making it vulnerable to a correction.

Conversely, oversold occurs when an asset’s price falls too much in a short time frame, which indicates that sellers have taken control and pushed down prices excessively. By identifying these conditions using the forex overbought oversold indicator, traders can adjust their trading strategies accordingly by taking profits at resistance levels during overbought conditions or buying dips during oversold situations.

Best Practices for Trading with the Forex Overbought Oversold Indicator

Traders can significantly improve their technical analysis and optimize their trading strategies by adhering to best practices when using the overbought/oversold tool in their market analysis.

One of the key aspects is to use a combination of entry and exit strategies that complement the overbought/oversold indicator. For example, traders can enter a long position when the asset price is oversold but only after confirming that other indicators also signal bullish momentum. Similarly, traders should consider exiting a long position when the asset price reaches an overbought level and shows signs of reversal.

Another essential aspect of trading with the overbought/oversold indicator is to implement risk management techniques that limit potential losses. Traders must avoid relying solely on this tool for making decisions as it may not always be accurate or reliable. Therefore, incorporating stop-loss orders based on the trader’s risk tolerance levels can prevent substantial losses if there are sudden market movements against their positions.

Additionally, traders should diversify their portfolios by investing in multiple assets across different sectors rather than sticking to one specific instrument alone. By following these best practices, traders can achieve better returns while reducing potential risks associated with using technical indicators such as overbought/oversold tools in forex trading.

Conclusion

In conclusion, the Forex Overbought Oversold Indicator is a valuable tool for traders who want to identify potential overbought or oversold markets. By using this indicator in conjunction with other technical analysis tools and fundamental analysis, traders can make more informed trading decisions and increase their chances of success in the Forex market.

However, it is important to remember that no indicator is perfect and should not be relied on solely for trading decisions. Traders should always practice risk management strategies and continuously educate themselves on the market to remain profitable in the long run.

Overall, the Forex Overbought Oversold Indicator can be a useful addition to any trader’s toolkit when used correctly and responsibly.