Forex Fibo Strong System Review

The Forex market is the largest and most liquid financial market in the world, attracting traders from all over the globe. With an average daily trading volume of $5.3 trillion, it offers numerous opportunities to make profits for those who understand its dynamics and utilize effective trading strategies.

One such strategy is the Fibonacci retracement tool, which helps traders identify potential entry and exit points in a trend. Fibonacci retracements are based on mathematical ratios that occur naturally in nature and have been observed to apply to financial markets too.

Download Free Forex Fibo Strong System

The Forex Fibo Strong System is a trading system that combines the use of Fibonacci levels with other technical indicators to generate profitable trades. In this article, we will explore how this system works, its benefits, and how it can be used by Forex traders to enhance their profitability.

Understanding Fibonacci Retracement Levels

The Current Section delves into the concept of Fibonacci retracement levels, which are widely used in technical analysis to identify potential levels of support and resistance in financial markets.

These levels are based on the mathematical principles discovered by Leonardo Fibonacci, an Italian mathematician from the 13th century.

The concept behind these levels is that after a significant price move, prices tend to retrace a predictable portion of that move before continuing in the original direction.

Fibonacci trading strategies are commonly used in forex trading due to their accuracy and reliability.

Traders use these retracement levels along with other technical indicators to determine entry and exit points for trades.

Additionally, traders may also employ Fibonacci extensions in forex trading which help predict future price movements beyond the initial retracement level.

Overall, understanding and using Fibonacci retracements and extensions can greatly improve a trader’s ability to make informed decisions about when to buy or sell currency pairs.

The Forex Fibo Strong System

The Forex Fibo Strong System is a trading strategy based on the principles of Fibonacci retracements and extensions.

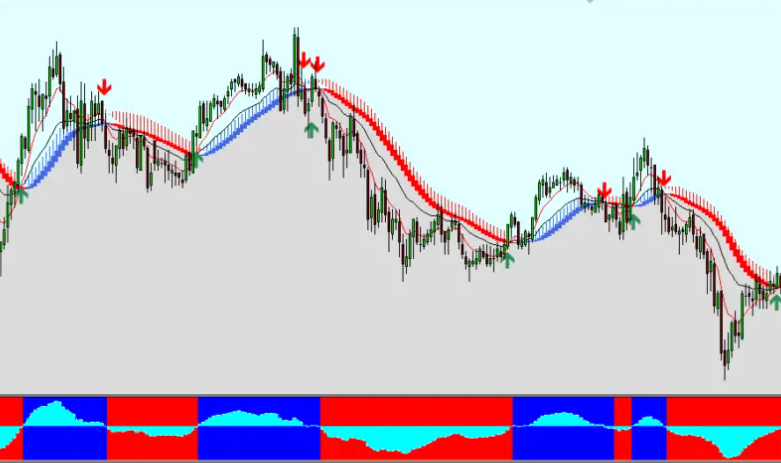

The system aims to identify profitable trades by analyzing trend direction and momentum.

To determine trend direction, traders can use technical indicators such as moving averages or price action analysis, while momentum can be measured through indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD).

Overview of the system

An introduction to the methodology and application of a highly effective trading strategy designed for optimal market analysis is the Forex Fibo Strong System. This system uses Fibonacci retracements to identify potential levels of support and resistance, allowing traders to enter trades with high probability of success.

The system also incorporates other technical indicators such as moving averages and trend lines to confirm potential trade setups. Benefits of using the system include its simplicity and ease of use, making it an ideal choice for both novice and experienced traders alike.

Additionally, its high accuracy rate allows for consistent profits over time, which can be measured using performance metrics such as win/loss ratio and average profit per trade. Overall, the Forex Fibo Strong System offers a reliable approach to trading that can lead to long-term success in the foreign exchange market.

Rules for identifying trend direction and momentum

This section outlines the rules for determining trend direction and momentum, which are crucial components of the Forex trading strategy discussed in the previous section. Using Fibonacci retracement in trading is a popular method for identifying potential levels of support and resistance based on key price levels.

Traders can use these levels to determine trend direction and momentum by observing how prices react when they approach or bounce off these levels. One common mistake traders make when identifying trend direction is relying solely on one indicator or signal. It’s important to look at multiple indicators, such as moving averages, chart patterns, and market sentiment, to confirm a trend before making any trades.

Additionally, traders should pay attention to changes in momentum by monitoring volume and price action. If there is a significant shift in either of these factors, it may indicate a change in trend direction or strength of the current trend. By following these guidelines for identifying trend direction and momentum, traders can make more informed decisions when executing their Forex trading strategies using the Fib Strong System.

Benefits of the Forex Fibo Strong System

The Forex Fibo Strong System is a user-friendly trading system that caters to traders of all experience levels. Its simplicity lies in its ability to identify entry and exit points through the use of Fibonacci retracement levels.

The effectiveness of this system has been proven by its ability to generate consistent profits for traders who have utilized it.

User-friendly for traders of all experience levels

Traders with varying levels of experience can effectively navigate and utilize the user-friendly features of this system.

The Forex Fibo Strong System is designed to cater to traders who are still learning the ropes of forex trading. It offers an intuitive interface that simplifies complex technical analysis and trading strategies, making it accessible even for novice traders. Additionally, the system provides educational resources that aid in improving trading psychology for beginners.

The Forex Fibo Strong System also incorporates technical analysis tools that are useful for novice traders. These tools include charting software, trend indicators, and Fibonacci retracement levels; all designed to help identify potential entry and exit points in trades.

By providing these technical analysis tools, the system assists experienced traders in conducting more precise market analyses while remaining easy enough for novices to use without feeling overwhelmed or intimidated by the vast amount of information available in forex trading.

Simplicity and effectiveness in identifying entry and exit points

Efficient identification of entry and exit points in trading can significantly affect a trader’s profits, and the simplicity and effectiveness of this current section’s strategies may evoke confidence in traders looking to improve their trading results.

The Forex Fibo Strong System uses Fibonacci retracement levels as an indicator for entry and exit points. This strategy is widely used by traders globally because it allows them to analyze price movements from different timeframes. In real-time trading, this system helps traders identify potential reversal or continuation patterns accurately.

When compared with other trading systems available in the market, the Forex Fibo Strong System stands out due to its simplicity and ease of use. Traders do not require advanced knowledge or experience to understand how this system works. Moreover, since it is based on Fibonacci retracement levels, it eliminates the need for complex technical indicators that are difficult to comprehend for novice traders.

By using this system, traders can avoid overcomplicating their analysis while still making profitable trades based on precise entry and exit points.

Conclusion

In conclusion, the Forex Fibo Strong System is a powerful tool for traders to use in their technical analysis. By understanding Fibonacci retracement levels and how they relate to price action, traders can identify potential entry and exit points with greater accuracy.

The system’s use of multiple timeframes allows for a more comprehensive view of market trends and increases the likelihood of successful trades.

The benefits of the Forex Fibo Strong System include its simplicity and effectiveness. Traders can easily incorporate it into their existing trading strategies or use it as a standalone method.

Additionally, the system’s ability to adapt to different market conditions makes it a versatile tool for both novice and experienced traders alike. By utilizing this system, traders can improve their chances of success in the highly competitive world of forex trading.