Forex Cycles Indicator For Mt4 Review

The foreign exchange (forex) market is a complex and ever-changing landscape, where traders must rely on a variety of tools and indicators to make informed decisions. One such tool that has gained popularity in recent years is the Forex Cycles Indicator for MT4.

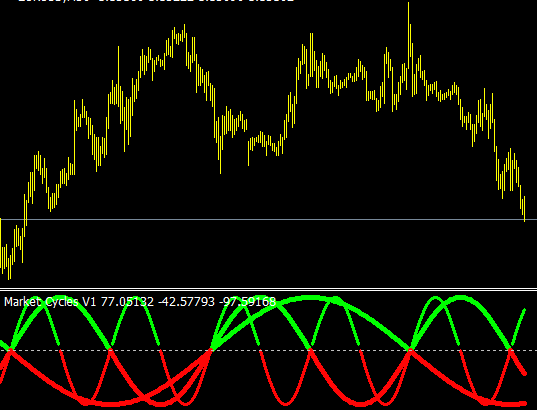

This powerful indicator uses advanced algorithms to identify cyclical patterns in price movements, helping traders to better understand market trends and make more profitable trades. At its core, the Forex Cycles Indicator analyzes the historical price data of a given currency pair to identify repeating patterns or cycles.

These cycles can range from short-term fluctuations lasting just hours or days, to long-term trends spanning several months or years. By identifying these patterns, traders can gain insights into future price movements and adjust their trading strategies accordingly.

Download Free Forex Cycles Indicator For Mt4

The Forex Cycles Indicator is particularly useful for those who employ technical analysis methods in their trading approach, as it provides valuable information about support and resistance levels, trend lines, and other key indicators.

How Does the Forex Cycles Indicator Work?

The Forex Cycles Indicator is a technical analysis tool that can be used to identify potential trading opportunities in the forex market.

It works by analyzing historical price patterns and cycles, as well as current market conditions, to determine whether a particular currency pair is trending or ranging.

By doing so, it can help traders make more informed decisions about when to enter or exit positions.

In terms of its mechanism of operation, the Forex Cycles Indicator relies on both technical analysis and trading psychology.

Technical analysis involves studying charts and other data to identify patterns and trends that may indicate future price movements.

Trading psychology refers to the emotional and mental processes that influence trader behavior, such as fear, greed, and discipline.

By incorporating both of these factors into its calculations, the Forex Cycles Indicator aims to provide a comprehensive view of the forex market that can help traders make better-informed decisions about their trades.

Benefits of Using the Forex Cycles Indicator

Maximizing profits and minimizing losses is the ultimate goal of any trader in the Forex market. The Forex Cycles Indicator for MT4 can help achieve this by providing accurate predictions of price movements based on historical data analysis.

By using this indicator, traders can make informed decisions and take advantage of profitable trading opportunities while avoiding potential losses.

Furthermore, gaining a competitive advantage in the market is crucial for success as traders face tough competition from other market participants. With its advanced algorithms and real-time analysis capabilities, the Forex Cycles Indicator provides a significant edge to traders looking to outperform their peers.

This tool helps identify trends before they become apparent to others in the market, allowing traders to make trades with greater confidence and accuracy.

Ultimately, utilizing the Forex Cycles Indicator can lead to increased profitability while minimizing risks associated with trading in an unpredictable market environment.

Maximizing Profits and Minimizing Losses

By identifying and utilizing effective strategies for profit maximization and loss reduction, traders can better navigate the market cycles and optimize their investment outcomes. Risk management techniques play a significant role in achieving these goals.

Traders should utilize stop-loss orders to limit potential losses in case the market moves against their position. Additionally, they can diversify their portfolio by spreading their investments across different currency pairs, asset classes, or markets. This approach reduces exposure to any single risk factor and improves overall portfolio performance.

Technical analysis principles are another critical tool that traders can use to maximize profits while minimizing losses. For instance, traders can use support and resistance levels to identify buy/sell signals in the market trends. They can also apply indicators like moving averages or oscillators to gauge market momentum and determine entry/exit points for trades.

Moreover, traders should keep up with economic news releases that may affect the markets’ direction and adjust their trading strategies accordingly. By combining these risk management techniques with technical analysis principles, traders can gain a competitive edge in the forex markets and achieve consistent profitability over time.

Gaining a Competitive Advantage in the Market

Developing a competitive advantage in the market requires traders to utilize effective risk management techniques, technical analysis principles, and stay up-to-date with economic news releases.

The first step towards gaining an edge over other traders is by conducting thorough market analysis. This involves monitoring price trends, identifying key support and resistance levels, and analyzing trading volumes to understand market sentiment. Traders must also be well-versed in using technical indicators such as moving averages, oscillators, and trend lines to make informed trading decisions.

Another important aspect of gaining a competitive advantage in the forex market is understanding trading psychology. Traders must learn how to control their emotions during periods of high volatility or when experiencing losses to prevent making irrational decisions that can lead to further losses. They must also have a disciplined approach to trading by setting realistic goals and sticking to their strategies without deviating from them based on emotion or impulse.

Successful traders not only have a solid grasp of fundamental and technical analysis principles but also possess strong psychological resilience that helps them navigate the ups and downs of the forex market with confidence.

How to Use the Forex Cycles Indicator in Your Trading Strategy

Setting parameters and customizing alerts are crucial steps in utilizing the Forex Cycles Indicator. Traders must carefully tailor the indicator to their trading style, risk tolerance, and desired level of sensitivity.

Additionally, incorporating the indicator into an existing trading plan requires a thorough understanding of its strengths and limitations within different market conditions.

Setting Parameters and Customizing Alerts

This section provides guidance on parameter setting and alert customization to optimize the performance of the Forex Cycles Indicator in trading strategies.

The parameters of the indicator allow traders to adjust settings such as cycle length, smoothing period, and trend filtering options. By adjusting these parameters, traders can customize their charts to fit their specific needs and improve the accuracy of their trading signals.

Creating alerts is another important aspect of using the Forex Cycles Indicator in a trading strategy. Traders can set alerts for specific market conditions such as when a cycle high or low is reached or when a trend reversal occurs. These alerts can be sent via email, SMS, or pop-up notifications within MetaTrader 4 (MT4).

Customizing alerts ensures that traders never miss an important market event and allows them to respond quickly to changes in market conditions. Overall, adjusting parameters and creating customized alerts are essential steps for optimizing the performance of the Forex Cycles Indicator in a trading strategy.

Incorporating the Indicator into Your Existing Trading Plan

Integrating the previously established Forex Cycles Indicator into an existing trading plan requires a thorough understanding of how the indicator aligns with one’s overall strategy. One must consider how the indicator can complement their current approach to trading and identify potential areas for improvement. This includes assessing whether incorporating the indicator will lead to any conflicts or inconsistencies within their existing plan.

Additionally, traders must evaluate how using this new tool may impact their risk management strategies and adjust accordingly. Trading psychology considerations should also be taken into account when integrating the Forex Cycles Indicator into a trading plan. Traders must ensure that they understand both the benefits and limitations of using this tool, as well as any potential emotional biases that may arise from relying on it too heavily.

Finally, backtesting and optimizing the indicator is crucial before fully incorporating it into one’s trading approach. By testing various settings and parameters under different market conditions, traders can gain insight into the best ways to use this tool in conjunction with their existing strategy, ultimately improving their chances of success in trading.

Conclusion

In conclusion, the Forex Cycles Indicator is a powerful tool that can help traders identify trends in the foreign exchange market. This indicator works by analyzing historical price data and identifying cyclical patterns that occur over time. By using this information, traders can make more informed decisions about when to buy or sell currency pairs.

One of the key benefits of using this indicator is that it can help traders avoid making emotional decisions based on short-term fluctuations in the market. Instead, they can focus on long-term trends and use this information to develop a more effective trading strategy.

Additionally, because the Forex Cycles Indicator is available as an MT4 plugin, it is easy for traders to integrate into their existing trading platforms.

Overall, if you are looking for a way to improve your forex trading performance, then the Forex Cycles Indicator may be just what you need. By providing valuable insights into market trends and helping you make more informed trading decisions, this tool can help you achieve greater success in your forex trading endeavors.