Forex Cycle System Review

The foreign exchange market, also known as forex, is one of the largest financial markets in the world. It is a decentralized market where currencies are traded 24/7 across different time zones. Despite its popularity and potential for high returns, trading in this market can be complex and challenging.

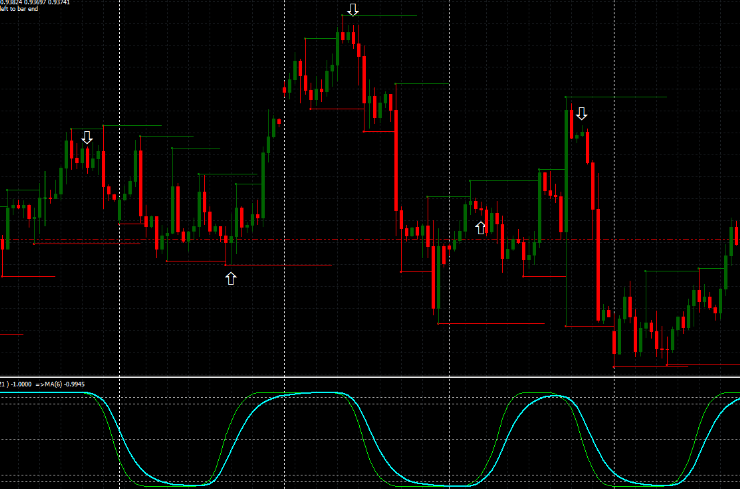

Forex cycle system is a trading strategy that aims to simplify the process of trading by identifying cyclical patterns in currency pairs. Forex cycle system uses technical analysis tools to identify trends and cycles in the forex market. The system analyzes price movements over a certain period of time and identifies recurring patterns that can be used to make profitable trades.

Download Free Forex Cycle System

The goal of forex cycle system is to enter trades at the right time during these cycles, maximizing profits while minimizing risks. In this article, we will explore how forex cycle system works, its benefits and drawbacks, and whether it can help traders achieve success in the highly competitive forex market.

How Does Forex Cycle System Work?

The mechanics of the aforementioned trading strategy involve identifying market cycles in currency prices through analysis of historical market data.

Forex cycle indicators are used to identify these cycles, which occur due to various factors such as economic events, geopolitical tensions, and global financial trends.

Once identified, traders can make informed decisions regarding entry and exit points for trades.

Forex cycle indicators work by analyzing past price movements and identifying patterns that indicate a particular trend or cycle in the market.

These indicators include moving averages, oscillators, and Fibonacci retracements among others.

By using these tools to analyze historical data, traders can determine when a particular currency is likely to enter into an uptrend or downtrend phase.

This information can then be used to make informed decisions about when to buy or sell currencies based on their predicted future performance in the market.

Overall, understanding how forex cycle systems work is essential for any trader looking to maximize profits while minimizing risk in this highly volatile marketplace.

Benefits of Using Forex Cycle System

This approach to trading offers a multitude of advantages, including the ability to analyze market trends and make informed decisions based on historical data.

The forex cycle system is a popular tool used by experienced traders to identify potential entry and exit points in the market. By analyzing historical price patterns, traders can gain insight into the cyclical nature of currency pairs and use this information to develop effective trading strategies.

One of the key benefits of using the forex cycle system is its ability to provide a comprehensive view of market trends over time. Traders can use this information to identify potential support and resistance levels, as well as key price points that may indicate an upcoming trend reversal.

Additionally, by analyzing past cycles, traders can gain insight into how certain economic events or geopolitical factors may impact currency prices in the future. This allows them to make more informed decisions when developing their trading strategies and reduce their exposure to risk.

Overall, the forex cycle system is an invaluable tool for any trader looking to improve their market analysis skills and maximize their profits in the foreign exchange market.

Drawbacks of Using Forex Cycle System

One potential limitation of using the Forex Cycle System in trading is that it heavily relies on historical data. Many traders use this system to identify patterns and predict future trends based on past market behavior. However, there is no guarantee that these patterns will continue in the same way, as market conditions can change quickly and unexpectedly. This means that traders using the Forex Cycle System may be vulnerable to false signals or inaccurate predictions.

Additionally, while the Forex Cycle System can be effective in certain market conditions, it may not always be the best strategy for all situations. Traders should consider alternative strategies or approaches depending on their goals and risk tolerance.

For example, some traders may prefer a more fundamental analysis-based approach that takes into account current events and news affecting currency markets rather than relying solely on technical indicators from past data. Ultimately, finding success in trading requires flexibility and adaptability to changing market conditions and a willingness to explore different approaches beyond any one particular system or methodology.

Therefore, it’s important for traders to recognize the potential drawbacks of using the Forex Cycle System and to consider other options when necessary. This can help them make more informed decisions and increase their chances of success in the dynamic and often unpredictable world of forex trading.

Conclusion

The Forex Cycle System is a popular trading strategy that aims to identify market cycles and trends in order to make profitable trades. The system utilizes technical indicators and analysis to predict future price movements based on past market behavior.

While the Forex Cycle System can provide traders with valuable insights into market dynamics, it is not foolproof and carries its own set of limitations. One benefit of using the Forex Cycle System is its ability to help traders spot potential trading opportunities by analyzing historical data and identifying patterns in the market. Additionally, the system provides traders with a clear understanding of where they should enter or exit positions for maximum profitability.

However, one drawback is that while the system may identify trends accurately, it cannot account for unforeseeable events that may cause sudden price fluctuations or market volatility. In conclusion, while the Forex Cycle System can be an effective tool for predicting market trends and making profitable trades, it has limitations that must be taken into consideration.

Traders who choose to utilize this strategy should do so with caution and use additional research and analysis to supplement their decision-making process. Ultimately, success in Forex trading requires a well-rounded approach that takes into account both technical analysis as well as fundamental factors such as economic news and global events.