Fibonacci Pivot Lines For Mt4 Review

Fibonacci pivot lines are a popular tool used by traders to identify potential support and resistance levels in the markets. These pivot lines are based on the Fibonacci sequence, a mathematical pattern that can be found throughout nature and has been applied to financial analysis for many years.

By using Fibonacci ratios and levels, traders can make more informed trading decisions and potentially increase their profits.

In this article, we will discuss how to calculate Fibonacci pivot lines for MT4 and how you can use them in your trading strategy. We will also provide step-by-step instructions on how to set up these pivot lines on your MT4 platform.

Download Free Fibonacci Pivot Lines For Mt4

Whether you are a beginner or an experienced trader, understanding how Fibonacci pivot lines work can be a valuable addition to your technical analysis toolkit.

Understanding Fibonacci Ratios and the Fibonacci Sequence

The current section explores the mathematical concepts of Fibonacci ratios and the Fibonacci sequence, which are commonly used in financial analysis and trading strategies.

Applying Fibonacci ratios to technical analysis involves using key levels derived from the Fibonacci sequence to predict potential support and resistance levels in financial markets. The ratios most commonly used in trading are 38.2%, 50%, and 61.8%, which are calculated by dividing a number in the sequence by its previous number or by skipping one number.

The history and origins of Fibonacci sequence in trading go back to the early 20th century when traders started noticing that certain retracement levels align with numbers from the Fibonacci sequence. However, it was not until later that traders began incorporating these levels into their technical analysis methods for predicting future price movements.

Today, many traders use Fibonacci pivot lines as part of their overall strategy for identifying potential entry and exit points based on historical price patterns and trends in financial markets.

Calculating Fibonacci Pivot Lines for MT4

Using high, low, and close prices from previous trading sessions is a common method for calculating Fibonacci pivot lines in MT4.

This involves identifying the highest and lowest prices during a given time frame and using them to calculate potential support and resistance levels.

By applying Fibonacci ratios to these levels, traders can gain insights into possible price movements and make more informed decisions about their trades.

Using High, Low, and Close Prices from Previous Trading Sessions

By incorporating historical prices of high, low, and close from previous trading sessions, traders can potentially gain valuable insights into the market’s behavior and make informed decisions based on this data.

The Fibonacci pivot lines for MT4 utilize a combination of these historical prices to calculate the support and resistance levels of the current trading session. This method is built upon two primary calculations: the pivot point calculation and the Fibonacci retracement levels.

To calculate the pivot point, traders must first take the sum of the high, low, and close prices from the previous session and divide it by three. This value becomes their baseline for calculating support and resistance levels. From there, they can use basic arithmetic to determine additional support and resistance levels above or below this baseline.

The Fibonacci retracement levels are then used to fine-tune these levels further using ratios derived from the famous Fibonacci sequence. By utilizing both pivot point calculation methods and Fibonnaci retracement techniques in conjunction with past price data, traders may be able to make more informed trading decisions than they would otherwise be capable of making.

Identifying Potential Support and Resistance Levels

Identifying potential support and resistance levels can offer traders a valuable tool for making informed decisions based on historical price data. Fibonacci pivot line benefits include the ability to identify these levels with greater accuracy, facilitating more precise entry and exit points in trading.

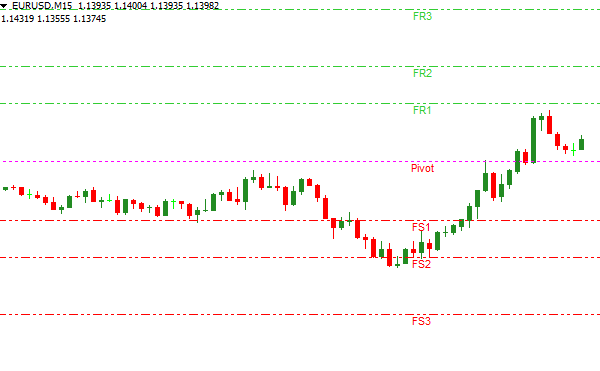

The use of Fibonacci sequences in other trading indicators has also gained popularity due to its reliability in predicting market trends. Fibonacci pivot lines are calculated based on the previous day’s high, low, and close prices. These lines provide traders with potential areas of support and resistance that can aid in determining where to enter or exit a trade.

By using key levels from the Fibonacci sequence, traders can take advantage of natural market movements that occur at these levels. Additionally, incorporating Fibonacci sequences into other technical analysis tools such as moving averages or oscillators may provide further insight into market behavior.

Overall, identifying potential support and resistance levels through the use of Fibonacci pivot lines can be a useful addition to any trader’s toolkit when analyzing past price data for future market predictions.

Using Fibonacci Pivot Lines in Your Trading Strategy

Incorporating the principles of Fibonacci retracements into a broader trading approach can provide traders with a valuable tool for identifying potential support and resistance levels. One application of this is through the use of Fibonacci pivot lines, which are derived from the same mathematical sequence as Fibonacci retracement levels but are calculated in a different way. These pivot lines can be used to identify key areas on a price chart where there may be significant buying or selling pressure.

To incorporate Fibonacci pivot lines into trend analysis, traders can follow these steps:

- Identify the high and low points of the previous trend.

- Calculate the pivot point by adding together the high, low, and close prices from that period and dividing by three.

- Calculate two resistance levels above the pivot point by multiplying the difference between the high and low prices by 0.618 and 1 respectively, then adding them to the pivot point.

- Calculate two support levels below the pivot point using similar calculations but multiplying by 0.382 and 0 respectively instead.

By using these calculations, traders can have a better understanding of where to place their trades based on potential market movements. However, it is important to note that like any technical analysis tool, Fibonacci pivot lines should be used in conjunction with other indicators and not relied upon solely for making trading decisions.

Setting Up Fibonacci Pivot Lines on Your MT4 Platform

Using Fibonacci Pivot Lines in your trading strategy can be a valuable tool in identifying potential support and resistance levels. However, setting up these lines on your MT4 platform can be challenging for some traders.

In this subtopic, we will guide you through the process of setting up Fibonacci Pivot Lines on your MT4 platform. To set up Fibonacci Pivot Lines on your MT4 platform, you need to start by opening the indicator list and selecting the ‘Fibonacci Pivots’ option. You can then customize the colors and adjust timeframes according to your preferences.

Once you have selected ‘Fibonacci Pivots,’ a new window will appear that allows you to adjust various settings such as pivot method, length, and style. Additionally, if necessary, you can change the line color or width of each level to make them more visible on your chart. After customizing these settings, click ‘OK,’ and the Fibonacci Pivot Lines will appear on your chart.

Overall, setting up Fibonacci Pivot Lines may seem complex at first but is relatively straightforward with proper guidance. By utilizing this tool effectively in conjunction with other technical indicators and price action analysis within a sound trading strategy framework, it is possible to improve trading performance substantially over time.

Conclusion

The Fibonacci Pivot Lines for MT4 provide traders with a powerful tool to add to their trading strategy. By understanding the principles of the Fibonacci sequence and ratios, traders can use these pivot lines to identify key levels of support and resistance in the market.

Through careful calculation and analysis, traders can utilize these pivot lines to make informed decisions about entry and exit points for trades. The process of setting up Fibonacci Pivot Lines on your MT4 platform is simple yet effective. By customizing your chart settings to include these lines, you can quickly identify important price levels that may influence market behavior.

With this information at your disposal, you can better anticipate potential trends and adjust your trading strategies accordingly. Overall, incorporating Fibonacci Pivot Lines into your trading approach offers an objective and analytical way to analyze market data and make informed trading decisions.