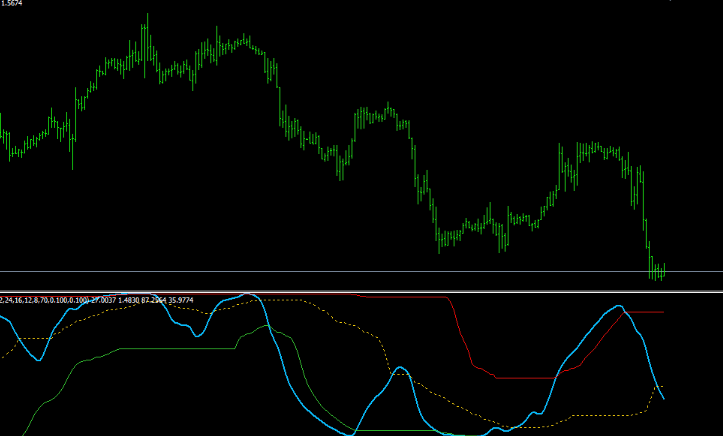

Dynamic Zone Rsi Macd Mt4 Indicator Review

The Dynamic Zone Rsi Macd MT4 Indicator is a popular trading tool used by many traders. It combines two well-known technical indicators, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), to generate accurate buy and sell signals.

This indicator is widely used in the Forex market, but it can also be applied to other financial markets. The RSI and MACD are both momentum indicators that provide valuable information about market trends. The RSI measures the strength of price movements, while the MACD tracks changes in trend direction.

Download Free Dynamic Zone Rsi Macd Mt4 Indicator

Combining these two indicators creates a powerful tool for identifying entry and exit points in the market. The Dynamic Zone Rsi Macd MT4 Indicator uses a unique algorithm that enhances signal accuracy, allowing traders to make informed decisions about their trades.

Overview of the Dynamic Zone Rsi Macd MT4 Indicator

This section provides an informative overview of a technical analysis tool that has the potential to aid traders in making informed decisions, enhancing their chances of success in the financial markets. The Dynamic Zone Rsi Macd MT4 Indicator is a popular tool used by traders for technical analysis and developing trading strategies.

This indicator combines two widely used indicators, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), with a unique feature called the dynamic zone oscillator. The RSI measures market momentum by comparing recent gains to recent losses, while the MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices.

The dynamic zone oscillator acts as a filter for these two indicators and helps identify oversold or overbought conditions in the market. Traders can use this information to make more informed decisions about when to enter or exit trades and develop profitable trading strategies based on market trends and signals.

The Power of Combining RSI and MACD

The combination of Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) is a popular trading strategy among technical analysts. These two indicators complement each other by providing different perspectives on price trends.

RSI measures the strength of a trend, while MACD identifies changes in momentum, making them useful for confirming trade signals and identifying trend reversals. Implementing both indicators can bring additional benefits to traders seeking to improve their decision-making process.

How They Complement Each Other

The complementary nature of the indicators is evident in their ability to provide a comprehensive analysis of market conditions, incorporating both momentum and trend-based perspectives. Technical analysis is essential when devising trading strategies, and these two popular indicators offer valuable insights into market trends and price movements.

The RSI measures the strength of buying or selling pressure by comparing average gains and losses over a specified period, while the MACD tracks the relationship between two moving averages. By combining these indicators, traders can gain a better understanding of market conditions and make more informed decisions.

One way that RSI and MACD complement each other is by identifying potential buy or sell signals. For instance, an RSI reading above 70 indicates an overbought condition, suggesting that prices may soon reverse downwards. Meanwhile, a bullish crossover on the MACD histogram indicates upward momentum gaining strength. Together, these signals suggest that it may be time to exit long positions or consider short positions in anticipation of a downward correction.

Overall, by utilizing multiple technical indicators such as RSI and MACD traders can obtain a more accurate picture of market conditions and develop profitable trading strategies based on reliable data-driven insights.

Benefits of Using Both Indicators

By incorporating both trend-based and momentum indicators, traders can gain a more comprehensive understanding of market conditions, allowing for informed decision-making and potentially increasing profitability. The dynamic zone RSI MACD MT4 indicator is an example of two powerful technical analysis tools that work in harmony to provide traders with valuable insights into the market. Understanding the benefits of using these indicators together can help traders develop effective trading strategies.

Here are some benefits of using both indicators:

- By combining trend-based and momentum indicators, traders can identify potential buying or selling opportunities at key levels.

- Using multiple indicators helps reduce false signals, as confirmation from different sources increases the probability of a successful trade.

- These indicators also provide information on market volatility, helping traders manage risk by adjusting position size or setting stop-loss orders accordingly.

- Finally, incorporating both trend-based and momentum indicators allows for a more holistic view of the market, which can help traders stay ahead of trends and make better-informed decisions.

Overall, utilizing both the dynamic zone RSI and MACD MT4 indicator can enhance a trader’s technical analysis arsenal and lead to more profitable trading strategies.

Unique Algorithm for Accurate Signals

The presented subtopic discusses a unique algorithm that generates accurate signals by accounting for market volatility.

The algorithm takes into consideration the dynamic nature of market conditions to produce reliable trading signals.

Through this approach, traders can make informed decisions and potentially increase their profitability in the market.

How Market Volatility is Accounted For

Market volatility is effectively accounted for through the evaluation of price movements and trends, which are analyzed using various technical indicators to identify potential risks and opportunities in the market.

Volatility measurement techniques such as standard deviation, beta, and average true range (ATR) are commonly used by traders to assess fluctuations in prices over a period of time. By analyzing these measures, traders can determine the level of risk associated with a particular investment and make informed decisions about whether or not to enter or exit a position.

In addition to measuring volatility, technical indicators such as the Dynamic Zone RSI MACD MT4 Indicator also account for market volatility by identifying trends in price movement and alerting traders to potential changes in direction. This indicator uses an algorithm that combines two popular technical indicators – Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) – along with a unique dynamic zone component that adjusts based on market conditions.

By incorporating this algorithm into their trading strategies, traders can better manage risk during periods of high volatility while still taking advantage of profitable opportunities presented by changing market conditions.

How Signals are Generated

This section delves into the process of signal generation in trading, which involves analyzing technical indicators to identify patterns and trends that suggest potential entry or exit points for trades. One such indicator is the Dynamic Zone RSI MACD MT4 Indicator. This indicator uses two popular technical indicators – Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) – to generate signals.

To understand how signals are generated using RSI and MACD interpretation, it is important to first understand these indicators. The RSI measures the strength of a security’s price action by comparing upward movements in price to downward movements over a specified period of time. The MACD, on the other hand, measures the relationship between two moving averages of prices. When traders use these two indicators together, they can identify potential trade opportunities based on oversold or overbought conditions (as indicated by the RSI), as well as changes in trend direction (as indicated by the MACD). Trading strategies using RSI and MACD can vary depending on individual preferences, but some common approaches include using crossovers between the two indicators as entry or exit signals, looking for divergences between price action and indicator readings, or simply waiting for extreme readings on either indicator before making a trade decision.

Advantages for Traders

Traders may benefit from the advantages presented by this technical analysis tool, as it allows for more informed decision-making based on quantifiable data. The dynamic zone RSI MACD MT4 indicator provides traders with a clear understanding of market trends and potential entry and exit points. This information can be used to develop effective trading strategies that are grounded in risk management principles.

Some advantages of using the dynamic zone RSI MACD MT4 indicator include:

- Improved accuracy: By providing traders with real-time data, this tool helps to eliminate guesswork and improve the accuracy of trading decisions.

- Increased efficiency: Traders can use the indicator to quickly identify potential opportunities and make informed decisions without spending hours analyzing market data.

- Better risk management: The dynamic zone RSI MACD MT4 indicator can help traders manage their risks by providing them with a clear understanding of market trends and potential entry and exit points.

- Customizable settings: Traders can customize the settings of the indicator to suit their individual needs, allowing them to tailor their trading strategies to specific market conditions.

Frequently Asked Questions

Can the Dynamic Zone Rsi Macd MT4 Indicator be used for scalping or is it more suited for long-term trading?

Scalping strategies are typically used for short-term trading and involve taking advantage of small market movements to generate profits. These types of strategies require quick decision-making and a high level of discipline, as scalpers aim to make multiple trades within a short period of time.

On the other hand, long term trading considerations take into account broader economic trends and may involve holding positions for an extended period before closing them out.

The suitability of the dynamic zone rsi macd mt4 indicator for either scalping or long-term trading will depend on the specific goals and preferences of individual traders. Ultimately, successful use of this indicator will require careful analysis and implementation within a well-defined trading strategy.

How does the indicator determine buy and sell signals based on the RSI and MACD?

The RSI and MACD are commonly used technical indicators that can generate buy and sell signals through their crossover points. The effectiveness of these signals may vary depending on the market conditions, as well as the time frame being analyzed.

In a trending market, the RSI-MACD crossover signals tend to be more reliable than in choppy or sideways markets where false signals may occur frequently. However, it is important to note that no single indicator can provide a fool-proof trading strategy, and it is recommended to use multiple indicators along with price action analysis for better decision-making.

Are there any specific currency pairs or timeframes that the indicator works best with?

When it comes to trading in the foreign exchange market, there are a variety of factors that traders must consider when choosing currency pairs and timeframes. Some of the best currency pairs for trading may include major currencies such as the EUR/USD, USD/JPY, or GBP/USD.

However, it’s important to note that different indicators may work better with certain currency pairs than others. Similarly, ideal timeframes can vary depending on a trader’s individual strategy and preferences.

For example, some traders may prefer shorter timeframes like 5-minute charts while others may favor longer-term charts like daily or weekly ones. Ultimately, selecting the right currency pair and timeframe will depend on a number of factors including market conditions, individual goals and risk tolerance levels.

Is it possible to customize the settings of the indicator to suit individual trading strategies?

Customization options for indicators provide traders with the opportunity to fine-tune their trading strategies and achieve more accurate results.

In terms of swing trading, having the ability to customize an indicator can be particularly useful as it allows for adjustments that take into account individual preferences for risk tolerance, market conditions, and other factors.

An effective indicator for swing trading should offer customization options that allow traders to adjust timeframes, currency pairs, and other parameters in order to maximize profitability.

By utilizing these customization options effectively, traders can enhance their swing trading strategies and improve their chances of success in the markets.

Can the indicator be used in conjunction with other technical analysis tools for more accurate predictions?

Using multiple technical analysis tools can improve the accuracy of market predictions. Fibonacci retracement levels are commonly used to identify potential support and resistance levels in a trend. Integrating these levels with other indicators, such as trend lines, can provide additional confirmation for trading decisions.

The Dynamic Zone Rsi Macd MT4 Indicator is one such tool that can be used in conjunction with others to enhance its effectiveness. By combining this indicator with Fibonacci retracement levels and trend lines, traders may be able to make more informed trades based on the confluence of signals from different sources.

Conclusion

The Dynamic Zone Rsi Macd MT4 Indicator is a powerful tool for traders. By combining the popular technical indicators RSI and MACD, this indicator uses a unique algorithm to generate accurate signals. These signals can help traders make informed decisions about when to enter or exit trades.

One of the advantages of using this indicator is its ability to adapt to changing market conditions. The dynamic zone feature adjusts the sensitivity of the indicator based on market volatility, allowing it to provide reliable signals in both trending and ranging markets.

Additionally, with customizable settings and alerts, traders can tailor the indicator to their specific trading strategies.

In conclusion, the Dynamic Zone Rsi Macd MT4 Indicator offers a valuable tool for traders seeking precise and adaptive technical analysis. With its combination of RSI and MACD and unique algorithm, this indicator provides accurate signals in various market conditions. Traders can benefit from its customizable settings and alerts to optimize their trading strategies. Overall, this indicator presents a powerful opportunity for traders looking to enhance their decision-making capabilities in the forex market.