Dynamic Zone Rsi Oscillator For Mt4 Review

The Relative Strength Index (RSI) is a popular technical analysis indicator used by traders to identify potential buying or selling opportunities in the market.

The traditional RSI calculates the ratio of upward price changes to downward price changes over a specified period of time, typically 14 days. This ratio is then plotted on a scale ranging from 0 to 100, with values above 70 indicating an overbought condition and values below 30 indicating an oversold condition.

Download Free Dynamic Zone Rsi Oscillator For Mt4

However, traders have developed various modifications to the traditional RSI in order to improve its accuracy and effectiveness. One such modification is the Dynamic Zone RSI Oscillator, which incorporates additional parameters to adjust for changing market conditions and provide more precise signals.

In this article, we will explore how the Dynamic Zone RSI Oscillator works and how it can be implemented in MT4 trading platform.

Understanding the Traditional RSI

The present section provides an overview of the traditional RSI, highlighting its mathematical formula, construction, and interpretation as a momentum indicator.

Developed by J. Welles Wilder in 1978, the Relative Strength Index (RSI) is a technical analysis tool used to measure the strength of price action.

The RSI oscillates between 0 and 100 and is calculated using the average gain and loss over a specified period of time.

The formula for calculating RSI involves dividing the average gain by the average loss over a particular period (usually 14 days).

A higher RSI value indicates that gains have been stronger than losses while lower values suggest stronger losses than gains.

Historically significant, RSI remains one of the most widely used indicators in technical analysis today.

Its popularity stems from its ability to signal potential trend reversals and divergences between price action and momentum.

A reading above 70 suggests an asset is overbought while a reading below 30 suggests oversold conditions.

Traders often use these levels as entry or exit points for trades or to confirm existing trends.

However, it’s important to note that like any other technical indicator, RSI has limitations and should be used in conjunction with other tools when making trading decisions.

Introducing the Dynamic Zone RSI Oscillator

This section provides an introduction to a technical analysis tool that utilizes a unique formula to generate signals based on RSI readings, allowing traders to identify potential trend reversals and momentum shifts in the market.

The dynamic zone RSI oscillator was developed by Robert Miner, who sought to improve upon the traditional RSI by incorporating additional parameters that adjust for changing levels of volatility in the market.

One advantage of using the dynamic zone RSI oscillator is its ability to adapt to different market conditions. Unlike traditional oscillators, which may give false signals during periods of high volatility or low trading volume, the dynamic zone RSI takes into account these factors and adjusts its calculations accordingly.

Additionally, because it combines elements of both trend-following and momentum-based indicators, it can provide more nuanced insights into market movements. However, some traders may find it difficult to use due to its complexity and reliance on multiple variables.

Furthermore, while it has been shown to be effective in certain situations, it should not be relied upon as a standalone indicator and should always be used in conjunction with other analytical tools.

How the Dynamic Zone RSI Oscillator Works

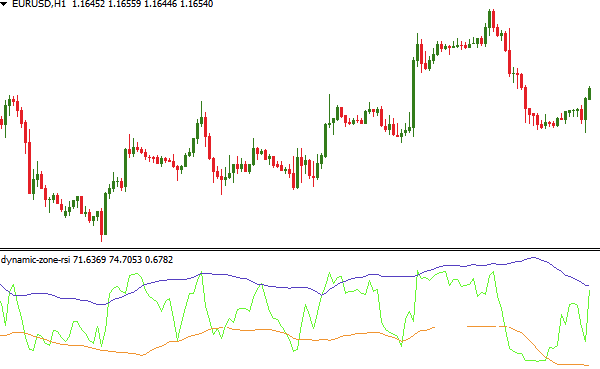

Understanding the mechanics of the formula behind the Dynamic Zone RSI Oscillator is crucial for traders who want to utilize this technical analysis tool effectively. The oscillator is based on two variations of the Relative Strength Index (RSI), which measures market momentum and identifies potential overbought or oversold conditions.

The first RSI variation calculates a standard RSI, while the second one uses a moving average to smooth out price fluctuations. These two RSIs are then combined in a formula that creates an oscillator that oscillates above and below zero.

The Dynamic Zone Oscillator generates trading signals by identifying when price movements are trending upwards or downwards. When prices are trending upwards, the oscillator will remain above zero, indicating bullish momentum. Conversely, when prices trend downwards, the oscillator will remain below zero, indicating bearish momentum.

Traders can use these signals to enter trades in line with market trends and exit positions before significant reversals occur. By understanding how this technical analysis tool works, traders can incorporate it into their trading strategies more effectively and potentially improve their overall profitability in financial markets.

Implementing the Dynamic Zone RSI Oscillator in MT4

Traders can enhance their technical analysis capabilities by incorporating the Dynamic Zone RSI Oscillator into their MT4 platform. This indicator is a momentum-based oscillator that generates trading signals based on overbought and oversold conditions in the market. The indicator measures the strength of price movements and helps traders identify potential trend reversals.

To implement this indicator, traders would need to download and install it onto their MT4 platform. Once installed, they can customize the settings according to their preferences, such as changing the period length or adjusting the levels for overbought and oversold conditions.

Backtesting results have shown that the Dynamic Zone RSI Oscillator can be an effective tool for identifying trend reversals and generating profitable trades. Traders can use this indicator in conjunction with other technical analysis tools such as moving averages or support and resistance levels to confirm trading signals and improve accuracy.

Additionally, traders can set up alerts within MT4 to notify them when certain conditions are met, allowing them to stay on top of market movements even when away from their computer screens. Overall, implementing the Dynamic Zone RSI Oscillator in MT4 provides traders with a powerful momentum-based tool that has been proven to generate successful trading signals when used correctly.

Conclusion

In conclusion, the Dynamic Zone RSI Oscillator is a powerful tool for traders looking to identify overbought and oversold conditions in the market. By incorporating a dynamic zone that adjusts to changing market conditions, this oscillator provides more accurate signals than traditional RSI indicators.

Traders can use the Dynamic Zone RSI Oscillator in conjunction with other technical analysis tools to confirm trading decisions and improve their overall profitability.

Implementing the Dynamic Zone RSI Oscillator in MT4 is relatively straightforward, as it is readily available as an indicator on most trading platforms. However, it is important for traders to understand how this oscillator works and how to interpret its signals before using it in live trading.

With proper education and practice, traders can effectively incorporate the Dynamic Zone RSI Oscillator into their trading strategies and achieve greater success in the markets.