Double Top & Bottom Pattern Indicator For Mt4 Review

Technical analysis is a popular method used by traders to identify potential market trends and trading opportunities. One of the most common patterns used in technical analysis is the double top and bottom pattern, which can indicate a potential trend reversal.

However, identifying this pattern manually can be time-consuming and challenging. That’s where the double top and bottom pattern indicator for MT4 comes in handy. The double top and bottom pattern indicator for MT4 is a tool designed to help traders identify these patterns quickly and easily.

Download Free Double Top & Bottom Pattern Indicator For Mt4

This indicator identifies two peaks or valleys that are roughly equal in price, indicating a possible resistance or support level. Traders can use this information to make informed decisions about their trades, potentially increasing their profits while minimizing risk.

In this article, we will take a closer look at the double top and bottom pattern indicator for MT4, how it works, and how you can use it to improve your trading strategies.

Understanding the Double Top & Bottom Pattern

The comprehension of the Double Top & Bottom pattern is a vital aspect in technical analysis, as it provides traders with insights into potential market reversals and aids them in making informed trading decisions.

This chart pattern consists of two consecutive peaks or troughs that are almost identical in height, separated by a minor retracement. These peaks or troughs are also referred to as ‘shoulders’ while the retracement between them is called the ‘neckline’.

Identifying signals for this pattern include one peak or trough followed by a minor retracement, another peak or trough that fails to surpass the first one and ends up forming a similar level before experiencing a sharp decline.

Once traders identify such signals on their charts, they can use various trading strategies to capitalize on the impending trend reversal. For instance, if they notice a double top formation where prices have reached an area of resistance twice without breaking through it, traders can open short positions at the neckline’s breakout point with their stop-loss set above both shoulders.

Conversely, when there is a double bottom formation where prices have hit support levels twice without breaking below it, traders can open long positions at the neckline’s breakout point with their stop-loss set below both bottoms.

Overall, understanding and being able to identify this chart pattern is critical for traders interested in using technical analysis tools to make informed trading decisions.

Overview of the Double Top & Bottom Pattern Indicator for MT4

This section provides a comprehensive overview of an analytical tool that can assist traders in identifying potential reversal points in the financial markets, thereby enabling them to make informed decisions about their trading strategies.

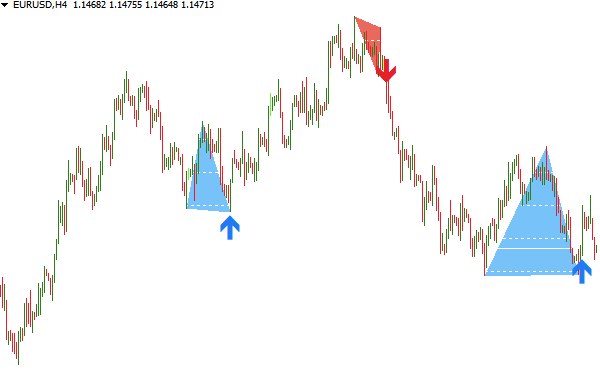

The Double Top & Bottom Pattern Indicator for MT4 is a technical analysis tool that identifies two patterns, the double top and double bottom formations. These formations are characterized by two highs or lows at approximately the same price level, separated by a trough or peak.

The Double Top & Bottom Pattern Indicator for MT4 utilizes chart patterns and trend lines to identify potential reversal points in the market. It can be used on any time frame and is compatible with all currency pairs, stocks, and commodities.

Traders can use this indicator to help identify potential entry and exit points for their trading strategies based on these pattern formations. Additionally, it offers visual alerts and sound notifications when these patterns occur on the chart, making it easier for traders to stay up-to-date with market analysis.

How to Use the Double Top & Bottom Pattern Indicator for MT4 to Improve Your Trading

By incorporating the Double Top & Bottom Pattern Indicator for MT4 into their trading strategies, traders can potentially improve their decision-making processes and increase the likelihood of success in the financial markets.

This technical tool allows traders to identify trading opportunities that may have been overlooked otherwise. The indicator works by identifying a specific pattern in price action that consists of two peaks (for a double top) or two troughs (for a double bottom) with a moderate decline or rise in between them.

To use this indicator effectively, it is recommended to first backtest its effectiveness on historical market data before implementing it in live trades. Backtesting involves testing the indicator’s signals against past market data to see how accurate they would have been if used at that time.

This helps traders determine if the indicator is suitable for their trading style and risk tolerance. Once confident in its effectiveness, traders can then use the Double Top & Bottom Pattern Indicator for MT4 as part of their overall technical analysis strategy to potentially improve their chances of success in the financial markets.

Conclusion

The Double Top & Bottom Pattern Indicator for MT4 is a technical analysis tool used to identify potential reversal patterns in price charts. By analyzing the formation of two peaks (in the case of double tops) or two troughs (in the case of double bottoms) at nearly the same level, traders can gain insight into possible shifts in market sentiment.

This indicator helps traders make more informed decisions by providing visual cues that signal when to enter or exit trades. Overall, the Double Top & Bottom Pattern Indicator for MT4 is a useful tool for traders who want to improve their ability to identify and act on potentially profitable trends.

By understanding how this indicator works and incorporating it into one’s trading strategy, traders can increase their chances of success in the highly competitive world of forex trading. While no technical analysis tool can guarantee profits, using indicators like this one can help traders stay ahead of market trends and make more informed decisions about when to buy, sell or hold positions.