Double Stochastic Rsi Multicolor Filtered 2 Indicator Review

Technical indicators play a crucial role in trading decisions as they help traders analyze price movements and identify potential entry and exit points.

One such indicator is the Double Stochastic RSI Multicolor Filtered 2 Indicator, which combines two popular technical analysis tools – the stochastic oscillator and relative strength index (RSI).

This indicator provides traders with an accurate reading of market momentum by measuring the oversold or overbought conditions of an asset.

Download Free Double Stochastic Rsi Multicolor Filtered 2 Indicator

The Double Stochastic RSI Multicolor Filtered 2 Indicator is a versatile tool that can be used across multiple timeframes and asset classes.

It is particularly useful for short-term traders who aim to capture quick profits from intra-day price movements.

However, like all technical indicators, it has its limitations, and traders must exercise caution in relying solely on this tool for their trading decisions.

In this article, we will dive deeper into the mechanics of the Double Stochastic RSI Multicolor Filtered 2 Indicator, discuss how it works, and explore ways to incorporate it into your trading strategy.

Understanding the Double Stochastic RSI Indicator

The current section provides an explanation of a technical analysis tool that combines two commonly used indicators to provide insight into market momentum and potential trend reversals.

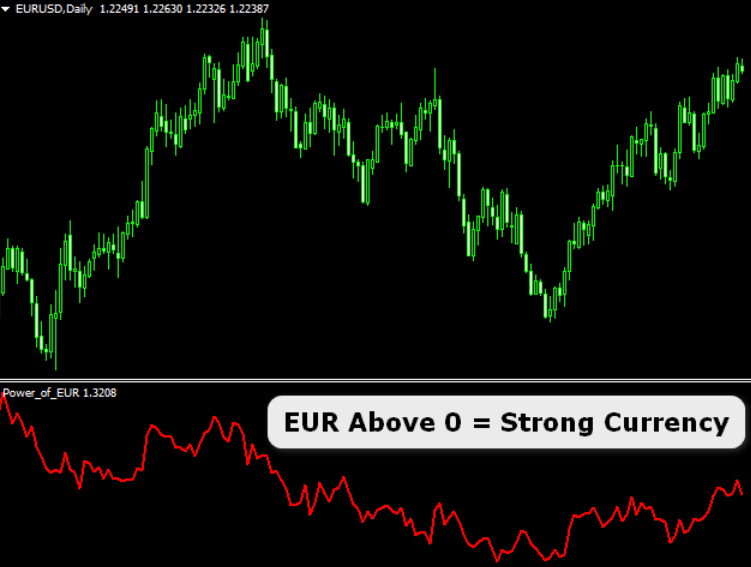

The Double Stochastic RSI (Relative Strength Index) indicator is a popular trading tool that measures the strength of price movements in relation to their own recent performance. It calculates values based on the closing prices of an asset for a specified period, typically 14 days, and compares these values against the highest high and lowest low during the same period.

Interpreting signals from the Double Stochastic RSI indicator involves understanding how it works and what it represents. A reading above 70 is considered overbought, suggesting that buyers have pushed prices up too far, while a reading below 30 is considered oversold, indicating that sellers have driven prices down too low.

Traders may use this information to identify potential buying or selling opportunities as well as possible trend reversals. However, like all technical analysis tools, it should be used in conjunction with other methods to confirm signals and reduce risk.

How the Multicolor Filtered 2 Indicator Works

This section provides an explanation of the functioning of a technical tool used in trading known as the Multicolor Filtered 2 Indicator.

This indicator is designed to filter market data, identify trends, and price reversals by using a complex algorithm that combines several indicators such as Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), Double Exponential Moving Average (DEMA) and Double Stochastic Oscillator.

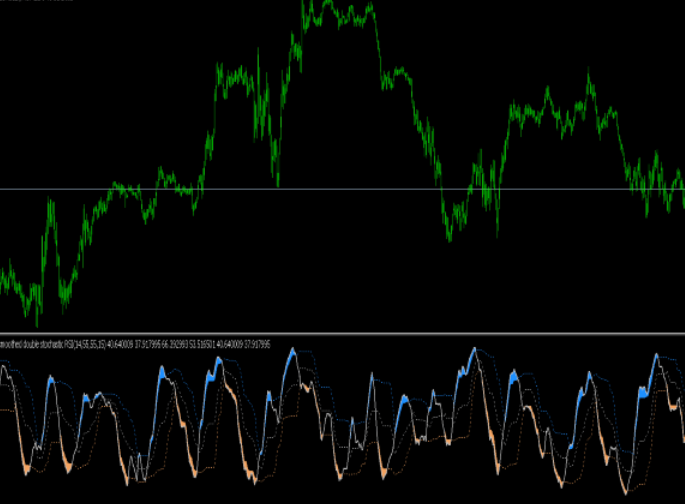

The Multicolor Filtered 2 Indicator presents traders with a color-coded interpretation of market conditions, which makes it easier to understand market behavior and make informed trading decisions. The color coding interpretation involves three colors: green, red, and gray.

When the indicator turns green, it indicates a bullish trend in the market; when it turns red, it indicates a bearish trend; while gray signals that there is no clear direction in the market.

Backtesting results analysis shows that this tool can be effective in identifying profitable trades when combined with other technical analysis tools such as support and resistance levels, Fibonacci retracements, and trend lines. However, like any other technical analysis tool, traders should exercise caution when using this indicator since no strategy or tool can guarantee successful trades all the time.

Applying the Double Stochastic RSI Multicolor Filtered 2 Indicator to Your Trading Strategy

By incorporating the complex algorithm of the Multicolor Filtered 2 Indicator into one’s trading strategy, traders can potentially identify trends and price reversals in a color-coded interpretation that may aid in making informed decisions when used alongside other technical analysis tools.

When using the Double Stochastic RSI Multicolor Filtered 2 Indicator for trend analysis, traders can benefit from its unique ability to highlight oversold or overbought conditions within a trend. This can be particularly useful when combined with other technical analysis tools such as moving averages or support and resistance levels.

Moreover, traders can use this indicator to identify potential entry and exit points by looking at color changes within the indicator’s bars. For instance, if the indicator is green (bullish) but begins to turn red (bearish), this could be an indication of a potential trend reversal.

Additionally, traders can use this information to confirm trends seen on other technical indicators such as MACD or Bollinger Bands. Ultimately, while it is important not to solely rely on any single technical indicator for trading decisions, incorporating the Double Stochastic RSI Multicolor Filtered 2 Indicator into one’s strategy may provide additional insights and enhance overall decision-making abilities.

Conclusion

The Double Stochastic RSI Multicolor Filtered 2 Indicator is a technical analysis tool that can be used to identify potential trends and reversals in the market. By combining two popular indicators, the Double Stochastic RSI and multicolor filtering, traders can gain additional insights into market conditions.

When using this indicator, it is important to keep in mind that no single indicator can predict future market movements with complete accuracy. It is always recommended to use multiple indicators and perform thorough technical analysis before making any trading decisions.

In conclusion, the Double Stochastic RSI Multicolor Filtered 2 Indicator is a useful tool for traders looking to gain a deeper understanding of market trends and potential reversals. However, it should not be relied upon as the sole basis for investment decisions.

Technical analysis should always be combined with fundamental analysis and risk management strategies to achieve long-term success in trading.