Donchian Middle Band Crossover For Mt4 Review

The Donchian Middle Band Crossover strategy is a popular trading technique used by traders to identify potential trends in the market. This strategy is based on the use of Donchian Channels, which are technical indicators that help traders identify support and resistance levels in a given market.

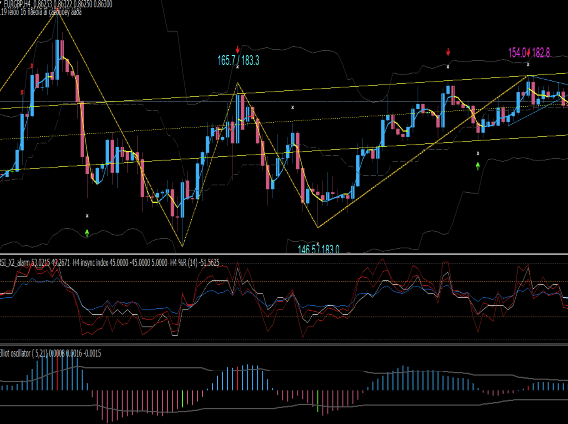

The Donchian Middle Band Crossover for MT4 involves using the middle band of the Donchian Channel as a trend indicator. When the price of an asset crosses above or below this middle band, it can signal a potential change in trend direction.

Download Free Donchian Middle Band Crossover For Mt4

This strategy can be implemented using various time frames and can be useful for both short-term and long-term trading approaches. In this article, we will explore how the Donchian Middle Band Crossover strategy works and provide some tips for successful trading with this approach.

Understanding Donchian Channels

The concept of Donchian Channels involves the use of high and low price levels over a specified period to create a visual representation of market volatility, which can be utilized as a tool for identifying potential areas of support and resistance.

Donchian channels are formed by taking the highest high and lowest low prices over a specific period, typically 20 days, and plotting them on a chart. The area between these two lines is referred to as the ‘channel,’ with the middle line representing an average or mean value.

Donchian channel breakout strategies involve monitoring price movements outside of these channels. Traders may look for breakouts above or below these channels to indicate potential trend reversals or continuation.

However, it is important to consider trading psychology when using this strategy since false breakouts can occur, leading to losses if traders do not manage their risk properly. It is also useful to combine technical analysis with fundamental analysis when utilizing Donchian channels in order to gain a more comprehensive understanding of market conditions.

The Donchian Middle Band Crossover Strategy

This section explores a trading strategy that involves identifying moments of potential trend reversals by analyzing the relationship between two moving averages. The Donchian middle band crossover strategy is based on the idea that when market volatility increases, price movements tend to become more erratic and unpredictable. In such situations, traders are often looking for reliable trading signals that can help them make informed decisions about when to enter or exit a trade.

To use this strategy, traders first need to calculate the Donchian channels for a given asset. They can then determine the middle band by taking the average of the upper and lower bands.

Next, they need to add two moving averages to their charts: one with a shorter period (e.g., 10) and another with a longer period (e.g., 30). When the shorter moving average crosses above or below the middle band from below or above respectively, it is considered a buy or sell signal. This indicates that there may be an upcoming trend reversal in favor of either buyers or sellers.

However, it is essential to use other technical indicators and fundamental analysis along with this strategy as it may not work well in all market conditions.

Tips for Successful Trading with the Donchian Middle Band Crossover

In trading with the Donchian Middle Band Crossover, successful traders prioritize risk management and position sizing.

They aim to minimize potential losses by setting clear stop-loss levels and determining the appropriate size of their positions based on their risk tolerance.

Additionally, backtesting and optimizing the strategy is crucial in ensuring its effectiveness over time, while staying disciplined and patient in trading helps traders avoid impulsive decisions that may lead to poor outcomes.

Risk management and position sizing

Effective risk management and appropriate position sizing are crucial components of any trading strategy, as they can help to minimize potential losses and optimize returns.

Position management involves determining the size of a trade based on factors such as account balance, risk tolerance, and market volatility. A trader must also consider their overall portfolio and ensure that they do not take on too much exposure in any one asset or market.

Risk assessment is another critical aspect of successful trading with the Donchian Middle Band Crossover. Traders must assess both the potential risks and rewards of a trade before entering into it.

This includes analyzing market conditions, identifying key support and resistance levels, evaluating technical indicators, and considering fundamental factors that could impact the price of an asset. Additionally, traders should always have a predetermined stop-loss point in place to limit potential losses if the trade does not go as planned.

By implementing sound risk management practices and appropriate position sizing techniques, traders can increase their chances of success when using the Donchian Middle Band Crossover strategy in MT4.

Backtesting and optimizing the strategy

Backtesting and optimizing a trading strategy are essential steps in determining its effectiveness, as they allow traders to evaluate the historical performance of the strategy under different market conditions and identify areas for improvement.

Backtesting involves simulating trades using historical data to evaluate how the strategy would have performed if it had been implemented in the past. However, backtesting has limitations that need to be considered, such as survivorship bias, which occurs when only successful strategies are included in the backtest results.

Optimizing parameters refers to adjusting certain variables within a trading strategy to improve its performance. It is important to find an optimal set of parameters that can achieve good results across different market conditions.

However, over-optimization can lead to curve-fitting, where the model fits too closely with past data but fails to perform well in real-time trading. Therefore, traders should use robust optimization techniques and avoid overfitting their models during parameter optimization.

Ultimately, backtesting and optimizing a donchian middle band crossover trading strategy can help traders make informed decisions about whether or not it is suitable for their portfolio and risk management goals.

Staying disciplined and patient in trading

Maintaining discipline and patience in trading is crucial to achieving long-term success, as it helps traders avoid emotional decision-making and stick to their predetermined strategies.

Developing a trading plan is an essential step that helps traders determine their entry and exit points, risk management strategies, and trade execution rules. A solid plan can help traders stay focused on their goals and avoid impulsive trades based on market fluctuations or emotions.

Building a strong mindset is also crucial for maintaining discipline and patience in trading. Successful traders understand that losses are part of the game and do not let them affect their overall strategy. They approach each trade with a clear mind, without being swayed by fear, greed, or other external factors.

Additionally, they have realistic expectations about the markets and do not expect overnight success but rather focus on consistent growth over time. Overall, staying disciplined and patient requires effort but can lead to significant rewards in the long run for those who commit to it.

Conclusion

Donchian Channels are a popular technical analysis tool used by traders to identify potential breakout opportunities. The channels are created by plotting the highest high and lowest low over a selected period, with the middle line representing the average of these values.

The Donchian Middle Band Crossover Strategy involves using this middle band as a signal for entering or exiting trades. Traders may buy when the price crosses above the middle band and sell when it falls below.

To successfully trade with this strategy, it is important to consider factors such as market volatility and trend direction. Additionally, it is vital to use proper risk management techniques such as setting stop-loss orders to limit potential losses.

As with any trading strategy, it is crucial to test and refine your approach through backtesting and demo trading before implementing it in live markets.

Overall, the Donchian Middle Band Crossover Strategy can be an effective tool for identifying potential trading opportunities in trending markets. However, traders should always exercise caution and carefully evaluate market conditions before making any trades based on this strategy. With proper risk management techniques and careful analysis of market trends, traders can potentially increase their chances of success with this approach.