Directional Breakout Indicator For Mt4 Review

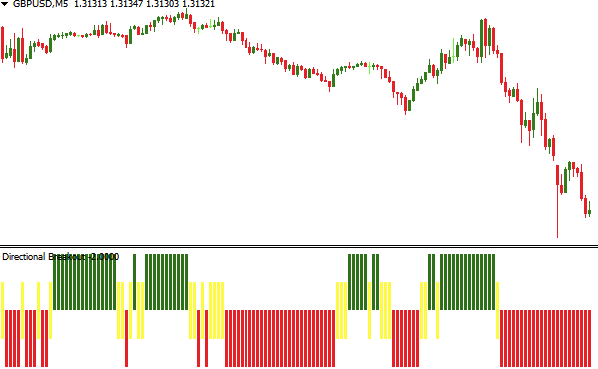

The Directional Breakout Indicator is a popular tool used by traders to identify potential breakouts in the market. This indicator works by measuring the strength of price movements and identifying key levels where breakouts are likely to occur.

Traders can use this information to enter trades at the right time, potentially maximizing profits and minimizing losses. In this article, we will explore the Directional Breakout Indicator for MT4 and how it can be applied in your trading strategy.

Download Free Directional Breakout Indicator For Mt4

We will discuss its basic principles, including how it works and what signals it generates. We will also provide some best practices for using this indicator effectively, as well as some final thoughts and considerations when incorporating it into your trading routine.

With a solid understanding of the Directional Breakout Indicator, you can gain an edge in the market and improve your overall trading performance.

Understanding the Directional Breakout Indicator

The present section aims to provide a comprehensive understanding of the Directional Breakout Indicator (DBI) and its significance in financial trading.

The DBI is a technical analysis tool that enables traders to identify potential changes in price trends and market volatility. It is based on the concept of directional movement, which refers to the strength and direction of market trends.

The DBI uses several indicator parameters such as Average True Range (ATR), Directional Movement Index (DMI), and Moving Average Convergence Divergence (MACD), among others, to generate signals for entry and exit points.

Additionally, traders can use backtesting results from historical data to evaluate the effectiveness of the DBI in different market conditions.

In summary, the DBI provides valuable insights into market trends, enabling traders to make informed decisions about when to enter or exit trades based on objective data rather than subjective opinions or emotions.

Applying the Indicator in Your Trading Strategy

By incorporating the unique signals generated by this tool into your trading strategy, you can potentially improve your trading efficiency and achieve greater success in the financial markets. However, it is important to note that the directional breakout indicator should not be relied on as the sole basis for making trading decisions. It should be used in conjunction with other technical analysis tools and fundamental analysis to confirm signals and identify potential entry and exit points.

To maximize the effectiveness of the directional breakout indicator, traders can customize its settings according to their specific needs and preferences. This includes adjusting parameters such as periods, thresholds, and colors. Backtesting results can also provide valuable insights into how well the indicator performs under different market conditions and time frames.

By consistently reviewing backtesting results and fine-tuning indicator settings, traders can optimize their use of the directional breakout indicator for greater profitability in their trades.

3 Ways Customizing Indicator Settings Can Benefit Your Trading Strategy:

- Allows for a personalized approach based on individual preferences

- Enhances accuracy of signal identification

- Enables better risk management through improved trade entry and exit points

Best Practices for Using the Directional Breakout Indicator

Combining the Directional Breakout Indicator with other technical indicators can provide more confirmation for potential trading opportunities.

It is important to set realistic targets and stop losses when using the indicator to manage risk and maximize profits.

Traders should consider factors such as market volatility, current trends, and overall market conditions when setting these levels.

Combining with Other Technical Indicators

One approach to enhancing the effectiveness of technical analysis is by integrating different indicators, allowing traders to evaluate multiple data points and gain a more holistic understanding of market trends.

The directional breakout indicator for MT4 can be combined with other technical indicators to increase its accuracy. For instance, traders can customize the indicator settings to suit their trading strategies or combine it with moving averages, Bollinger bands, or trend lines.

Indicator customization is crucial when combining the directional breakout indicator with other technical indicators. Traders should adjust the period length and sensitivity of each indicator to ensure they work harmoniously together.

Additionally, backtesting results can help traders determine which combination works best for their trading style. By testing various combinations using historical data, traders can identify patterns and refine their strategies based on past performance.

Overall, combining the directional breakout indicator with other technical indicators can provide a more comprehensive view of market trends and improve trading outcomes.

Setting Realistic Targets and Stop Losses

To optimize trading outcomes, it is crucial for traders to establish realistic targets and stop losses when implementing technical analysis strategies. Risk management is a critical component of successful trading, and setting appropriate targets and stop losses is an essential part of managing risk.

Traders must determine the level of risk they are willing to accept before entering into a trade and use that information to set appropriate target levels and stop losses. When setting targets, traders should consider both short-term and long-term goals. Short-term targets should be based on technical indicators such as support and resistance levels, while long-term targets may be influenced by fundamental factors such as economic data or geopolitical events.

Stop losses should also be set based on technical indicators, with a focus on minimizing potential losses while allowing room for market fluctuations. The combination of appropriate target levels and stop losses can help traders achieve consistent profits while minimizing the risks associated with trading. By using these tools in conjunction with other technical indicators to identify entry points, traders can increase their chances of success in the markets.

Final Thoughts and Considerations

The final considerations of this section provide valuable insights into the applicability and usefulness of the proposed directional breakout indicator for MT4. While the tool offers significant advantages in identifying potential breakouts, traders should be mindful of its limitations and potential drawbacks.

Here are some key points to keep in mind:

- Backtesting performance: Before incorporating the tool into their trading strategy, traders should conduct thorough backtesting to assess its historical performance. This will help them gauge the reliability and effectiveness of the indicator over time.

- Limitations: Like any trading tool or strategy, directional breakout indicators have their limitations. For example, they may not work well in certain market conditions or during periods of high volatility. Traders should be aware of these limitations and use other tools or strategies to complement their trading approach.

- Potential drawbacks: It’s important to note that no trading tool is foolproof or can guarantee profits. Over-reliance on a single indicator can lead to false signals and losses. Therefore, traders should use a combination of technical analysis tools and fundamental analysis to make informed decisions about their trades.

In conclusion, while directional breakout indicators can be a valuable addition to a trader’s arsenal, it’s essential to evaluate its effectiveness through backtesting performance before using it live in real-time markets. Additionally, understanding its limitations and potential drawbacks can help traders avoid common pitfalls associated with relying too heavily on a single indicator for decision-making purposes.

Conclusion

In conclusion, the Directional Breakout Indicator is a powerful tool that can be used to identify potential breakout points in the market. By analyzing price movements and using trend lines, traders can use this indicator to make informed trading decisions and increase their chances of success in the market.

When applying this indicator to your trading strategy, it is important to remember that no single indicator can guarantee success. It is always recommended to use multiple indicators and analysis tools in conjunction with each other for more accurate predictions.

Additionally, it is crucial to practice proper risk management techniques while trading.

Overall, the Directional Breakout Indicator can provide valuable insights into market trends and potential breakouts. With proper application and careful consideration, traders can use this tool to improve their overall trading performance.