Day Bears Mt4 Indicator Review

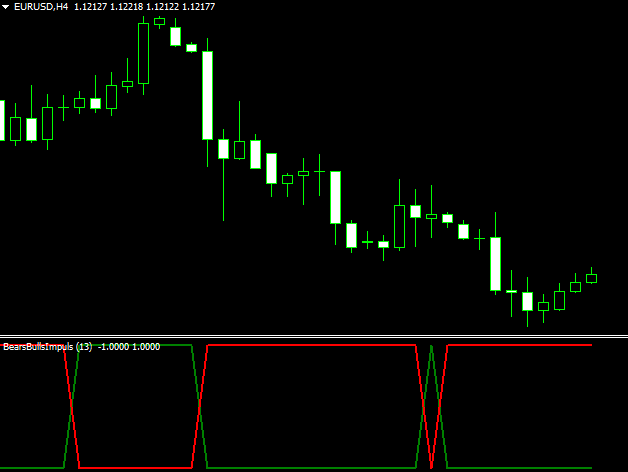

Day Bears MT4 Indicator is a technical analysis tool that is widely used by traders to identify bearish market trends in the financial markets. This indicator provides valuable information to traders regarding the strength of bearish pressure on a particular asset, which can help them make informed trading decisions.

The Day Bears MT4 Indicator is designed to track the movement of market prices and detect any significant changes in market sentiment. It uses a combination of moving averages, trend lines, and other technical indicators to analyze price movements and identify potential bearish trends.

Download Free Day Bears Mt4 Indicator

Traders use this indicator to gain an edge in the market by identifying potential short-selling opportunities or exiting long positions before major price drops occur. Overall, this article will explore how the Day Bears MT4 Indicator works, how it can be installed and set up for use, and its benefits for traders looking to capitalize on bearish market trends.

Overview of the Day Bears MT4 Indicator

This section provides a comprehensive overview of the technical analysis tool used in financial markets to identify potential downtrends and bearish market conditions – the Day Bears MT4 Indicator.

This indicator is designed to detect bearish signals within a given trading period, allowing traders to make informed decisions on their positions. The Day Bears MT4 Indicator comes with several features and advantages that make it an essential tool for traders.

One of its most significant advantages is its ability to show clear signals of potential downtrends in a variety of timeframes. Additionally, this indicator has customizable settings, making it suitable for different trading styles and strategies.

Traders can also use the Day Bears MT4 Indicator alongside other indicators to create more robust trading strategies that minimize risks while maximizing profits.

Installation and Setup

To successfully use the Day Bears MT4 Indicator, it is essential to correctly install and configure it on your trading platform. The process involves downloading the indicator from a reputable source and adding it to your MT4 platform.

Once added, you can customize the indicator settings to suit your trading preferences and maximize its effectiveness in identifying bearish trends throughout the day.

This subtopic will provide step-by-step instructions on how to download, install, and configure this powerful trading tool.

Downloading and Installing the Indicator

The process of downloading and installing the day bears MT4 indicator is a straightforward and effortless task. Users can gain access to valuable market information by following a few simple steps.

Firstly, they need to download the necessary files from a reliable source. Once downloaded, they must copy and paste the files into the correct folder located within their MetaTrader 4 platform directory.

However, users may encounter some common errors during this process, such as incorrect file placement or compatibility issues with their trading platform version. Such problems can be easily resolved through basic troubleshooting methods or by seeking assistance from online forums or customer support services provided by the indicator’s developer.

If users are unable to resolve these issues, they may consider using alternative indicators that cater to their specific requirements or preferences for market analysis.

Configuring Indicator Settings

Configuring the settings of this technical analysis tool is essential for traders to personalize their market analysis and optimize trading strategies. The Day Bears MT4 Indicator offers a range of adjustable parameters that can be customized according to individual preferences. Here are four key settings that traders should consider when using this indicator:

- Timeframe: This setting allows traders to specify the timeframe they want to analyze, from one minute to one month. Traders should choose a timeframe that aligns with their trading strategy and objectives.

- Alert Settings: The Day Bears MT4 Indicator can be set up to alert traders via email or push notification if certain conditions are met, such as when the indicator crosses a certain level or when there is a trend reversal.

- Line Style: Traders can customize the appearance of the indicator line by selecting different colors and styles (such as dashed or solid lines).

- Calculation Method: The calculation method determines how the indicator values are derived from price data. Traders can choose between several methods, including simple moving average (SMA) and exponential moving average (EMA).

By adjusting these parameters and customizing the display of the Day Bears MT4 Indicator, traders can gain deeper insights into market trends and make more informed trading decisions based on their unique preferences and goals.

Adding the Indicator to Your Trading Platform

This section focuses on seamlessly integrating the Day Bears MT4 indicator into your trading platform. To start, once you have downloaded and installed the indicator, you need to open your MetaTrader 4 platform.

In your navigator window, find the ‘Indicators’ folder and right-click it. Select ‘Refresh’, and you should see the Day Bears MT4 indicator appear in the list of available tools.

After refreshing the navigator window, drag and drop the Day Bears MT4 indicator onto a chart of your choice. Once added to a chart, traders can customize its appearance by changing colors or adjusting settings such as period length.

If any errors occur during installation or use of this tool, troubleshooting steps are available online through various forums or websites dedicated to technical analysis tools. By following these simple steps for adding an indicator to your trading platform and customizing its appearance while also being prepared for potential troubleshooting issues, traders can gain a better understanding of market trends and optimize their trading strategies with confidence.

Using the Day Bears Indicator

This section will discuss the use of the Day Bears indicator, focusing on its ability to identify bearish trends and signal potential sell positions.

In order to effectively utilize this tool, it is important to have a clear understanding of current market conditions. By analyzing these key points, traders can make informed decisions and improve their overall trading strategies.

Identifying Bearish Trends

The identification of bearish trends is a crucial aspect of technical analysis in financial markets. By identifying bearish patterns and analyzing market trends, traders can make informed decisions about when to enter or exit positions. Bearish trends are characterized by a series of lower highs and lower lows over an extended period of time, indicating that sellers are in control of the market.

To identify a bearish trend, traders should look for the following key indicators:

- Lower highs and lower lows: The first sign of a bearish trend is when prices begin to form lower highs and lower lows. This indicates that sellers are consistently pushing prices down.

- Moving averages: Traders can use moving averages to help identify the direction of the trend. If the price is below a long-term moving average, such as the 200-day moving average, it suggests that the overall trend is bearish.

- Volume: Increasing volume on downward moves can be a sign that sellers are becoming more aggressive and may continue to push prices lower.

- Price patterns: Traders can also look for specific price patterns, such as descending triangles or head-and-shoulders formations, which suggest that selling pressure is building and could lead to further downside movement.

By combining these indicators with other technical analysis tools, such as support and resistance levels or momentum indicators like RSI or MACD, traders can gain a clearer picture of where the market is headed and make more confident trading decisions.

Signal for Potential Sell Positions

One effective approach to identifying potential sell positions is by looking for bearish market signals using technical analysis tools. These tools can include moving averages, volume indicators, and price patterns.

Moving averages are used to identify trends in the market and can be helpful in identifying potential sell positions when the shorter-term moving average crosses below the longer-term moving average.

Volume indicators measure the amount of trading activity in a particular asset and can provide insight into whether a trend is likely to continue or reverse.

Price patterns such as head and shoulders or double tops can also signal potential sell positions.

Timing entry and exit points is crucial when trading in any market, but especially in a bearish one where prices are falling. Technical analysis tools can be useful for timing entry and exit points based on bearish signals.

For example, if a trader identifies a bearish signal using a volume indicator, they may choose to enter a short position at that point with the expectation that prices will continue to fall. On the other hand, if prices begin to rise again after entering a short position, they may choose to exit that position before suffering significant losses.

By incorporating technical analysis tools into their trading strategy, traders may increase their chances of success by better identifying potential sell positions and timing their entry and exit points accordingly.

Understanding Market Conditions

Understanding the prevailing market conditions is an essential aspect of trading, as it allows traders to make informed decisions based on objective data and analysis. Market analysis involves examining various factors that influence the price movement of a given asset such as economic indicators, news events, and technical chart patterns.

Technical indicators are tools used in market analysis to identify potential buy or sell signals in financial markets. Technical indicators like the Day Bears MT4 Indicator offer critical information about the current market conditions by analyzing past price movements and identifying trends.

Understanding these trends can help traders make better-informed decisions about when to enter or exit a trade. Additionally, some technical indicators like trendlines and moving averages can also provide insight into support and resistance levels which can be useful for predicting future price movements.

Therefore, understanding market conditions is crucial for successful trading as it helps traders develop reliable strategies based on objective data rather than relying solely on intuition or guesswork.

Benefits of the Day Bears MT4 Indicator

The Day Bears MT4 Indicator offers numerous benefits to traders who wish to optimize their trading experience. Firstly, it saves time by providing accurate and reliable signals for identifying bearish trends in the market.

Secondly, its accuracy and reliability minimize risks associated with false signals, allowing traders to make informed decisions based on trustworthy data.

Lastly, the indicator helps maximize profits by identifying entry and exit points that align with the identified trends. Overall, these benefits make the Day Bears MT4 Indicator a valuable tool for traders seeking efficient and profitable trading strategies.

Time-Saving

Efficient allocation of resources can be achieved by implementing time-saving strategies when utilizing the Day Bears MT4 Indicator.

As a trading tool, the indicator provides users with valuable information regarding bearish market trends. However, without a proper understanding of how to use the tool effectively, traders may find themselves wasting precious time trying to decipher its signals.

The benefits of using time-saving trading tools such as the Day Bears MT4 Indicator cannot be overstated. By reducing the amount of time spent analyzing market trends and making trading decisions, traders can free up more resources for other important aspects of their business.

Furthermore, in today’s fast-paced trading environment where every second counts, efficiency is key in developing successful trading strategies. The Day Bears MT4 Indicator’s ability to quickly identify bearish market trends allows traders to react swiftly and make informed decisions that could lead to profitable trades.

Accuracy and Reliability

The accuracy and reliability of the Day Bears MT4 indicator is paramount for traders who seek to make informed decisions based on the data provided by this trading tool. The success of any trading strategy is largely dependent on how accurately and consistently a trader can read and interpret market signals. The Day Bears MT4 indicator has been designed with a focus on improving performance, which makes it an indispensable tool in today’s highly competitive trading environment.

To ensure that traders get the most out of the Day Bears MT4 indicator, there are several steps that they can take to improve its accuracy and reliability. Firstly, traders should backtest their strategies using historical price data to see how well they perform using this tool.

Secondly, they should take advantage of the various customization options available within the indicator to fine-tune it according to their specific needs.

Lastly, traders should keep themselves updated with new developments in the market and adjust their strategies accordingly, as this will enable them to stay ahead of other investors who may be using less reliable tools or outdated techniques.

Minimizing Risks and Maximizing Profits

In order to optimize trading performance, it is essential for traders to understand how to minimize risks and maximize profits in today’s competitive market environment. Risk management strategies are critical for traders who want to reduce their exposure to financial risk while ensuring that they can still make a profit from their trades. One effective way of managing risk is through diversification, which involves spreading investments across different assets and markets.

Another crucial aspect of maximizing profits is by using profit maximization techniques such as setting stop-loss orders, trailing stops, and take-profit orders. These tools allow traders to lock in gains while limiting potential losses. For instance, a stop-loss order ensures that a trader closes out an order if the price moves against them beyond a predetermined point. Meanwhile, take-profit orders enable traders to exit profitable trades before the market conditions change. By combining these two approaches, traders can effectively manage their risks while increasing their chances of making sustainable profits over time.

| Risk Management Strategies | Profit Maximization Techniques | Emotional Response |

|---|---|---|

| Diversification | Setting Stop-Loss Orders | Relieved |

| Hedging with Options or Futures Contracts | Utilizing Trailing Stops | Confident |

| Position Sizing & Money Management Techniques | Using Take-Profit Orders | Empowered |

| Trading Psychology & Discipline | Implementing Scalping Strategies | Focused on Strategy |

Frequently Asked Questions

What is the historical performance of the Day Bears MT4 Indicator?

Analyzing the effectiveness of technical indicators is an important aspect of trading strategies. Backtesting results provide valuable insights into the historical performance of these indicators and can help traders determine whether they are suitable for their investment goals. It is essential to evaluate the predictive accuracy of technical indicators, especially in fast-moving markets where timing is critical.

Thus, assessing how well Day Bears MT4 Indicator performs requires a thorough analysis of its backtesting results and predictive accuracy.

Can the Day Bears MT4 Indicator be used on multiple currency pairs simultaneously?

Scalping and day trading are popular strategies in the forex market, where traders aim to make quick profits by entering and exiting trades within a short period. One way to increase efficiency is by using multiple currency pairs simultaneously, which allows traders to diversify their portfolio and take advantage of different market conditions.

However, it is important to note that this approach requires a high level of skill and experience, as well as access to reliable tools such as indicators and charting software. While there are many indicators available for MT4 platform, not all of them are suitable for scalping or day trading multiple currency pairs simultaneously.

Therefore, it is crucial to carefully evaluate the performance and reliability of any indicator before incorporating it into your trading strategy.

Is there a way to customize the settings of the Day Bears MT4 Indicator?

Customization options are an integral part of any software application, as they allow users to tailor the functionality and appearance of their preferred tool according to their preferences. These options can include a variety of settings that can be adjusted by the user in order to optimize performance, improve usability, and enhance the overall experience.

User preferences vary widely across different applications, and therefore it is important for software developers to provide a range of customization options that are both flexible and intuitive to use. When it comes to trading indicators such as the Day Bears MT4 Indicator, providing customization options can help traders fine-tune its settings according to their specific needs, thereby increasing its effectiveness and accuracy.

How does the Day Bears MT4 Indicator differ from other similar indicators in the market?

When comparing the different indicators available in the market, it is important to consider their features and how they differ from one another. Some key indicator features that are commonly evaluated include accuracy, reliability, ease of use, and customization options.

Additionally, market competition plays a role in determining which indicators are popular and widely used by traders. When considering how the Day Bears MT4 Indicator differs from other similar indicators on the market, it is important to evaluate its unique combination of features and how these compare to other options available.

Factors such as its algorithmic design, ability to identify trends and patterns in price movements, and customizable settings may make it more appealing to certain traders than other indicators with different feature sets.

Are there any recommended trading strategies or techniques to use in conjunction with the Day Bears MT4 Indicator?

Combining technical indicators with trading strategies can enhance traders’ decision-making processes and improve their overall profitability.

One popular approach is to incorporate Fibonacci retracement levels as a means of identifying potential entry and exit points in the market. By using these levels in conjunction with other technical tools, traders can identify key price areas where the market may reverse or continue its trend, which can be especially useful for swing trading.

Additionally, traders may consider using Day Bears MT4 Indicator to confirm bearish price action and further validate potential short positions. By combining these strategies, traders may increase their probability of success while minimizing risk exposure.

Conclusion

The Day Bears MT4 Indicator is a useful tool for traders looking to identify bearish market trends and potential entry points. Its clear visual display allows for easy interpretation of market movements and can assist in making informed trading decisions. Installation and setup are straightforward, requiring only basic knowledge of the MT4 platform.

When using the Day Bears Indicator, traders should keep in mind that it is just one tool in their overall trading strategy, and should not be relied upon solely for decision-making. However, when used in conjunction with other technical analysis tools and fundamental analysis, the Day Bears Indicator can provide valuable insights into market trends.

Overall, the Day Bears MT4 Indicator offers several benefits to traders seeking to improve their trading strategies. By providing real-time information on bearish market trends and potential entry points, it can help traders make more informed decisions and increase their chances of success in the markets.