Dm Oscillator Forex Mt4 Indicator Review

The DM oscillator is a popular technical indicator used by traders in the foreign exchange (forex) market. Also known as the directional movement indicator, this tool helps traders identify price trends and potential reversals, allowing them to make informed trading decisions. Download Free Dm Oscillator Forex Mt4 Indicator

The DM oscillator was developed by J. Welles Wilder Jr., an American mechanical engineer turned trader who also created other widely-used indicators such as the relative strength index (RSI) and the average directional index (ADX).

This article will provide an overview of the DM oscillator forex MT4 indicator, its benefits, and how to use it in your trading strategy. We will also offer tips on maximizing its effectiveness based on our analysis of historical data and expert opinions from industry professionals.

By understanding how to interpret this powerful tool, you can improve your chances of success in forex trading.

Download Free Dm Oscillator Forex Mt4 Indicator

The DM oscillator was developed by J. Welles Wilder Jr., an American mechanical engineer turned trader who also created other widely-used indicators such as the relative strength index (RSI) and the average directional index (ADX).

This article will provide an overview of the DM oscillator forex MT4 indicator, its benefits, and how to use it in your trading strategy. We will also offer tips on maximizing its effectiveness based on our analysis of historical data and expert opinions from industry professionals.

By understanding how to interpret this powerful tool, you can improve your chances of success in forex trading.

What is the DM Oscillator Forex MT4 Indicator?

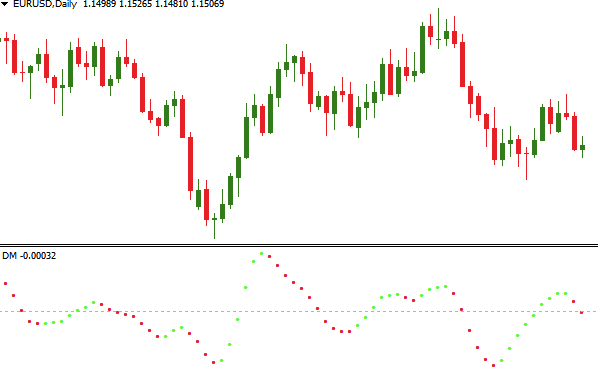

The DM Oscillator Forex MT4 Indicator is a technical tool that traders use to analyze the foreign exchange market. It is a momentum indicator that measures the strength of price movements, and it can be used to identify potential trend reversals or confirm existing trends. The oscillator is based on two components – Directional Movement (DM) Plus and Directional Movement (DM) Minus – which are calculated using price data from multiple time frames. One of the advantages of using the DM Oscillator is that it provides traders with a visual representation of market momentum, allowing them to make informed trading decisions. It can also be used in conjunction with other technical indicators to confirm signals or filter out false ones. In terms of application areas, the oscillator can be used for both short-term and long-term trading strategies, depending on individual preferences and risk tolerance levels. Overall, it is a versatile tool that can enhance a trader’s ability to navigate the complex world of forex trading.Benefits of Using the DM Oscillator

The DM Oscillator offers several benefits that make it a valuable tool for traders. One of these is its ability to identify trends, which is crucial in determining the direction of the market. Additionally, the indicator can aid in spotting potential market reversals, allowing traders to exit trades before they turn against them. Another advantage of the DM Oscillator is its customizable settings, which provide flexibility and allow users to tailor the indicator to their specific trading strategies.Trend Identification

Through a systematic analysis of market data, one can identify trends in the financial instruments being traded. Trends are essential for traders who engage in trend following strategies. These traders aim to profit by identifying and taking positions in the direction of a prevailing trend. The DM Oscillator is an effective tool for identifying trends as it measures the strength of price action over a specified period. The DM Oscillator is based on Directional Movement Indicator (DMI), which was developed by J Welles Wilder Jr. The DMI consists of two lines, namely, +DI and -DI lines that indicate upward and downward momentum, respectively. The DM Oscillator combines these two lines into one indicator that oscillates around zero levels, reflecting changes in trend direction and strength. When the oscillator value is above zero, it suggests an uptrend, while values below zero signal a downtrend. Traders can use this information to enter long or short positions accordingly.Potential Market Reversals

Identifying potential market reversals is crucial for traders seeking to capitalize on changes in trend direction and avoid significant losses. The ability to predict a trend reversal accurately allows traders to enter trades early, maximizing their profits while minimizing risk. One of the most widely used indicators for identifying potential reversal scenarios is the dm oscillator forex MT4 indicator. This indicator measures the momentum of price movements in a given currency pair by comparing recent highs and lows. Interpreting oscillator signals can be challenging, but there are some key guidelines that traders should follow. Firstly, when an asset is overbought or oversold, it suggests that a reversal may be imminent. Secondly, when the oscillator crosses above or below its signal line, it can indicate a change in momentum and an impending trend reversal. Finally, divergence between price action and the oscillator is another signal that traders use to identify potential reversals. While these signals are not foolproof, they provide valuable insights into market sentiment and help traders make informed decisions about when to enter or exit positions. Overall, with careful interpretation of dm oscillator forex MT4 indicator signals, traders have a better chance of identifying potential market reversals before they happen and maximizing their profits as a result.Customizable Settings

By providing traders with the ability to customize settings based on their trading objectives and risk tolerance, this section offers a valuable tool for maximizing profits and minimizing losses in an ever-changing market. Customization options allow traders to tailor the indicator’s settings to their specific preferences, including choice of time frame, color scheme, and notification alerts. This level of flexibility in the dm oscillator forex MT4 indicator allows traders to adjust their strategies quickly as market conditions change. User preferences are a critical component when it comes to successful trading. Every trader has unique goals and risk tolerance levels that must be taken into account when making investment decisions. The customizable settings offered by the dm oscillator forex MT4 indicator provide traders with a powerful tool for aligning their trades with these individual preferences, ultimately leading to more profitable outcomes. With its highly configurable platform and user-friendly interface, this indicator is an excellent choice for both novice and experienced currency investors alike.What Are the Benefits of Using Double Zero Forex MT4 Indicator?

The double zero forex mt4 indicator is a versatile tool that offers several benefits to traders. It helps identify critical price levels, enabling traders to make informed decisions about market entry and exit points. This indicator assists in determining potential areas of support and resistance, aiding in better trade analysis. By incorporating the double zero forex MT4 indicator into their strategies, traders can enhance their overall profitability and make more accurate trading decisions.

How to Use the DM Oscillator in Your Trading Strategy

This section outlines a practical approach to incorporating the DM Oscillator into your trading strategy, providing valuable insights on how to leverage its signals for more informed decision-making. When using the DM Oscillator, it is important to consider both trading psychology and risk management. Trading psychology refers to the emotional state of a trader when making decisions, which can often lead to impulsive or irrational actions. Therefore, it is crucial to remain disciplined and stick to a predetermined plan when using any technical indicator. Risk management is also an essential aspect of incorporating the DM Oscillator into your trading strategy. This involves setting stop-loss orders and taking profits at predetermined levels based on market conditions and individual risk tolerance. By doing so, traders can limit their potential losses while maximizing their gains. Additionally, it is recommended that traders use other technical indicators in conjunction with the DM Oscillator for confirmation of signals before entering or exiting trades. Overall, by considering both trading psychology and risk management when using the DM Oscillator, traders can make more informed decisions and improve their chances of success in the forex market.Tips for Maximizing the Effectiveness of the DM Oscillator

In order to maximize the effectiveness of the DM Oscillator, it is important to use it in conjunction with other technical analysis tools. This can provide a more comprehensive understanding of market trends and potential signals. Additionally, regularly monitoring and analyzing signals generated by the indicator can help traders make informed decisions based on current market conditions. By following these tips, traders can increase their chances of success when utilizing the DM Oscillator as part of their trading strategy.Using the Indicator in Conjunction with Other Technical Analysis Tools

The integration of the DM oscillator with other technical analysis tools can help traders gain a more comprehensive understanding of market trends and make informed trading decisions. Here are some ways to use the DM oscillator in conjunction with other technical indicators:- Combining DM Oscillator with Fibonacci levels: One way traders can combine the DM oscillator with other technical analysis tools is by using Fibonacci retracement levels. The DM oscillator can help identify potential trend reversals, while Fibonacci retracements can be used to identify support and resistance levels within a trend. By combining these two tools, traders can get a clearer picture of where price may potentially bounce or reverse.

- Using the DM Oscillator for day trading strategies: Another way to use the DM oscillator is in conjunction with other technical indicators such as moving averages or Bollinger Bands for day trading strategies. For example, if the DM oscillator crosses above its signal line while price is above its 50-period moving average or upper Bollinger Band, this could indicate a potential long entry point.

Regularly Monitoring and Analyzing Signals Generated by the Indicator

As mentioned in the previous subtopic, using the DM Oscillator Forex MT4 Indicator alongside other technical analysis tools can provide a more comprehensive understanding of market trends. However, it is equally important to regularly monitor and analyze signals generated by the indicator to make informed trading decisions. This involves interpreting data correctly and implementing effective risk management strategies. Interpreting data from the DM Oscillator Forex MT4 Indicator requires a deep understanding of its nuances and how it relates to other technical indicators. Traders must be able to identify patterns, understand trendlines, and recognize when signals are bullish or bearish. Moreover, it is essential to use this information in conjunction with other economic indicators such as inflation rates, employment figures, and GDP growth rates for a complete picture of market conditions. To ensure that traders can take advantage of signals generated by the indicator while minimizing risk exposure, they must implement effective risk management strategies. This includes setting stop-loss orders at appropriate levels to limit losses should trades go against them. Additionally, traders should avoid overtrading or making impulsive decisions based solely on short-term market movements. By incorporating these best practices into their trading strategy, traders can maximize profits while minimizing risks associated with market volatility.| Concept | Explanation | Application |

|---|---|---|

| Data Interpretation | Correctly analyzing signals generated by the DM Oscillator Forex MT4 Indicator | Using pattern recognition techniques and understanding trendlines |

| Risk Management Strategies | Implementing best practices for limiting losses during volatile market conditions | Setting stop-loss orders at appropriate levels and avoiding overtrading |